How to Build Credit from Scratch: Easy Steps to Success

So, you have an ITIN and you're ready to build your financial future in the U.S. Where do you begin? The answer is simpler than you might think. Building credit from scratch all boils down to one thing: proving you're a reliable borrower.

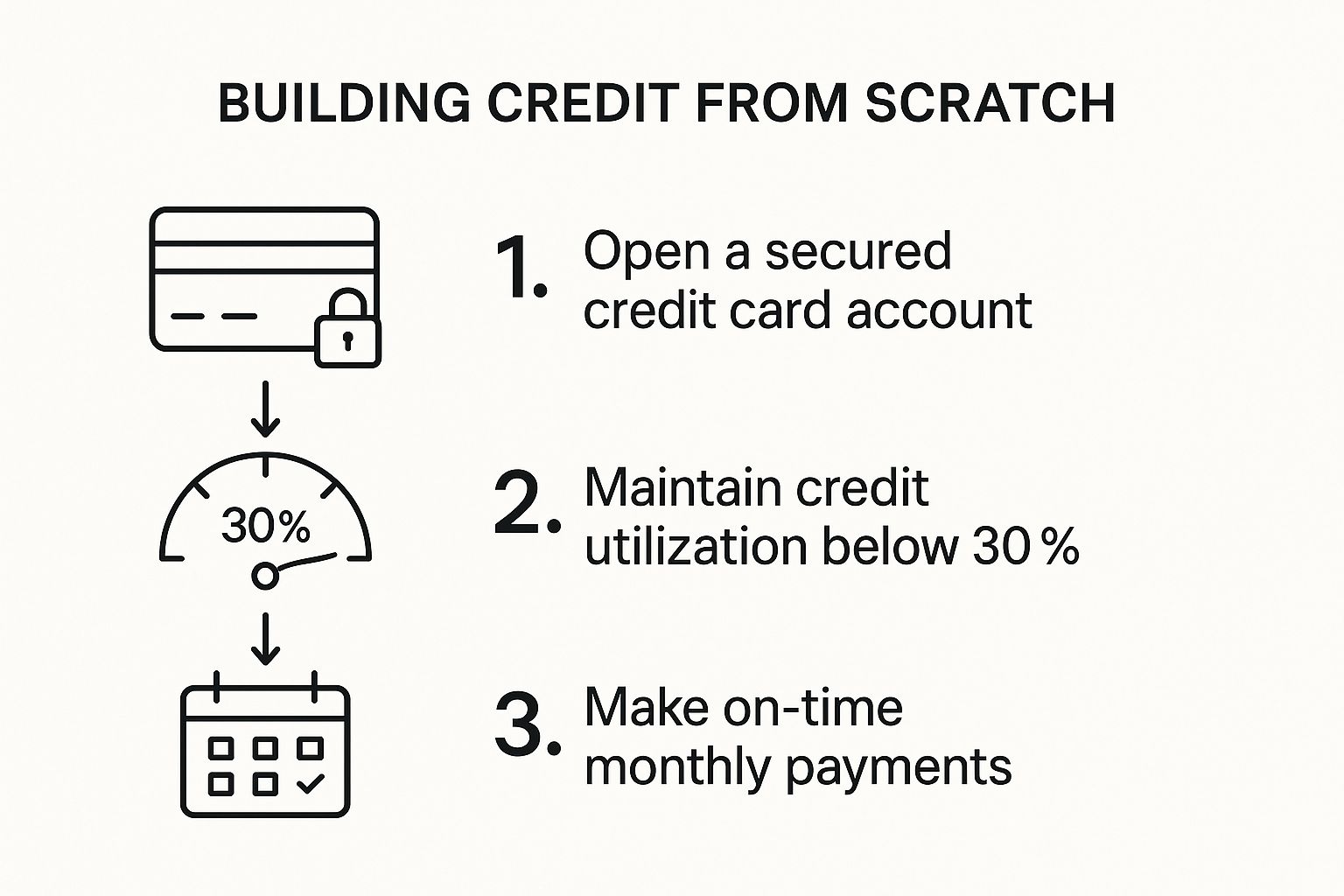

This means opening a credit account, using it wisely, and always, always making your payments on time. That’s the foundation. You’re showing lenders, one transaction at a time, that you can be trusted.

Your Starting Point: A Clean Slate is Your Advantage

Here’s a secret most people don't realize: starting with no credit history isn’t a disadvantage. It’s a blank canvas. Lenders often prefer what they call a “thin file” (no history) over a “bad file” (a history filled with late payments and defaults). You get to write your own financial story from the very first chapter.

Think of credit as a measure of trust. Lenders are asking, "If I lend this person money, will I get it back?" Your credit score is the number that answers that question. For ITIN holders, the first step is learning how to build that initial record of trustworthiness. If you want to dive deeper into this, we have a detailed guide on how an ITIN can be used to establish your financial footprint.

What Actually Makes Up Your Credit Score?

You don't need to be a financial wizard to understand what drives your credit score. While the exact formulas used by companies like FICO are kept under wraps, the main ingredients are public knowledge. Getting a handle on these is your key to success.

Here's a breakdown of what matters most when building your score. Think of this as your cheat sheet for what to prioritize.

| Key Factors That Build Your Credit Score | | :--- | :--- | :--- | | Credit Score Factor | Percentage of Your Score | What It Means for You | | Payment History | 35% | This is the heavyweight. Always pay your bills on time. Even one late payment can cause a significant drop. | | Amounts Owed (Credit Utilization) | 30% | How much of your available credit are you using? Keep this low (ideally under 30%, but under 10% is even better). | | Length of Credit History | 15% | The longer you've responsibly managed credit, the better. Start as soon as you can and keep old accounts open. | | Credit Mix | 10% | Lenders like to see you can handle different types of credit (e.g., credit cards, loans). This is less critical when you're starting out. | | New Credit | 10% | Opening too many new accounts in a short time can be a red flag. Apply for new credit strategically. |

Focusing on the top two factors—payment history and credit utilization—will give you the most bang for your buck, especially in the early days.

The goal is to get your score as high as possible. In the U.S., FICO scores range from 300 to 850. A higher number means you're seen as lower risk, which unlocks better interest rates and financial products. For example, a person with a 750 credit score might qualify for a mortgage rate that saves them tens of thousands of dollars over the life of the loan compared to someone with a score of 650. The difference is real and significant.

Picking the Right Tools to Start Building Your Credit

Alright, you've got the basics down. Now it's time to put that knowledge to work and actually start building your credit history. This is a big step, and the first products you choose will set the foundation for your entire financial future in the U.S. It's all about picking the right tool for your specific situation.

The three most common paths I see people take, and the ones I recommend most often, are secured credit cards, credit-builder loans, and becoming an authorized user. Each one works a little differently and is designed for different needs. There’s no single "best" choice—just the one that’s best for you right now.

Secured Credit Cards: The Hands-On Approach

For many people starting from zero, a secured credit card is the most direct path forward. Think of it as a regular credit card with training wheels. The main difference is that you provide a small, refundable security deposit when you open the account.

This deposit, usually between 200 and 500, becomes your credit limit. Because you've put down your own money, the bank sees you as a much lower risk. This makes getting approved a whole lot easier, even with no credit history to your name.

Credit-Builder Loans: The “Set It and Forget It” Method

A credit-builder loan is a fascinating tool because it works backwards from a normal loan. You don't get a lump sum of cash upfront. Instead, the lender puts the loan amount into a locked savings account in your name. You then make small, fixed monthly payments over a specific period, typically 6 to 24 months.

Once you’ve made all the payments, the full amount is released to you, sometimes with a little interest you've earned along the way. The entire point of this product is to demonstrate one simple thing to the credit bureaus: you can be trusted to make payments consistently and on time.

As this image shows, the core habits—opening an account, keeping your usage low, and always paying on time—are what truly build a strong credit profile over the long haul.

Becoming an Authorized User: The Relationship Route

Do you have a family member or a very close friend with a stellar credit history? If so, you might have a shortcut. You can ask them to add you as an authorized user to one of their well-established credit card accounts.

