How to Establish Credit History from Scratch

Think of your credit history as your financial reputation in the United States. It's the first and most fundamental step you'll take toward unlocking the entire U.S. financial system. This record of how you handle borrowing and repayments is what lenders, landlords, and even cell phone companies look at to decide if they can trust you.

Why Building Credit Is Your Financial Launchpad

If you're new to the country, the whole idea of a 'credit history' can feel a bit overwhelming. But it’s so much more than just a gateway to getting a mortgage or a car loan. A strong credit history is a master key that opens doors to countless opportunities, often making life easier and more affordable. Without one, you're what's known as "credit invisible," a label that can pop up and create unexpected roadblocks.

Picture this: you've found the perfect apartment, but when the landlord runs a credit check, they find nothing. Suddenly, they're demanding a security deposit equal to three months' rent just to be safe. Or maybe you're trying to get a new phone plan, but the carrier insists on a huge upfront deposit before they'll activate your line. These aren't just hypotheticals—they are real-world headaches faced by millions.

It's About More Than Just Borrowing

Learning how to establish credit history is really about proving your reliability, which translates into real savings and fewer hassles in your daily life.

You're Not Alone in This

This isn't a niche problem. In the U.S., a staggering 45 million people are considered credit unserved or underserved, meaning they have a thin or non-existent credit file. That makes getting even basic financial tools a real struggle.

But here's the good news: things are changing. A TransUnion study revealed that every two years, about 20% of these individuals successfully move from being credit invisible to credit active. Many do it by using the very tools we'll discuss, like secured cards and credit-builder loans.

Taking proactive steps to build your credit file is one of the most powerful financial moves you can make. It takes you from being a financial question mark to a trustworthy partner in the eyes of the U.S. financial system.

Your First Steps in Building Credit with an ITIN

Getting started is often the toughest part, but when it comes to building a credit history, the path is actually more straightforward than you might think. For ITIN holders starting from a clean slate, there are two fantastic, low-risk tools that financial institutions trust: secured credit cards and credit-builder loans.

Think of these as your training wheels for the U.S. financial system. They’re specifically designed for people with little to no credit history, making them much easier to get than a traditional credit card or loan. Let's break down how each one works so you can pick the right one for your situation.

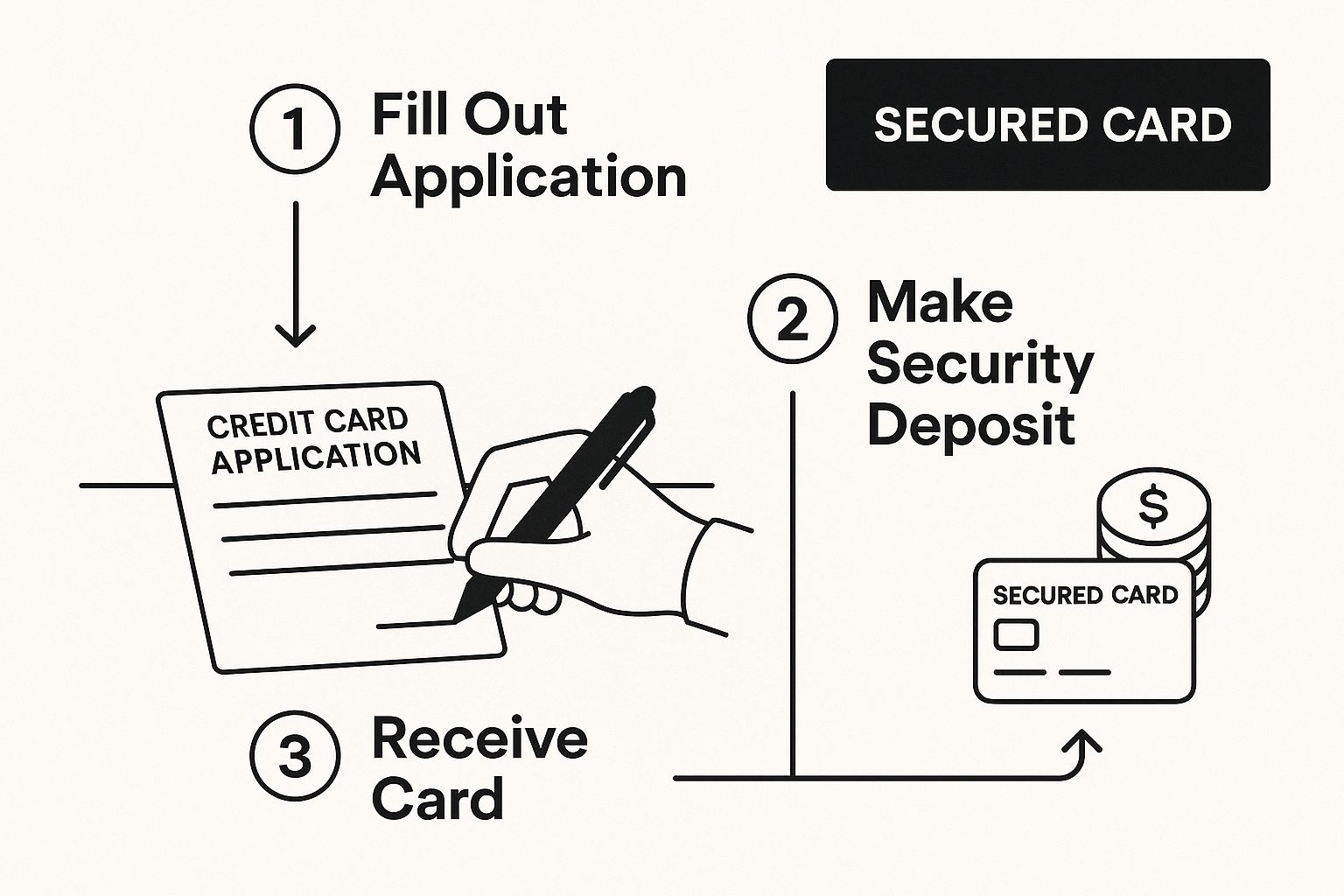

As you can see, the process for a secured card is simple. Your own deposit secures your credit line, creating a safe starting point for both you and the bank.

The Secured Credit Card: Your Reliable Starting Point

A secured credit card is easily one of the most common and effective ways to kick off your credit journey. It works just like a regular credit card, but with one key twist: you put down a refundable security deposit first.

This deposit, usually somewhere between 200 and 500, sets your credit limit. So, if you deposit 300**, you’ll get a credit card with a **300 spending limit. This cash acts as collateral, which takes the risk off the bank’s shoulders. If for some reason you can’t pay your bill, they can use your deposit to cover what’s owed.

Once you have the card, use it for small, routine purchases like gas or groceries, and—this is the important part—pay the bill on time every single month. The bank then reports your positive payment history to the three major credit bureaus: Experian, Equifax, and TransUnion. This reporting is exactly how you build your credit file from the ground up.

When you're shopping around, keep an eye out for cards with low or no annual fees. After about 6 to 12 months of consistent, on-time payments, many banks will review your account. They might even refund your deposit and "graduate" you to a regular, unsecured credit card, often with a higher credit limit.

The Credit-Builder Loan: A Unique Approach

A credit-builder loan is a bit different—I like to think of it as a loan in reverse. The goal isn't really to borrow money you need right now. It’s all about proving you can make steady payments over time, with the added bonus of helping you build up some savings.

Here’s the breakdown of how it works:

Once you’ve made all the payments, the bank unlocks the savings account and gives you the full amount. You've successfully built a positive payment history and now have a nice little nest egg to show for it. It's a great method for showing financial discipline without having an open line of credit to tempt you.

To go deeper on these foundational strategies, check out our complete guide on how to build credit from scratch.

Comparing Your First Credit-Building Tools

So, which one is right for you? Deciding between a secured card and a credit-builder loan really comes down to your personal financial habits and goals. One gives you spending power right away, while the other forces you into a savings habit.

This table puts them side-by-side to make the choice a little clearer.

Honestly, you can't go wrong with either option. Both are powerful tools designed to help people in your exact position enter the U.S. credit system safely. By making those small, consistent payments, you're laying a rock-solid foundation for your financial future.

Tapping into Relationships to Fast-Track Your Credit

While secured cards and credit-builder loans are fantastic tools for going it alone, don't overlook one of the most powerful methods available: leveraging the strong credit history of someone you trust. The most common way to do this is by becoming an authorized user on another person’s credit card.

Think of it like getting a massive head start. When a primary cardholder with an excellent track record adds you to their account, their years of positive payment history and the age of their account can be reported to the credit bureaus under your name. For someone just starting out, this can be a total game-changer, helping you establish credit history almost overnight.

For an ITIN holder, this is often the quickest way to get an initial credit score on the board. It doesn’t require a security deposit and can signal to lenders that you're associated with a responsible account, making them much more willing to give you a shot on your own.

What It Really Means to Be an Authorized User

Becoming an authorized user is much simpler than it sounds. The primary cardholder—a parent, spouse, or very trusted friend—simply calls their credit card company and asks to add you to their account. They'll need some basic info, like your name and date of birth, and some banks might ask for your ITIN.

The key thing to understand is that you are not financially on the hook for the balance. The legal responsibility to pay the bill belongs entirely to the primary cardholder. You might get a card with your name on it, but you don't even have to use it for the positive reporting to benefit you.

The perfect account to be added to has two main characteristics:

These are two of the biggest factors in a credit score, so piggybacking on a great record can give your own score a serious boost.

How to Approach Someone with This Big Favor

Asking someone to add you to their credit card is a big deal. It’s a request built on a foundation of trust. You have to approach the conversation with total transparency and show you understand what you're asking. It's best to frame it as a temporary step to help you get on your feet financially in the U.S.

