How Long Does It Take to Build Credit? Find Out Now

So, how long does it really take to build credit? It’s a question on every newcomer's mind. The short answer is you can often see your very first credit score pop up in as little as 3-6 months after opening your first account. But that's just the starting whistle, not the finish line.

The Credit Building Timeline From Zero to Good

Think of building credit like planting a tree. It might sprout a few leaves pretty quickly, which is exciting! But for it to grow into a strong, sturdy oak that lenders see as reliable, it needs consistent watering and time. Your real goal isn't just to have a score; it's to build a "thick" credit file with a solid history that opens doors to better loans, lower interest rates, and more financial freedom.

This timeline will give you a realistic idea of what to expect, from those first few months to building a truly excellent score that works for you.

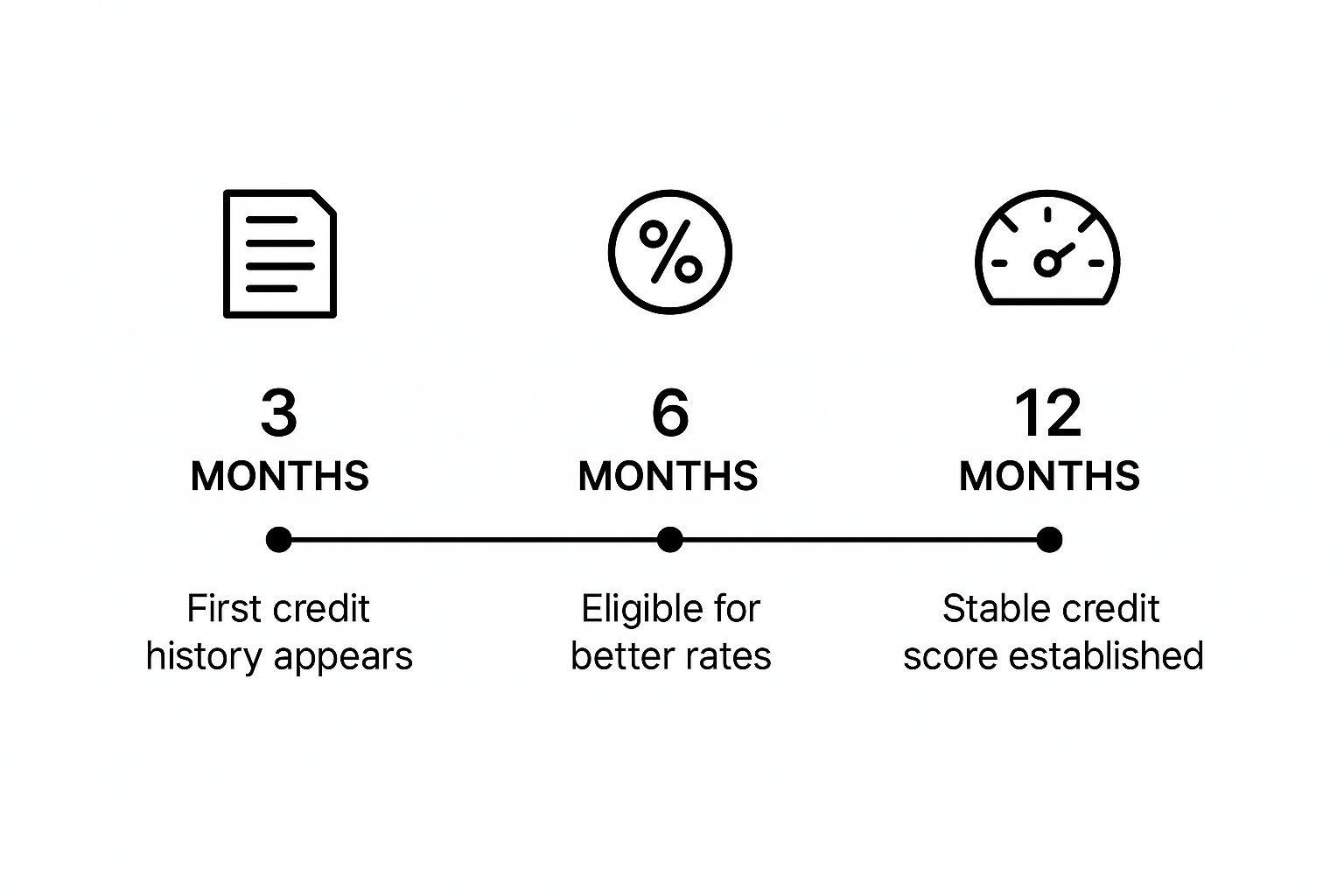

Here’s a look at the major milestones you’ll hit on your credit-building journey.

As you can see, getting started happens fast, but building a credit profile that lenders truly trust is a process that unfolds over your first year and continues to strengthen from there.

To help you track your journey, here's a table mapping out the key stages of building a strong credit history.

