How to Get Approved for a Credit Card: Tips & Strategies

Getting approved for a credit card isn't a game of chance. It’s all about preparation. Lenders are looking at three main things: your credit score, a stable income, and how much debt you're already carrying. Once you understand how these elements work together, you're well on your way to putting together an application that gets a "yes."

Your Credit Card Approval Game Plan

Before you even think about applying for that shiny new rewards card, you need to take a hard look at your own finances. Lenders have a specific checklist they run through to figure out if you're a good risk, and knowing what's on that list gives you a huge advantage.

It lets you see your financial picture from their perspective and clean up any potential red flags before they see them. This isn't just about having a big paycheck; it's about proving you're a responsible person who can handle credit wisely.

The Foundation of a Strong Application

When a lender reviews your application, they zero in on a few key metrics. Nailing these will seriously boost your approval odds.

A Look at the Approval Landscape

It's helpful to know what you're up against. In the United States, recent data shows that about 44% of all general-purpose credit card applications get approved. That's the highest it's been since 2016, but it still means more than half are denied.

Generally, lenders want to see a credit score north of 700. Once you hit that "prime" category, your approval odds go way up. You can find more details on these trends and other credit card statistics on ClearlyPayments.com.

Knowing these numbers helps you set realistic goals. If your score isn't quite there yet, your focus should be on building it up before you apply. This proactive approach works so much better than just firing off applications and hoping one sticks.

To give you a clearer picture, here’s a quick breakdown of what lenders are looking for.

Key Factors for Credit Card Approval

This table sums up the most important parts of your application and what a strong profile looks like from a lender's point of view.

By focusing on these key areas, you're not just guessing—you're building a strategy. And that’s how you get that credit card approval.

Assessing Your Financial Health Like a Lender

Before you even think about filling out an application, you need to see your finances the way a lender does. It’s a crucial first step. Lenders get a quick read from your credit score, but that's just the headline. The real story—your entire history of managing debt—is found in your credit report.

Getting a handle on this information before you apply is the single most important thing you can do. By putting yourself in the lender's shoes, you can spot and fix potential red flags that might otherwise lead to a denial.

Decoding Your Credit Score

Think of your credit score as a quick summary of how reliable you are with money. While the exact math behind it is a secret, we know exactly what ingredients matter most. A high score tells lenders you're a safe bet, while a low score signals risk.

Here’s a look at what goes into that all-important number:

It's also worth noting that the lending world has gotten a bit tougher. Banks have been tightening their standards, making a strong credit profile more important than ever. In early 2025, the share of credit cards issued to borrowers with scores under 660 fell to just 16.4%, a big drop from 23.3% in 2022. You can dig into more of this data directly from the Federal Reserve Bank of Philadelphia.

Your Credit Report: The Full Story

If the score is the summary, the credit report is your financial biography. It lists every credit account, your payment history for each, and any public records. You absolutely must review this report for errors. Even one small mistake can pull your score down.

You’re legally entitled to a free report from each of the three main bureaus—Equifax, Experian, and TransUnion—every single year. For a more detailed breakdown, we have a guide that explains the differences between a credit report and a credit score.

Calculating Your Debt-to-Income Ratio

Besides your credit history, lenders are laser-focused on one other thing: your ability to take on more debt right now. They use a simple calculation called the Debt-to-Income (DTI) ratio to figure this out. It’s a straightforward comparison of how much you owe each month versus how much you earn.

Here’s how to find yours: add up all your monthly debt payments (rent/mortgage, car payments, student loans, minimum credit card payments). Divide that total by your gross monthly income (your income before taxes), and then multiply by 100.

Let's walk through an example:

Say your gross monthly income is $4,000. Your monthly debts look like this:

Your DTI would be (1,750 / 4,000) * 100 = 43.75%.

Most lenders want to see a DTI ratio below 36%. If you're creeping over 43%, it becomes very difficult to get approved for anything new because it looks like your budget is stretched too thin. If your DTI is on the high side, your best move is to focus on paying down some of that existing debt before you apply for a new card. It can make all the difference.

How to Build a Stronger Credit Profile

If your current credit profile isn’t quite where lenders want it to be, don’t sweat it. Building a solid financial identity is a marathon, not a sprint. With the right game plan, you can construct a credit history that opens doors and proves you're a reliable borrower.

Think of your credit profile as your financial resume. Every smart move you make adds a glowing reference. The goal is to create a track record that screams responsibility and stability, which is exactly what lenders are looking for.

There are a few proven paths you can take to get there. Each one is designed to show you can handle credit responsibly—the key to getting approved for a new credit card.

