How Often to Check Credit Report: Essential Tips

So, what's the magic number for checking your credit report? While there's no single answer that fits everyone, a quarterly check is a fantastic baseline for most of us.

Think of it this way: you don't wait for your car's engine to start smoking to check the oil. The same idea applies to your financial health. Regular peeks at your credit report let you catch small drips—like an error or a fraudulent charge—before they turn into a major gusher of a problem.

Your Guide to Regular Credit Report Checks

Making this a regular habit is one of the smartest things you can do for your finances. It puts you in the driver's seat, allowing you to spot mistakes, catch fraud early, and get a clear, honest picture of where you stand.

Let’s break down a simple framework for how often you should pull your report, whether you're about to apply for a mortgage or just want to keep your good credit in great shape.

Establishing a Checking Rhythm

The right frequency for checking your credit really comes down to what’s happening in your financial life. Are you actively seeking new loans, or are you just coasting and maintaining your existing accounts? Your answer will shape your ideal schedule.

Financial experts suggest being flexible. For example, if you've frozen your credit, a great strategy is to check the report from one of the three major bureaus each quarter on a rotating basis. This gives you a complete picture over the course of a year.

However, if you're actively applying for credit or haven't frozen your reports, a monthly check-in is a much better bet. It provides a more immediate heads-up on potential identity theft, errors, or changes that could affect your borrowing power. Since you can get free weekly reports from all three bureaus through services like AnnualCreditReport.com, there’s no reason to hold back—and it won’t hurt your score. For a deeper dive, NerdWallet offers great expert recommendations on creating a personal schedule.

Here’s a simple table to help you figure out the best rhythm for your situation.

Recommended Credit Check Frequency Guide

Use this guide as a starting point, and adjust as your financial life changes. The goal is to stay informed without feeling overwhelmed.

When to Check More Frequently

Sometimes, life throws you a curveball that demands you pay closer attention to your credit. Don’t just wait for your next scheduled check-in if you find yourself in one of these situations:

Why Checking Your Credit Report Is Essential

Your credit report is more than just a number—it’s the detailed story of your financial life. Reviewing it regularly isn't just a good habit; it's a fundamental part of keeping your finances healthy. Think of it as a routine check-up for your wallet, making sure every detail is accurate and working for you.

Ignoring your report is like letting a stranger write your biography without a single fact-check. The consequences can be serious, affecting everything from the interest rates you’re offered to your ability to get approved for loans at all.

Catch and Correct Costly Errors

Let's face it, mistakes happen. A payment you made on time might get misreported as late, or an old account you closed years ago could still appear to have a balance. These might seem like small typos, but they can drag your credit score down and potentially cost you thousands in higher interest on a mortgage or car loan.

In fact, a 2021 study from Consumer Reports revealed that one-third of volunteers found at least one mistake on their credit reports. By checking yours consistently, you can spot these inaccuracies early on and dispute them before they cause any real damage. It’s a simple, proactive step that ensures lenders see the true story of your financial responsibility.

Guard Against Identity Theft

In an age of constant data breaches, identity theft is a real and growing threat. Your credit report is often the first place you'll see the red flags. A criminal could use your information to open a new credit card or take out a loan, and you might not know until an unfamiliar account pops up on your report.

Gain Clarity Before Major Decisions

Thinking about buying a car, applying for a mortgage, or even just renting a new apartment? Before making any big financial move, you absolutely need to know what lenders will see when they look you up.

Reviewing your report gives you that honest, clear picture of your creditworthiness from their point of view. For a deeper dive into the specifics, you can learn how to check your credit report for free and what to look for. This insight empowers you to fix any potential issues ahead of time, so you can walk into your application with total confidence.

How Credit Reports Are Updated

Ever checked your credit report and felt like you were trying to hit a moving target? You're not wrong. Your report isn't some static document filed away in a dusty cabinet; it's a living, breathing profile of your financial life.

Think of it like a personal financial news feed. Throughout the month, all your lenders—from credit card issuers to auto loan providers—are sending updates to the three major credit bureaus: Experian, TransUnion, and Equifax. This constant flow of information is exactly why knowing how often to check your credit report is so important.

The 30-Day Reporting Cycle

Each of your creditors plays by its own clock. Your credit card company might send its report on the 5th of the month, while your car loan payment isn't reported until the 20th. Because of this, your credit information is in a constant state of flux.

