How Long Do Late Payments Stay on Your Credit Report?

So, you've missed a payment. It happens to the best of us. The big question is, how long will this mistake follow you around? The short answer is seven years.

A late payment will typically stay on your credit report for a full seven years from the date you first missed the payment. This isn't just a rule of thumb; it's a standard set by the Fair Credit Reporting Act (FCRA). It’s crucial to understand that the seven-year clock starts ticking from the original delinquency date—the day the payment was officially late—not from when you eventually catch up.

The Seven-Year Lifespan of a Late Payment

Think of a late payment like a blemish on your financial history. When it first appears, it's a fresh, glaring mark that can really drag down your credit score. But over time, that blemish starts to fade. Its influence on your score gradually lessens until, one day, it vanishes completely.

The first couple of years after a delinquency are the most damaging. Lenders see that recent misstep as a sign of potential risk, which can make it tougher to get approved for a new loan or land a good interest rate. They're trying to gauge your current financial habits.

How the Impact Changes Over Time

Here’s the good news: the impact of that late payment isn’t static for all seven years. A late payment from six years ago carries far less weight than one from six months ago. Lenders are much more interested in your recent track record. The best way to counteract the damage is to build a new, consistent pattern of on-time payments.

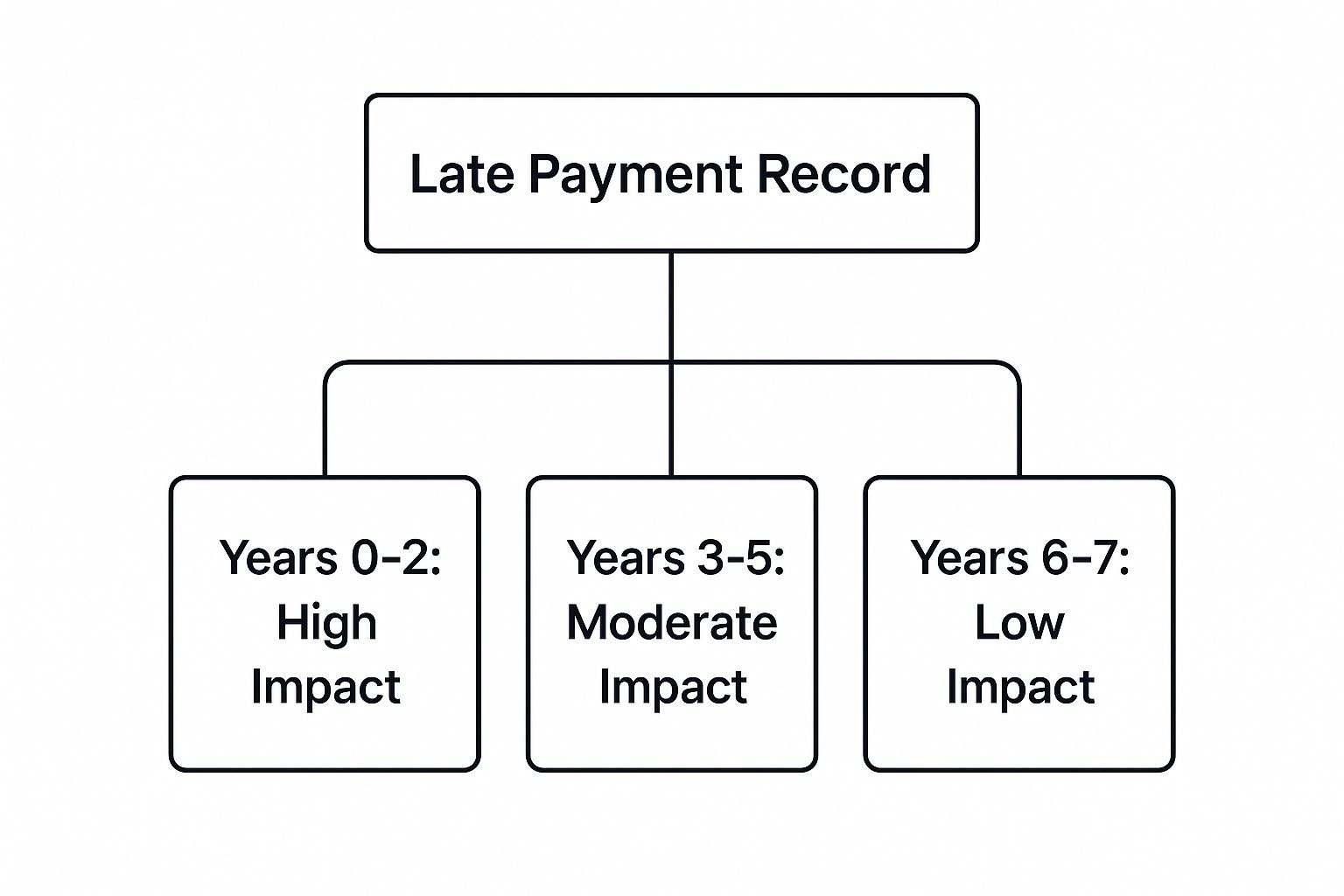

This infographic gives you a great visual of how a late payment's sting lessens over its seven-year lifespan.

