How to Dispute Credit Report Errors and Win

Finding an error on your credit report is more than just a minor hassle—it’s a direct threat to your financial well-being that you need to address head-on. Tackling these inaccuracies involves a clear process: you spot the mistake, gather the proof to back up your claim, file a formal dispute with the credit bureaus, and then stay on top of it until the error is gone for good. Think of it as essential financial self-defense.

Why You Can't Afford to Ignore Credit Report Errors

An unchecked error on your credit report can quietly wreak havoc on your financial life. This isn't some far-off problem; it has real, tangible, and often expensive consequences. A single mistake—like a payment marked late when you know you paid on time, or an account that isn't even yours—can directly inflate the interest rates you're offered on mortgages and car loans. We're talking about a difference that can cost you thousands over the life of the loan.

These inaccuracies can also be a major roadblock. I've seen people get rejected for an apartment lease because a bogus collections account spooked the landlord. It doesn't stop there. Insurance companies often use credit-based scores to set premiums, meaning an error could easily mean you’re paying more than you should for car or home coverage.

Mistakes Are More Common Than You Think

It’s easy to assume these errors are rare, but the data tells a different story. A major study by the Federal Trade Commission (FTC) found that about 5% of American consumers have significant errors on their credit reports. These aren't just small typos; they are the kind of serious mistakes that lead to people paying more for loans and other financial products.

When you consider that the three major credit bureaus—Equifax, Experian, and TransUnion—each maintain files on around 200 million people, that 5% translates to roughly 10 million Americans paying higher costs because of mistakes they didn't make.

Credit report errors can range from simple mix-ups to fraudulent activity. Understanding what to look for is the first step in protecting yourself.

| Common Credit Report Errors and Their Financial Impact | | :--- | :--- | :--- | | Type of Error | Example | Potential Financial Impact | | Identity Mix-Up | Information belonging to someone with a similar name appears on your report. | Negative items from another person's history can lower your score, leading to loan denials or higher interest rates. | | Incorrect Account Status | A closed account is reported as open, or a current account is marked as delinquent. | Can incorrectly lower your credit score and make you appear riskier to lenders. | | Data Mismanagement | A single late payment is reported multiple times, or a debt is listed more than once. | Artificially inflates your debt levels and can significantly damage your payment history, a key scoring factor. | | Fraudulent Accounts | A thief opens a new credit card or loan using your personal information. | You could be held responsible for debt you never incurred, leading to collections and severe credit damage. |

These examples aren't just hypotheticals; they happen every day. The good news is that you have the power to fix them.

Your Path to a Clean Report

Fortunately, you have rights. The Fair Credit Reporting Act (FCRA) gives you the legal power to demand accuracy from the very institutions that hold so much influence over your financial future. Taking back control of your financial story involves a few key actions:

First Things First: Getting and Reviewing Your Credit Reports

Before you can even think about fixing an error on your credit report, you have to find it. This means you need to get your hands on the reports from all three major credit bureaus: Experian, Equifax, and TransUnion. And you shouldn't have to pay a dime for them.

The only place to get your official, federally-mandated free reports is AnnualCreditReport.com. Be careful—there are a ton of look-alike sites out there designed to sell you services you don't need right now. Stick with the official one. Checking your reports here won't affect your score at all.

It’s absolutely critical to pull all three. I've seen it happen time and again: a creditor or landlord pulls from just one bureau, and that's the one with the mistake. If you only check your Experian report, you could completely miss a damaging error sitting on your Equifax file.

Put on Your Detective Hat

Once you have the reports in hand, resist the urge to just glance over them. Think of this as a detailed investigation. The information can be overwhelming, so you need a plan to make sure nothing slips through the cracks.

Here’s a practical tip I always share: grab a few different colored highlighters. Use one color for personal information that’s off (a misspelled name, an old address you haven't lived at in years), another for account details that look fishy (an incorrect balance, a payment you know was on time marked as late), and a third for anything else that makes you pause. This simple visual system helps you spot patterns and organize your thoughts.

What to Look For: A Breakdown

So, where should you focus your attention? A solid, thorough review is the bedrock of any successful dispute. While the question of how often you should check your credit report is a good one for maintenance, this is a deep dive.

Your review checklist should zero in on these areas:

When you treat this review like a focused project instead of a chore, you’ll have everything you need to build an airtight dispute.

Building Your Case: How to Gather Evidence for a Credit Dispute

Spotting an error on your credit report is just the starting line. To actually get it removed, you have to prove it. When you file a dispute, you aren't just pointing a finger; you're building a case. And believe me, a weak case with zero evidence is easy for a credit bureau to brush aside. But one that's backed by solid, organized proof? That’s much harder for them to ignore.

