How to Improve Credit Score by 50 Points Quickly & Effectively

Boosting your credit score by 50 points isn't some far-off dream. In my experience, it often boils down to mastering two simple but powerful habits: always paying your bills on time and aggressively paying down your credit card balances. These actions directly feed into the most heavily weighted parts of your credit score, and you can see a real, tangible improvement in just a couple of months by focusing on them.

Charting Your Course to a Higher Credit Score

The idea of raising your credit score by 50 points might feel like a huge mountain to climb, but it’s more straightforward than you think. There are no secret tricks or loopholes here. It’s all about building and maintaining solid financial habits.

At the end of the day, your credit score is just a snapshot of your reliability with debt. Lenders want to know two main things: do you pay your bills as agreed, and how much debt are you juggling compared to your available credit? That's really the heart of it.

This guide is designed to be your practical roadmap. We're skipping the vague, generic advice and giving you a concrete action plan that focuses on the core strategies that will actually move the needle on your score.

Understanding the Key Factors

To make real progress, you have to know where to put your effort. Two factors tower above the rest in their influence on your score:

Just how important is payment history? It accounts for a massive 35% of your FICO score. Consistently making every single payment on time is the single most effective thing you can do to see that 50-point jump. Recent trends from VantageScore show that even small increases in late payments have pulled down average scores nationwide, proving just how much weight this one factor carries.

While you're working on your habits, making sure you have the right tools is also part of the game. Having one of the best credit cards can help your credit utilization and overall credit mix. A card with a higher limit, for example, can instantly lower your utilization ratio without you spending a dime less.

To help you get started, I've put together a table that breaks down the most critical factors. This will give you a clear view of where to focus your energy and what kind of timeline to expect for seeing results.

Key Factors for a 50-Point Score Increase

This table summarizes the most critical credit score factors, their impact, and actionable steps for improvement.

Think of this table as your guide. As we dive deeper into each strategy in the following sections, you can refer back to it to see how each action connects to the bigger picture of boosting your score.

Tackle Your Credit Utilization for a Quick Score Boost

After you’ve locked in a solid history of on-time payments, the next most powerful lever you can pull for a 50-point score increase is your credit utilization ratio (CUR). It’s a simple concept: it’s just the percentage of your available credit that you're currently using.

For instance, if you have a single credit card with a 5,000 limit and you owe 2,500, your utilization is 50%.

Lenders are almost obsessed with this number because it gives them a quick snapshot of your financial stability. A high CUR can make it look like you're stretched thin and might struggle to pay your bills. That’s why getting this ratio down is one of the fastest ways to see your score climb.

The 30 Percent Rule Is Just the Beginning

You've probably heard the common advice to keep your credit utilization below 30%. That’s a good rule of thumb, but if you're serious about a fast 50-point jump, you have to get more aggressive.

To really move the needle, you should be aiming for the single digits—under 10%.

Think of it this way: keeping your utilization at 30% is like following the speed limit. You’re doing what you’re supposed to, but you’re not really impressing anyone. Dropping it below 10% is like getting into the express lane. It tells the credit scoring models that you’re a pro at managing credit without depending on it. If you want to get into the weeds, you can explore the credit utilization ratio in our detailed guide.

This isn't just a theory; it's backed by hard data. People with the highest credit scores often maintain an average utilization of just 7%. On the flip side, those with poor scores are often using over 90% of their available credit. That massive gap shows just how critical this one metric really is.

Smart Strategies to Shrink Your Utilization

Getting your CUR down is a two-part game: you need to lower your balances while also considering ways to increase your total available credit.

Here are a few proven tactics you can put into action right away:

This chart shows just how much weight "amounts owed"—which is mostly your utilization ratio—carries in your FICO score. It's the second-biggest piece of the puzzle.

Let’s Walk Through an Example

Imagine you have a credit card with a 3,000 limit and a 1,500 balance. Right now, your utilization is 50%—a number that's almost certainly dragging your score down.

You get serious and pay the balance down to $870. Just like that, your utilization drops to 29%, getting you under that crucial 30% threshold. That's a solid improvement.

But what if you pushed a little harder and paid it down to $270? Now your utilization is a stellar 9%. Taking that single step could be enough to deliver a huge score jump, potentially getting you halfway to your 50-point goal in just a month or two.

The data from Experian on credit score statistics shows that while the average American’s utilization is around 29%, people with excellent scores consistently keep theirs much, much lower. By actively managing this ratio, you’re taking direct control of a major scoring factor and putting yourself on the fast track to a better credit profile.

Building an Unbreakable Payment History

If you're serious about bumping your credit score by 50 points, there's one area you absolutely cannot ignore: your payment history. It's the undisputed heavyweight champion of credit score factors, accounting for a massive 35% of your FICO score.

