How to Calculate Debt to Income Accurately

Ready to figure out your debt-to-income ratio? It's simpler than you might think. All you need are two key numbers: what you owe each month and what you earn each month.

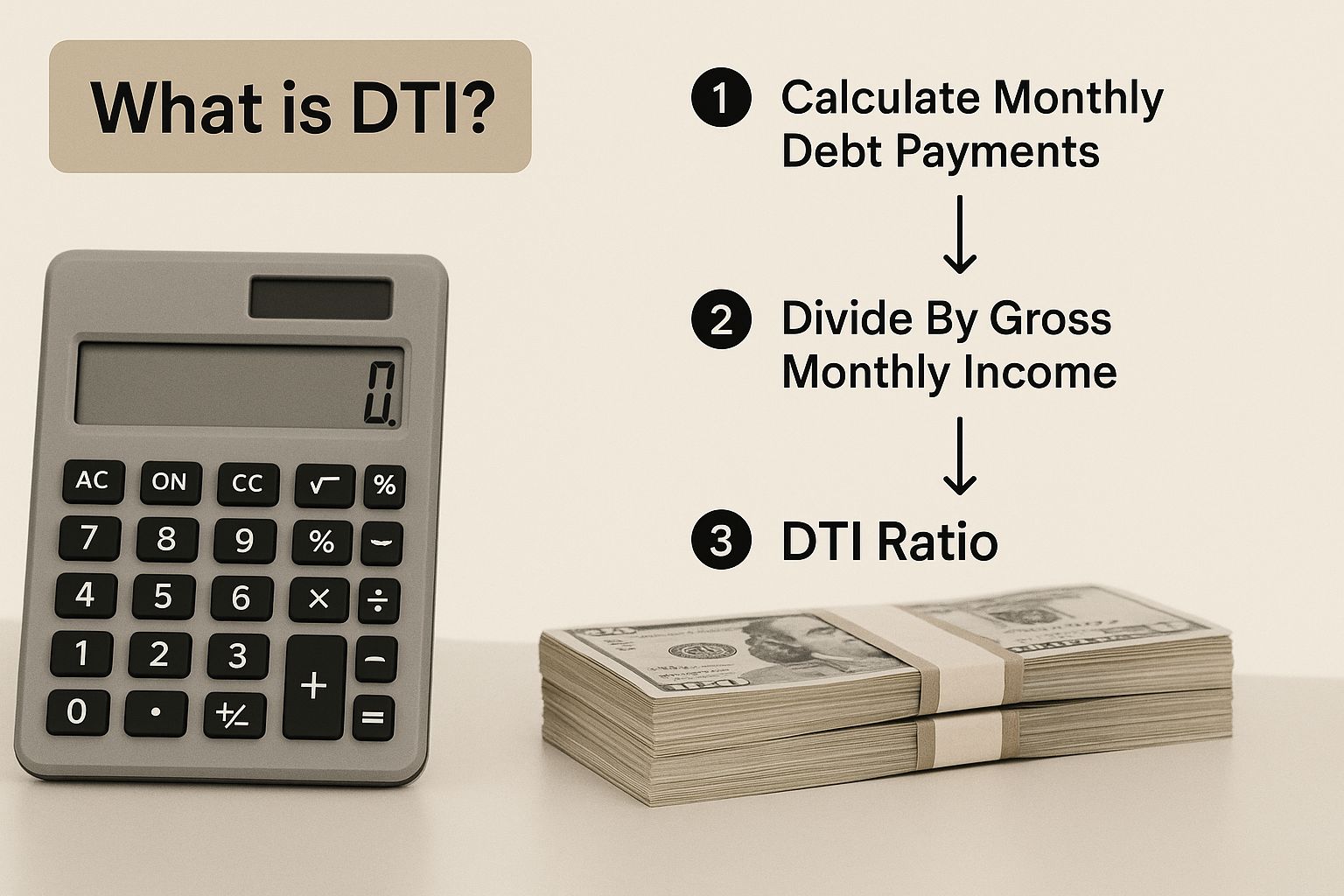

The formula is straightforward: Total Monthly Debt / Gross Monthly Income = DTI Ratio.

Let's say your monthly debt payments add up to 2,000**, and your gross monthly income (before taxes) is **6,000. In this case, your DTI ratio would be 33%. It’s just a simple division problem that gives you a powerful snapshot of your financial health.

