How to get inquiries off your credit report: Quick fixes

The only way to get unauthorized or fraudulent inquiries off your credit report is to formally dispute them with the credit bureaus. To have a real shot at success, you’ll need to pinpoint which inquiries are actually eligible for removal, draft a clear and concise dispute letter, and send it via certified mail with any proof you have.

Remember, legitimate inquiries can't be removed, no matter how much you wish they could. The whole game is about finding and zapping the errors.

Understanding Which Credit Inquiries Matter

Before you can even think about removing inquiries, you first have to understand the two different kinds that show up on your report. They aren't all the same, and knowing which is which is the critical first step in figuring out what’s worth your time and what’s not.

The two categories you’ll see are hard inquiries and soft inquiries.

The Impact of Hard Inquiries

A hard inquiry, or a "hard pull," happens when a potential lender checks your credit because you've officially applied for something new. This could be a mortgage, an auto loan, or that store credit card the cashier offered you at checkout. These are the ones you need to watch.

Why? Because they can knock a few points off your credit score, at least temporarily.

When other lenders review your credit profile, they see these inquiries. A sudden bunch of them in a short period can look like a major red flag, signaling that you might be in financial distress or are about to take on a lot of new debt. This is precisely why it's smart to be selective about where and when you apply for credit.

Hard inquiries stick around on your report for two years, though their impact on your score usually fades after the first twelve months. You absolutely have the right to dispute any hard inquiry that you didn't authorize or that is a flat-out error. To learn more about how they're recorded, this detailed guide from American Express is a great resource.

Why Soft Inquiries Don't Affect Your Score

On the flip side, soft inquiries (or "soft pulls") have zero impact on your credit score. These happen all the time without you even noticing—like when you check your own credit score, a company sends you a "pre-approved" credit card offer in the mail, or a potential employer runs a background check.

This distinction is everything. Your focus should be 100% on identifying and challenging incorrect hard inquiries. Don’t waste a second of your time or energy worrying about soft pulls. They’re just harmless background noise. If you want to dive deeper into the basics, check out our guide on what a credit inquiry is.

Hard vs Soft Credit Inquiries At A Glance

Here’s a quick comparison to help you tell the two apart when you’re scanning your credit report.

Knowing this difference is your first line of defense. Focus only on the hard inquiries that look suspicious or that you know for a fact you did not authorize.

Finding Inquiries You Can Actually Dispute

First things first, not every hard inquiry on your credit report is set in stone. Before you can even think about removing them, you need to play detective. That means digging into your credit files from Equifax, Experian, and TransUnion to figure out which inquiries you can actually challenge.

An inquiry from a loan you legitimately applied for isn't going anywhere. But mistakes, and especially unauthorized pulls? Those are fair game.

Your first move is to get your free reports from AnnualCreditReport.com. Once you have them, flip straight to the hard inquiry section and get ready to go through it with a fine-tooth comb.

Identifying Prime Candidates for Removal

As you scan your reports, you’re looking for specific red flags. Don't just glance at the company names; check the dates and think back to what you were doing financially at that time.

You’re hunting for inquiries that fit one of these classic scenarios:

These are the inquiries that will form the backbone of your dispute letters. If you want to get a better handle on the mechanics behind these checks, our guide on what a hard credit pull entails breaks it down even further.

Understanding the Gray Areas

Now, some inquiries can look a little fishy at first but are actually perfectly legitimate. Knowing the difference will save you from wasting time on disputes you're bound to lose.

A classic example is "rate shopping." When you’re looking for a mortgage or auto loan, you might apply with several lenders in a short period to find the best deal. Credit scoring models like FICO are built for this; they typically treat all those inquiries within a 14 to 45 day window as a single event.

After this review, you should have a solid, targeted list. For each inquiry you plan to challenge, you'll know exactly why it doesn't belong on your report.

How to Write a Dispute Letter That Actually Works

So you've found an inquiry that shouldn't be there. Now what? The next step is all about communication—making your case so clearly and professionally that the credit bureaus can't just brush it aside. A vague or sloppy letter is an easy one for them to dismiss. Your goal is to make it impossible for them to ignore your request.

Think of your letter less like a complaint and more like a formal business request that demands a specific action. Getting this right is crucial, and it's a good reason to improve your business communication skills in general.

The Anatomy of an Effective Dispute Letter

Your letter needs to be direct and packed with all the information the credit bureau needs to find the inquiry and understand exactly what you're disputing. If you leave out key details, you're just setting yourself up for delays or an outright rejection.