Think of it this way: your payment history is your financial reputation in black and white. Every on-time payment is a vote of confidence, while a single late payment can ding your score and take a long time to recover from. The goal isn't just to be "good enough," but to build a system that makes missing a payment almost impossible. After all, a slip-up can haunt your credit report for seven long years.

This is about more than just dodging negative marks. It’s about proactively building a positive track record. Each on-time payment you make adds another brick to a strong foundation, showing lenders you’re someone they can count on. Stick with it, and you'll see that consistency pay off in your score.

Automating Your On-Time Payments

I've seen it time and time again: the best way to guarantee a perfect payment history is to take human error out of the picture. Life gets busy, and it's just too easy to forget a due date. That's why setting up automatic payments is your secret weapon.

For every single account—credit cards, car loans, personal loans, you name it—you should set up autopay to cover at least the minimum amount due. This acts as a safety net. It ensures you’ll never get hit with a late fee or a credit-damaging late payment report just because a due date slipped your mind.

Here’s a practical system I recommend to my clients:

This hybrid approach gives you the reliability of automation without sacrificing control over your finances. It’s the best of both worlds.

Dealing with a Late Payment

Look, even the most organized person can make a mistake. If you realize you've missed a payment, don't panic—but do act fast. The damage gets worse the longer the bill goes unpaid.

Here’s the good news: a creditor typically won't report your payment as late to the credit bureaus until it's 30 days past the due date. If you're just a few days or a week late, pay it immediately. You'll probably have to eat a late fee, but you can usually avoid any lasting damage to your credit score.

But what if it's already past 30 days and the late payment has hit your report? You still have one more card to play: the goodwill letter. This is exactly what it sounds like—a polite letter asking the creditor to remove the negative mark as a gesture of goodwill.

When you write one, make sure you:

There’s no guarantee it will work, but for a one-time slip-up with a lender you have a good history with, you'd be surprised how often they're willing to help. Getting that single negative mark removed can be a huge step toward getting that 50-point boost you're looking for.