Become an Authorized User

One of the fastest ways to give your credit a leg up is to become an authorized user on someone else's credit card. This works wonders if you have a family member or partner you trust who has a long and spotless credit history.

When they add you to their account, the card's history—its age, credit limit, and payment record—can get added to your credit report. If that account has been in good standing for years, it can instantly inject a ton of positive data into your file.

Imagine your parent adds you to a card they've managed perfectly for 15 years. That long history of on-time payments can give your report a major boost. It helps increase the average age of your accounts and shows lenders you're connected to responsible credit management.

Use a Secured Credit Card

For anyone starting from scratch or rebuilding their credit, a secured credit card is an absolute game-changer. Unlike a regular credit card, a secured card requires you to put down a small, refundable cash deposit to get started.

That deposit usually sets your credit limit. Put down 300**, and your credit limit becomes **300. This deposit takes the risk off the bank's shoulders, which is why it's so much easier to get approved, even if you have a thin credit file or a few past mistakes.

The real magic happens when the issuer starts reporting your activity to the credit bureaus each month. By making small purchases and paying your bill on time, every time, you're actively building a positive payment history—the single most important factor in your credit score. To get the full scoop, check out our guide on what a secured credit card is and how it can work for you.

After six to twelve months of consistent, responsible use, many banks will review your account and may even upgrade you to a traditional unsecured card, returning your original deposit.

Try a Credit-Builder Loan

Another smart tool in your arsenal is the credit-builder loan. It’s a bit different because it works backward from a normal loan. Instead of getting cash upfront, your loan amount is held in a locked savings account while you make small, fixed monthly payments.

Each payment you make is reported to the credit bureaus. Once you've paid off the loan, the full amount is released to you, sometimes with a little interest earned. It's a brilliant way to build credit while forcing yourself to save money.

Here’s a quick breakdown of how these options compare:

Master Your Credit Utilization

Finally, let’s talk about one of the most powerful habits you can build: managing your credit utilization ratio (CUR). This is simply the percentage of your available credit that you're using at any given time. Lenders get nervous when they see high utilization because it can be a red flag for financial stress.

You’ve probably heard the rule of thumb: keep your utilization below 30%. So, if you have a 1,000** total credit limit, you should try to keep your balance under **300.

But if you want to really impress lenders, aim for under 10%. This signals that you have your finances under control and don't depend on credit for daily life. A simple trick is to pay your bill right after a big purchase or even a few times a month. This ensures the balance that gets reported to the bureaus is always low, a key step in getting that credit card approval.

Choosing the Right Card and Applying Strategically

Once you've done the hard work of getting your financial house in order, it's time to make your move. This is where a little strategy goes a long way. The biggest mistake I see people make is applying for the wrong card, which almost always ends in a quick rejection and a ding on their credit report from a hard inquiry.

Think of it this way: you wouldn't apply for a senior management position with an entry-level resume. The same logic applies here. If you're just starting to build your credit, that premium travel rewards card isn't for you—not yet, anyway. Your best bet is to focus on starter cards, like secured or student cards. They’re designed for people in your exact situation and have much friendlier approval odds.

Use Pre-Qualification Tools First

Before you even think about hitting that "submit" button, do yourself a favor and use the pre-qualification or pre-approval tools offered by most major card issuers. This is one of the smartest things you can do.

These tools run a soft credit inquiry, which does not impact your credit score. It's like getting a sneak peek at the bank's decision. If the pre-qualification comes back positive, your approval chances are very good. If it doesn't, you know to look elsewhere without taking a hit to your credit.

Match Your Profile to the Right Card Tier

Knowing where you stand is everything. Lenders group their cards into different tiers based on the credit scores they're looking for. Your job is to find a card where your score fits right in with their target audience.