Lenders and other financial institutions typically push out these updates monthly, but their individual schedules vary. While your report can technically change any day, the general rhythm is that it reflects new data every 30 days or so. This staggered timing is also why your report might look slightly different across the three bureaus at any given moment. You can learn more about this continuous cycle directly from Experian's insights.

Getting a handle on this cycle is a game-changer, especially for anyone building their financial footprint with an ITIN. When you don't have a Social Security Number, understanding the mechanics of these updates is a foundational step. Our guide on how to get your ITIN credit report walks you through this process.

Knowing this rhythm helps you time your credit checks perfectly, so you’ll know exactly when to expect changes to show up. It’s all about making sure you always have the most accurate picture of your financial health.

Creating Your Personal Credit Check Schedule

Knowing you should check your credit report is one thing. Actually doing it consistently is another ball game entirely. The key is to build a practical schedule that fits your life, not the other way around. There’s no single magic number for how often to check—it really depends on what’s happening with your finances.

Think about it this way: are you just maintaining things, or are you actively trying to build credit or get ready for a big purchase? Your answer to that question will tell you exactly how often you need to peek at your reports.

The Staggered Approach: For When Your Credit is Stable

If your credit is in good shape and you aren't planning to buy a house or a car anytime soon, the "staggered" method is a fantastic, low-stress strategy. It gives you a bird's-eye view of your credit throughout the year without feeling like a chore.

Here’s the simple breakdown:

By rotating through the bureaus, you get a fresh look at your credit file every four months. This is a smart way to catch potential errors or signs of fraud early on, long before they can become bigger headaches.

Monthly Check-Ins: For Active Credit Builders and Big Purchases

Now, if you're on a mission—whether that's building credit from scratch, repairing a damaged score, or gearing up for a major loan like a mortgage—you need to be more hands-on. In this case, a monthly check-in is your best friend. It lets you see your progress in near real-time, verify that new positive accounts are showing up, and jump on any problems immediately.

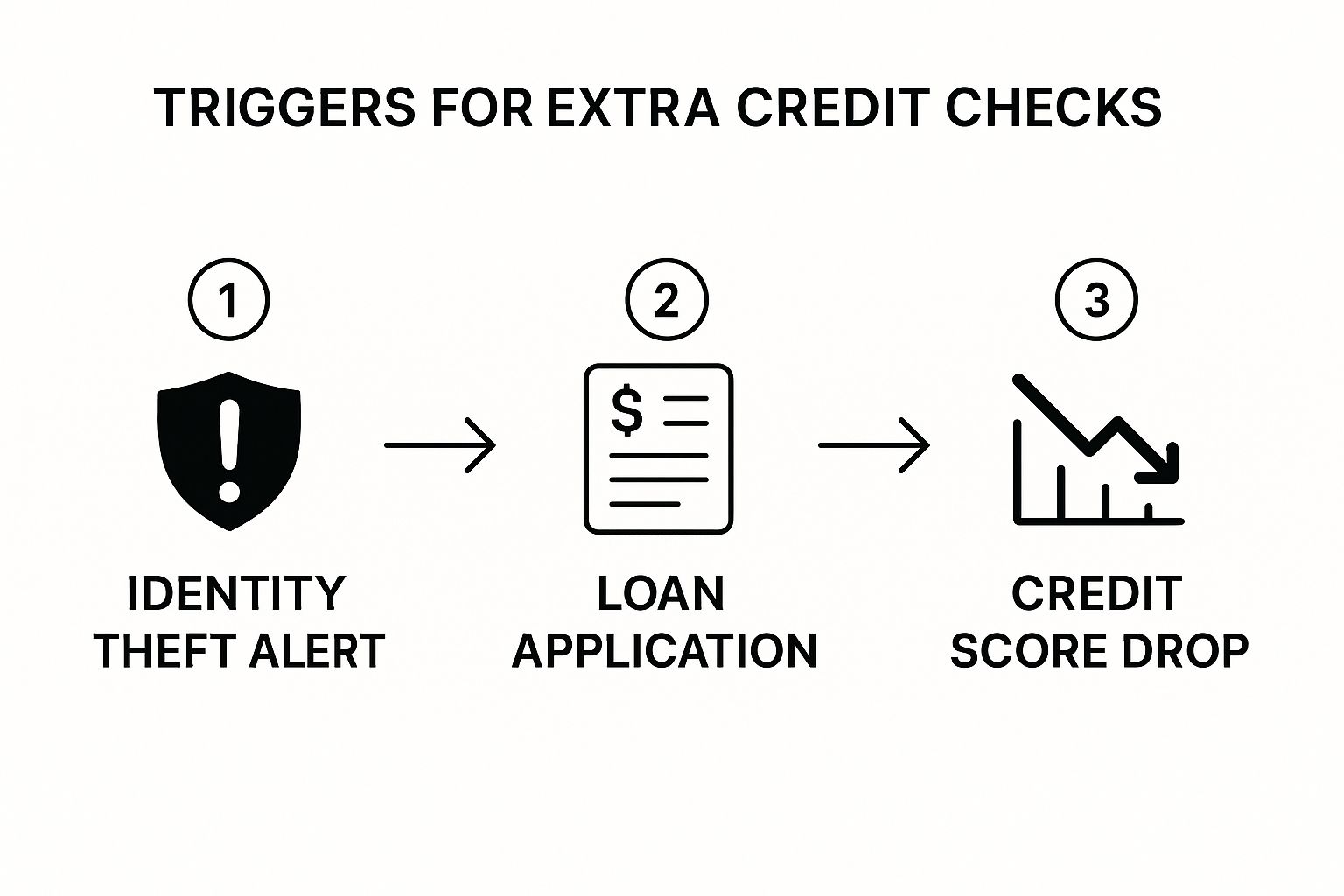

Beyond your regular schedule, certain life events should always trigger an immediate credit check. Think of them as red flags you can't ignore.

Events like getting an identity theft alert, applying for a loan, or seeing an unexpected drop in your score are clear signals. They mean it's time to drop everything and investigate to protect your financial standing.

Common Myths About Checking Your Credit

A lot of misinformation out there can make people nervous about looking at their own credit reports. Let's clear the air and tackle some of the biggest myths that prevent people from taking this simple but crucial step for their financial health.

The most persistent myth by far is that checking your own credit report will damage your score. This is completely untrue. Think of it like looking in the mirror—it's just a check-in, not a major event. In the credit world, this is called a "soft inquiry," and it has absolutely no impact on your score.

A "hard inquiry" is different. That happens when a bank or lender pulls your credit because you've applied for something new, like a loan or a credit card. A bunch of those in a short period can cause a temporary dip in your score, as it might signal to lenders that you're in financial distress. We have a full guide that breaks this down even further, so you can learn more about whether checking your credit hurts your score.

Debunking Other Common Fictions

Beyond the main "soft inquiry" myth, a few other misunderstandings often trip people up. Getting these straight is key to feeling confident about managing your credit.

Once you separate the facts from the fiction, you can monitor your credit without the anxiety that holds so many people back. It’s your information, and you have every right to see it.

Unpacking the Fine Print: Your Credit Check Questions Answered

Diving into your credit reports for the first time can feel like learning a new language. You're bound to have questions, and that's perfectly normal. Let's clear up some of the most common uncertainties people face when they start monitoring their financial health.

Will Checking My Credit Report Lower My Score?

This is probably the biggest myth out there, and the answer is a simple "no." When you check your own credit report, it’s what’s known as a “soft inquiry.” It has zero impact on your credit score. Think of it like a personal check-up; it’s for your eyes only and doesn't tell lenders you're desperate for new credit.

The inquiries that can affect your score are “hard inquiries.” These only happen when a lender or creditor pulls your report because you’ve applied for something new, like a car loan, a mortgage, or a new credit card. A flurry of these in a short period can cause a small, temporary dip in your score.

What Should I Do If I Find an Error?

Finding a mistake on your report can be stressful, but don't panic. The law is on your side. Thanks to the Fair Credit Reporting Act (FCRA), you have the right to dispute any inaccuracies you find and have them corrected.

If you spot something that isn't right—maybe a late payment that was actually on time, an incorrect account balance, or an account you never opened—here’s what you do:

Should I Check All Three Reports at Once or Stagger Them?

Your best strategy really depends on what you're trying to accomplish.

For routine, year-round monitoring, staggering your checks is a fantastic tactic. You can pull a free report from a different bureau every four months, giving you a steady, ongoing look at your credit profile without any gaps.

However, if you're gearing up for a big financial move—like buying a house or a car—it's smart to check all three reports at once. This gives you the full 360-degree view that your potential lender will see, allowing you to catch and fix any discrepancies across all reports before you apply.

Ready to take control of your financial future but don't have an SSN? itin score provides the first comprehensive credit-building platform designed for ITIN holders. Get free, unlimited credit monitoring and personalized guidance to build your U.S. credit history securely. Start your journey at https://www.itinscore.com.