Your Guide to Financial Literacy for Immigrants

Building a solid financial foundation is your first real step toward security and opportunity in a new country. It’s all about learning the local rules of money—from the basics of opening a bank account and budgeting to understanding the absolutely critical role of credit. Mastering these things is how you’ll build a stable future for yourself and your family.

Your Financial Fresh Start in a New Country

Arriving in a new country is an incredible mix of excitement and, let’s be honest, feeling completely overwhelmed. While you’re figuring out where to live and soaking in a new culture, the financial system can feel like the biggest puzzle of all.

This guide is here to help you skip the confusing jargon. My goal is to give you the direct, practical knowledge you need to take control of your finances with real confidence, starting right now.

Think of this as your personal checklist for financial success. We'll walk through the essential first steps every newcomer should take, focusing on building a solid foundation from your very first day.

The First Financial Hurdles for Newcomers

Immigrants often run into unique financial roadblocks that go way beyond just learning a new currency. It’s a global issue—language barriers and cultural differences can make it tough to get a handle on a new country's financial system.

For example, here in the United States, roughly one in 12 people over the age of five has limited English proficiency. This can make simple things like opening a bank account or applying for a loan much harder. Your cultural background and how you view money also play a huge part. Many cultures prioritize saving cash at home over investing, which comes from different ideas about risk. In the U.S. system, however, that approach can slow down your ability to build wealth.

This guide is going to focus on four core areas to get you started on the right foot:

Your First 90-Day Financial Action Plan

To get you moving, I’ve put together a simple action plan. Focusing on these priorities in your first three months can set a powerful, positive tone for your entire financial future. Think of it as your quick-start guide.

Your First 90-Day Financial Action Plan

Tackling these four steps will put you miles ahead. It's about taking small, deliberate actions that add up to big results over time.

How to Open a Bank Account Without an SSN

One of the very first things you'll want to do when building a financial life in a new country is open a bank account. Think of it as your financial home base—it's where you can safely keep your money, easily pay your bills, and start creating a formal record of your journey. There's a persistent myth that you absolutely need a Social Security Number (SSN) for this, but I'm here to tell you that’s simply not true.

Many banks and credit unions are more than willing to open an account for you using your Individual Taxpayer Identification Number (ITIN). An ITIN is a tax processing number issued by the IRS for people who aren't eligible for an SSN. If you have one, you hold a key to unlocking the U.S. banking system.

Choosing the Right Financial Institution

When you start looking, you'll quickly see that not all banks are created equal, especially when it comes to helping newcomers. While the big national players often have ITIN-friendly policies, sometimes the best fit is found closer to home.

Don't get discouraged if the first bank you visit says no. Sometimes, policies can even differ from one branch to another. The goal is to find an institution that sees your potential and wants to help you get started.

The Documents You'll Probably Need

Walking into a bank prepared makes a world of difference. It shows you’re organized and makes the entire process go much more smoothly. While the exact requirements can vary, this is a solid checklist of what you should plan to bring.

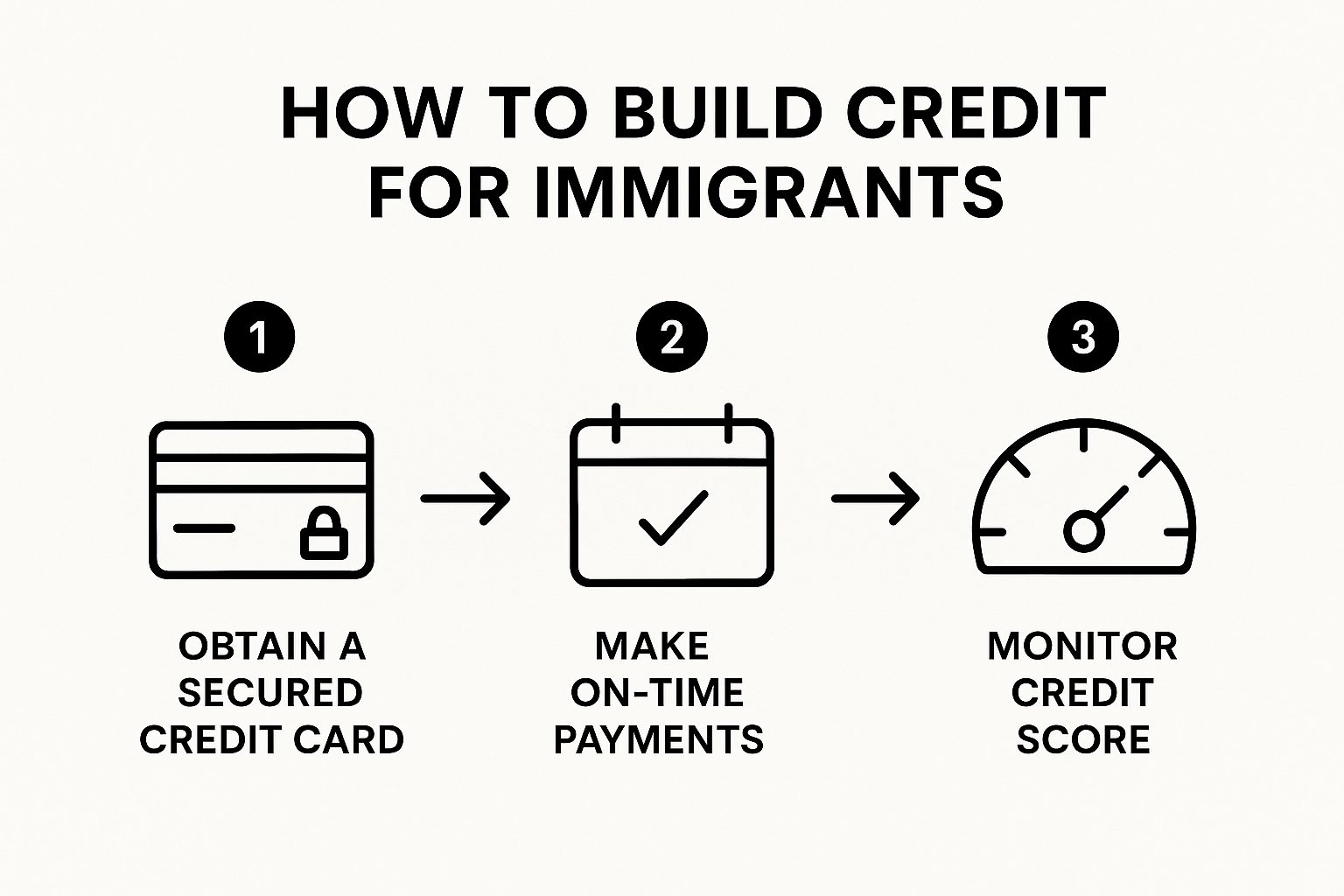

Opening that first account is a huge milestone. It’s the first concrete step toward building a formal financial history, which is absolutely critical for your future. The infographic below shows how this simple action fits into the bigger picture of building U.S. credit.

This visual roadmap makes it clear how foundational steps, like opening a bank account to manage a secured card, directly pave the way to establishing a strong credit profile over time.

Once your account is open, you can finally say goodbye to expensive check-cashing services that take a bite out of every paycheck. It also enables you to set up direct deposit with your employer, which is often the key to getting better, fee-free checking accounts. If you're looking for a head start, our guide on banks that accept ITIN applications has a detailed list of institutions to check out. A bank account makes your financial life safer, simpler, and much more affordable.

Creating a Budget That Works for Your Family

Let's be honest: a budget is the single most powerful tool you have for taking control of your financial life. But most of the budgeting advice you find online is generic. It just doesn't account for the real-world situations many immigrants face, like sending money home to family, saving for immigration fees, or managing an income that might change from one month to the next.

The goal here isn't to restrict every penny. It’s about creating a simple, clear plan that shows you exactly where your money is going. This clarity is what reduces financial stress, helps you find opportunities to save, and gives you the confidence to plan for your family’s most important goals.

This is especially true for newcomers. Research from the Organisation for Economic Co-operation and Development (OECD) shows that immigrants often have a tough time with financial services because of language barriers or just being unfamiliar with how things work in a new country. This can lead to using expensive or less secure ways to manage money, making stability feel out of reach. Building your financial know-how with a solid budget is a direct path to becoming more economically resilient. To learn more, you can discover the full OECD report on migrant financial literacy needs.

Adapting Budgeting Rules for Your Reality

You've probably heard of popular methods like the 50/30/20 rule, which suggests putting 50% of your income to needs, 30% to wants, and 20% to savings. It’s a decent starting point, but for it to really work, we need to adapt it to fit the immigrant experience.

Let's rethink those categories to reflect what truly matters to you.

Budgeting with a Fluctuating Income

Many newcomers work in jobs where the pay isn't the same every month. Trying to follow a rigid budget when your income changes can feel impossible. The secret? Base your budget on your lowest estimated monthly income.

Then, when you have a better-than-average month, that extra money already has a job. Don't just let it disappear on random spending.

This approach keeps you from overspending when money is good and gives you a much-needed buffer during leaner times.

User-Friendly Tools to Help You Succeed

You don't need a PhD in accounting or complicated spreadsheets to manage your money. There are plenty of apps designed to make tracking your finances simple, and some are especially helpful if English isn't your first language.

Ultimately, what matters most is finding a system that works for you—whether it's a simple notebook or a user-friendly app. The best budget is always the one you'll actually use.

Building Your U.S. Credit History from Zero

When you first arrive in the United States, you’ll quickly realize that the financial system runs on something called credit. Think of it as your financial reputation—a track record that shows lenders whether you’re reliable with money you borrow. Without a credit history, even basic things like renting a great apartment, getting a car loan, or signing up for a cell phone plan without a huge deposit can feel impossible.

The good news? You’re starting with a clean slate. That means you have a golden opportunity to build a strong, positive financial reputation from your very first day.

Building credit is a marathon, not a sprint. It’s all about creating a pattern of responsible financial habits over time. And you don't need a Social Security Number to get going. Your Individual Taxpayer Identification Number (ITIN) is the key that unlocks the door to many essential credit-building tools. In fact, a community survey on Maui found that over 32% of immigrant respondents called ITIN registration a high-priority need, which just shows how vital this number is for financial stability.

Your ITIN Is More Than Just for Taxes

While you get an ITIN to file taxes, it has become so much more than that. It’s your official entry pass into the U.S. financial world. Smart financial institutions now recognize the millions of people who use an ITIN and have started offering products designed specifically for this community.

Even the Consumer Financial Protection Bureau officially acknowledges an ITIN's role in tax reporting.

This confirmation is important. While its primary purpose is taxes, the ITIN is now a widely accepted ID for opening bank accounts and, crucially, for applying for credit.

Your First Move: The Secured Credit Card

For anyone starting with no credit history, a secured credit card is, without a doubt, the best first step. It’s a wonderfully simple and low-risk way for you and a bank to start building trust.

Here’s how it works:

Stick with it for about 6 to 12 months, making every payment on time, and most banks will upgrade you to a standard, unsecured credit card and give you your deposit back. You’ve just proven you’re reliable and are now officially in the game.

Other Great Tools for Building Credit

Secured cards are the perfect starting point, but they aren't the only option. Combining a few different strategies can build a stronger, more resilient credit profile even faster.

Credit-Builder Loans These are exactly what they sound like: small loans designed purely to help you build credit. Here’s the clever part: a bank or credit union approves you for a small loan, say $500, but they don’t hand you the cash. Instead, they place it in a locked savings account for you.

You then make small monthly payments over 6 or 12 months. Each payment gets reported to the credit bureaus. Once you've paid it all back, the bank unlocks the account and gives you the full $500. You've just built a perfect payment history and saved a little money in the process.

Becoming an Authorized User Do you have a family member or a close friend with a long, sparkling credit history? They might be able to add you as an authorized user on one of their credit cards. You’ll get a card with your name on it, and their responsible habits—like years of on-time payments—will start showing up on your credit report, giving you an instant boost.

A word of caution here: this is a two-way street. If the main cardholder ever misses a payment or racks up a huge balance, that negative information will also hit your report. Only do this with someone whose financial discipline you trust completely.

Common Missteps to Sidestep on Your Credit Journey

Building a great credit history is as much about avoiding pitfalls as it is about taking the right steps. One wrong move can unfortunately undo months of hard work.

Creating a credit history from scratch is a huge step toward financial empowerment in the U.S. By using your ITIN to open doors to tools like secured cards and understanding these simple rules of the road, you're laying the groundwork for a solid financial future. For an even more detailed playbook, you can learn more about how to establish credit with our in-depth guide. This process takes patience, but every on-time payment is a step toward better opportunities and true financial freedom.

How to Spot and Avoid Financial Scams

When you're new to a country, just figuring out the financial system is a huge task. The last thing you need is someone trying to take advantage of your trust. Unfortunately, scammers and predatory businesses often view newcomers as easy targets, hoping to exploit any confusion about local rules and customs.

This isn't just a feeling; it's a known vulnerability. A 2018 academic survey, for example, highlighted just how real this knowledge gap can be. The study found that only 32% of Syrian refugees in Germany could answer basic financial questions correctly, while 65% of native Germans could. You can read more about these financial inclusion challenges in the full report.

That gap is where scams thrive. This is why financial literacy isn't just about growing your money—it's about fiercely protecting it. Learning to spot the red flags is one of the most powerful skills you can develop.

Common Traps and Their Red Flags

Once you know what to look for, you'll start to see the same kinds of scams and high-cost services over and over again. Here are a few of the most common ones to watch out for.