As you can see, the negative effect is most severe in the first two years. After that, its power to hurt your score progressively shrinks as it gets older. Understanding this timeline is a key part of making sense of what you see when your credit report is explained.

Let's use a real-world example. Say you missed a payment back in March 2019. That negative mark is scheduled to be wiped from your report by March 2026. This timeline is set in stone, regardless of whether you pay the account off or close it later. This seven-year rule provides a clear path forward, proving that even significant financial mistakes aren't a life sentence.

Late Payment Reporting Timelines at a Glance

This table breaks down the key timeframes for late payments, giving you a quick reference for how they appear on your credit report.

Knowing these milestones can help you anticipate the impact and plan your strategy for rebuilding your credit.

How Late Payments Actually Get Reported and Classified

Ever wondered what happens behind the scenes when you miss a payment? It’s not as simple as a single "late" stamp on your file. Credit bureaus have a specific system for classifying just how late you are, which tells a story to anyone who looks at your credit report down the line.

Think of it this way: a single missed payment is a bump in the road, but multiple missed payments start to look like a pattern of risky driving. Lenders want to know the difference.

Most creditors won't report you the day after a due date. There's usually a grace period. The real trouble starts when your payment is a full 30 days past due. That’s the trigger point for most lenders to send that first negative alert to the big three bureaus—Experian, Equifax, and TransUnion.

Breaking Down the Delinquency Tiers

Once that first 30-day mark is reported, the clock is ticking. If the bill remains unpaid, the negative mark on your report gets worse in 30-day increments. This tiered system is how lenders quickly gauge the seriousness of the situation.

Here’s the typical progression:

This is exactly why it’s so critical to fix a missed payment as soon as you realize it happened. A 30-day late payment hurts, but letting it snowball into a 90-day delinquency tells a much scarier story to future lenders. The exact timing of these updates can differ, and knowing when credit cards report to bureaus can help you understand the cycle.

The Real-World Snowball Effect

Let's make this practical. Say your car payment was due on May 1st. If you forget and don't pay by June 1st, your lender can report it as 30 days late. If you still haven't caught up by July 1st, that same late payment gets updated to 60 days late. Each new tier digs a deeper hole for your credit score.

This progressive reporting structure is the industry standard. A single 30-day late payment might knock your score down, but allowing it to age into a 90-day delinquency or a collection account will multiply the damage substantially.

The Real Impact of a Late Payment on Your Score

It’s easy to think of a late payment as a small slip-up, maybe something that just costs you a late fee. But when it comes to your credit score, it's a direct hit to the most critical component. Your payment history isn't just one factor among many; it's the heavyweight champion, making up a massive 35% of your FICO and VantageScore scores.

This means a single payment reported as 30 days late can do some serious damage, especially if you’ve worked hard to build a great credit profile. In a weird twist, the higher your score is, the more a single mistake can hurt. Someone with a spotless 780 score could see it tumble by 60 points or more from just one late payment. That’s a steep drop that can instantly change how lenders see you.

How the Damage Fades Over Time

The good news? The sting of a late payment doesn't last forever. Its impact is most severe right after it hits your report and stays potent for about two years. During that time, lenders see it as a recent, relevant sign of risk.

But as time goes on and you stack up a new, solid history of on-time payments, that old mistake starts to lose its power. Think of it like this: each new month you pay on time helps to push that negative mark further into the past, lessening its weight in your score calculation. After a few years, what was once a glaring red flag becomes more of a historical footnote, long before it vanishes for good after seven years.

And this isn't a rare problem. In 2019, Americans were hit with over $14 billion in credit card late fees, which shows just how frequently these delays happen. For people already struggling with lower credit scores, these late marks can create a tough cycle to break, keeping their scores down for the full seven years. You can discover more insights about credit card late fees and how they affect different people.

Understanding the Severity of Late Payments

It’s crucial to understand that not all late payments are created equal. The longer you let a bill go unpaid, the more severe the consequences become. A 30-day late payment is bad, but a 90-day delinquency sends a much more alarming signal to potential lenders about your financial stability.

The table below breaks down how the damage escalates over time.

Seeing this progression makes it clear why every single day matters once you’ve missed a due date. The quicker you can get the account current, the less long-term damage you'll have to worry about down the road.