Every solid dispute letter must have these core elements:

This is not the place to tell a long, emotional story. Just stick to the facts. The bureaus are dealing with a massive volume of these requests, so clarity is your best friend.

A Simple Template to Get You Started

While you should always tailor your letter to your specific situation, this structure gives you a rock-solid foundation to build on. Just remember to fill in the bracketed information with your personal details.

[Your Name] [Your Address] [Your City, State, ZIP Code] [Your Date of Birth] [Your ITIN or SSN]

[Date]

[Credit Bureau Name - Experian, Equifax, or TransUnion] [Credit Bureau Address]

Subject: Dispute of Unauthorized Credit Inquiry

To Whom It May Concern,

I am writing to dispute an unauthorized hard inquiry currently listed on my credit report. I am formally requesting that this inaccurate item be removed immediately.

The inquiry I am disputing is as follows:

I did not authorize this inquiry, nor have I applied for any form of credit with this company. Under my rights granted by the Fair Credit Reporting Act, I request that you investigate this matter and remove this item from my credit file.

Please send me an updated copy of my credit report once this inquiry has been removed.

Thank you for your time and attention to this matter.

Sincerely,

[Your Signature]

[Your Printed Name]

Backing Up Your Claim

If your dispute stems from something serious like identity theft, you need to bring more firepower. Including a copy of your FTC Identity Theft Report or an official police report will make your letter significantly stronger. These documents give your claim official validation and can really speed up the removal process.

Just be sure to send copies—never the originals. You'll want to hang onto those.

Understanding the Credit Bureau Dispute Process

Mailing your dispute letter is a huge first step, but it's really just the beginning. What comes next is a bit of a waiting game, one that's governed by federal law. Knowing the rules of that game is how you stay in control. This isn't just about dropping a letter in the mail; it's about creating an undeniable paper trail for your dispute.

There's only one way I recommend sending your letter: certified mail with a return receipt requested. It might feel a little old-school and overly cautious, but trust me, it’s your most powerful tool here. It costs a few extra bucks, but you get a mailing receipt and, more importantly, a signature card proving the credit bureau got your letter. This paper trail is your non-negotiable proof of when the clock started ticking on them.

The 30-Day Investigation Clock

Once that signature card is stamped, the Fair Credit Reporting Act (FCRA) puts the credit bureau on a strict timeline. They generally have 30 days from the day they receive your letter to investigate your claim. During this month, they are legally required to reach out to the creditor who reported the inquiry and ask them to verify it.

What's happening behind the scenes is that the bureau forwards all the information you provided to the original lender. That lender then has to dig into their records and confirm you actually authorized the credit pull. If they can't find proof, or if they just don't respond within that 30-day window, the bureau must delete the inquiry from your file.

This system is designed to protect consumers like you, but you have to be patient and let the process run its course. For a deeper dive into your rights and the different ways you can tackle credit disputes, check out our complete guide on how to dispute your credit report.

Following Up and What the Results Mean

So, what happens if 30 days go by and you've heard nothing but crickets? This is exactly why you sent your letter via certified mail. If the deadline passes without a response, it's time to send a follow-up.

In this second letter, include a copy of your original dispute and a copy of the certified mail receipt that proves they received it. State firmly that they have failed to respond within the legally mandated timeframe and demand the immediate removal of the inquiry.

When you do hear back, the results of the investigation will arrive in one of two ways:

If the inquiry is deleted, congratulations—your work is done! But if it's verified and you're still certain it’s an error, don't give up. Your next move is to escalate the dispute, which we'll get into in the next section. Navigating this process takes persistence, but by following these steps, you can confidently see it through.

What To Do When Your Dispute Is Denied

It’s incredibly frustrating to get that letter in the mail. You’ve done your homework, sent in your dispute, and waited, only to be told the inquiry is staying put. It feels like hitting a brick wall, but I can tell you from experience, this is rarely the end of the road.

A denial just means the creditor told the bureau, "Yep, that was us." It doesn't mean you have to accept it. You still have some powerful moves left to make.

Re-Dispute with Stronger Evidence

Your first instinct might be to just send the same letter again. Don't. It won't work. The key to a successful second dispute is bringing new, compelling evidence to the table.

What does that look like? Maybe you dug up an old bank statement proving you had no relationship with that company on the date of the inquiry. Or perhaps you have a police report number from an identity theft claim that you didn't include the first time. The goal is to give the credit bureau a solid reason to reopen the case, not just re-read your old one.