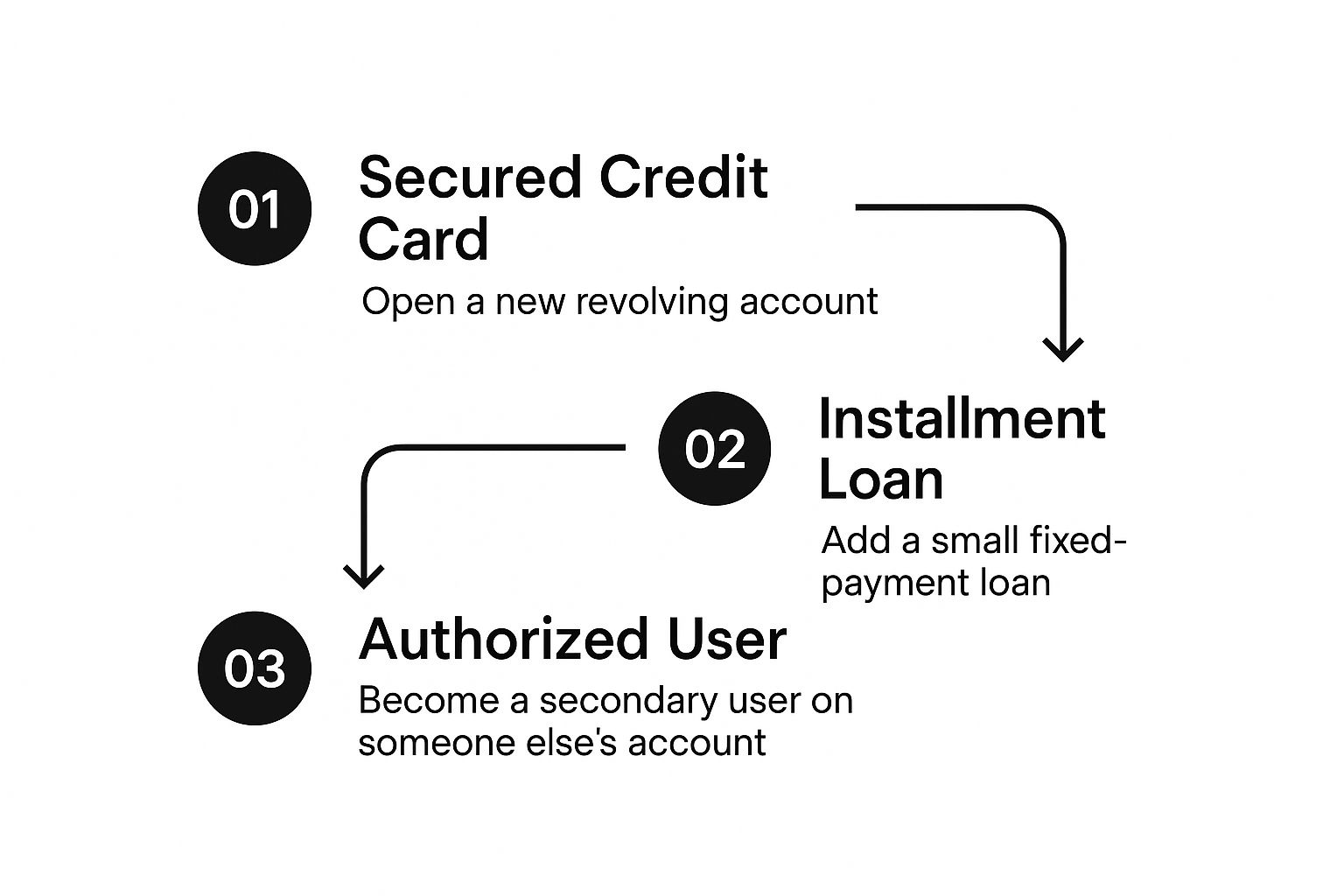

Managing Your Credit Mix and Account Age

While your payment history and utilization are the heavy hitters, two other factors play a surprisingly big role in your mission to boost your score by 50 points: your credit mix and the length of your credit history.

These might not give you the same quick win as paying down a credit card, but getting them right is absolutely essential for building a resilient, long-term credit profile that can weather financial ups and downs. Think of them as the seasoning in a recipe—they add depth and complexity, making the final dish (your credit score) that much better.

Why Your Oldest Accounts Are Gold

I see this mistake all the time: someone closes an old credit card they never use anymore to "simplify" their finances. It feels like a smart, tidy move, but it can backfire in a big way.

Closing an old account can sting your score from two different angles. First, you instantly lose that account's credit limit, which can make your overall credit utilization ratio jump up. More importantly, though, it can shorten the average age of all your accounts.

The length of your credit history accounts for about 15% of your FICO score. To a lender, a long, well-managed history is a clear sign of stability and experience.

Here’s a simple trick to keep those old, forgotten accounts alive: put a small, recurring charge on them. A Netflix subscription or a monthly coffee works perfectly. Then, just set up an automatic payment to clear the balance each month. The account stays active and reports positive history without you having to lift a finger.

The Power of a Healthy Credit Mix

Your credit mix, which makes up about 10% of your score, is all about the different types of credit you have. Lenders really like to see that you can responsibly handle both revolving credit (like credit cards) and installment loans (like a car loan, mortgage, or personal loan).

Having a healthy mix shows you’re a versatile borrower who can manage different kinds of payments and loan terms. For instance, if your report is nothing but credit cards, adding a small installment loan could give your score a modest but meaningful bump over time. We cover this in more detail in our guide on what is a credit mix.

But let me be clear: never take out a loan you don’t actually need just for the sake of your credit mix. The potential score increase is small and simply not worth the interest payments and the risk of taking on debt.

Navigating New Credit Applications Carefully

Opening a new account is a classic double-edged sword. On one hand, it can improve your credit mix or lower your overall utilization. On the other hand, every application usually triggers a hard inquiry on your credit report.

Too many hard inquiries in a short time frame can look like a red flag to lenders, suggesting you might be in financial trouble. A single inquiry might only ding your score by 5 to 10 points, but a few of them can really add up.

This is where you need to be strategic. For perspective, carefully managing credit inquiries is a hallmark of people with top-tier scores. According to a report from Experian, about 23% of U.S. consumers have exceptional scores (800+), and part of their secret is limiting new applications to protect their average account age.

To put this into practice, follow these ground rules:

To help you visualize how different actions can play out, here’s a quick breakdown of common credit decisions and their potential effects.

Impact of Common Credit Actions on Your Score

Ultimately, managing your accounts is a balancing act. The goal is to build a diverse and mature credit profile over time. When you combine this long-term thinking with excellent payment and utilization habits, you have a proven formula for hitting that 50-point score increase and beyond.

Finding and Disputing Credit Report Errors

Think of this as your first, most impactful mission: becoming a credit detective. You'd be shocked at how common errors are on credit reports, and they can be silent score killers, dragging you down for reasons you don't even know exist. Hunting down and eliminating these mistakes can deliver a surprisingly fast and substantial score bump.

Your first move is to pull your credit reports from the "big three" bureaus: Equifax, Experian, and TransUnion. You have a legal right to get a free copy from each one, every single week, from one specific, federally-approved source.

Getting Your Hands on Your Free Reports

The only website you should ever use for this is AnnualCreditReport.com. Steer clear of any site that dangles a "free" report in exchange for your credit card details—that's usually a trick to enroll you in a paid service you don't need.

This is what the homepage of the legitimate site looks like. Bookmark it.

Once you've downloaded all three reports, it's time to get forensic. Don't just give them a quick glance.

What to Look For: Common Credit Report Errors

I recommend printing your reports out, grabbing a highlighter, and going through them line by line. You're searching for anything that looks off, no matter how small it seems.