How to Calculate Credit Utilization & Improve Your Credit Score

Figuring out your credit utilization is simpler than it sounds. At its core, you just divide what you owe on your credit cards by your total credit limits. This number, once you turn it into a percentage, is a heavyweight champion when it comes to influencing your credit score. Getting a handle on this basic math is the first real step you can take to get your financial health on the right track.

What Is Credit Utilization and Why It Matters

Think of your credit utilization ratio—often called CUR—as a quick financial check-up. It tells lenders how much of your available credit you’re leaning on at any given moment. A high ratio can be a red flag, making it look like you're relying too heavily on borrowed funds to get by. On the flip side, a low ratio sends a powerful message: you're managing your credit responsibly.

This isn't just some number floating in the ether; it's a critical piece of the puzzle that credit bureaus use to calculate your score. Lenders watch it like a hawk because it gives them an instant glimpse into your financial discipline. Keeping this ratio low is one of the most effective ways to build a strong credit history, which is especially important for ITIN holders who might be starting with a thinner credit file.

The Basic Calculation

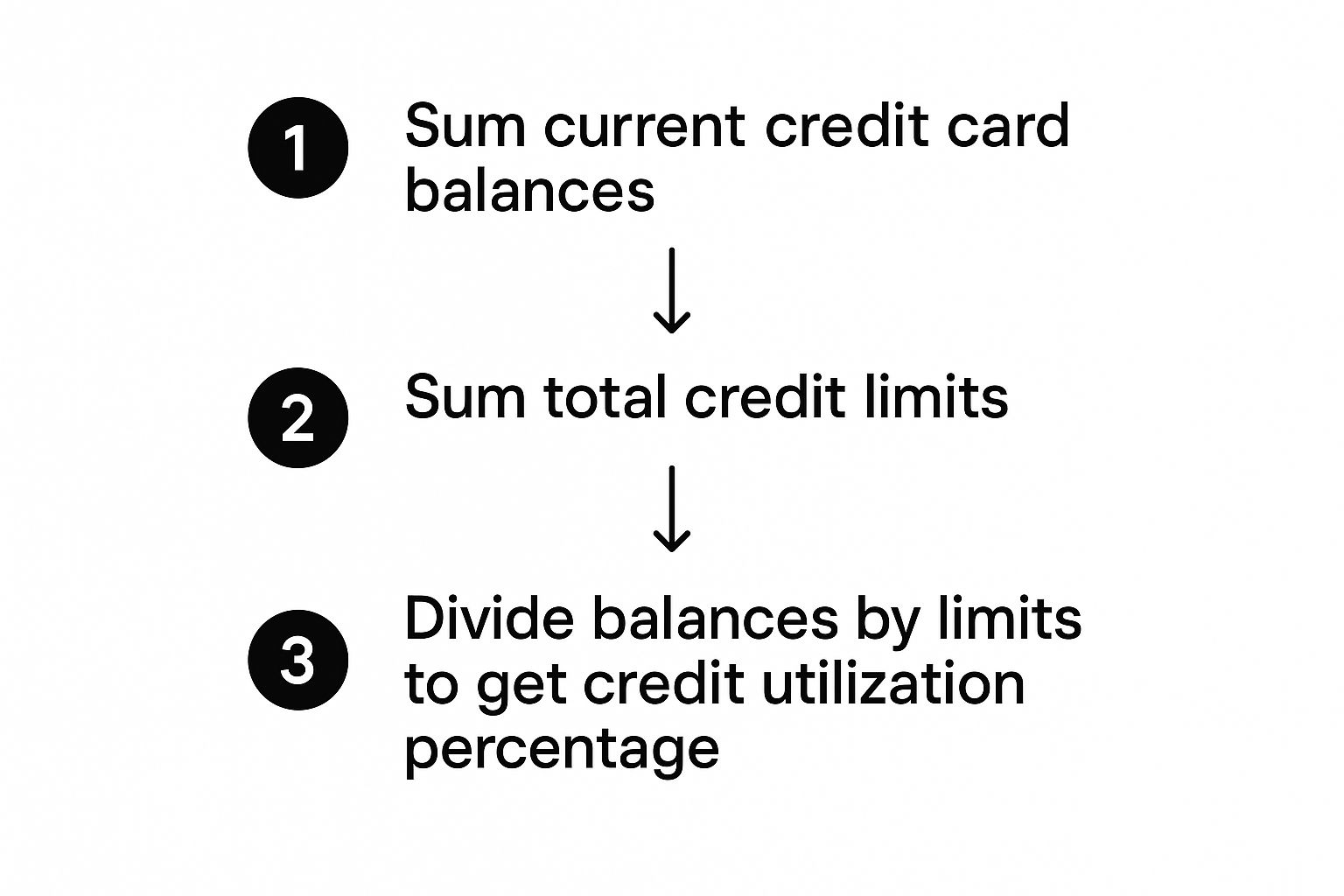

The formula itself is refreshingly simple. You just add up the current balances on all your revolving credit accounts (like credit cards and lines of credit), then divide that sum by your total available credit limits. Multiply the result by 100, and you’ve got your percentage.

Let's walk through a real-world example. Say you have three credit cards:

First, add up your balances: 1,000 + 2,500 + 4,000 gives you a **total balance of 7,500**.

Next, add up your limits: 5,000 + 10,000 + 8,000 gives you a **total credit limit of 23,000**.

Now, do the division: 7,500 ÷ 23,000 = 0.326. As a percentage, your overall credit utilization is 32.6%. You can dig into more detailed examples of this calculation on Investopedia.com.

To make it even clearer, here's a quick breakdown of the formula.

Quick Guide to Calculating Your Credit Utilization

This simple table shows how the pieces fit together to give you that final, crucial percentage.

Once you understand how to calculate credit utilization, you gain direct control over a key factor that shapes how lenders perceive your creditworthiness.

The Real Impact of Utilization on Your Credit Score

Knowing the math behind your credit utilization is just the first step. The real key is understanding how deeply this one number affects your financial life. Lenders see your utilization ratio as a direct reflection of how you handle your money. If the number is high, they might worry that you're stretched too thin and could have trouble making payments down the road.