Your Debt To Income Ratio Explained

Think of your DTI ratio as a quick financial check-up. It reveals what percentage of your income is already spoken for by debt payments. For lenders, this number is crucial—it helps them gauge your ability to handle new payments without getting overextended.

A low DTI signals a good balance between your income and your debts, making you a more attractive borrower. On the other hand, a high DTI can be a red flag, suggesting you might be stretched a bit thin.

But this isn't just a number for the banks. Knowing your own DTI gives you a crystal-clear view of where your money is going. It’s an empowering piece of information that can help you budget smarter and make confident decisions about your financial future. If you want to dive deeper, we have a complete guide on what the debt-to-income ratio is and why it matters.

Breaking Down The DTI Calculation

So, how do we get to that final percentage? It's all about comparing your recurring monthly debt payments to your gross monthly income.

You’ll start by adding up all your regular debt obligations. This includes things like:

Once you have that total, you divide it by your gross monthly income—that’s your income before any taxes or deductions are taken out.

For example, if all your debts come to 1,500** a month and your gross income is **5,000, your DTI is 30% (1,500** / **5,000 = 0.30). It’s a universally recognized method used by financial institutions to assess a borrower's capacity for new debt.

To get started, you'll need to gather a few documents. This table breaks down exactly what you need to find.

What You Need for Your DTI Calculation

With these two figures in hand, you have everything you need to plug into the formula and find your DTI.

This visual breaks down the calculation into a simple, easy-to-follow process, turning the numbers into a clear picture.

As you can see, the formula itself is pretty basic. The real work is in gathering the right numbers. Once you know your DTI, you’ve taken the first and most important step toward taking control of your financial story.

Finding Your Total Monthly Debt Payments

First things first, we need to figure out exactly what you owe each month. This isn't about your total loan balances, but the minimum payment you're required to make on each of your debts. Think of it as creating a snapshot of your monthly financial commitments.

To get this right, you’ll need to do a little digging. Pull up your recent loan statements, log into your online banking portals, and maybe even take a look at your credit report. Accuracy is key here, so avoid guesstimating.

What Debts Should You Actually Include?

Now, let's make a list of all your recurring debt payments. You want this to be thorough so the final DTI number is spot-on.

Here’s what you should be looking for:

Why Lenders Care So Much About This Number

Putting this list together is more than just busywork; it's the exact number lenders use to gauge your financial health. In the United States, for example, most lenders want to see a DTI ratio below 36%. They also prefer that no more than 28% of that debt comes from your housing payment alone.

A higher DTI suggests to them that you might be stretched too thin, which could make it harder to get approved for new credit or land a good interest rate. If you're curious about how this works on a global scale, you can find more data on how financial institutions use these metrics on data.bis.org.

Calculating Your Gross Monthly Income

Alright, let's tackle the other side of the DTI equation: your gross monthly income. This is the key number representing your total earnings before a single dollar is taken out for taxes, deductions, or retirement savings. Getting this figure right is essential for an accurate DTI.

If you're a salaried employee, this part is usually pretty simple. Just take your total annual salary and divide it by 12. For someone earning 72,000** a year, the gross monthly income comes out to a clean **6,000.

But let's be real—not everyone's income is that neat and tidy. If your paychecks change from month to month, you'll need to do a little more digging to find a reliable average.

What to Do With Variable or Irregular Income

For those of us who are hourly workers, freelancers, or live on commissions, calculating income isn't as simple as dividing by 12. Lenders are looking for a stable, predictable earnings history, so one great month sandwiched between two slow ones won't cut it.

The standard approach is to average your income over a longer period, usually the last 12 to 24 months. This gives a much more accurate snapshot of what you can consistently expect to earn. Grab your recent pay stubs, bank statements, and tax returns to get started.

Here’s a quick list of what generally counts as income:

For those in the gig economy, knowing how to maximize your gig cash flow can make a huge difference. The more stable you can make your earnings, the stronger your financial profile will look to a lender.

Once you’ve pinned down a solid gross monthly income figure, you have the final piece of the puzzle. Now you’re ready to put it all together and calculate your DTI ratio.

What Your DTI Number Actually Means

So, you've calculated your debt-to-income ratio. That number isn't just a random percentage; it's one of the most powerful indicators of your financial health, at least in the eyes of a lender. They use it as a quick snapshot to judge how well you're managing your money and whether you can handle new debt.

