How to Build Credit with an ITIN Number: Expert Tips

Absolutely. It's a common misconception, but you can definitely build a strong U.S. credit history with an ITIN number.

The real key is knowing where to look and what to do. You'll need to find financial institutions that work with ITIN holders and then commit to solid financial habits, like always paying your bills on time. It’s this simple process that opens the door to getting loans, credit cards, and building a more stable financial life here in the U.S., all without a Social Security Number.

Your Path to Building Credit with an ITIN

For many people new to the U.S. financial system, trying to build credit without a Social Security Number (SSN) can feel like hitting a brick wall. There's a persistent myth that an Individual Taxpayer Identification Number (ITIN) is just for filing taxes. While that's its main job, your ITIN is also a powerful key to financial inclusion. It allows you to establish the credit history you need to achieve major life goals.

Think of your ITIN as your official ticket into the U.S. credit world. The three major credit bureaus—Experian, TransUnion, and Equifax—can and do create credit files using ITINs. So, the question isn't if it's possible. The real challenge is knowing how to start and which banks to approach.

The Foundation of ITIN Credit Building

Learning how to build credit with an ITIN really comes down to a few core principles. Getting these right from the beginning will give you a clear and encouraging path forward.

The ITIN program itself is a huge part of the U.S. tax system. Since it started, the IRS has issued over 25 million ITINs, with roughly 5.4 million of those being active as of early 2021.

A 2023 report from the Treasury Inspector General for Tax Administration (TIGTA) pointed out some administrative hurdles but also stressed the need for modernization. These improvements could make ITIN documentation even more reliable for lenders, potentially speeding up the credit-building journey for people like you. For a deeper dive, you can review the complete TIGTA report on their official site.

This guide is here to cut through the noise and give you a practical, step-by-step plan. With the right strategy, your ITIN will become the key that unlocks the credit you need to thrive.

Finding Financial Partners Who Welcome ITIN Holders

Choosing where to bank and borrow is one of the most important decisions you'll make on your credit-building journey. The reality is, not every bank or lender is equipped or willing to work with ITIN holders. So, your first real task is finding an institution that actively welcomes you. This isn't just about opening an account; it's about finding a supportive partner who actually understands what you're trying to achieve.

The good news is that the financial landscape for ITIN holders is growing. It just takes a little focused searching to find the right fit. Your best allies will often be institutions with deep community roots or those specifically built to serve immigrant and non-citizen populations.

Where to Start Your Search

Your search should zero in on institutions known for their inclusive practices. While some massive national banks have made progress, many ITIN holders I've worked with found their first "yes" from smaller, more community-focused organizations.

Pinpointing ITIN-Friendly Institutions

This isn't a niche market anymore. The growth in ITIN lending is significant, especially within the credit union sector, highlighting both the strong demand and the success of these programs. A 2023 Filene Research Institute report found that 70% of credit unions surveyed are actively implementing or expanding their ITIN lending services.

In one incredible case, a credit union saw its ITIN loan portfolio explode from 640,000 to 5.3 million in just three years—a powerful testament to the reliability of ITIN borrowers. These numbers prove that ITIN lending is a smart, low-risk way for institutions to forge lasting community relationships.

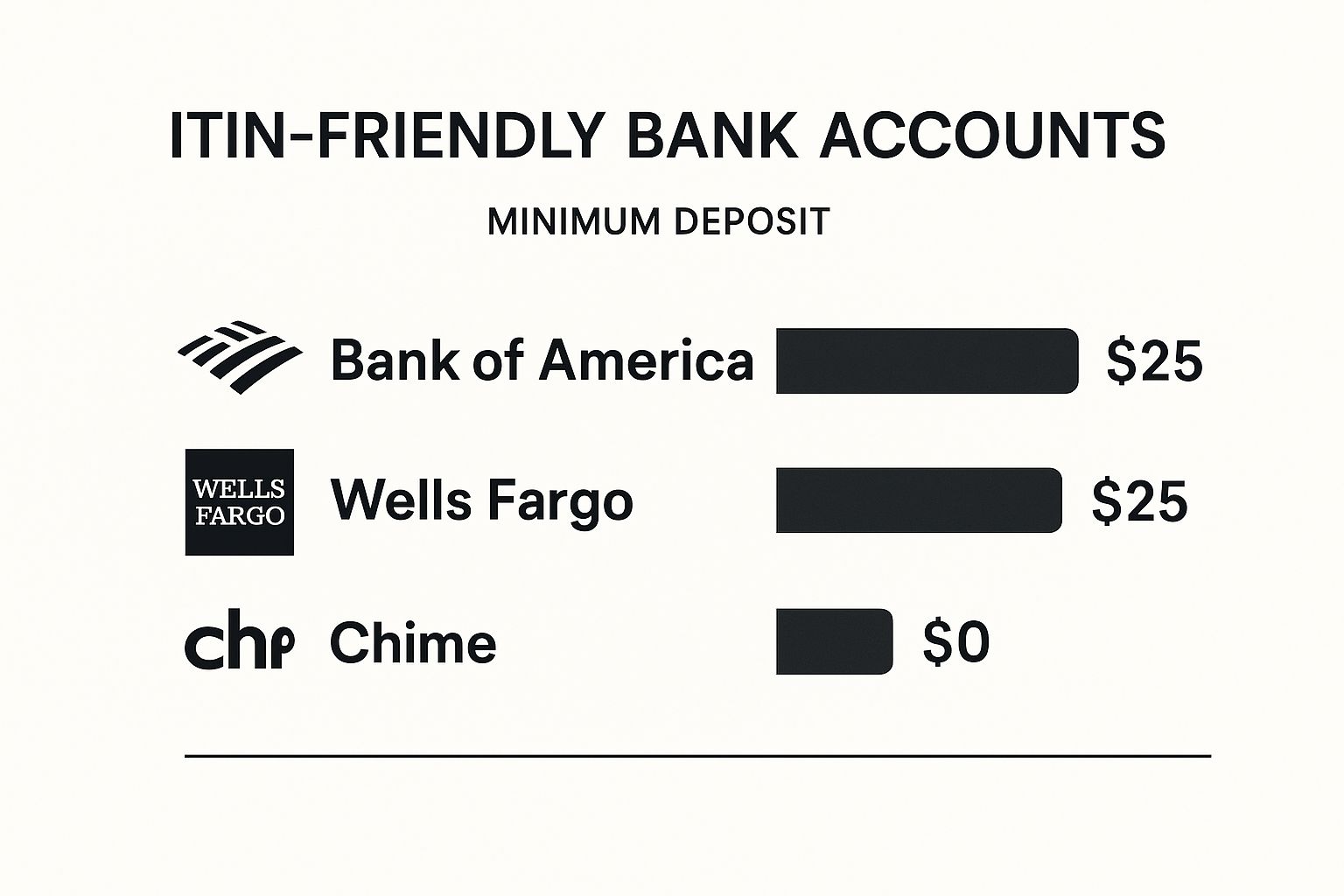

While many institutions are heading in the right direction, some big names already have established processes. The image below shows that getting started doesn't always require a huge upfront deposit.

As you can see, some digital-first options like Chime have removed the minimum deposit barrier entirely, making it even easier to get started.

To help you weigh your options, this table breaks down what you can generally expect from different types of financial institutions.

Comparing Financial Institutions for ITIN Credit Building

Ultimately, the best choice depends on your personal situation and what you value most—be it low fees, personalized service, or digital convenience.

What to Ask and What to Bring

Once you've shortlisted a few potential partners, it's time to reach out. Walking in prepared shows you're serious and helps you get the clear answers you need. Don't be shy—ask direct questions.

Key Questions for Your Potential Banker:

That last question is a deal-breaker. If they don't report your on-time payments, the account won't help you build credit. It's that simple.

To make the process go smoothly, get your documents in order before you go. Having everything ready shows you're organized and makes a great first impression.

Your ITIN Document Checklist:

Finding the right financial partner is the bedrock of your credit-building strategy. Once you've secured a bank account and your first credit product, you're officially in the game. For more tips on this crucial first phase, check out our complete guide on how to establish credit.

Choosing Your First ITIN Credit Building Products

Once you've found a financial institution that works with ITINs, your next move is to pick the right tools to kickstart your credit history. This isn't about grabbing the first offer you see. It's a strategic choice, one that should match your current finances without adding unnecessary risk. The real goal is to find a product that will consistently report your responsible financial habits to the major credit bureaus.

Let's walk through the best starter options for ITIN holders. You don’t need to go all-in at once. In my experience, starting with just one or two well-chosen products is the smartest way to begin building credit with an ITIN number.

Start with a Secured Credit Card

For anyone building credit from the ground up, a secured credit card is often the best first step. It’s incredibly accessible and effective. The reason it’s called "secured" is simple: you provide a small, refundable cash deposit when you open the account.

That deposit usually sets your credit limit. For instance, if you put down 300**, your credit limit will be **300. This isn't a pre-payment for your bill; it's collateral the bank holds. This safety net for the bank lowers their risk, making them much more likely to approve your application, even with zero credit history.

You use the card for everyday purchases—gas, groceries, a new pair of shoes—just like any other credit card. Then, you pay the bill every month. This is the crucial part: the bank reports those payments to the credit bureaus. After a few months of on-time payments, many banks will graduate you to a standard, unsecured card and send your deposit back.

Explore Credit-Builder Loans

Another fantastic tool, designed specifically for this purpose, is a credit-builder loan. It works in reverse compared to a normal loan. Instead of handing you cash upfront, the lender places the loan amount into a locked savings account for you.

You then make small, fixed monthly payments over a set period, typically anywhere from 6 to 24 months. Each payment you make on time gets reported to the credit bureaus. After you've made all the payments, the account is unlocked, and you receive the full loan amount—often with a little bit of interest it earned along the way.

Consider Small Personal or Auto Loans

While secured cards and credit-builder loans are the bedrock of a new credit file, other types of credit can round out your strategy, especially after you have a few months of payment history under your belt. A small personal loan from an ITIN-friendly credit union can be a logical next step.

Auto loans present another huge opportunity. In fact, recent data shows that lenders are increasingly recognizing ITIN holders as dependable borrowers. An analysis from Open Lending found that ITIN holders often have higher average FICO scores than SSN borrowers, helping them get approved for larger auto loans.

This trend is largely thanks to credit unions that have pioneered ITIN auto financing. They saw the potential in the community early on. The study even noted that popular vehicles like the Chevy Silverado 1500 are common purchases, highlighting how car ownership can support both personal life and work, driving economic progress.

What About Rent Reporting Services?

Never underestimate the power of your single largest monthly expense: your rent. A growing number of services can now report your on-time rent payments to the credit bureaus. This is a game-changer because it turns an expense you're already paying into a credit-building asset.

While it’s not a credit product in the traditional sense, it’s an incredibly valuable way to add a consistent, positive payment history to your credit file. If this sounds like a good fit, you can dive deeper into how to build credit with rent payments in our detailed guide.

Choosing that first product is a major milestone. Whether you go with a secured card, a credit-builder loan, or another option, the most important thing is how you manage it. Make every payment on time and keep your balances low. These are the fundamental habits that will transform your ITIN from a tax ID into a key that unlocks your financial future in the U.S.

Building the Habits That Build Your Score

Getting that first credit product in your hands is a fantastic milestone, but it's really just the beginning. The true secret to building a strong credit profile with your ITIN isn't about some complicated financial strategy—it's all about the small, consistent habits you build day after day.

Think of it like getting in shape. Buying a gym membership is the first step, but real progress comes from showing up, being consistent, and using the equipment correctly. Your credit habits are the financial equivalent, and getting them right is crucial for your long-term success. The two most fundamental habits are paying on time and using your credit responsibly.

The Unbreakable Rule: Always Pay on Time

If you take only one piece of advice away from this guide, let it be this: pay every bill on time, every single time. Nothing else even comes close. Your payment history is the single biggest factor influencing your credit score, making up a massive 35% of your FICO Score.

Just one payment that's 30 days late can torpedo your score, especially when you're just starting out. Without a long, positive history to cushion the blow, a single mistake stands out and can stay on your report for seven years. It’s a very high price to pay for a simple oversight.

The easiest way to prevent this? Put it on autopilot. The moment you activate your card, log in and set up automatic payments from your bank account. You can choose to pay the full balance (ideal), the minimum due, or another fixed amount. At the absolute minimum, automate the minimum payment. It's your safety net.

Keep Your Balances Low: The Power of Credit Utilization

Right behind payment history is your credit utilization ratio (CUR), which accounts for a hefty 30% of your FICO score. It sounds technical, but it’s just the percentage of your available credit that you're currently using.

For instance, if your credit card has a 500 limit and you have a 100 balance, your utilization is 20% (100 divided by 500). Lenders see low utilization as a sign of financial discipline. It shows you have access to credit but don't need to rely on it to make ends meet.

Simple Tips for Managing Utilization:

By keeping your balances small in relation to your credit limit, you're sending a powerful message to lenders: "I am in control of my finances." For someone building credit with an ITIN, that’s exactly the reputation you want.

Simple Systems for Staying on Track

Good habits thrive on good systems. Automating your payments is step one, but staying actively involved is just as important.

Here's a simple but effective strategy: set a recurring reminder on your phone for a few days before your payment due date. When it pops up, take five minutes to log into your account. Check for any weird charges, confirm your auto-payment is good to go, and see what your current balance is. This quick check-in is your best defense against errors and helps you stay in the driver’s seat of your financial future.

How to Keep Tabs on Your Credit and Make Sense of It All

Trying to build a strong credit history without actually checking it is like driving across the country with no map. You're putting in the work, but you have no idea if you're headed in the right direction. For anyone figuring out how to build credit with an ITIN number, watching your progress isn't just a suggestion—it's a critical part of the game.

The good news? The three big credit bureaus—Experian, TransUnion, and Equifax—absolutely create and keep credit files for ITIN holders. When your bank reports your on-time payments, they just use your ITIN instead of an SSN to link that good behavior to you. This is exactly how your credit report gets started.

Getting Your Hands on Your ITIN Credit Report

Here's the one catch: you can't use the popular online portal AnnualCreditReport.com when you have an ITIN. Don't worry, though. You still have the right to a free report from each of the three bureaus every single year. The process is just a bit more old-school and requires you to request them by mail.

When you mail in your request, you'll generally need to include:

Each bureau has its own mailing address for these requests, so you'll have to send three separate letters. It's worth the effort, because some lenders might only report your account to one or two bureaus, not all three. This way, you see the complete picture.