This isn't just some small piece of the puzzle. It's a huge one. In fact, under the FICO model, it accounts for 30% of your credit score. For VantageScore, it's about 20%. That’s a massive slice of the pie, which means that simply keeping your balances in check can give your credit health a serious boost. For a deeper dive, Capital One offers some great money management insights on this very topic.

Aiming for the Sweet Spot

You've probably heard the common advice to keep your utilization below 30%, and that's a solid starting point. But the people with the very best scores? They're often keeping it much, much lower.

This is especially important for those of us building credit with an ITIN. Often, you start with lower credit limits, which means even a small balance can make your utilization ratio jump up unexpectedly.

Think of it this way: managing each card's balance is just as vital as watching the overall number. A balanced approach across all your accounts paints a much better picture for anyone looking at your credit profile.

Your Practical Guide to Calculating the Ratio

Alright, let's roll up our sleeves and figure out your credit utilization ratio. This isn't just a random number; it's a powerful metric that gives you a clear snapshot of your financial health. The process is pretty simple. To start, you'll want to grab your latest credit card statements or, even easier, just log into your online banking portals.

For every credit card or revolving line of credit you have, you're looking for two key numbers: the current balance (what you owe right now) and the total credit limit. Once you have these for all your accounts, you're ready to do some basic math.

Let’s walk through a real-world example to make this crystal clear.

A Multi-Card Calculation Example

Many people, especially ITIN holders working to build their credit history, have a mix of different cards. Let's say your wallet looks something like this:

First, you need to add up all your outstanding balances. 450 + 75 + 0 = **525** total balance.

Next, do the same for your total available credit. 2,000 + 500 + 3,000 = **5,500** total credit limit.

Now for the final step. To find your utilization ratio, you just divide your total balances by your total limits.

525 (Total Balances) ÷ 5,500 (Total Limits) = 0.095

To turn that into a percentage, just multiply by 100. That gives you an overall credit utilization of 9.5%—a fantastic number that lenders love to see.

This simple visual breaks it down: add up what you owe, add up what you can borrow, and then divide.