Think of it as their primary risk assessment tool. A low DTI tells them you have plenty of cash flow after your bills are paid, while a high one signals that your budget might be stretched thin. Understanding where your number falls on their scale is key to getting ahead.

How Lenders Interpret Your DTI Ratio

Lenders have pretty specific benchmarks they use when they pull your loan application. While the exact numbers can differ slightly from one bank to the next, they all operate within a similar framework. Knowing these thresholds is like getting a peek at their playbook.

The table below breaks down what your DTI ratio signals to a potential creditor and how it can affect your borrowing power.

As you can see, the lower your DTI, the better you look on paper.

The DTI Sweet Spot and Danger Zone

Here’s a more detailed look at what those percentages mean in the real world:

Ultimately, your DTI number tells a powerful story. It can unlock new financial opportunities or serve as a wake-up call to start paying down debt and freeing up your income.

Actionable Ways to Lower Your DTI Ratio

If your DTI ratio is sitting higher than you'd like, don't worry—you have more control than you think. Bringing that number down really comes down to a simple formula: lower your monthly debt payments, raise your gross monthly income, or—the gold standard—do both at the same time. Even small, consistent changes can make a huge difference over time.

Tackling the debt side of the equation is often the fastest way to see results. I've seen clients have great success with classic strategies like the debt snowball method, where you pay off your smallest debts first to build momentum. Others prefer the debt avalanche approach, which focuses on knocking out high-interest debts first to save the most on interest. You could also look into refinancing high-interest loans or consolidating credit card debt to slash your total monthly output.

Just think about it: refinancing a 25,000** car loan from a **7%** interest rate down to **4%** could easily cut your monthly payment by around **40. That single move could trim a whole percentage point or two off your DTI.

Boost Your Income

The other side of the coin is, of course, earning more. This doesn't necessarily mean you have to quit your job and find a new career. A great place to start is right where you are. Build a solid, data-backed case for why you deserve a raise and present it to your boss, making sure to highlight your key accomplishments and market value.

Adding another stream of income is also a fantastic strategy. To effectively lower your DTI ratio, increasing your gross monthly income is a key strategy; consider exploring high-paying remote job opportunities to boost your earnings. Even picking up a side gig that brings in an extra few hundred dollars a month will directly and positively impact your DTI calculation.

Stay Consistent and Track Your Progress

Remember, improving your DTI is a marathon, not a sprint. Consistency is everything. Economic shifts constantly affect household debt, which just goes to show how important it is to keep a close eye on your own numbers.

If you're thinking about using a loan to consolidate some of your debt, make sure you explore all the angles. Our guide on using personal loans to build credit is a great resource that explains how this financial tool can fit into your overall plan. Keep chipping away, track your DTI each month, and you'll see your financial health improve one step at a time.

Common Questions About Debt to Income

Once you start digging into how to calculate debt-to-income, a few questions almost always come up. Let's tackle some of the most common points of confusion so you can feel completely confident in your numbers.

A big one I hear all the time is: "Does my DTI ratio directly impact my credit score?" The short answer is no. Your income isn't reported to the credit bureaus, so it's not a direct ingredient in credit scoring models like FICO®.

But here's the catch—the individual debts that make up your DTI absolutely affect your credit. When you pay down a big credit card balance to improve your DTI, you're also lowering your credit utilization rate. That single action can give your credit score a serious boost.

What Expenses Should I Leave Out?

Another common trip-up is figuring out which monthly bills actually count as "debt." This is critical. Your DTI calculation should only include recurring debt payments, not your everyday living expenses.

People often make the mistake of including these, which will make your DTI look much higher than it really is. Be sure to leave these out:

Front-End DTI vs. Back-End DTI

Finally, you might hear lenders talk about two different kinds of DTI, which can sound confusing. It's actually pretty simple.

The front-end DTI (sometimes called the "housing ratio") just compares your monthly housing payment—your rent or mortgage—to your gross monthly income.

The back-end DTI, which is what we've been focused on, gives the full picture. It includes your housing payment plus all your other monthly debts. Lenders almost always care more about your back-end DTI because it shows them exactly how much of your income is already spoken for each month.

Ready to take the first step toward a stronger financial future? With itin score, ITIN holders can finally build and monitor their credit with confidence. Our free platform offers a real-time dashboard, an AI-powered credit coach, and personalized guidance to help you reach your goals. Sign up in minutes and get the tools you need to build the credit you deserve. Start your journey with itin score today!