Why Some Late Payments Hurt More Than Others

Lenders don't see all debt as equal, and the same goes for late payments. Not every missed payment carries the same weight. It helps to think of your credit report as a story about how you handle financial obligations. A missed payment on a huge, long-term loan tells a much more dramatic part of that story than a minor slip-up on a small retail card.

A late mortgage payment, for instance, is often the biggest red flag you can raise. It's a massive installment loan secured by your home, and not paying it on time can suggest you're in serious financial trouble. That kind of delinquency will almost always hit your credit score harder than a late payment on a revolving credit card.

The Hierarchy of Late Payments

While any late payment is a problem, lenders and credit scoring models definitely play favorites. Understanding this pecking order helps you see your credit profile through their eyes and can help you prioritize bills if you're ever in a tight spot.

Here’s a general rundown of how different late payments are usually viewed, from most to least damaging:

Closing an Account Will Not Erase the Past

Here’s a credit myth I hear all the time: "If I close the account, the bad history will go away." Unfortunately, that’s just not how it works.

Let's say you have a credit card with a few late payments on its record. Shutting down that account won't magically wipe the slate clean. That negative payment history is already baked into your credit file.

The late payments tied to that now-closed account will stay on your credit report for a full seven years from the date they first became delinquent. The account will just be marked as "closed," but its entire payment history—the good and the bad—sticks around until it ages off naturally. It's a crucial detail to remember as you manage your credit.

Actionable Strategies for Dealing with Late Payments

It’s one thing to know that a late payment can haunt your credit report for seven years, but it's another to know what you can actually do about it. You can't rewind the clock, but you have more influence over the situation than you might realize. By taking the right steps, you can often soften the impact or, in some cases, get the negative mark wiped away completely.

You essentially have two paths forward: asking for a second chance directly from your creditor or formally challenging an error with the credit bureaus. Both approaches take a bit of patience and a solid game plan.

Requesting a Goodwill Removal

Was the late payment a genuine, one-time slip-up? If you have an otherwise spotless payment history with that particular creditor, sending a goodwill letter is your best first shot. It’s exactly what it sounds like—a polite request for the creditor to remove the negative mark as an act of courtesy, based on your history as a good customer.

Think of it as asking for forgiveness, not demanding a right.

For the best chance of success, your letter should be respectful, to the point, and honest. Here’s a simple formula to follow:

There are no guarantees, of course. But you'd be surprised how often creditors are willing to help a long-standing, reliable customer protect their credit score, especially if the account is now paid up and in good standing.

Disputing Inaccurate Information

The Fair Credit Reporting Act (FCRA) is a powerful law that gives you the right to a completely accurate credit report. If you spot a late payment that’s listed incorrectly, you are legally empowered to dispute it with each credit bureau that’s reporting it (that’s Experian, Equifax, and TransUnion).

A successful dispute isn't about arguing whether you should have been reported late; it’s about proving the reported information is factually wrong.

Common reasons for a dispute include things like:

Taking these steps gives you a clear path to regaining control. For a more comprehensive look at cleaning up your credit, check out our guide on how to remove derogatory items from your credit report.

Beyond fixing past mistakes, setting up a solid system to prevent future ones is crucial. Exploring different debt management strategies and using helpful resources like debt snowball calculator tools can make all the difference in keeping your payments organized and on time.

Your Game Plan for Rebuilding Credit

So, you've got a late payment on your report. Whether you can get it removed or not, your credit comeback story starts right now. A negative mark isn't a life sentence for your score; think of it as a chance to build an even stronger financial foundation. The goal here is to consistently pile on positive information, which will, over time, dilute the impact of that past misstep.

I like to think of a credit report as a garden. That late payment? It's a weed. But you can easily overpower it by planting a bunch of healthy, beautiful flowers. Every single on-time payment, every smart financial choice—that's a new flower. Before you know it, your garden is flourishing, and that one little weed is barely noticeable.

Master the Fundamentals of Credit Health

Your recovery plan really comes down to three core habits. If you can stick to these, you'll show lenders that the late payment was a fluke, not a pattern. These actions build a powerful new history that starts to overshadow the old stuff.

As you work on cleaning up your finances, you might also look into removing negative search results that could affect your reputation online. By taking these proactive steps, you’re grabbing the steering wheel and proving that your financial future is much brighter than your past.

Common Questions About Late Payments Answered

When you're trying to get a handle on your credit, it’s easy to get lost in the details. The question of "how long do late payments stay on your credit?" often brings up a whole host of other concerns. Let's break down some of the most common ones you're likely wondering about.

Can One Late Payment Ruin My Credit Forever?

Let's get this one out of the way first: no, a single late payment will not torpedo your credit for good. It will cause a sting, for sure—you'll likely see a noticeable drop in your credit score right away. But its impact definitely lessens over time.