Key Factors Affecting Credit Score You Need to Know

Decoding The Credit Score Mystery (It's Simpler Than You Think)

Think of your credit score like a restaurant review. But instead of judging the food, it's evaluating how well you manage borrowed money. Just like a restaurant review considers multiple factors (food, service, atmosphere), your credit score weighs five key components, each with different levels of importance. This three-digit number, calculated by credit bureaus like Experian, Equifax, and TransUnion, can feel like it controls our financial lives. But understanding these factors empowers us to take the reins.

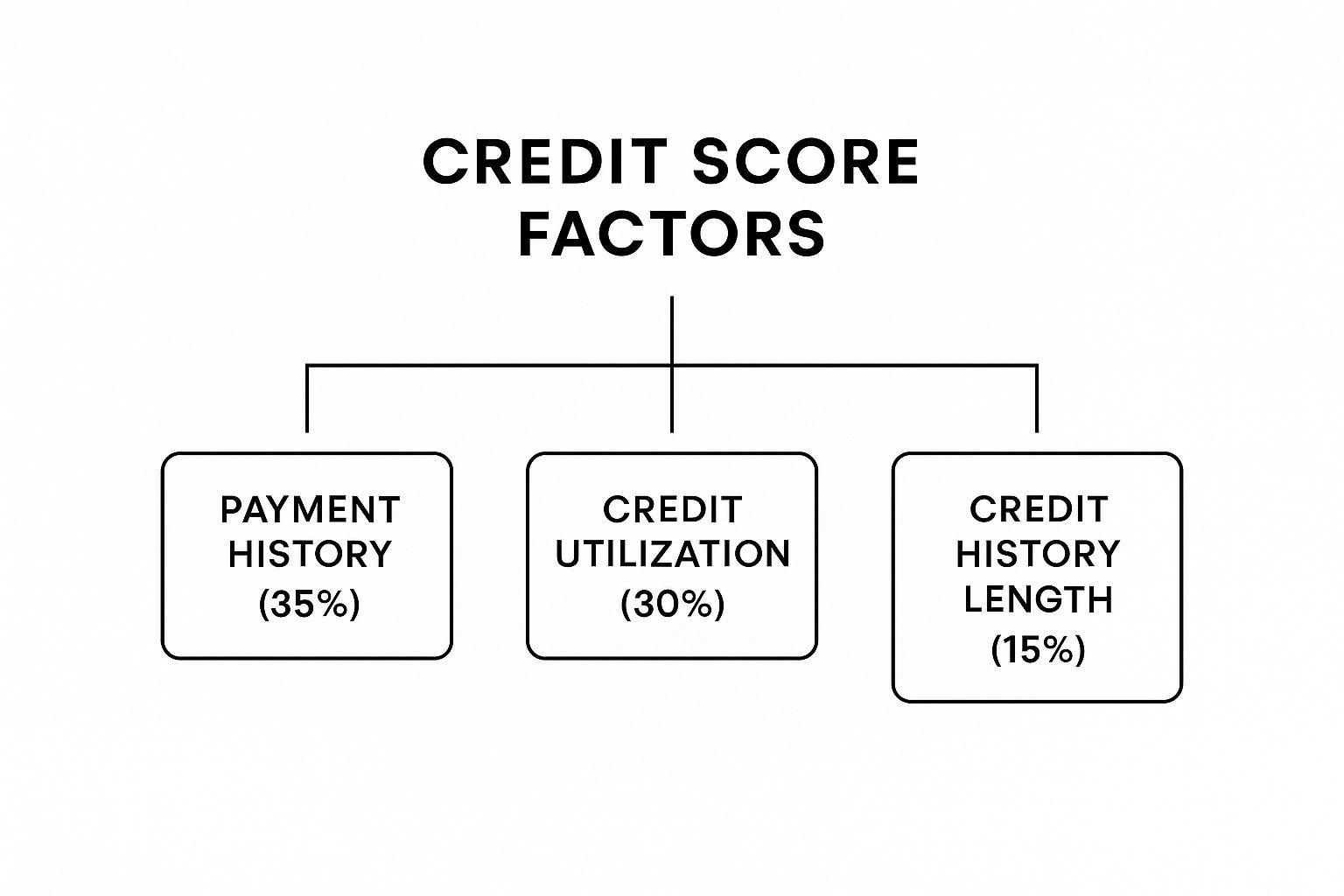

This infographic visualizes the top three factors and their influence within the FICO model:

As you can see, payment history is the heavyweight champion at 35%, followed closely by amounts owed (credit utilization) at 30%. Even factors that might seem less important, like credit history length (15%), still pack a punch. These percentages tell us where to focus our efforts for maximum impact. Prioritizing on-time payments and managing credit card balances are crucial for building strong credit. But what makes up that other 20%? Let’s explore.

Unveiling the Remaining Credit Score Factors

Beyond payment history, amounts owed, and length of credit history, two more factors round out the credit score recipe. These are new credit (10%) and credit mix (10%).

Imagine applying for several credit cards in a short period. Lenders might see this as a red flag, suggesting potential financial instability. This is why opening multiple new accounts quickly can temporarily lower your score. Think of it like a chef suddenly adding a bunch of new ingredients to a dish – it might not blend well immediately.

Credit mix refers to the variety of credit accounts you hold. Having a mix of credit cards, installment loans (like auto or student loans), and perhaps a mortgage, shows lenders you can handle different types of credit responsibly. It’s like a restaurant offering a diverse menu – it caters to a wider range of tastes.

To illustrate how these factors combine, let’s look at a table summarizing their weights across two major scoring models, FICO and VantageScore.

Credit Score Factors and Their Impact Weights

A breakdown of the five main factors affecting credit scores and their relative importance in major scoring models.

This table highlights the similar importance placed on payment history and amounts owed across both FICO and VantageScore. While the other factors hold less weight, they still contribute to the overall score. Understanding these nuances helps you focus your improvement efforts strategically.

Payment History: Your Financial Track Record Speaks Volumes

Think of your payment history like a restaurant's online reviews. One bad review can scare away potential diners. Similarly, one missed payment can make lenders wary. Your payment history is a snapshot of your financial reliability, and lenders use it to predict how likely you are to repay future debts. Let's explore how different payment scenarios, from a minor slip-up to a series of missed payments, can affect your credit score.

The Weight of Your Payment Past

Payment history is the heavyweight champion of credit score factors, making up a whopping 35% of your overall score. This means consistently paying your bills on time is paramount. Whether you're using a FICO Score or a VantageScore, payment history is the cornerstone of your creditworthiness worldwide. Missing a single payment by just 30 days can knock your score down by as much as 100 points, depending on your current score and other factors in your credit profile. A 2023 study of U.S. consumer credit reports revealed a clear link: even one late payment correlated with scores 40 to 80 points lower compared to those with perfect payment records. Want to dig deeper? You can find more detailed analysis here.

Understanding the Timeline of Missed Payments

It's crucial to understand how quickly a missed payment shows up on your credit report and how long it stays there. Generally, lenders report late payments to the credit bureaus after 30 days. This means even a small oversight can have a swift impact. These late payment marks can stick around on your report for up to seven years, potentially affecting your ability to get loans, rent an apartment, or even land certain jobs. The good news is the impact fades over time, with recent late payments carrying more weight than older ones.

Rebuilding Your Financial Reputation

Even if you've stumbled in the past, rebuilding a positive payment history is absolutely achievable. Think of it like recovering from a bad restaurant review - consistent good service can eventually turn things around. Here are a few strategies to help you recover from late payments and build a stronger credit profile:

Credit Utilization: The Balancing Act That Can Transform Your Score

After looking at payment history, let's explore another key factor influencing your credit score: credit utilization. Think of it like managing a restaurant's seating capacity. While you could pack every table, a little breathing room makes the experience more enjoyable for everyone. Lenders feel the same way about your credit. They want to see you using it responsibly, not maxing it out.

Understanding the 30% Rule and Its Impact

Credit utilization is simply the percentage of your available credit you're currently using. It's calculated by dividing your outstanding balance by your total credit limit. So, if you have a credit card with a 1,000 limit and a 300 balance, your credit utilization is 30%.

This 30% figure is often mentioned as a good target. However, staying well below it can do wonders for your score. High utilization can suggest to lenders that you depend heavily on credit, potentially increasing the chance of missed payments.

The Magic of Low Utilization: Aiming for Single Digits

While staying under 30% is good, aiming for 10% or less can really unlock a higher score. Think back to our restaurant analogy – keeping it comfortably full, but not overcrowded, creates a better experience.

A 2024 TransUnion global credit study showed a strong link between low credit utilization and high credit scores. Consumers with scores above 760 maintained an average utilization of just 6.2%. Those with fair scores (650-700) were closer to 30%. Want to dig deeper? Check out the TransUnion study.

Credit utilization—the ratio of current debt to available credit—typically represents around 30% of most international credit score calculations. Keeping it below 30% is standard advice, but those who achieve sub-10% utilization often see the biggest score improvements.

Busting the Myth of Carrying a Small Balance

You might have heard that carrying a small balance helps your credit score. This is simply not true. Lenders want to see responsible credit management, not unnecessary interest payments. Paying your balances in full each month is the best way to optimize this part of your score. It shows responsible behavior and keeps your interest payments down.

Optimizing Utilization Across Multiple Cards

If you have multiple credit cards, your overall utilization combines all your balances and credit limits. Managing your balances strategically across your cards can further improve your score.

For example, if you have one card with a higher limit, focus your spending there. Keep balances lower on other cards to lower your overall utilization ratio. This demonstrates good credit management and reinforces responsible financial habits.

Let's take a closer look at how different utilization rates can impact your score. The table below illustrates typical score ranges, potential improvements, and the associated risk level.

Credit Utilization Rates and Score Impact

As you can see, maintaining a lower utilization rate correlates with higher credit scores and greater potential for improvement. Conversely, high utilization signals risk and limits your scoring potential. By mastering these techniques, you can significantly impact one of the most important factors affecting your credit score.

Length Of Credit History: Why Your Credit Age Matters More Than You Think

Think of building credit like making a fine wine. Time is a key ingredient. This factor, length of credit history, makes up 15% of your FICO score. But it's not just about having ancient accounts gathering dust. It's about the subtle ways credit scoring models look at both your oldest account and the average age of all your accounts. This nuance is especially important for ITIN holders.

The Two Sides of Credit Age: Oldest Account vs. Average Age

Let's say two friends want a loan. One has a single credit card, opened ten years ago. The other has a handful of cards, all opened within the last two years. Who looks better to a lender? Probably the friend with the older card, even if they've had a few minor bumps along the way. Lenders value seeing a long track record of responsible credit use.

This is mirrored in how the FICO model calculates credit age. It considers the age of your oldest account, the age of your newest account, and the average age of all your accounts. A longer average age shows you have more experience managing credit responsibly.

The Costly Mistake of Closing Old Accounts

Understanding this is key to navigating the factors affecting your credit score. Closing that old, unused credit card may seem like a good way to declutter, but it could actually lower your score. Why? Because closing your oldest account lowers the average age of your credit accounts. It's like selling a vintage wine just because you're not drinking it right now—you lose the value it adds to your collection.

Building Credit History from Scratch

Building credit history takes time, especially if you’re just starting out or rebuilding. But there are smart ways to begin without racking up debt.

These tools allow you to show responsible credit behavior, establish a positive payment history, and gradually increase the length of your credit history.

Practical Tips for Managing Credit History

Building a strong credit history is a marathon, not a sprint. By understanding the importance of credit age and following these practical tips, you can steadily improve a key part of your credit score.

Types Of Credit: Building Your Financial Portfolio The Smart Way

Just like a well-diversified investment portfolio helps you weather market ups and downs, a healthy mix of different credit types strengthens your overall credit profile. Lenders want to see that you can responsibly handle various financial obligations, not just one kind. Think of it as proof you can manage your money across the board. This is especially key for ITIN holders building credit in the U.S. You can learn more about building credit with an ITIN in our article about ITIN and credit reports.

Revolving Credit Vs. Installment Loans: Understanding the Difference

Let’s break down the main credit types. Imagine revolving credit, like credit cards, as an all-you-can-eat buffet. You have a credit limit (your plate size) and can borrow and repay repeatedly. Your balance (how much food is on your plate) goes up and down based on your spending and payments.

Now, think of installment loans, such as car loans or mortgages, as a prix fixe menu. You borrow a fixed amount (your meal) and repay it in set installments (pre-determined bites) over a specific time (the duration of your meal).

Having both revolving credit and installment loans in your credit mix demonstrates you can handle different repayment styles. It shows you’re comfortable managing short-term, variable debt (credit cards) and long-term, fixed debt (loans). This financial versatility is a good sign for lenders.

The Power Of A Well-Rounded Credit Mix

Why is a diverse credit mix so important? It signals financial maturity to lenders. It tells them you’ve successfully juggled different borrowing scenarios and repayment schedules. This can significantly improve your chances of loan or credit card approval and potentially unlock better interest rates.

Let’s say two people have similar payment histories and credit utilization. One only has credit cards. The other has credit cards, an auto loan, and a student loan. The second borrower, with the more diverse credit mix, often appears less risky. That diversified profile can give them a real advantage.

Building Your Credit Mix Strategically

Building a diverse credit mix isn’t about opening a bunch of accounts all at once. Remember, each new credit inquiry can temporarily ding your score. Start slow and steady. If you’re new to credit, a secured credit card or a credit-builder loan can be excellent first steps.

As your credit history grows, consider adding an installment loan or another credit card. The key is consistently making on-time payments and keeping your credit utilization low across all your accounts.

Modern Alternatives For Building Credit

Besides traditional credit cards and loans, options like credit-builder loans and secured cards can also help diversify your credit profile. These are especially helpful for those new to credit or rebuilding after financial difficulties. They provide a structured way to establish creditworthiness and demonstrate responsible financial behavior.

By understanding the different types of credit and thoughtfully building a well-rounded portfolio, you can positively influence your credit score and boost your overall financial health. This is particularly important for ITIN holders working to establish credit within the U.S. system.

New Credit And Inquiries: Timing Your Credit Moves Like A Pro

Opening new credit can feel like navigating a minefield. One wrong step, and your credit score could take a hit. But with a little strategy, you can build credit confidently. This is especially important for ITIN holders building a U.S. credit history. This section explores how timing and understanding credit inquiries are key to success.

Hard Inquiries Vs. Soft Inquiries: Knowing The Difference

Let's talk about credit inquiries. Not all inquiries are the same. Think of it like browsing online. A soft inquiry is like window shopping. You're looking, but you're not buying. Lenders do this when you pre-qualify for offers or check your own credit report. These soft glances don't affect your credit score at all.

A hard inquiry, however, is like clicking "buy now." It signifies a serious commitment. These occur when you formally apply for credit. Hard inquiries can temporarily ding your score a few points, especially if you have several in a short time.

Why Multiple Applications Can Hurt Your Score

Applying for multiple credit cards within a short timeframe can raise red flags for lenders. It can signal financial distress or potential overextension. Imagine applying for several loans at once—it might make lenders question your financial stability.

Each hard inquiry can shave a few points from your score. While one inquiry might not make a huge dent, several within a year can have a noticeable impact. This is especially important for mortgages or auto loans, where even small score fluctuations can affect interest rates.

Minimizing The Impact Of Credit Applications

So, how do you strategically build credit without harming your score? Here are a few tips:

By understanding the difference between inquiries and using strategic timing, you can build a healthy credit profile. This is especially valuable for ITIN holders establishing their financial presence in the U.S.

Special Strategies For ITIN Holders: Your Unique Path To Credit Success

Building credit with an Individual Taxpayer Identification Number (ITIN) can feel like navigating a maze. Traditional credit scoring models often rely on Social Security Numbers, making it tricky for ITIN holders. But don't worry, building a strong credit history is absolutely possible with the right approach. Let's explore some practical steps.

Finding ITIN-Friendly Lenders and Products

Think of it like finding the right key for a specific lock. Not all lenders report ITIN-based accounts to the credit bureaus. Finding the ones that do is crucial. Our guide on banks that accept ITINs is a great place to start. Look for financial products designed specifically for ITIN holders, such as secured credit cards and credit-builder loans.

Think of secured credit cards like training wheels for your credit. You provide a security deposit, which usually becomes your credit limit. This reduces the risk for the lender and allows you to safely begin building credit. Many secured cards even offer a "graduation" path to unsecured cards after responsible use.

Credit-builder loans are a different approach. Imagine putting money aside in a savings account while simultaneously building credit. You borrow a small amount, but the funds are held until you fully repay the loan. This consistent repayment activity is reported to the credit bureaus, establishing a positive payment history.

Leveraging Alternative Credit Scoring Models

While FICO and VantageScore are the most common credit scoring models, think of them as just two flavors of ice cream. There are other options! Alternative credit scoring models might consider factors beyond traditional credit data. Some incorporate your banking history, rent payments, and utility bills, which can be particularly helpful for ITIN holders with limited credit history. Explore these models and see which ones align with your chosen lenders.