When they add you, the positive history of that account—like its long record of on-time payments and low balance—can get added to your own credit report. This can give your score a significant, almost immediate, boost. For a deeper dive, our guide on how to establish credit covers this and other strategies in more detail.

So, how do you decide? It really comes down to your life circumstances. If you're a student with a little money saved, a secured card is a great way to learn the ropes. If you prefer a more disciplined, hands-off approach, a credit-builder loan is a solid bet. And if you have that trusted person in your corner, becoming an authorized user can be a fantastic springboard.

Developing Smart Habits for Long-Term Credit Health

Getting that first credit product is a huge win, but it’s really just the starting point. The real work—and the real reward—comes from building consistent, responsible habits from day one. Your new credit account is a tool. How you handle it now will determine whether you're building a strong financial future or just creating headaches for yourself down the road.

The key is to create a routine that makes smart credit management second nature. We're not talking about complicated financial wizardry here, just simple, repeatable actions that have a massive payoff over time.

Automate Your Payments, Automate Your Success

Let’s be clear about one thing: your payment history is the single most important piece of the credit puzzle. It makes up about 35% of your FICO score. Just one missed payment can tank your progress and take months to recover from. The best way to avoid this? Take human error out of the picture.

Go into your account and set up automatic payments for at least the minimum amount due. Think of this as your safety net—it guarantees you’ll never be marked late. Then, I always recommend setting a calendar reminder a few days before the due date. This prompts you to log in and pay the rest of the balance off in full. This simple, two-step system ensures you’re always on time and, just as importantly, you're not paying a dime in interest.

Get a Handle on Your Credit Utilization

Right after payment history comes your credit utilization ratio (CUR). It sounds technical, but it’s just the percentage of your available credit you’re using. If you have a secured card with a 500** limit and you've spent **100, your CUR is 20%. Simple as that.

Keeping this number low tells lenders you're in control and not living on borrowed money. The standard advice is to keep your CUR below 30%, but if you really want to see your score climb, aim for under 10%.

An easy way to do this is to put one small, predictable bill on the card, like your Netflix or phone bill. This shows you're using the card consistently but keeps the balance tiny. Here's a pro tip: you can even make a payment before your statement closing date. This ensures an even lower balance gets reported to the credit bureaus.

Smart Strategies for Everyday Use

Here are a few practical tips I've seen work time and time again:

By turning these actions into habits, you transform that piece of plastic into a genuine asset. If you're just starting out, it's also worth exploring different types of credit-building accounts to see what fits your style. Building credit from the ground up is a marathon, not a sprint, and it’s these small, smart steps that pave the way to long-term financial freedom.

When you move to the U.S., you bring your skills, your experiences, and your ambitions. What you often can't bring, however, is your credit history. It’s a frustrating reality for so many immigrants and international professionals.

You could have a perfect track record of paying bills on time for decades back home, but to the U.S. credit system, you’re often starting from zero. It feels like being an accomplished professional who’s suddenly treated like an intern. This happens because financial systems are incredibly local; a lender in Ohio simply doesn't have a way to see or understand your financial life from another country.

A New Way to Look at Credit

Thankfully, this old way of thinking is starting to change, driven by financial innovation happening all over the globe. In many countries, especially in emerging markets, a lack of traditional banking access forced a rethink of what "creditworthiness" really means.

Instead of just looking at loans and credit cards, innovators began to see the value in other consistent financial behaviors. After all, if someone reliably pays their bills month after month, doesn't that say something important about their character and financial responsibility? This led to the rise of new credit models that incorporate everyday payments.

This approach is just common sense. It recognizes that your daily financial habits are a powerful predictor of how you'll manage debt.

What We Can Learn from Global Finance

This worldwide shift offers some powerful insights for anyone building credit from the ground up. Take India, for example, where a massive digital payment boom has completely changed the game. As of 2022, over 70% of the population was using digital payment methods.

This created a tidal wave of new financial data, allowing companies to build credit profiles for millions of people who were once invisible to banks. You can dive deeper into these trends in this detailed report on global credit markets.

Watching these international trends gives you a much bigger picture. It proves that the core principles of good credit—consistency and reliability—are universal, even if the tools used to measure them are different. For ITIN holders in the U.S., this global movement is fantastic news. It’s paving the way for more modern, inclusive services that can finally see and value a broader range of your financial data.

Understanding The Evolving Credit Landscape

The financial world is always in motion, and having a feel for these shifts gives you a serious edge. When you're learning how to build credit from the ground up, your personal habits are only one part of the equation. The broader economic climate plays a huge role in how lenders operate, and knowing this helps you position yourself for success.

Think of it this way: you wouldn't play a game without knowing the rules. The same goes for credit. Big economic events and new regulations constantly change what lenders are looking for in an applicant. By grasping these larger forces, you can navigate the system with confidence and find the best opportunities to grow your credit profile. It's the difference between being a passive applicant and a savvy, strategic borrower.

How Global Trends Affect Your Credit Journey

It might not seem obvious, but major financial events can directly impact the kinds of credit products you can get. For example, the evolution of global banking rules has totally reshaped how credit is built and managed today. After the Global Financial Crisis, there was a major pivot away from traditional bank lending and toward capital markets, which opened the door for private credit to boom. This trend has really accelerated since 2020, with private credit markets growing at a rapid pace.

For someone just starting out, this shift is a mixed bag. Some private lenders might have tougher requirements or higher interest rates. The upside? Banks in developed markets have kept their finances incredibly stable and strong. They’re sitting on historic levels of cash and capital, which makes for a more predictable and reliable lending environment. You can dig deeper into these macroeconomic changes and get the full 2025 credit research outlook.

This stability from established banks is a huge plus when you’re building your financial identity from scratch.

Positioning Yourself for Success

So, what does this all mean for you as an ITIN holder? It means that while things are complex, the system is also brimming with opportunities if you know where to look. Here’s how to put this knowledge into practice:

By getting a handle on these broader market dynamics, you can make smarter, more informed choices. You'll know which products are the right fit for the current climate and how to present yourself as the low-risk, dependable borrower every lender is looking for.

Answering Your Top Credit-Building Questions

When you're starting your credit journey, you're bound to have questions. Everyone does. Getting straight answers is key to building your financial confidence, so let's tackle some of the most common things people ask when they're just starting out.

How Long Until I Have a Good Credit Score?

You can technically get a FICO score just six months after opening your first credit account. But building a good score—what lenders usually see as 670 or higher—is a longer game. It’s all about consistency.

Lenders want to see a proven track record. If you can show them 12 to 24 months of solid, positive habits, like always paying on time and not maxing out your cards, you'll see a real difference. Patience and discipline are your best friends here.

Will Checking My Own Credit Score Lower It?

This is a big one, and the answer is a firm no. When you check your own credit score or pull your own report, it's called a "soft inquiry." It has absolutely zero effect on your score. In fact, keeping an eye on your score is one of the smartest things you can do for your financial health.

What can affect your score is a "hard inquiry." This happens when a bank or lender pulls your credit because you've applied for something like a loan or a new credit card. A hard inquiry might cause a small, temporary dip in your score, which is why it’s smart to only apply for new credit when you really need it.

Should I Stick to One Credit Card or Get More?

When you’re first starting, your best bet is to master just one credit card. The goal is to prove you can handle that single account flawlessly. Think of it as learning to walk before you run—nail the basics first.

Once you have about 6 to 12 months of perfect payment history under your belt, adding a second card can actually help. Why? It improves your "credit mix" and can lower your overall credit utilization ratio, both of which look great to lenders. The golden rule is simple: only open new accounts you know you can manage without overextending yourself.

Do I Have to Carry a Balance to Build Credit?

This is probably the most damaging myth out there. You absolutely do not need to carry a balance—and pay interest—to build your credit score. It's a costly misunderstanding.

Your payment history gets reported whether you pay the minimum due or the full statement balance. The smartest strategy is to use your card for small, manageable purchases and then pay the entire balance in full before the due date.

Ready to take control of your financial future? With itinScore, you can start building your credit history using your ITIN today. Get free credit monitoring, personalized guidance, and access to ITIN-friendly financial products. Sign up in minutes.