Does Prepaid Credit Cards Build Credit? Find Out Here

Let's cut right to the chase: Prepaid cards do not build your credit. It’s a common misconception, but the answer is a firm no.

Think of a prepaid card like a modern-day piggy bank or a gift card you load yourself. You’re simply putting your own money onto a piece of plastic for convenience. Because you're spending funds you already have, you aren't actually borrowing anything.

And borrowing is the name of the game when it comes to building credit.

Why It's All About Borrowing

The entire credit system is built on one simple idea: tracking how well you manage borrowed money. The three major credit bureaus—Experian, Equifax, and TransUnion—collect data on your debts, like loans and credit card balances.

When you consistently pay back what you owe on time, they see you as a reliable borrower. This positive payment history is what builds a strong credit score. Since a prepaid card doesn't involve a loan, there’s no payment activity to report. It’s completely invisible to the credit bureaus.

Using one won't hurt your credit, but it won't help it either. It's just a payment tool, not a credit-building one. You can find more details on why this activity isn't tracked in this SoFi.com article.

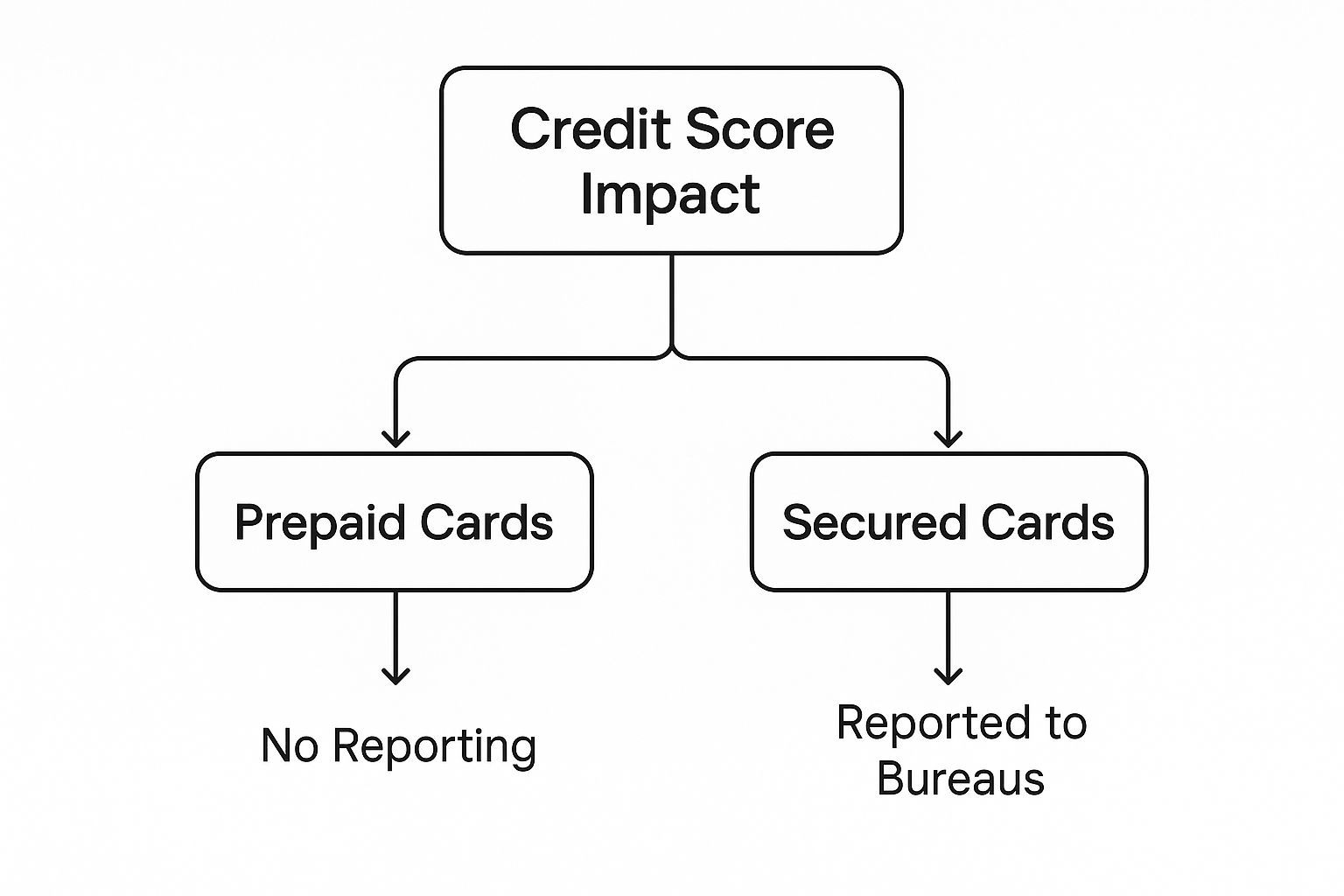

The image below really drives this point home, showing the clear difference between a prepaid card and a card designed to build credit.

