How to Get First Credit Card: Tips to Build Credit Fast

So, you're ready to get your first credit card. It's a big step, and honestly, it’s one of the most important moves you can make for your financial future here in the United States. Getting it right from the start sets the foundation for everything else.

The process boils down to a few key things: making sure you're financially ready, picking the right beginner-friendly card (like a secured or student card), and putting together a solid application.

Starting Your Credit Journey the Right Way

Diving into the world of credit can feel a little intimidating, but it’s more straightforward than most people think. The market today is more welcoming to newcomers than ever before, which is great news for you.

Think of your first credit card as more than just a way to pay for things. It’s your primary tool for building a credit score. That three-digit number is what lenders will look at when you want to rent an apartment, finance a car, or get a personal loan down the road. Plus, it gives you a safety net for emergencies and can even earn you rewards like cashback on your daily spending.

Why Now Is a Great Time to Start

The consumer credit market is booming, creating a ton of opportunities for people applying for the first time. As of the first quarter of this year, there are a record-breaking 631.39 million credit card accounts in the U.S. That’s an increase of over 50% in just the last ten years.

What does that mean for you? It means card issuers are actively looking to bring new people into the credit system. You can find more insights on this trend over at Sellers Commerce's blog.

This welcoming environment gives you fantastic options designed specifically for beginners. You get to start with a clean slate and build responsible habits from day one. If you're truly starting from scratch, our guide on how to establish credit is the perfect place to begin.

Finding Your Perfect First Card

To make things easier, let's break down the most common types of starter cards. Each one is built for a different situation, whether you're a student or just someone looking to build a credit history from the ground up.

Quick Guide to Your First Credit Card Options

This table gives you a quick snapshot of the best card types to start with. Think about your own financial situation to see which one fits you best.

Choosing the right type of card from the get-go dramatically increases your odds of approval and helps you build credit effectively. Take a moment to consider which path makes the most sense for your journey.

Checking Your Financial Readiness

Before you even start looking at credit cards, it's a good idea to pause and take a quick inventory of your financial situation. Getting that first approval isn't just about filling out a form; it’s about proving to the card issuer that you’re a responsible person they can trust with credit. A little prep work now will help you apply with confidence.

First off, make sure you meet the basic requirements. In the U.S., you have to be at least 18 years old to get a credit card in your own name. If you're under 21, you'll also need to prove you have an independent source of income.

This brings us to what is arguably the most important piece of the puzzle for a first-timer: your income. Without a credit history for lenders to look at, they'll lean heavily on your ability to pay back what you borrow.

Proving You Can Make Payments

Your income is the main way a credit card company will size up your financial stability. The good news is that you don't necessarily need a traditional 9-to-5 job to get approved. Lenders are often flexible about what they consider valid income.

Think about all your financial resources. You can usually include a variety of sources on your application, such as:

The most important thing is to be completely honest and accurate. A lender might ask for proof, so be ready to provide documents like pay stubs or bank statements that back up the numbers you put on your application.

Gathering Your Essential Documents

Getting your paperwork sorted out before you start an application will make the whole process a thousand times easier. You'll avoid that frantic last-minute scramble to find a specific document.

Here’s a quick checklist of what you should have ready to go:

When you have all of this ready, you're not just organized—you're sending a message to lenders that you're serious about your financial future. This simple prep can make a real difference in how smoothly your application goes.

Finding the Perfect First Credit Card

Choosing your first credit card isn't just about getting a piece of plastic in your wallet. It’s about picking a financial tool that will help you build a strong credit foundation for years to come. The right card makes this process easy and even rewarding, but the wrong one can quickly become a headache.

Let's break down the three main types of cards you'll encounter and figure out which one fits your life right now.

The Power of Secured Credit Cards

For most people starting from scratch with an ITIN, a secured credit card is the single best way to get your foot in the door. The magic behind them is a refundable security deposit you pay upfront.

This deposit, which is usually between 200** and **500, sets your credit limit. So, if you deposit 300**, your credit limit is **300. This completely removes the risk for the bank, which is why approval rates are so high for applicants with no credit history.

You use it just like a regular credit card. As you make purchases and pay your bill on time, the bank reports all that good activity to the credit bureaus. After about a year of responsible use, most banks will "graduate" you to a traditional unsecured card and send your deposit back.

Exploring Student Credit Cards

If you happen to be enrolled in college, you’re in luck. Student credit cards are specifically designed for people just like you—with limited income and no credit history to speak of.

Since banks are trying to win over students, these cards often come with perks tailored to campus life, like extra cash back on food, textbooks, or even your favorite streaming service. The income requirements are also much more relaxed compared to standard cards.

The biggest long-term advantage? You start building a relationship with a major bank early on. Managing a student card well can make it so much easier to get approved for premium rewards cards once you graduate and start your career.