A question I get all the time is whether to use the statement balance or the current balance. For the most accurate, real-time picture of where you stand, always use your current balance. Your card issuer usually reports your balance to the credit bureaus around your statement closing date. If you make a big payment right before that date, your real-time balance will more accurately reflect what the lenders will see.

It's surprisingly easy to accidentally jack up your credit utilization. You might be paying your bills on time every month, but a few common habits can still push your ratio into a risky zone without you even noticing. Knowing what these tripwires are is the first step to avoiding them.

A classic mistake comes down to simple timing. Let's say you put a big purchase on your card—a new 1,500 laptop, for example. You fully intend to pay it off when the statement arrives. The problem is, your card issuer often reports your balance to the credit bureaus *before* your payment due date. So, for that reporting period, it looks like you’re carrying a heavy 1,500 debt, which can cause your utilization to spike temporarily.

The Pitfall of Closing Old Accounts

Another thing I see all the time is people closing old credit cards. It seems like smart financial housekeeping, right? Get rid of the clutter. But this can seriously backfire. When you close a credit card account, you don't just lose the plastic—you wipe out its entire credit limit from your overall financial picture.

Say that old, unused card has a $5,000 limit. The moment you close it, your total available credit shrinks by that much. Even if your spending stays exactly the same, your utilization ratio can shoot up overnight. This is a crucial factor when you calculate credit utilization.

Just look at how the numbers change:

Unless a card carries a hefty annual fee, you're almost always better off keeping it open. Just use it for a tiny, recurring purchase now and then to keep the account active.

For more hands-on advice, you can find many more helpful credit utilization tips in our guide. Sidestepping these simple errors keeps your credit foundation strong.

Credit Utilization Insights for ITIN Holders

The math behind credit utilization is the same for everyone, but the reality for ITIN holders can be a bit different. When you're building credit without an SSN, you often start out with just one or two credit accounts, and those usually come with lower credit limits. This can feel like a double-edged sword.

On one hand, you have access to credit. On the other, every single dollar you spend carries more weight. A seemingly small purchase on a card with a low limit can send your utilization ratio soaring, which is why disciplined management is critical right from the very beginning.

A secured credit card is often the first stop on this journey, and it's a fantastic training ground. Use it for small, regular purchases you'd be making anyway—think a tank of gas or a streaming subscription—and then pay the balance off in full right away. This is how you show lenders you're responsible while keeping your reported balance and utilization incredibly low.

Building a Strong Credit Profile

This simple strategy achieves two crucial goals at once. First, it keeps your credit utilization ratio well under control. Second, it starts building a positive payment history, which is the #1 factor in your credit score. Every single on-time payment adds a positive data point to your credit report.

Treating your first credit card with this level of care is a cornerstone of a solid financial foundation. For a more detailed walkthrough, our guide on how to build credit with an ITIN number lays out the entire process. Mastering these fundamentals early is the quickest path to a strong credit profile and access to better financial products in the U.S.

Answering Your Top Questions About Credit Utilization

As you get the hang of calculating your credit utilization, a few common questions tend to pop up. Let's walk through some of the things people often ask so you can manage your credit with total confidence.

Does swiping my debit card impact my utilization?

Nope, not at all. Your debit card is completely separate from your credit utilization.

Since a debit card just pulls money you already have from your checking account, it’s not considered a line of credit. The utilization ratio only cares about your revolving credit accounts—think credit cards or lines of credit where you borrow money and then pay it back over time.

How fast does my credit score change after I pay down a credit card?

Changes aren't instantaneous, but you can usually predict the timing. It typically takes one to two full billing cycles for your credit score to update after you’ve paid down a balance.

Your credit card company reports your latest balance to the credit bureaus once a month, usually right after your statement closes.

Is it a bad thing to have 0% credit utilization?

It’s not necessarily bad, but it might not be doing your score any favors either. Lenders actually like to see that you're using credit and managing it well.

A utilization ratio somewhere between 1% and 9% is often seen as the sweet spot. It proves your accounts are active and you're handling them responsibly, which can look slightly better to scoring models than having no activity at all.

Ready to take control of your credit journey? With itin score, you get free, unlimited credit monitoring and personalized insights on our real-time dashboard. Sign up in minutes to see your credit report and start building a stronger financial future today. Check out your options at https://www.itinscore.com.