Your Credit Building Milestones

These milestones show that while the first score is an important first step, the real benefits come from patience and consistency over time.

Your First Six Months From Scratch

The first six months are all about laying the groundwork. Your main job here is simple: prove you're responsible. Every single on-time payment you make is like laying another brick in your financial foundation.

It typically takes about six months of reported activity for the most common scoring model, FICO, to calculate a score. And since 90% of top lenders use FICO, this is a milestone worth waiting for. That said, you might see a score sooner from VantageScore, which can sometimes generate one after your first account reports.

Just remember, even with a score, your file is considered "thin" if you have fewer than five accounts. This can make some lenders hesitant. If you're looking for more details on this early stage, Experian offers a great guide on building your initial credit file.

Milestones in Your First Year

Once you cross that six-month mark and head toward your one-year anniversary, your credit profile really starts to take shape. Your hard work begins to pay off in tangible ways.

Here’s what you can look forward to:

By the end of your first year, you’ve graduated from the seedling stage. You've built a solid base, and that financial tree you planted is starting to look strong and dependable.

What Actually Makes Your Credit Score Grow

If you want to know how long it takes to build credit, you first have to understand what makes a credit score move in the first place. The best way to think about it is like a recipe that lenders use to decide if you’re a safe bet. Once you know the ingredients and how much of each to use, you can cook up a truly excellent score.

The most critical ingredient, the absolute foundation of your score, is your payment history. It makes up a massive 35% of a typical FICO score. Think of it as the flour in a cake—without it, the whole thing falls apart. Simply paying your bills on time, every single time, is the most powerful thing you can do.

Next up is your credit utilization ratio, which is almost as important at 30% of your score. This is like the salt in your recipe; you need some, but too much will completely ruin the dish. This ratio is just a fancy term for how much of your available credit you're currently using. For instance, if you have a credit card with a 1,000 limit and you've spent 200, your utilization is 20%.

The Supporting Ingredients for a Strong Score

While timely payments and low balances do the heavy lifting, three other factors round out your credit profile and help it mature over time.

Getting a handle on how these five ingredients work together is the real key to making progress. When you focus on making smart, consistent moves in each of these areas, you're not just hoping your score will improve—you're actively following a proven recipe for success. For more hands-on strategies, you might want to check out our guide on how to improve your credit score. It’s all about taking control and building a stronger financial future for yourself.

Your First Steps in Building Credit History

Knowing what makes up a good credit score is one thing, but actually building one from zero is a completely different ballgame. If you're starting with no credit history, your first real task is to find a safe and reliable "on-ramp" into the credit system.

Fortunately, there are tools designed just for this. The two most common and effective options are secured credit cards and credit-builder loans.

Think of a secured credit card as a regular credit card, just with training wheels. To open an account, you put down a small, refundable security deposit. This deposit typically sets your credit limit—so, a 300** deposit usually gets you a **300 credit limit.

This setup removes the risk for lenders, since your own money backs the credit line. From there, you use it just like any other card for small purchases and, most importantly, pay the bill on time every single month. Those on-time payments get reported to the credit bureaus, and that’s how you start laying the bricks for a positive credit history.

Starting Your Credit Building Journey

Another fantastic tool is the credit-builder loan. This one flips the traditional loan process on its head. Instead of getting a lump sum of cash upfront, the loan amount is held for you in a locked savings account.

You then make small, fixed monthly payments over a specific term, usually between 6 to 24 months. Each payment you make is reported to the credit bureaus, demonstrating your reliability. After you've made all the payments, the full loan amount is released to you. It's an ingenious way to prove your financial discipline while saving money at the same time.

These starter products have become incredibly popular. The market for these tools now holds around $845 million in balances across more than 3 million accounts. Secured cards alone account for nearly 60% of that, which shows just how many people depend on them to get started. For a deeper look, you can explore insights on the growth of credit-building products from the Federal Reserve.

Choosing Your First Product

So, which one should you choose? It really comes down to your personal financial habits and what you want to achieve.

Both of these are powerful first steps. They were specifically created for people with no credit history, which makes them much easier to get. By picking one and using it responsibly, you're actively building the foundation for a much stronger financial future.

If you’re ready to take that first step, our complete roadmap on how to build credit from scratch is the perfect guide for ITIN holders.

Ready to Speed Things Up? Here’s How to Build Credit Faster

Once you’ve opened that first account and it’s showing up on your report, you can switch gears from just starting out to actively building momentum. Building a great credit score always takes time and patience, but some smart moves can definitely speed up the process. Think of these as responsible "credit hacks" to shorten your timeline.

One of the most powerful tricks in the book is becoming an authorized user on someone else's credit card. It’s a bit like getting a glowing reference from a trusted friend. When a family member or partner with a long history of on-time payments adds you to their account, their good financial habits can start to rub off on your credit report.

This can instantly add a seasoned account to your file, which works wonders for the "length of credit history" part of your score. But there's a huge catch: you have to be absolutely sure the person is financially responsible. If they run up high balances or miss payments, that negative history will show up on your report, too, and drag your score down.

Turn Your Everyday Bills into Credit-Building Tools

What if you could get credit for the bills you're already paying like clockwork? A growing number of services now make this possible by reporting your monthly rent and utility payments to the major credit bureaus. For anyone starting from zero, this is a total game-changer.

Traditionally, these consistent payments were completely invisible to credit scoring models. Now, you can put them to work for you. Services such as Experian Boost or various rent-reporting platforms can add a positive payment history to your file, which can give your score a nice, quick lift.

Smart Habits for Faster Growth

Beyond these specific tactics, speeding up your credit journey really means mastering the fundamentals. The faster you make these core habits second nature, the faster your score will improve.

Here are a few proactive steps you can take to get there sooner:

When you combine these proactive habits with strategies like becoming an authorized user, you can shave a significant amount of time off your credit-building journey. For a complete playbook designed specifically for ITIN holders, be sure to read our article on how to establish credit to make sure you're starting on the right foot.

When you're building credit, it's not just about what you do—it's also about what you don't do. Knowing the timeline for building credit is half the battle; the other half is avoiding the common pitfalls that can send you right back to square one.

Think of it like hiking a trail. Making the right moves is like steadily climbing, but one wrong step can send you tumbling backward, forcing you to regain lost ground.

The Single Biggest Mistake: Late Payments

If there’s one mistake that does the most damage, it’s paying your bills late. Nothing craters a credit score faster. Your payment history is the heavyweight champion of credit score factors, accounting for a massive 35% of your FICO Score.

Just one payment that’s 30 days or more late can cause a significant drop in your score. Worse yet, that blemish will stick to your credit report for up to seven years. It’s a long-lasting headache that can undo months of your careful, hard work.

The easiest way to prevent this? Set up automatic payments for at least the minimum amount due on all your accounts. It’s a simple safety net that ensures you never accidentally miss a deadline.

The "Silent" Score Killer: High Balances

Here’s a trap that catches a lot of people: carrying high balances on your credit cards, even if you never miss a payment. This directly impacts your credit utilization ratio, which is simply the amount of credit you're using compared to your total available credit. It's the second most important factor in your score.

Let's say you have a card with a 500** limit and you consistently carry a **450 balance. Your utilization is a sky-high 90%. To lenders, this can look like you're financially stretched and relying too heavily on debt. It can lower your score almost as much as a minor negative mark would.

The goal is to show lenders you can manage credit responsibly, not that you depend on it to get by. A good rule of thumb is to keep your utilization below 30%, but if you want to see your score climb faster, keeping it under 10% is the real sweet spot.

Other Costly Errors to Avoid

Beyond late payments and high balances, a few other missteps can easily sabotage your progress. Keep an eye out for these common credit roadblocks:

Why Building Credit Varies Across the Globe

The answer to "how long does it take to build credit?" isn't a simple one—it really depends on where in the world you're asking the question. Your personal timeline is tied directly to the financial system of the country you're in.

Think of it like growing a plant. In some places, the soil is rich and has been cultivated for generations, making it easy for a seed to sprout. In others, the soil is new and needs more time and effort to support growth. The same is true for credit.

In countries with deeply established financial systems, like the United States or the United Kingdom, credit bureaus have been gathering financial data for a very long time. Thanks to this well-oiled machine, a newcomer can often establish a basic credit score in as little as 3-6 months.

But in many emerging economies, the whole concept of credit reporting is much younger and less developed. As a result, simply getting your financial identity on the map can be a much slower process.

Understanding Global Credit Infrastructure

The single biggest factor is how mature a country’s credit bureaus are. As of mid-2019, a World Bank analysis found that only 117 out of 191 economies had a credit bureau at all. What's more, over a third of those were set up within the last decade.

Even in countries with long-standing bureaus, building a strong credit profile still requires several years of consistent, on-time payments.

This global context is crucial for immigrants, expatriates, and anyone managing their finances across borders. It shines a light on a key truth about building credit:

Ultimately, knowing this helps set realistic expectations. While your financial habits are absolutely essential, the speed of your progress is a partnership between you and the environment around you. It's perfectly normal for your journey to look completely different from someone else’s.

Your Top Credit-Building Questions Answered

Even with the best plan, you're bound to have questions as you start your credit journey. Let's tackle some of the most common ones we hear. Getting these answers can give you the clarity and confidence you need to keep moving forward.

Can I Build Credit Without a Credit Card?

Yes, absolutely. While credit cards are a popular first step, they’re far from the only path. You have several other powerful tools at your disposal to build a solid credit history.

A great example is a credit-builder loan, which is designed specifically for this purpose. You can also use services that report your regular rent and utility payments to the credit bureaus, turning your existing on-time payments into credit-building activity. And, of course, taking out a small personal or auto loan and paying it back consistently also does the trick.