Here’s a straightforward, honest way to ask a family member you trust:

"I'm working hard to build my U.S. credit history so I can eventually qualify for an apartment and get better rates on financial products. I learned that one of the best ways to get started is by becoming an authorized user on an established, well-managed account. Would you be comfortable adding me to your credit card for a little while? I wouldn't even need to use the card. Your positive payment history would just get reported to my credit file, which would help me immensely. I'm happy to talk through any concerns you might have."

This approach is direct, explains the "why," and immediately addresses their potential risks.

Navigating the Risks for Everyone Involved

This strategy is powerful, but it’s not without risks. Honesty is crucial.

For the Primary Cardholder: The main risk is obvious—what if the authorized user goes on a spending spree? This is a valid concern. To prevent this, the primary cardholder can add you as a user but simply not give you the physical card. The positive history will still report to the bureaus.

For you, the Authorized User: You're tying your financial reputation to theirs. If the primary cardholder starts missing payments or maxes out the card, that negative activity will show up on your credit report, too. It could tank your score instead of helping it.

This is exactly why the entire strategy hinges on trust. You should only do this with someone whose financial habits you know inside and out. With clear communication and mutual respect, becoming an authorized user can be an incredible launchpad on your journey to financial independence.

Use Your Everyday Bills to Prove You're Creditworthy

Building credit used to mean one thing: taking on debt. You'd get a credit card or a loan and hope for the best. But what if you could build a strong credit history just by paying the bills you already have? It's a game-changer, and it's happening right now.

A new wave of services lets you get credit for the responsible financial habits you already practice, like paying your rent and utility bills on time. This is a huge deal for anyone starting from scratch, especially ITIN holders. You're essentially turning your existing monthly expenses into powerful credit-building tools, all without opening a new line of credit.

This whole idea of broadening what "creditworthiness" means is catching on worldwide. Just look at the work the International Finance Corporation is doing, supporting credit infrastructure projects in over 44 countries. They're helping systems, like a regional bureau in West Africa serving more than 6 million people, get a fuller picture of someone's financial life. To see how these global initiatives are shaping credit, you can explore the IFC's credit infrastructure work.

Turn Your Rent Payments into a Credit Score Boost

For most of us, rent is the biggest check we write each month. It only makes sense that paying it on time, over and over, should count for something. And now, it can. Rent-reporting services are designed to do exactly that—report your on-time rent payments to the major credit bureaus.

When you use one of these services, a new tradeline appears on your credit report, much like a loan or credit card would. A long, consistent history of on-time rent payments can make a real difference, especially when your credit file is thin.

So how does it work? It's pretty simple:

Some of these services are free, especially if your landlord is already partnered with them (like with Esusu), while others like Rental Kharma work with individual landlords for a small fee. We've got a whole guide on this, so if you want the full rundown, check out our article on how to build credit with your rent payments.

Leverage Your Utility and Phone Bills

Rent isn't the only bill you can use. Those other recurring expenses—your cell phone, electricity, even your streaming subscriptions—can also add positive history to your credit file. This is another fantastic way to build credit without actually borrowing money.

The best-known tool for this is Experian Boost. It's a completely free feature from the credit bureau Experian. You just link the bank account you use to pay your bills, and it scans for on-time payments for things like utilities, your phone, and streaming services.

Getting started is easy. Connect your bank account, point out the recurring payments you want to add, and confirm. Experian reports that users see an average FICO Score 8 increase of 13 points.

Choosing the Right Bill-Reporting Service

With a few options out there, how do you pick the right one? It really comes down to your personal situation. You'll want to look at the cost, which credit bureaus they report to, and how much work you'll need to put in.

A Quick Comparison of Bill-Reporting Options

Using these services is a savvy move. You're getting the credit you deserve for bills you're already paying anyway. It's a low-risk strategy that lets you use your existing financial discipline to build a solid foundation for your future in the U.S.

How to Read and Understand Your U.S. Credit Report

Building your credit is a huge first step, but the real work lies in keeping it healthy. Once you start using credit-building products, every move you make gets recorded on a document called a credit report. This report is essentially your financial reputation in the U.S., so learning how to read it is a skill you can't afford to skip.

In the United States, your financial story is told by three main characters: Experian, Equifax, and TransUnion. These are the major credit bureaus. They collect information from your lenders and other financial companies to build a detailed file on your credit habits.

You’ll probably notice that your reports from each bureau look slightly different. That's perfectly normal. Not every lender reports your activity to all three bureaus, which is why it's so important to check all three to get the full story.

What's Actually Inside Your Credit Report?

Think of your credit report as a financial resume. It might seem complicated at first, but it’s really just broken down into a few main sections. Once you know what they are, the whole thing becomes much clearer.

Here’s what you’ll find:

From Report to Score: What the Numbers Mean

All that data in your report gets crunched into a simple, three-digit number: your credit score. Lenders use this score as a quick snapshot to judge how risky it might be to lend you money. The two big scoring models you’ll hear about are FICO Score and VantageScore.

Both models look at your report, but they weigh things a little differently. Here are the ingredients that matter most for your FICO Score: