How to Apply for ITIN: Your Complete Success Roadmap

Understanding ITINs and Who Actually Needs One

An Individual Taxpayer Identification Number (ITIN) is essential for individuals residing in the U.S. who have tax filing requirements but aren't eligible for a Social Security Number (SSN). It's the key that allows these individuals to participate in the U.S. tax system. But how do you know if you need one?

ITINs vs. SSNs: Clearing Up the Confusion

Many people confuse ITINs and SSNs. Both are nine-digit numbers, but their purposes are distinct. The Social Security Administration issues SSNs primarily as proof of eligibility to work in the United States. An ITIN, issued by the IRS, is solely for tax purposes and doesn't authorize you to work.

Who Needs an ITIN?

Several groups need an ITIN. Non-resident aliens with U.S.-sourced income require an ITIN to file their tax returns. Resident aliens who are not eligible for an SSN also need one. Additionally, their spouses and dependents claimed on a tax return will also require an ITIN. This allows everyone, regardless of citizenship status, to fulfill their tax obligations.

The History and Importance of the ITIN Program

The ITIN program, established in 1996, is now a vital part of U.S. tax administration. It allows millions to comply with federal tax laws, regardless of their immigration status. The ITIN, a nine-digit number starting with a 9, is obtained through Form W-7. Over 5.8 million active ITINs exist, highlighting the program’s significant reach.

ITINs are essential for accurate tax record-keeping and ensuring compliance across a diverse population. Knowing if you need an ITIN is the first step towards navigating the U.S. tax system. The next step is learning how to apply.

Mastering Form W-7: Your Application Success Blueprint

Successfully applying for an Individual Taxpayer Identification Number (ITIN) depends on accurately completing Form W-7. This form is how you communicate directly with the IRS, so accuracy is paramount. Understanding the form's details is crucial for a smooth, hassle-free application process. This section offers a clear guide to navigating Form W-7 and avoiding common mistakes that can lead to rejection.

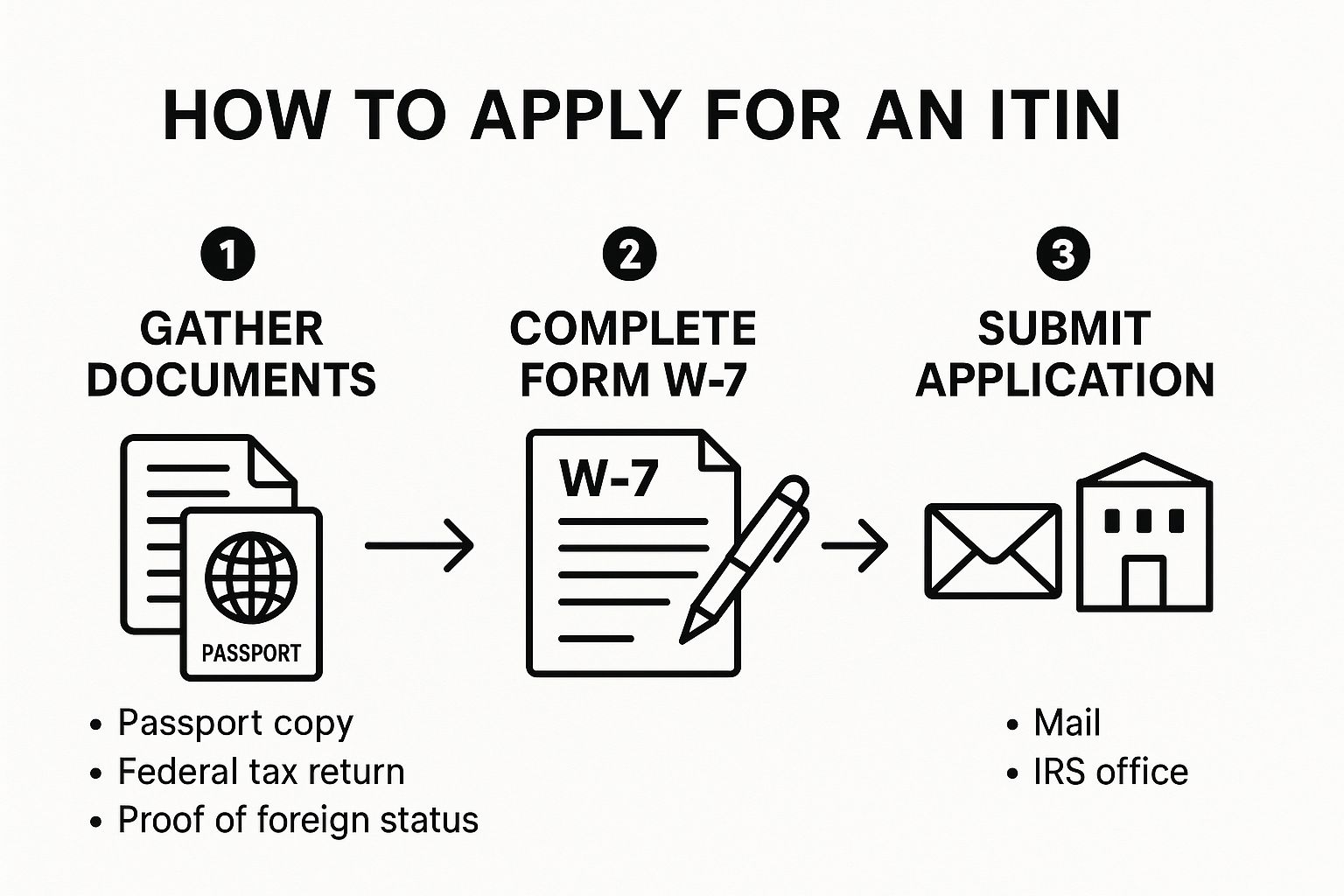

The infographic above illustrates the three primary steps in the ITIN application process: gathering necessary documents, completing Form W-7, and submitting your application. While these steps appear straightforward, they require close attention to detail to prevent delays or rejections.

Understanding the Different Sections of Form W-7

Form W-7 is comprised of several sections, each requiring specific information. Providing accurate information in every section is vital to avoid processing delays. Let's examine the key components of the form.

To help you navigate the complexities of Form W-7, we've provided a detailed breakdown in the table below:

To help you navigate the complexities of Form W-7, we've provided a detailed breakdown in the table below:

Form W-7 Section Breakdown

This table highlights the critical information needed for each section, common errors to avoid, and helpful tips for successful completion. By carefully reviewing this information, you can significantly increase your chances of a smooth application process.

Common Mistakes and How to Avoid Them

Many W-7 applications are rejected because of preventable errors. For instance, submitting an incomplete form or providing inconsistent information between the form and supporting documents are frequent issues. Thoroughly review every detail before submission to avoid these pitfalls.

Tips for a Successful Application

Here are some additional recommendations to ensure a successful Form W-7 submission:

By diligently completing Form W-7 and following these suggestions, you’ll considerably improve your likelihood of a successful and efficient ITIN application process. This allows you to pursue your financial objectives and access essential benefits.

Required Documents That Actually Get Approved

Getting your ITIN application approved depends on having the right documentation. Instead of guessing, learn exactly what the IRS accepts to save time and avoid a rejected application. This section clarifies the most effective documents, explains the difference between original documents and copies, and shows how Certified Acceptance Agents can help.

The 13 Acceptable Documents

The IRS accepts 13 documents to verify your identity and foreign status for an ITIN application. Knowing which ones work best for you is key to a smooth process.

Original Documents vs. Certified Copies: What's the Difference?

The IRS distinguishes between original documents and certified copies. Original documents are the physical documents from the issuing authority. Certified copies are copies verified and stamped by that agency. Originals can speed up the process, but the IRS will return them. Certified copies offer a safe, efficient alternative.

Certified Acceptance Agents: Your ITIN Allies

Certified Acceptance Agents are authorized by the IRS to help with ITIN applications. They review your documents, verify authenticity, and submit your application, so you don't have to send originals to the IRS. This saves time and ensures accuracy, streamlining the application.

To help you further understand what documents the IRS will accept for your ITIN application, we’ve prepared a quick reference matrix. It highlights which documents can stand alone to prove your identity and/or foreign status, or if supplemental documents are needed.

Acceptable ITIN Documentation Matrix

Comprehensive list of acceptable documents showing which prove identity, foreign status, or both.

As the matrix shows, several documents can serve as standalone proof of identity and foreign status, while others work best in conjunction with other forms of identification.

Building a Strong Application Package

Choosing the right document combination is important. A passport and foreign birth certificate often work well. For dependents, a birth certificate with school or medical records usually suffices. Unique circumstances may need other documents.

Obtaining Missing Documentation

Getting documents from your home country can be difficult. Contact your country’s embassy or consulate for help getting certified copies. This avoids delays. By understanding the document requirements, the difference between originals and certified copies, and the role of Certified Acceptance Agents, you can navigate the ITIN application with confidence and increase your chances of approval.

Processing Times and What Really Happens to Your Application

After carefully completing Form W-7 and gathering your supporting documents, you’re ready to submit your ITIN application. But what happens next? Understanding the IRS processing timeline and the factors that influence it can help manage your expectations and avoid unnecessary stress.

Understanding ITIN Processing Times

The IRS processing time for ITIN applications isn't set in stone. It varies based on several factors, including application volume and the complexity of your documents. Generally, processing takes about 7 weeks outside of peak tax season.

However, during the tax filing season (January to April), the timeline can stretch to 11 weeks. This extended timeframe is due to the surge in applications the IRS receives during this period. Knowing these seasonal variations is important for realistic planning. Submitting your application well in advance of any deadlines is key.

The ITIN application process involves submitting Form W-7 along with necessary documentation like proof of identity and foreign status. Processing can take up to 11 weeks during tax season and around 7 weeks otherwise. In 2022, the IRS received nearly 988,500 ITIN applications, assigning about 652,300 and rejecting over 218,600. This highlights the thorough review process involved in ITIN applications to ensure compliance with federal tax regulations. Find more detailed statistics here: https://oiss.washu.edu/itin/

Factors Influencing Processing Time

Several factors can affect how quickly your application is processed. These include:

Tracking Your Application Status

While you wait, you can track your ITIN application status online using the IRS's "Where's My ITIN?" tool. This tool offers updates on your application’s progress and notifies you of any potential issues.

What to Do if Processing Time Exceeds Expectations

If the processing time goes beyond the typical timeframe, don't worry. Contact the IRS directly for assistance. They can give you updates and address any concerns. Keeping records of your submission date and any communication with the IRS is always recommended.

Understanding processing times and what goes on behind the scenes helps you prepare for the ITIN application process. While the waiting period can feel lengthy, understanding the factors involved will help you manage your expectations and make the experience smoother.

Why Applications Get Rejected and How to Bulletproof Yours

Applying for an Individual Taxpayer Identification Number (ITIN) can be simple, but many applications are rejected. The IRS rejects over 20% of applications, often due to avoidable errors. Understanding these common reasons for rejection can save you months of delays and the frustration of starting over. This section will explore these pitfalls and offer solutions to ensure your application is airtight.

Common Reasons for ITIN Application Rejection

Several factors contribute to ITIN application rejections, ranging from simple oversights to more complex documentation issues. Let's examine the most frequent reasons:

How to Avoid Common Mistakes

Preventing these issues requires attention to detail and careful preparation:

How to Respond to IRS Requests for Additional Information

If the IRS requests more information, respond promptly and professionally. Provide the requested documents quickly and clearly to avoid further delays. Maintain records of all communication with the IRS.

Resubmitting a Rejected Application

If your application is rejected, don’t give up. Carefully review the rejection notice to understand the reason. Correct the error, ensuring your resubmitted application meets all requirements. Consulting with a tax professional or a Certified Acceptance Agent can be invaluable.

Successfully applying for an ITIN requires careful attention to detail and understanding of the process. By avoiding common mistakes and following these tips, you can significantly increase your chances of first-time approval and avoid the hassle of a rejected application. This knowledge empowers you to navigate the ITIN application process confidently.

Choosing Your Submission Method for Maximum Success

Now that you understand Form W-7 and the required documentation, let's explore how to submit your ITIN application. This decision involves weighing the pros and cons of mailing directly to the IRS versus using a Certified Acceptance Agent (CAA).

Mailing Directly to the IRS

Mailing your application directly to the IRS seems simple, but requires meticulous attention to detail. Here's what you need to know: