Help Build Credit with an ITIN and Secure Your Future

Trying to get your financial footing in the U.S. with an ITIN can often feel like an uphill battle. To start building a credit history, you first need a way to show you're financially responsible. That means opening accounts that actually report your payments to the major credit bureaus. This guide is all about how you can use your ITIN to do just that, unlocking opportunities and building a strong credit profile from the ground up.

Why Building Credit With An ITIN Matters

For anyone with an ITIN, a good credit score isn't just a number. It's the key to real financial access and stability here in the United States. Without a credit history, you're essentially "credit invisible," a status that creates some very real-world roadblocks.

Think about trying to rent an apartment, only to have the landlord run a credit check you can't pass. Or imagine needing a car loan to commute to your job, but you're either denied outright or offered a ridiculously high interest rate that makes the car unaffordable. These aren't just what-if scenarios; they are the everyday reality for millions.

Overcoming The Credit Invisibility Hurdle

The issue of credit invisibility is massive. In the U.S. alone, about 26 million adults are 'credit invisible,' which means they have zero credit history with the major bureaus. On top of that, another 19 million have files that are too thin to be scored, making it incredibly tough to get approved for affordable financial products.

This lack of a traditional credit footprint can push people toward high-cost options like payday loans or check-cashing services. These often trap them in a cycle of debt rather than helping them build wealth. Building credit with your ITIN is your way to break free from that system.

The Power of a Good Credit Score

Once you start establishing that positive payment history, you’ll find you can:

Building your credit profile is the first, most important step toward making these goals a reality. The great news is that with the right tools and a clearer understanding of how to use your ITIN for credit, the entire landscape is changing for the better. To dive deeper, check out our guide on how your ITIN number and credit score are connected.

Finding Your Financial Starting Point with an ITIN

So, you have your ITIN and you're ready to build credit. Where do you even begin? Most people in this situation assume they're starting from absolute zero—a complete blank slate. And while that's often the reality, it's not always the full story. The first real step is to move past the guesswork and figure out exactly what your financial footprint looks like right now.

Think about it: you've likely been living and paying bills in the U.S. for a while. Do you have utility accounts in your name? A consistent history of paying rent on time? This kind of information, often called alternative data, can be incredibly valuable. Even if it hasn't been reported to the big three credit bureaus (Equifax, Experian, and TransUnion), it demonstrates your financial responsibility.

This is where a specialized tool like itinscore comes in handy. It's built specifically for the ITIN community, looking beyond the standard credit reporting system. By analyzing your entire financial picture, it helps uncover any existing data and shows you how to put it to work. This gives you a real, tangible starting point, not just a shot in the dark.

Assessing Your Credit Building Options

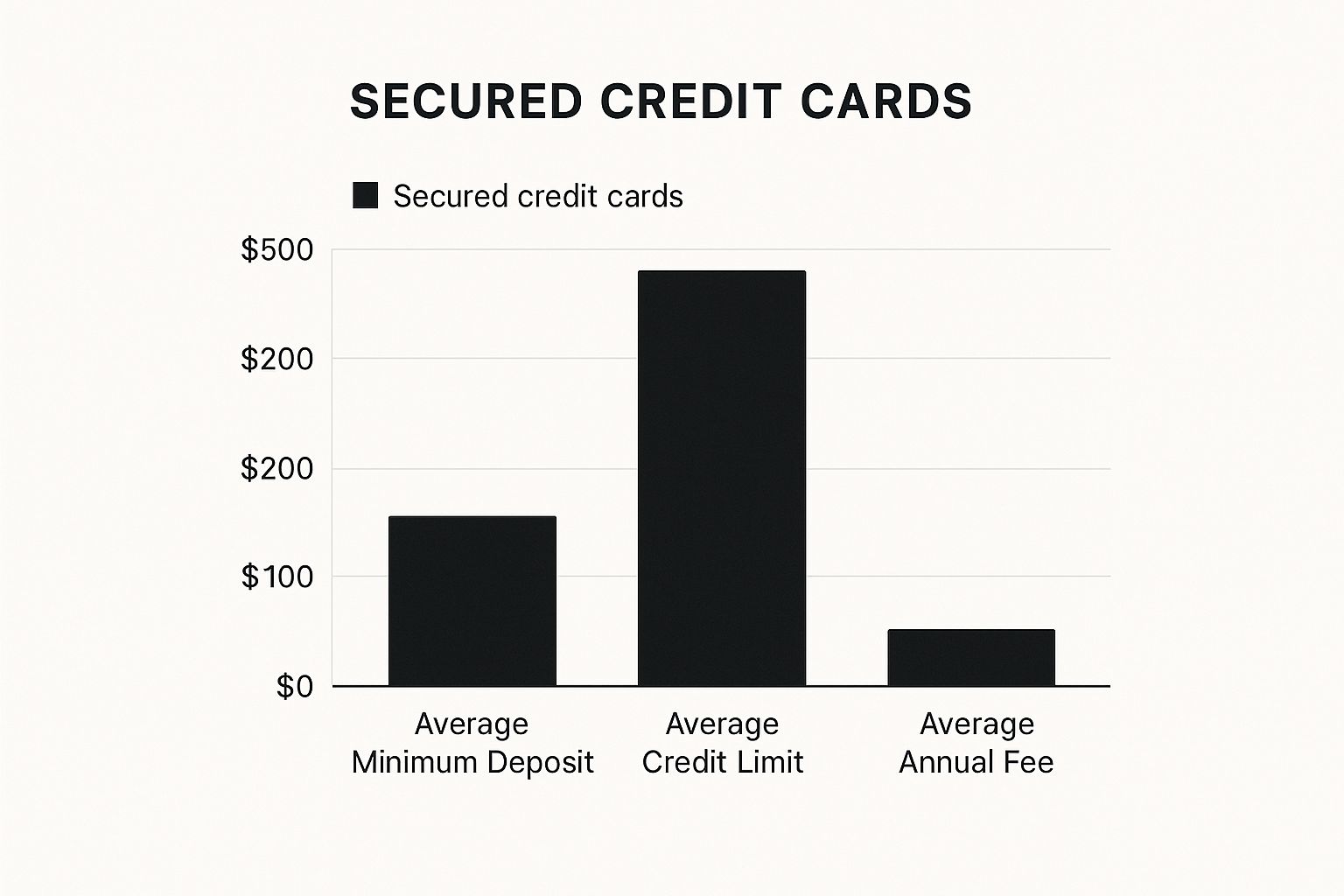

Once you have a clear picture of where you stand, you can start exploring the best ways to build an official credit history. For many just starting out, secured credit cards are one of the most accessible and effective tools available.

They require a small, refundable security deposit that typically sets your credit limit. This makes them lower risk for lenders and easier to get approved for, even with no prior credit.

As you can see, the barrier to entry is quite low. With a deposit often around 200**, you can get a card with a limit of about **500. As you use the card and pay it off on time, that positive history gets reported to the credit bureaus, and your score starts to grow.

To help you weigh your choices, here’s a quick look at some of the most common paths ITIN holders take to build credit.

Credit Building Options for ITIN Holders

Choosing the right option depends entirely on your personal situation and comfort level. There's no single "best" way—only what's best for you.

From Knowledge to Action

Knowing your starting point gives you the power to choose the right path forward. You might discover you’re what’s known as “credit invisible,” meaning you have no file at all. In that case, a secured card is a fantastic first step. On the other hand, you might find you have a solid history of rent payments that can be reported to give you a head start.

Understanding all the tools available is key to making an informed decision. For a more detailed breakdown of your options, you can explore our complete guide on how to establish credit and find the best fit for your financial situation. Moving from discovery to a concrete plan is the most important move you can make.

Actionable Strategies to Build Your Credit Profile

Alright, you know where you stand financially. The next step is to start actively shaping your credit future. This isn't just about wishing for a better score; it's about taking clear, consistent actions that get you noticed by lenders for all the right reasons.

For anyone with an ITIN, the journey often begins with two fantastic tools: secured credit cards and credit-builder loans. I've seen countless clients use these to go from a zero credit footprint to having a solid foundation. They are specifically designed for people new to credit, providing a direct route to getting positive payment history on your reports.

The Power of a Secured Credit Card

Think of a secured credit card as your entry ticket into the world of credit. It’s one of the simplest and most effective first steps you can take. To get one, you’ll put down a small, refundable security deposit—typically somewhere between 200** and **500. That deposit then becomes your credit limit.

From the lender's perspective, this deposit makes you a safe bet, which is why approvals are much easier to come by, even if you have no credit history to speak of.

Once you’re approved, you use the card just like any other. But here's the important part: every time you make a payment, the issuer reports that good behavior to the big three credit bureaus—Equifax, Experian, and TransUnion. This is how you start building your file.

Here's a pro-tip I always give my clients:

This "set it and forget it" approach is genius. You’re not spending extra money, but you're creating a perfect record of on-time payments, month after month. It's an incredibly low-effort way to build a strong credit foundation.

Understanding Credit-Builder Loans

Another fantastic tool is the credit-builder loan. These are a bit different from traditional loans because they work in reverse. You don't get a lump sum of cash upfront. Instead, you make small monthly payments into a locked savings account held by the lender.

Let's say you take out a 500** credit-builder loan over 12 months. Your job is to make a payment of about **42 each month. As you do, every single one of those on-time payments gets reported to the credit bureaus.

Credit-builder loans are perfect if you want a structured, disciplined way to build your credit report. There’s no temptation to spend, just a clear focus on showing you're a reliable borrower. You can find more strategies on how to build credit with an ITIN number in our in-depth guide.

So, which one is right for you? A secured card teaches you how to manage a line of credit, while a credit-builder loan is a straightforward savings and credit-building machine. Honestly, using both can be a powerful combination for anyone with an ITIN who is serious about creating a strong financial future.

Taking Advantage of Modern Financial Tools

For a long time, traditional banks just weren't set up to help ITIN holders. It was a huge source of frustration, leaving millions of people unable to build a real financial future in the U.S. Thankfully, that's starting to change. A new generation of financial technology—fintech—is opening up doors to credit that simply didn't exist before, giving you powerful ways to help build credit without needing an SSN.

These modern tools aren't stuck in the past. They look beyond the old, rigid lending models. Platforms like itinscore were built from the ground up to see your complete financial story. They get that being creditworthy is about more than just past loans; it’s about the responsible habits you practice every single day.

The Power of Alternative Data and Private Credit

This is a game-changer for ITIN holders. It means your consistent, on-time rent payments, utility bills, and other regular expenses can finally count for something. This type of information, what the industry calls alternative data, allows for a much fairer and more accurate picture of your financial responsibility.

What you're seeing is part of a much bigger shift in the world of finance. As big banks tightened their lending belts, a massive private credit market emerged. To give you an idea, global private credit assets shot up from about 300 billion** in 2010 to over **1.5 trillion by 2024. This boom has created more flexible funding opportunities for people who don't fit the old, narrow criteria. If you're curious about the numbers, the latest global credit outlook research breaks it down further.

How Today's Platforms Fast-Track Your Credit-Building

Fintech platforms give you a much more direct path to establishing credit. Instead of trying to force your way through a system that wasn't designed for you, you can now use tools built specifically with your journey in mind. Here's how they really make a difference:

Ultimately, these tools put you back in the driver's seat. You're no longer invisible to the financial system. By using platforms that recognize your entire financial life, you can start building the strong credit profile you need to reach your goals, one smart step at a time.

Smart Habits for Long-Term Credit Growth

Getting that first credit product approved feels like a massive win, and it is! But it's really just the starting line. The real work—and the real reward—comes from developing smart, sustainable habits that will grow your credit score for the long haul. This isn't about finding a quick fix; it's about building a solid financial routine that serves you for years.

Think of these habits as the foundation of your entire credit profile. They're what prove to lenders that you're a reliable and responsible borrower, which is exactly what you need to unlock bigger financial goals down the road.

The Golden Rule: Pay Every Bill on Time

This is it. If you only take away one thing, make it this one. Your payment history is the single biggest piece of the credit score puzzle, accounting for a massive 35% of your score. A single late payment can knock your score down, and it can happen fast.

The best way to avoid this is to take human error out of the equation. Automation is your best friend here.

By automating payments, you build a powerful defense for your score. It’s a simple strategy with a huge payoff.

Keep Your Credit Utilization Low

Right after payment history, the next most important factor is your credit utilization ratio (CUR). It sounds complicated, but it's just the percentage of your available credit that you're currently using. For instance, if your credit card has a 1,000** limit and you have a **200 balance, your utilization is 20%.

The easiest way to manage this is to pay your balance in full every month. If that's not possible, try making a few smaller payments throughout the month instead of one big one right before the due date. This keeps your reported balance lower and is an excellent way to help build credit by demonstrating responsible management.

Be Strategic About New Credit

When you're focused on building credit, it's easy to get excited and start applying for multiple cards or loans at once. Try to resist that impulse. Every time you apply for new credit, the lender runs a "hard inquiry" on your report. Each one can temporarily ding your score by a few points.

A much better approach is to be patient and strategic.

This is where a tool like itinscore becomes incredibly useful. You can see your progress in real time and get personalized tips from the AI credit coach. It lets you watch how these habits directly impact your score, giving you the confidence and knowledge to manage your financial future.

Your Questions About Building Credit with an ITIN, Answered

Starting to build credit in the U.S. with an ITIN often brings up a ton of questions. That’s completely normal. Let's walk through some of the most common things people ask, so you can move forward with total confidence.

Can I Really Get a Credit Card with Just an ITIN?

Yes, absolutely. It's a common misconception that you need a Social Security Number for everything. While it's true many big banks haven't caught up, a growing number of forward-thinking banks and fintech companies now welcome ITIN holders.

Most of the time, your first step will be a secured credit card. You'll put down a small, refundable deposit, and that amount usually becomes your credit limit. This gives the lender peace of mind and gives you a fantastic tool to start building a positive payment history. When you pay your bill on time, they report that good behavior to the credit bureaus—and that's exactly how you help build credit.

How Long Until I See My Credit Score Improve?

Patience is your best friend here. If you're starting from scratch, you can typically expect to see your very first credit score pop up within 3 to 6 months of opening and using a new credit account.

For real, noticeable improvement, you'll want to focus on two things for at least 6 to 12 months: paying every single bill on time and keeping your credit card balances low. The more disciplined you are, the more momentum you'll build.

What Is the Biggest Mistake to Avoid When Building Credit?

Without a doubt, the single worst thing you can do is pay your bills late. Nothing damages your credit score more. Your payment history is the heavyweight champion of credit factors, accounting for about 35% of your total score. A single late payment can knock your score down and stay on your record for years.

Another classic mistake is maxing out your credit cards. A good rule of thumb is to keep your balance below 30% of your credit limit. This shows lenders you're in control and not overly reliant on debt to get by.

Will Checking My Credit Score Hurt It?

This is a huge myth, so let's set the record straight. There are two very different ways your credit is checked: