A Practical Guide on How to Improve Credit Score

Alright, let's get down to business. If you want to see a real, positive change in your credit score, it all boils down to two core habits: paying every single bill on time and keeping your credit card balances as low as possible. These two actions are the bedrock of a strong credit profile.

Your Starting Point for a Better Credit Score

Figuring out how to improve your credit score can feel like a huge challenge, but the journey really begins with understanding a few key ideas. Think of your credit score as a quick snapshot of your financial reliability. Lenders look at this number to gauge how likely you are to pay back any money you borrow.

For anyone just starting their financial life in the U.S., especially if you're using an ITIN, building this number from the ground up is absolutely essential. It's your key to unlocking better financial products down the road.

The Most Influential Credit Factors

Your score is a blend of several factors, but some just matter more than others. If you focus on mastering these, you're on the fast track to a better score.

Your payment history, for instance, is the undisputed champion. It accounts for a massive 35% of your FICO® Score. This is exactly why making your payments on time, every time, is completely non-negotiable for good credit health.

Right behind that is how much you owe, specifically your credit utilization ratio. This piece of the puzzle makes up another 30% of your score. It’s simply the total of your credit card balances compared to your total credit limits. Lenders want to see a low number here—it shows you can manage your finances without relying too heavily on debt.

This guide will break down these concepts into simple, sustainable habits you can use in the real world. We’ll also show you some powerful strategies, like using alternative data to report payments that the big credit bureaus might otherwise miss. This is a game-changer for ITIN holders, who can use platforms like itinscore to report recurring expenses and build a solid credit history.

To give you a clearer picture, this table breaks down the main components that shape your credit score.

Key Factors Influencing Your Credit Score

Understanding these factors is the first step. By focusing your energy on payment history and the amounts you owe, you’re putting your efforts where they’ll have the greatest impact.

Turn Your Everyday Bills Into Serious Credit-Building Tools

Let’s talk about the biggest piece of the credit puzzle: your payment history. It makes up a massive 35% of your FICO® Score, making it the most important factor by a long shot. But here’s something a lot of people miss: just "paying on time" isn't enough. The real strategy, especially for ITIN holders, is making sure every single possible payment you make actually gets counted.

Think about it. Many of your biggest and most consistent monthly bills—rent, utilities, your cell phone—are often invisible to the major credit bureaus like Equifax, Experian, and TransUnion. This means your track record of responsible payments isn't helping you build the strong credit profile you deserve. It’s time to change that.

Put Your Alternative Data to Work

The secret weapon here is what the industry calls "alternative data." For ITIN holders, this is a complete game-changer. It's how you can take the bills you’re already paying and turn them into powerful proof of your financial reliability. Instead of waiting years for a credit card to build up history, you can start today.

Your rent is a perfect example. It's likely your largest monthly expense, yet it usually does nothing for your credit. This is where a service like itinscore comes in. It’s designed to report these types of payments to the credit bureaus for you, effectively turning a simple transaction into a positive mark on your report.

A single late payment can haunt your credit report for up to seven years. Automation is your best defense against those accidental slip-ups.

A Practical Plan for Reporting Your Payments

Getting this set up is much simpler than it sounds. Here’s a straightforward approach to make your everyday expenses start building your credit.

Think about the impact. Let's say you've been reliably paying your 150 monthly utility bill** and **80 phone bill for the last year. Without reporting, that's just money going out the door. But by reporting them, you've just added 24 new on-time payments to your credit history. That's the kind of consistent, dependable pattern that lenders want to see, and it's a foundational step in learning how to improve your credit score.

Getting a Handle on Your Credit Utilization Ratio

If you’re looking for the quickest way to give your credit score a serious boost—besides always paying on time—this is it: get a handle on your credit utilization ratio (CUR).

It sounds complicated, but it's really just the percentage of available credit you're currently using. Lenders see it as a major clue about your financial health. When you’re maxing out your cards, it makes them uneasy. It suggests you might be stretched too thin.

Believe it or not, this single metric makes up about 30% of your FICO® Score. The calculation is simple. Say you have a credit card with a 1,000 limit and you owe 500. Your utilization is 50%. This math applies to each card you have and to your total credit picture.

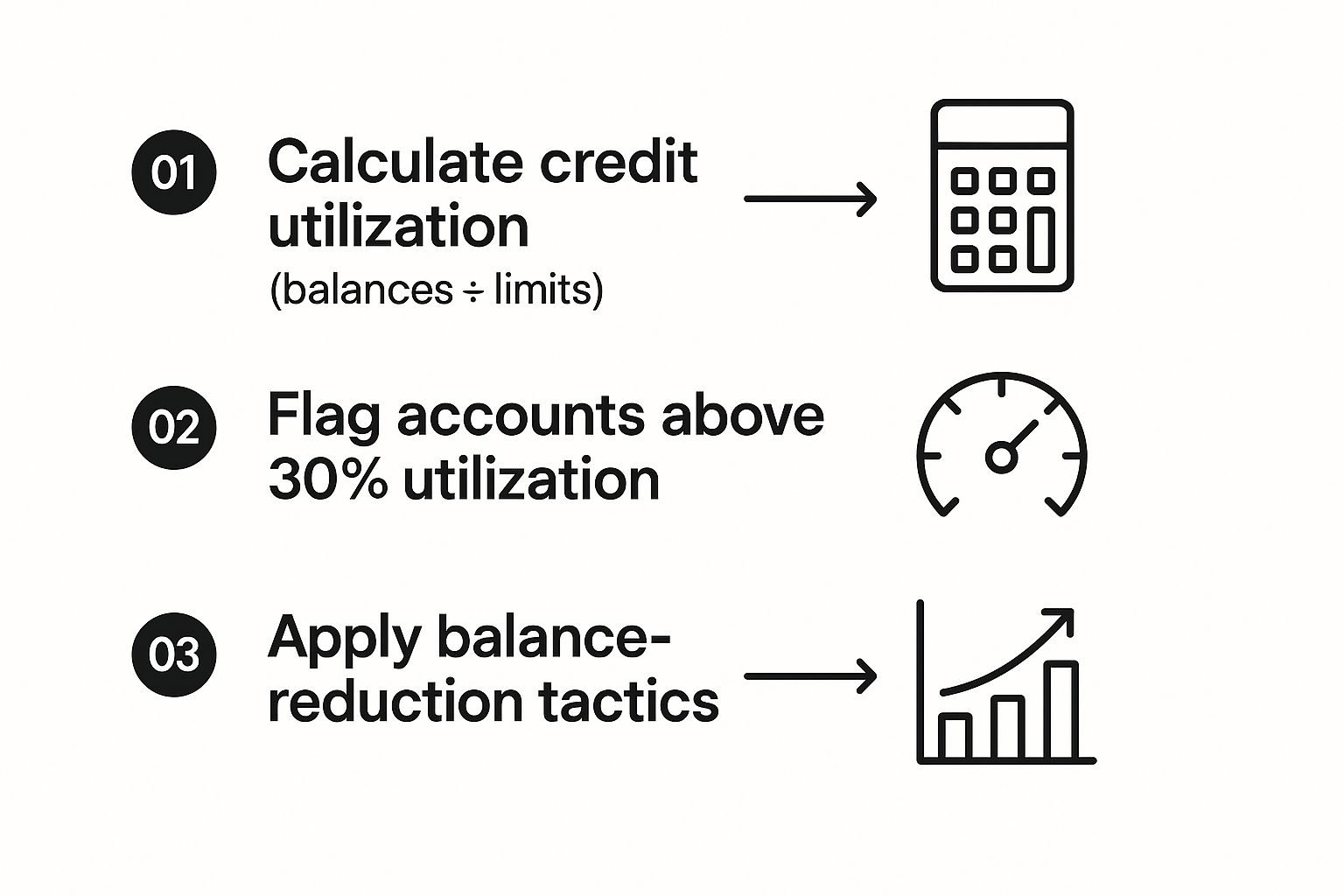

This image breaks down the cycle of managing this key metric.

As you can see, keeping your utilization in check is an ongoing process. You have to know your numbers, spot high balances, and take action to pay them down.

The 30% Rule of Thumb (and How to Beat It)

You’ll hear a lot of advice about keeping your credit utilization below 30%, and that’s a solid starting point. But if you're really trying to build an excellent score, aim even lower. Getting under 10% is the gold standard.

This doesn't mean you can't actually use your credit card. The trick is to pay down the balance before your statement closing date.

Let's go back to that card with the 1,000 limit. A statement balance under 300 (30%) is good. But a balance under $100 (10%) is what really moves the needle.

Smart Ways to Lower Your Utilization

When your utilization is high, your score suffers. The good news is that you have direct control over it. Here are two of the most effective ways to bring that number down quickly.

For a deeper dive, check out our guide on credit utilization tips for ITIN holders. Learning these techniques will put you in a much stronger position as you build your financial future in the U.S.

Building a Healthy and Diverse Credit Mix

While your payment history and how much credit you use are the big players, lenders also want to see that you can handle different kinds of credit responsibly. This is what's known as your credit mix, and it makes up about 10% of your FICO® Score. A solid mix shows you can manage both revolving credit, like credit cards, and installment loans, like a car or credit-builder loan.

I know what you're thinking. If you're an ITIN holder just starting out, this can feel like a tall order. How are you supposed to get different types of credit when you’re building from scratch? The secret is to start small with tools specifically designed for someone in your exact situation.

Your First Step: The Secured Credit Card

A secured credit card is probably the best first step you can take into the U.S. credit system. It functions just like a regular credit card for purchases, but with one key difference: it's "secured" by a small cash deposit you provide when you open the account. This deposit usually sets your credit limit, which takes the risk off the lender and makes getting approved much, much easier.

Once you have the card, use it for small, everyday purchases you can pay off in full each month. Every on-time payment gets reported to the credit bureaus, laying the foundation for your positive credit history. For a more detailed breakdown, our guide on how to build credit from scratch walks you through this exact strategy.

Adding an Installment Loan to the Mix

Another great tool to add some variety to your profile is a credit-builder loan. These are interesting because they work backward compared to a normal loan. Instead of getting money upfront, you make small, regular payments to a lender. They hold onto this money for you in a locked savings account. After you've paid off the full "loan" amount, the funds are released to you.

It's a fantastic, low-risk way to get an installment loan onto your credit report. Each payment demonstrates you can handle fixed payments, which looks great to lenders.

When you pair a credit-builder loan with a responsibly used secured card, you start to build a strong, diverse credit profile that will pay off down the road. It proves that small, disciplined steps can make a real difference.

How to Keep a Close Watch on Your Credit and Protect It

Building credit is one thing; protecting it is another. It requires being watchful. You can't fix a problem you don't know exists, which is why regularly checking your credit reports and scores is one of the best habits you can build. This isn't just about finding trouble—it's about staying in control and seeing your hard work pay off.

Think of your credit report as the official story of your financial life. When you review it, you're making sure that story is being told correctly. By keeping an eye on your reports from the three major bureaus—Equifax, Experian, and TransUnion—you can spot problems early, before they do real damage to your score.

What to Look for on Your Credit Report

When you pull your credit report, you’re doing more than just glancing at a number. You need to put on your detective hat and scan for anything that looks off. Even a small mistake can be the difference between getting a yes or a no on that loan you need.

Be thorough in your review. You're looking for common errors that can unfairly drag down your score.

If you want a full breakdown of every section, our guide on how to read your credit report is a great resource.

Finding and Fixing Errors Makes a Real Difference

Let me give you a real-world example. We had a user, Maria, who was doing everything right—paying her bills on time, keeping balances low—but her score just wouldn't budge. Frustrated, she pulled her full credit report and found the culprit: an old utility bill she had paid off years ago was mistakenly reported to a collections agency and was still sitting there as an unpaid debt.

That single error was an anchor on her score. Maria immediately filed a dispute with the credit bureau and sent them proof that the bill was paid. About 45 days later, the collection was removed, and her score shot up by over 50 points. That’s the power of being vigilant.

The data backs this up. A study from TransUnion found that around 15% of people using credit monitoring services become "Credit Improvers." These are folks who often start with lower scores but see an average increase of 28 points within just one year of starting to monitor their credit.

When you regularly check your credit, you shift from being a passenger to being the driver of your financial life. It allows you to see the direct impact of your good habits, like paying down a card or seeing a new on-time payment get reported. That feedback loop is incredibly motivating and helps you stay on track.

Got Questions About Building Credit? We've Got Answers

Even with the best plan, you're bound to have questions as you start building your credit. That's completely normal. Let's walk through some of the most common ones I hear from ITIN holders, so you can feel confident you're making the right moves.

"How Long Is This Actually Going to Take?"

This is always the first question, and the honest answer is: it depends. Where you're starting from and how consistently you act will determine your timeline. There's no overnight fix, but you can see real progress faster than you might think.

If you find a mistake on your credit report and get it corrected, you could see a jump in your score in as little as 30 to 60 days after the credit bureaus process the change. But if you're building your credit file from the ground up, think in terms of months, not days. By making every payment on time and keeping your balances low, most people see a significant, positive change within six to twelve months.

"Will Checking My Score All the Time Hurt It?"

This is a huge myth, and it keeps too many people in the dark about their own finances. Let me be clear: No, checking your own credit score does not lower it.

When you check your own score—whether through a service like itinscore or directly from the bureaus—it's logged as a "soft inquiry." Soft inquiries are invisible to lenders and have zero effect on your score. Think of it as a personal check-up; it's a healthy financial habit.

A "hard inquiry," on the other hand, happens when a lender pulls your report because you've applied for a new loan or credit card. These can cause a small, temporary dip in your score. So, apply for new credit strategically, but check your own progress as often as you like. It's your information, after all.

"Should I Close My Old, Unused Credit Cards?"

It sounds like a good idea to tidy up your finances by closing accounts you don't use, right? In reality, this can backfire and actually damage your score. My advice is almost always to keep old accounts open, especially if they don't have an annual fee.

Here's what happens when you keep them open:

A much better approach? Use that old card for a tiny, planned purchase once every few months—like a tank of gas or a cup of coffee. Pay the bill in full right away. This keeps the account active and working in your favor without you having to carry a balance.

"Can I Use My Debit Card or a Prepaid Card to Build Credit?"

Unfortunately, no. This is a common point of confusion. Debit and prepaid cards are linked directly to the money you already have in an account. Since you're not borrowing and repaying money, none of this activity gets reported to the credit bureaus.

To build a credit history, you have to show that you can responsibly manage borrowed money. That means using products designed for credit-building, such as:

Ready to take control and turn your responsible financial habits into a strong credit score? itin score provides the tools you need, from free credit monitoring to an AI-driven coach, all designed for ITIN holders. Sign up in minutes and start your journey today.