how to build business credit: A Founder's Guide

Establishing your business as a separate financial entity is the first and most critical move you'll make in building business credit. It's all about drawing a clear, undeniable line in the sand between your personal finances and your company's. This means registering your business legally, getting an Employer Identification Number (EIN), and opening a dedicated business bank account. These aren't just bureaucratic hoops to jump through; they're the foundational pillars that prove to lenders your business is a legitimate, standalone operation.

Why a Formal Business Structure Is Non-Negotiable

Before you can even think about a business credit score, you have to build a business that credit bureaus and lenders can see. They need to recognize a distinct, legally registered company, not just an extension of you. This is the bedrock of your entire credit-building journey.

Imagine this: operating as a sole proprietorship is like running your company from a messy desk where personal bills and business invoices are all jumbled together. Forming an LLC or corporation, on the other hand, is like leasing a professional office space with its own address and identity. That distinction is everything when you're trying to establish credibility.

Creating a Separate Legal Entity

Your very first task is to formalize your business structure. Choosing to become a Limited Liability Company (LLC) or a Corporation (S-Corp or C-Corp) is more than just paperwork—it’s about creating a legal shield between your personal life and your business operations.

This separation is vital for two main reasons:

Without this formal setup, any credit you try to get will almost certainly be tied directly to your personal credit profile, which completely defeats the purpose of building business credit in the first place.

Securing Your Employer Identification Number (EIN)

Once your business is officially registered, your next move is getting an Employer Identification Number (EIN) from the IRS. An EIN is a unique nine-digit number that essentially functions as a Social Security Number for your business. You'll need it for just about everything—filing taxes, hiring employees, opening a bank account, and, most importantly, applying for business credit.

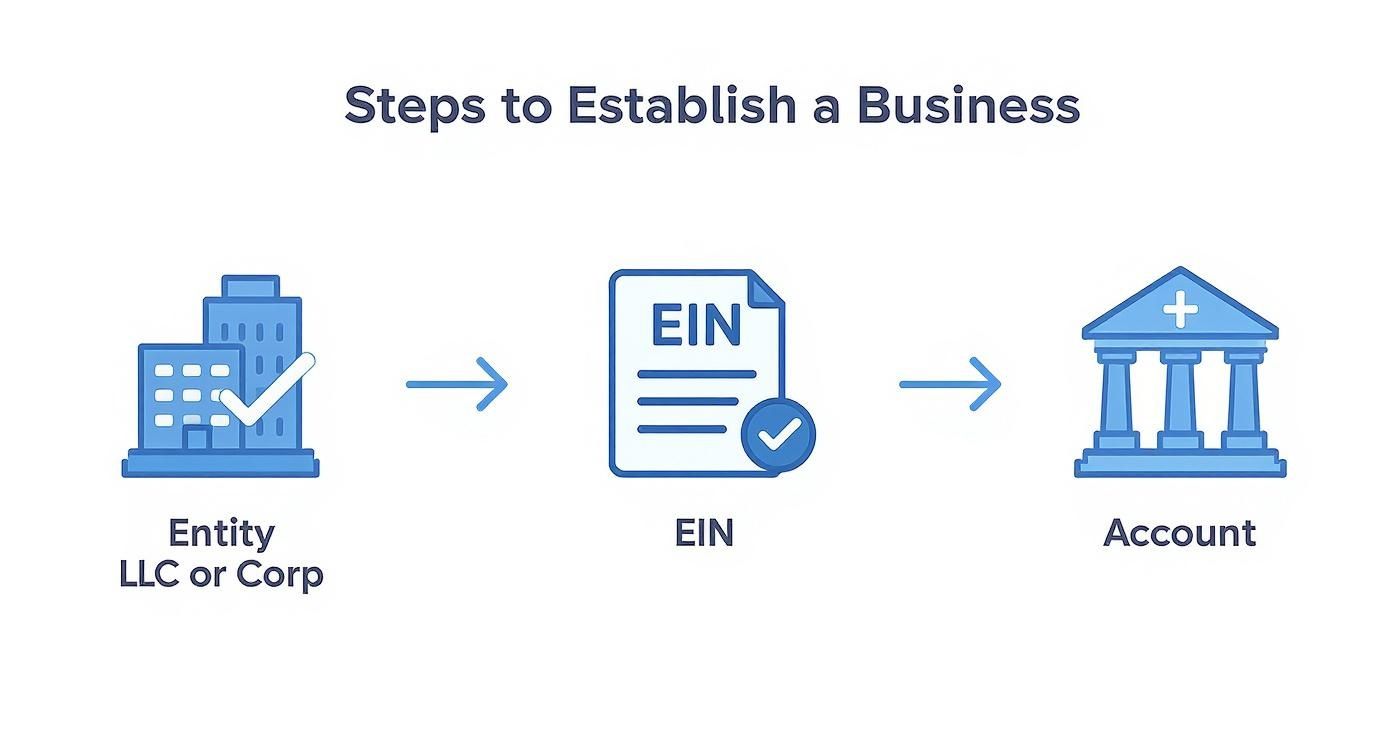

This visual shows how these essential first steps work together to create a credit-ready business.

As you can see, each step—forming an entity, getting an EIN, and opening an account—builds on the one before it to create a rock-solid financial foundation for your company.

Opening a Dedicated Business Bank Account

The final piece of the foundation is opening a business checking account. This must be done using your company's legal name and your new EIN. Mixing funds by using a personal account for business transactions is one of the biggest red flags for lenders. It makes you look disorganized and raises questions about the legitimacy of your business.

A dedicated business bank account does several crucial things:

Data shows just how much small businesses rely on these credit products. For example, about 45% of U.S. small businesses have used a credit card for funding, and 34% have taken out loans. Both of these are nearly impossible to secure without a separate business bank account to manage the funds.

To help you get organized, here’s a quick checklist of what you need to have in place before you start seeking credit.

Business Credit Readiness Checklist

Once you've ticked off these boxes, you've built the proper foundation.

This clear separation is non-negotiable. It's also wise to understand the role of personal guarantees, which can sometimes link your personal assets back to business debts, especially when your company is new. With these three pillars—entity, EIN, and bank account—firmly in place, you are officially ready to start applying for accounts and building a positive payment history through what the industry calls "tradelines." To learn more about how this works, take a look at our guide on how business credit report tradelines work.

Time to Open Your First Vendor and Trade Accounts

Okay, so your business is officially registered and has its own identity. Now comes the fun part: actually building its credit history. This isn't about walking into a bank and asking for a big loan right away. Instead, you'll start small, building strategic relationships with vendors and suppliers.

These initial accounts are your foot in the door. They're often called trade accounts or vendor credit, and they typically operate on terms like Net-30, Net-60, or Net-90. All this means is you get the products or services you need now and have 30, 60, or 90 days to pay the bill.

Getting Started with Net-30 and Starter Vendors

A Net-30 account is simply a form of short-term credit a supplier gives you. You might buy office supplies, shipping materials, or marketing products for your business today and pay the invoice within 30 days. It’s a simple concept, but it's incredibly powerful when that vendor reports your payment history to the business credit bureaus.

The trick is to begin with vendors known for working with new businesses—we call these "starter vendors." Think of them as training wheels. They help you create a solid payment history before you ever approach a traditional lender.

A few well-known starter vendors to check out:

By making necessary purchases from these suppliers and paying their invoices on time, every time, you’re actively generating the positive data that will form the foundation of your business credit scores.

The Strategy for Building with Trade Accounts

The process itself is straightforward, but it demands discipline. Your main objective is to prove that your business is a reliable, low-risk partner that pays its bills.

First, find vendors that sell things your business actually needs. This isn't about buying stuff just to build credit. If you run a small e-commerce shop, ordering shipping boxes from Uline is a no-brainer. If you’ve got a home office, buying printer paper from Quill is a legitimate business expense.

Once you’ve identified a few, apply for a credit account with them. Most starter vendors have simple online applications. After you're approved, make a small purchase to get the account active.

This consistent, early payment history is the single most important factor in your initial business credit profile. It proves you can manage financial obligations responsibly, even on a small scale.

Make Sure Your Payments Are Being Counted

This entire strategy lives or dies on one crucial detail: the vendor must report your payments to at least one major business credit bureau, like Dun & Bradstreet, Experian Business, or Equifax Business. If they don't report, your good payment habits won't help your business credit score at all.

So, how can you be sure?

Establishing these early trade lines is a foundational move. As you build this history, you’ll also prepare to add different types of credit to your profile. It's smart to get a handle on how various accounts work together, which is why it’s helpful to understand what is a credit mix and why it matters for your company’s long-term financial health.

By successfully managing several vendor accounts, you create a diverse and positive payment history. This track record makes your business a much more appealing applicant when you’re ready to apply for business credit cards, lines of credit, and eventually, larger business loans.

Broadening Your Financial Footprint with Credit Products

You've successfully managed your vendor accounts, paying on time and proving your business is reliable. That’s a fantastic start. Now, it's time to level up and show lenders you can handle more sophisticated financial tools. This is all about strategically layering different kinds of credit into your profile, which is a major signal of financial health.

The natural next step up from vendor trade lines is almost always a business credit card. Getting that first card is a huge milestone. It introduces a revolving line of credit to your business profile, which is something the credit bureaus and lenders really want to see.

Getting Your First Business Credit Card

A business credit card is more than just a convenient way to pay for things. It’s a powerful tool for separating your personal and business finances, smoothing out cash flow, and most importantly, actively building your credit history.

Unlike some vendor accounts that might not bother reporting, virtually all major business credit card issuers report your payment activity to the business credit bureaus. This means every on-time payment you make directly beefs up your credit score.

But don't just jump on the first pre-approval letter that lands in your mailbox. Think strategically.

Once you get the card, how you manage it is everything. Use it for your regular, planned business expenses—think software subscriptions or inventory—and make it a rule to pay the balance in full every single month. This shows you're disciplined and keeps your credit utilization low, a huge factor in your score.

Stepping Up to Business Loans and Lines of Credit

Once you have a solid six months or more of history with vendor accounts and a business credit card under your belt, you can start thinking about small business loans or lines of credit. These aren't just tools; they're trophies. Securing one shows the financial world that your company can be trusted with more substantial responsibility.

Applying for a loan is a different ballgame than getting a Uline account, though. Lenders will pull your business credit score, but they're going to dig a lot deeper into the health of your actual business.

What Lenders Really Care About

When a lender reviews your loan application, they’re basically trying to answer one question: "Will we get our money back?" Your credit score is part of that answer, but they also need to see that your business itself is standing on solid ground.

Get your paperwork in order before you even think about applying.

The global business loan market is a behemoth, valued at around $8 trillion, and it's only getting bigger. This competition is good for you! Banks, online lenders, and credit unions are all looking to fund solid businesses. A well-prepared application puts you at the front of the line. You can see just how massive this market is in this global business loan market research from dataintelo.com.

Finally, know what you're asking for. A term loan gives you a lump sum of cash for a big, one-time purchase, like a piece of equipment. A line of credit, on the other hand, is a flexible credit limit you can tap into as needed, perfect for covering unexpected costs or managing inventory. By adding these products to your profile, you're not just borrowing—you're building a rock-solid financial reputation that will unlock future opportunities.

Keeping a Close Eye on Your Business Credit Scores

Building business credit isn't something you can set and forget. It's an active, ongoing process. Think of your business credit score as your company's financial GPA—it needs regular check-ups to stay healthy and unlock better opportunities down the road. The only way to protect all your hard work is to consistently monitor your scores and reports.

This hands-on approach helps you catch errors, spot potential fraud, and truly understand how your day-to-day financial decisions are shaping your company's reputation. It’s all about staying in the driver's seat of your financial future.

Getting to Know the Major Business Credit Scores

Unlike personal credit, which is largely dominated by FICO and VantageScore, the business world has a few key players. Each credit bureau uses a slightly different formula to figure out how risky your company is, so it’s crucial to know who they are and what they’re looking for.

This table breaks down the three main business credit bureaus and what makes their scores tick.

As you can see, while they all care about on-time payments, the specific details they weigh can differ. That's why you can't just check one score and call it a day; they all paint part of your company's financial picture.

How to Access and Review Your Credit Reports

The first real step in managing your credit is getting your hands on your reports. You can get them directly from the main bureaus: Dun & Bradstreet, Experian Business, and Equifax Business. Yes, some services charge a fee, but think of it as a small, necessary investment in your company's financial well-being.

Once you have the reports, don't just glance at the score. You need to comb through the details.

If you spot an error, don't panic. Each bureau has a formal dispute process. Just gather your evidence—like bank statements or proof of payment—and submit a dispute. They are legally required to investigate your claim and correct any mistakes.

Proactive Strategies to Protect and Improve Your Scores

Monitoring is more than just playing defense; it’s also about going on offense. When you understand what drives your scores, you can make strategic moves to constantly improve them.

A powerful lever you can pull is maintaining a low credit utilization ratio. This is just the amount of credit you're using compared to your total available limit. For instance, if you have a business credit card with a 10,000** limit and a **2,000 balance, your utilization is 20%. Aim to keep this number below 30%—it’s a huge positive signal to the credit bureaus.

You also want to be smart about hard inquiries. Every time you apply for a new loan or line of credit, it can trigger a "hard pull" on your report, which might temporarily ding your score. This doesn't mean you should never apply for credit. It just means you should be strategic and only apply when you have a solid chance of getting approved.

To really get a handle on all these moving parts, it helps to understand the tools at your disposal. You can learn more about what credit monitoring is and how services can send you real-time alerts when something changes on your report, allowing you to act fast.

Ultimately, building and managing business credit is a marathon, not a sprint. It’s the consistent, positive financial habits that create a strong, resilient credit profile that will support your company's growth for years to come.