Unsecured Cards for Beginners

Finally, there's a small category of unsecured cards built for people with a "thin file"—meaning you have very little credit history, but maybe not zero. Unlike secured cards, these don't require any security deposit.

That might sound ideal, but there's a catch. These cards almost always come with higher interest rates and very low starting credit limits. The lender is taking a bigger risk on you, so they protect themselves with stricter terms.

This can still be a good path if you have a stable income, but be sure to read the fine print on fees and interest rates. To get a better idea of what's out there, check out our guide on the best credit cards for people with no credit history.

The financial world is constantly changing. With worldwide card transactions projected to jump by 43% by 2029, banks are more motivated than ever to create accessible products for newcomers. You can dive deeper into these trends by reading the full report on payment industry growth.

Comparing Starter Credit Card Options

To help you visualize the differences, here’s a quick breakdown of the three main options. Think about your current situation—are you a student? Do you have money for a deposit?—and see which column aligns best with your needs.

Ultimately, there's no single "best" card—only the one that's best for you. A secured card is often the safest and most reliable starting point for ITIN holders, but if you qualify for a student or unsecured starter card, they are excellent alternatives worth exploring.

Applying to Maximize Your Approval Odds

Alright, you've done the research and picked out a card. Now for the application itself. This is where all that prep work really shines, but there are a few extra things you can do to nudge the odds firmly in your favor.

Think of the application as your one shot to convince the lender you're a good bet. It’s not just about filling out forms; it's about presenting a clear, accurate picture of yourself as a reliable borrower. A simple mistake—a typo in your address or a transposed number in your ITIN—can get your application kicked out by an automated system before a human ever sees it. Before you even think about hitting "submit," take five minutes to review every single piece of information. Seriously.

Use Pre-Approval Tools to Your Advantage

One of the best-kept secrets for first-time applicants is the pre-approval tool. Most major card issuers have one on their website, and it's a game-changer. It lets you check which cards you have a good shot at getting without actually affecting your credit score.

This works because the issuer runs a "soft" credit inquiry, which isn't visible to other lenders. If you get the green light, it's a very strong indicator that you’ll be approved when you submit the real application. It’s the perfect way to test the waters and avoid the sting—and the temporary score dip—of a "hard" inquiry from a formal application that gets denied.

The Power of Being an Authorized User

Here’s another fantastic strategy: ask a trusted family member or friend with a great credit history to add you as an authorized user on their credit card. You’ll get a card with your name on it, but they remain responsible for paying the bill.

The real benefit? The entire positive payment history of that account can show up on your credit report. Suddenly, you have a credit history that demonstrates on-time payments and responsible use. For someone starting from scratch, this can be a massive shortcut to building a solid credit foundation.

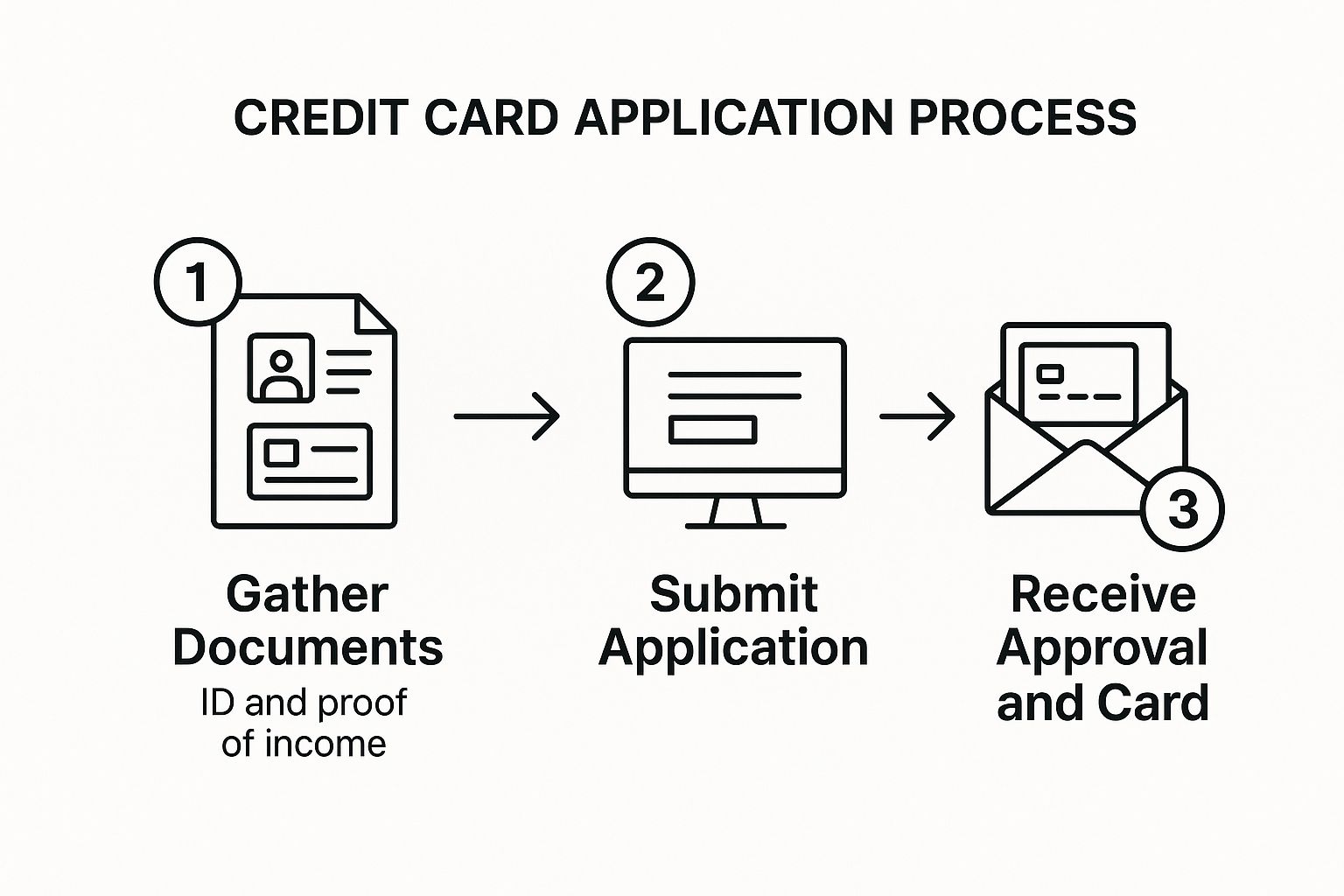

Navigating the Application Process

The application itself is usually pretty straightforward, but knowing what to expect can make the process much less stressful. This visual guide breaks down the essential flow.

As you can see, the heavy lifting is all in the preparation phase. Once you have your documents in order, the submission and decision part is often quick and direct.

After you submit, you might get an instant decision, or it could take a few business days. If you aren't approved on the spot, don't panic. Sometimes the bank just needs a little more time to verify your information. If you do get denied, they are required by law to mail you a letter explaining the reasons. Treat that letter as valuable feedback for your next application.

Using Your New Card to Build Great Credit

Getting approved is a fantastic first step—congratulations! It's a huge milestone. But remember, the plastic card in your wallet is just a tool. The real work, and the real reward, begins now. Using it wisely is your key to building a strong credit history, which opens doors to a much better financial future in the U.S.

The single most important habit you can form is almost painfully simple: pay your bill on time, every single month. No exceptions. A single late payment can knock your new credit score down and haunt your report for years. My best advice? Set up autopay for at least the minimum payment. It's a safety net that ensures you're never late.

Keep an Eye on Your Credit Utilization

Right after on-time payments, the next biggest factor influencing your score is something called your credit utilization ratio. It sounds complicated, but it's just the percentage of your available credit you're currently using. Lenders want to see that you aren't maxing out your card.

Let's say you have a secured card with a 300** limit. If you charge **210 to it, your utilization is a sky-high 70%. Even if you pay it off at the end of the month, that high ratio can drag your score down. A solid rule of thumb is to keep your balance below 30% of your limit. In this case, that means keeping your spending under $90.

Smart Habits for a Stronger Score

The small, consistent habits you build now will set the foundation for your entire financial life. It all comes down to being mindful and staying organized.

Building a solid financial base doesn't happen overnight. It takes patience. If you want to explore these strategies in more detail, our complete guide on how to build credit from scratch is a fantastic next step.

The High Cost of Carrying a Balance

Letting a balance roll over from one month to the next is a trap that's easy to fall into—and very expensive to get out of. The average interest rate on credit cards is now sitting around 20.8%. At that rate, even a small debt can quickly balloon.

It’s a major reason why total U.S. credit card debt has soared past $1.14 trillion. By paying your bill in full every time, you completely avoid those costly interest charges and keep your financial journey on a much healthier path.

A Few Common Questions About Getting Your First Credit Card

Even with the best plan, you're bound to have some questions when you apply for your very first credit card. It's totally normal. Let's walk through some of the most common ones I hear so you can move forward without any second-guessing.

What Credit Score Do I Need for My First Card?

This is the best part: you often don’t need any credit score at all. Seriously.

Cards designed for newcomers, especially secured and student cards, are built for people with a blank credit slate. The banks know you're just getting started. Instead of looking at a score you don't have, they'll focus more on things like your income and whether you can handle the payments.

With a secured card, your deposit does all the heavy lifting. It removes the risk for the bank, making your lack of a credit history a complete non-issue.

What Happens If My Application Is Denied?

Getting a denial stings, I get it. But try to see it as a clue, not a failure. By law, the card issuer has to send you a letter (it's called an adverse action notice) that spells out exactly why they said no.