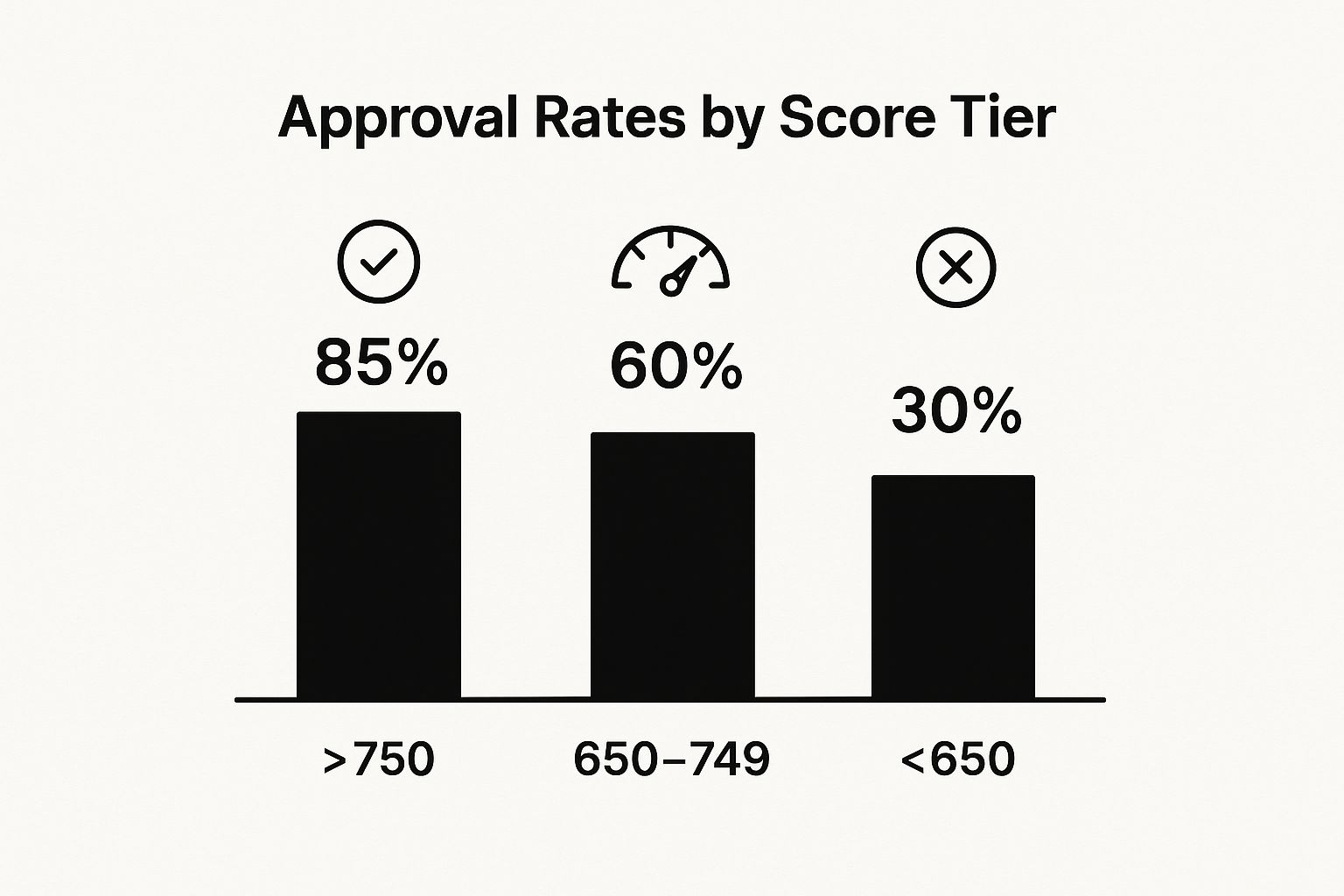

The image below shows just how much approval rates can swing depending on credit score.

As you can see, having excellent credit makes a massive difference. That's why it's so important to apply within your league.

Credit card issuers have a pretty good idea of what a "good" applicant looks like for each of their products. This table breaks down the general expectations.

Credit Card Tiers vs. Typical Credit Score Requirements

Applying for a card that aligns with your current score dramatically increases your odds of getting that "approved" notification.

Nailing the Details on the Application

When you finally sit down to fill out the application, accuracy is your best friend. Seriously, double-check every single field—your name, address, date of birth. One tiny typo can get you an automatic denial.

Pay close attention to the total annual income field. You need to be honest, but don't sell yourself short. You can often include more than just your salary from your main job. Lenders typically allow you to report any income you have reasonable access to, which could include:

Listing your full household income gives the lender a clearer picture of your ability to manage payments, which can really boost your chances. If this is your first time, check out our guide on the essentials for a https://www.itinscore.com/blog/first-time-credit-card-application/ to steer clear of common rookie errors.

If you’re self-employed, getting approved often requires a slightly different game plan. For more specific advice, this complete approval guide for self-employed individuals is a fantastic resource. By choosing the right card and being meticulous with your application, you turn what feels like a gamble into a calculated step toward building a stronger financial future.

What to Do When Your Application Is Denied

Getting a credit card rejection is frustrating. It’s easy to feel like you’ve hit a wall, but I encourage you to see it as valuable feedback. A denial isn't a final "no"—it’s a clear signal that something in your financial profile just didn't quite line up with what that particular lender was looking for.

This is your chance to get some insider information and come back with a much stronger application next time. But first, your initial move shouldn't be to apply for another card. It's to check your mail.