Think of it this way: your job is to make the investigator's job as simple as possible. You want to hand them a file so compelling that siding with you is the only logical move. It's less about filling out a form and more about acting as the lawyer for your own financial future. The quality of your proof is everything.

Match the Proof to the Problem

So, what kind of evidence do you need? It completely depends on the specific error you're tackling. You need the right documents for your unique situation.

Let's say you're dealing with a common headache: a payment marked as late that you swear you paid on time. A payment confirmation email is a decent start. But what’s even better? A bank statement showing the money leaving your account before the due date. That’s a third-party, time-stamped record that’s tough to argue with.

Assembling Your Dispute File

For each error you plan to dispute, create a separate evidence packet. This simple step keeps you organized and makes your dispute look professional and serious.

What goes in this file depends on the inaccuracy you've found.

For an Incorrect Late Payment:

For Fraud or Identity Theft:

For an Incorrect Balance or Account Status:

Once you have your documents ready, make clean, high-quality copies. Never, ever send your originals. They can get lost, and you’ll need them for your records.

Arrange your packet logically: your dispute letter goes on top, followed by your proof in an order that makes sense. Whether you're uploading it online or sending it via certified mail, a neat, organized submission screams credibility and makes your claim undeniable. This prep work is what separates a successful dispute from a frustrating one.

Sending Your Dispute: How to Make Sure the Bureaus Listen

Alright, you've gathered your proof and you're ready to go on the offensive. This is where the rubber meets the road. How you actually submit your dispute is just as important as the evidence you've collected.

You've got three basic options: firing off a dispute online, picking up the phone, or going the old-school route with snail mail. While online portals are fast and a phone call feels direct, I'm here to tell you that one method gives you an undeniable advantage: certified mail with a return receipt requested.

It might sound like a hassle, but it's a strategic move. When you get that signed green card back in the mail, it's rock-solid proof of the exact date the credit bureau received your dispute. This is huge. It officially starts their 30-day clock to investigate and respond, which is a legal requirement under the Fair Credit Reporting Act (FCRA). It's the best way to hold their feet to the fire.

Which Submission Method is Right for You?

Each option has its pros and cons. The key is knowing which one fits your specific situation.

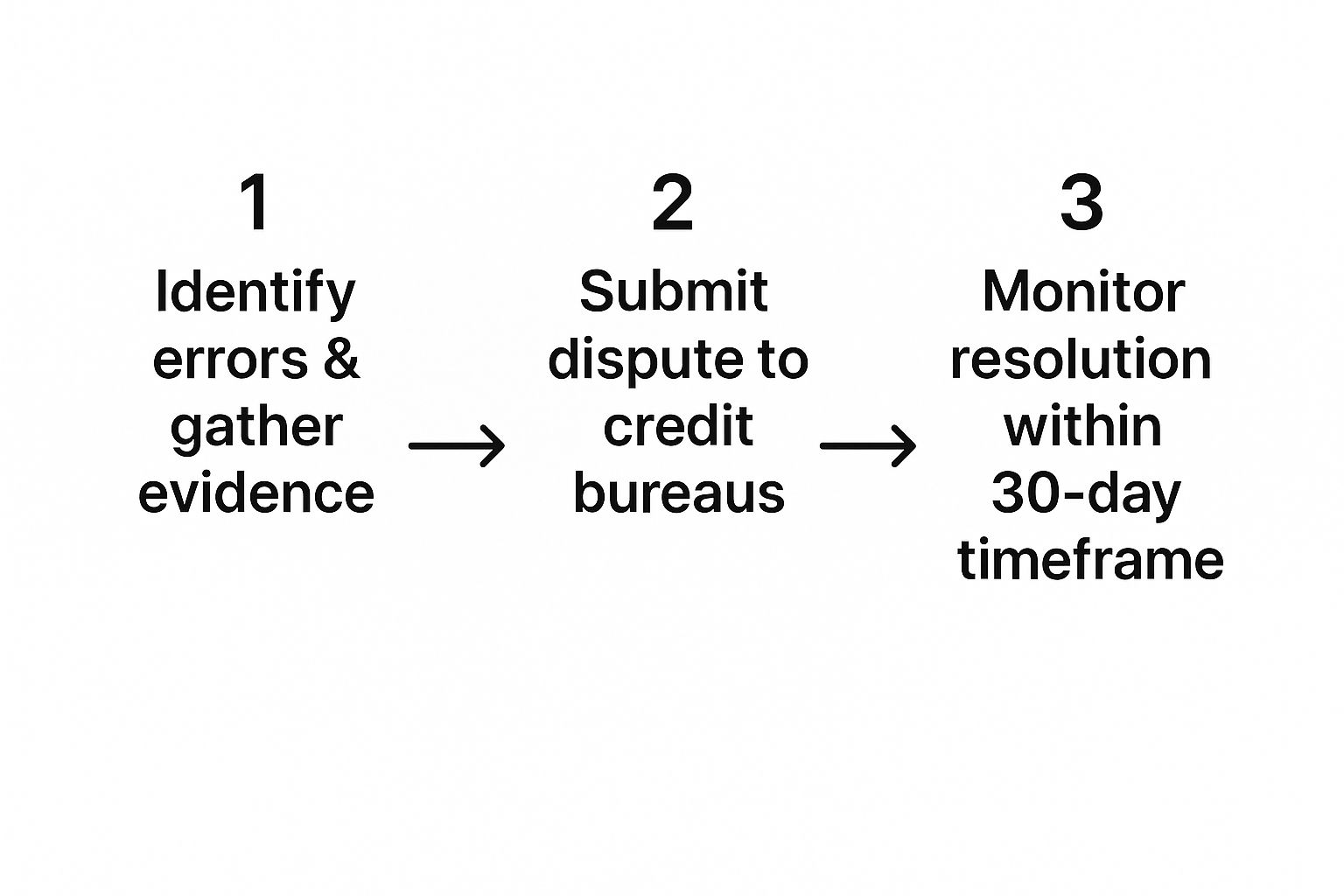

This infographic breaks down the entire journey, from spotting the error on your report to seeing it finally resolved.

Seeing the steps laid out visually can make the whole process feel much less intimidating. It gives you a clear roadmap to follow from start to finish.

Writing a Dispute Letter That Gets Results

Your dispute letter is the core of your case. It needs to be clear, factual, and straight to the point. This isn't the time for an angry, rambling essay; you want to present the facts like a pro.

Here’s what your letter absolutely must include:

Staying on top of your credit has never been more critical. The number of people finding errors is skyrocketing. The Consumer Financial Protection Bureau (CFPB) received a staggering 443,321 complaints about credit report mistakes in 2023 alone. That’s a massive 168% increase from the 165,129 complaints filed just two years earlier in 2021, which shows you just how widespread this problem is.

For a deeper dive into the entire process, from spotting errors to following up, check out our guide on how to dispute credit report errors. By mastering these submission strategies, you're not just sending a letter; you're building a solid case that forces the bureaus to take you seriously.

What to Expect After You’ve Sent Your Dispute Letter

Alright, you’ve mailed your dispute. Now comes the hard part: waiting. But this isn't just a passive waiting game. The clock is officially ticking for the credit bureaus.

Thanks to the Fair Credit Reporting Act (FCRA), the bureau has a legal obligation to investigate your claim and get back to you, typically within 30 days of receiving your letter.

During this month, they’ll forward all the proof you sent over to the original creditor—the bank, collection agency, or lender who put the item on your report. That company, known as the "data furnisher," then has to do its own internal review. They can't just ignore it.

The Three Potential Outcomes of Your Dispute

Once that 30-day investigation window closes, you'll get a letter in the mail with the results. From my experience, the outcome almost always falls into one of three buckets. Understanding what each one means is crucial for deciding what to do next.

Here’s what you might see:

Your Game Plan for Each Outcome

No matter what the letter says, your job isn't over. You need a clear, strategic response for each possibility.

If They Corrected the Error...

Success! This is fantastic news. But don't just pop the champagne and move on. The bureau is now required to send you a free, updated copy of your credit report. Get it.

Once it arrives, go over it with a fine-tooth comb. Confirm the error is actually gone or has been updated correctly. Mistakes happen, and you want to be certain the fix was implemented properly. You should also give the rest of the report a quick scan to ensure no new, mysterious errors have appeared in the shuffle.

If Your Dispute Was Denied...

Getting a notice that the item was "verified as accurate" is incredibly frustrating. I've been there. But it is absolutely not the end of the line. Often, this just means the creditor’s automated system sent a simple "yep, it's accurate" response to the bureau without a real person ever looking at your evidence.

This is where you escalate. Your next move is to take the dispute directly to the data furnisher themselves. At the same time, I highly recommend filing a complaint with the Consumer Financial Protection Bureau (CFPB). This gets a federal agency involved, which applies a whole new level of pressure on the creditor to take your claim seriously.