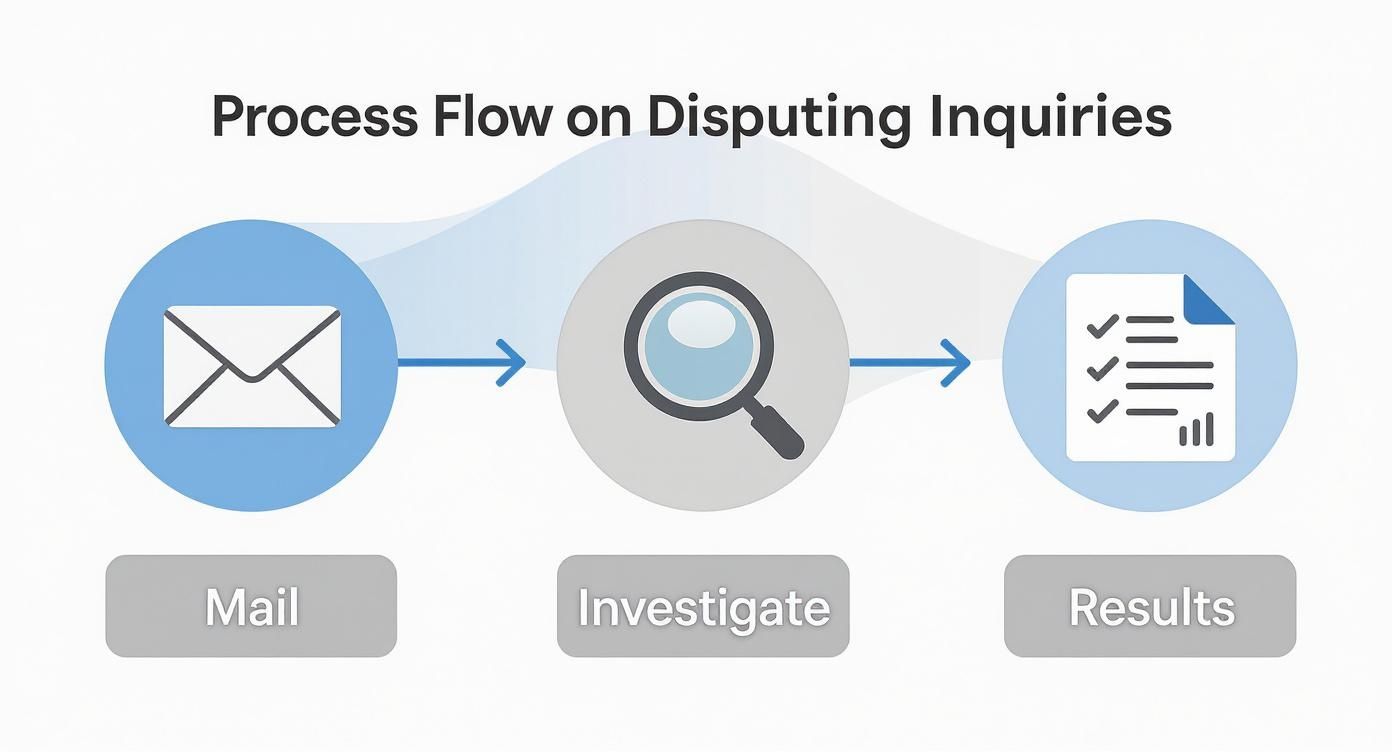

The whole dispute process is a fundamental consumer right. This is a good visual of how it's supposed to work, from your initial contact to their final decision.

As you can see, you've already been through these stages. Now, it's time to escalate.

File a Complaint with the CFPB

If the credit bureau still won't budge after your second attempt, it's time to bring in the big guns: the Consumer Financial Protection Bureau (CFPB). This is a federal agency that keeps an eye on the credit bureaus, and they take consumer complaints very seriously.

Filing a complaint is free and can be done right on their website. Once you submit it, the CFPB forwards your case directly to the credit bureau and requires them to respond—usually within 15 days. Suddenly, your dispute isn't just a letter in a pile; it's a formal complaint with a government watchdog waiting for an answer. This pressure often produces the results you were looking for all along.

Add a Consumer Statement to Your Report

If all else fails, you have one final right: you can add a 100-word statement to your credit file. This is your chance to attach your side of the story directly to the inquiry for any future lender to see.

While this won't remove the inquiry, it provides critical context. It tells anyone pulling your credit that you've actively challenged the item. As the global credit bureau market grows—projected to reach $16.8 billion by 2033—consumer rights are becoming more recognized. You can discover more insights about the global credit market to see how these systems are evolving. Adding a statement ensures your voice is officially part of your record.