As you can see, one path leads to a credit history, and the other is a dead end. To make it even clearer, let's look at a side-by-side comparison.

Prepaid Cards vs Credit-Building Cards At a Glance

This table quickly highlights the core differences between a standard prepaid card and a secured credit card—a popular tool for building credit from scratch.

The key takeaway is that secured cards are specifically designed to report your activity to the credit bureaus, creating the payment history you need. Prepaid cards, on the other hand, are just for spending.

How Your Credit Score Is Actually Built

To understand why the answer to "do prepaid cards build credit?" is a clear "no," we first need to pull back the curtain on how your credit score is put together.

Think of your credit score as your financial report card. It’s a quick way for lenders to see how you’ve handled borrowed money in the past. It’s not some random number; it’s calculated using five key ingredients that the major credit bureaus—Experian, Equifax, and TransUnion—keep a close eye on.

These factors paint a picture of you as a borrower. Are you a safe bet or a potential risk? Each piece tells part of your story, and together, they create your credit profile.

The Five Pillars of Your Credit Score

Your score is a mix of different financial habits, and some weigh more heavily than others. Here’s a breakdown of what the bureaus are looking at:

These ingredients are what matter because they all depend on reported borrowing activity. In 2022, U.S. credit card holders charged over $3.2 trillion, and spending on these cards has shot up 101% since 2015. This mountain of data is what fuels the credit reporting system, which is why tools that don't report, like prepaid cards, are left completely out of the equation.

If you want to dig deeper into these concepts, check out our guide on what a credit score is and how it functions. Getting this foundation right is the first step to choosing the right tools for your financial journey.

Why Prepaid Cards Are Invisible to Credit Bureaus

So, why is the answer to the question "do prepaid cards build credit?" always a hard no? It really just comes down to one simple fact: a prepaid card is a payment tool, not a credit instrument. Think of it as a modern-day piggy bank—you're just putting your own cash into a more convenient, plastic form.

When you load money onto a prepaid card, you're essentially just handing your funds over to a company to hold for you. Every time you swipe it, that company simply subtracts the purchase amount from your balance. There’s no borrowing, no debt, and no repayment schedule. It’s pretty much the same as a debit card, except it isn't linked to a bank account.

Because you're not actually borrowing anything, there's absolutely no risk for the company that issued the card. They aren't lending you a dime; they're just helping you spend the money you already gave them. This is the key reason it does nothing for your credit. Credit bureaus are only interested in how you handle money you've borrowed, but with a prepaid card, there’s no borrowing behavior to track.

A Payment Network Logo Is Not a Credit Line

It’s easy to get tripped up when you see a Visa or Mastercard logo on a prepaid card. Many people see that logo and instantly think "credit card," but that's a common misconception. All that logo means is the card runs on that company's payment network.

Let's break it down:

Seeing a Visa or Mastercard logo just tells you where the card is accepted. It has absolutely nothing to do with whether you're being offered a line of credit or if your payment habits are being reported to the credit bureaus. At the end of the day, the card is still just a container for your own money.

Ultimately, this distinction changes everything. Without a lender giving you credit and without a track record of you paying it back on time, there's no data to report. That’s why a prepaid card is a dead end for anyone trying to build or improve their credit.

So, What Actually Builds Credit?

Okay, so we've established that prepaid cards won't get you very far. Let's talk about the tools that will actually move the needle on your credit journey. If you're serious about building a credit score, you need a product that reports your good habits to the credit bureaus. The best place to start? A secured credit card.

Think of a secured card as a credit card with training wheels. You put down a small, refundable security deposit, and that amount usually becomes your credit limit. This deposit takes the risk off the lender's shoulders, which is why they're often willing to approve people with little to no credit history.

Why Secured Credit Cards Work

Here's the key difference: with a prepaid card, you're just spending your own loaded funds. With a secured card, you're technically borrowing money. Every month, you use the card, get a statement, and pay it off. It’s that payment activity that gets reported to the three major credit bureaus.

Making those payments on time, every single month, is how you show you're a responsible borrower. That's the positive history that builds a strong credit score from the ground up.

Credit building is all about getting accounts on your report, and secured cards are designed for exactly that. For instance, popular cards like the Capital One Platinum Secured card report your activity every month, letting you build a solid history with consistent use. You can dive deeper into how secured cards build credit on CardRates.com.

Other Powerful Credit-Building Tools

While a secured card is a fantastic first step, it's not the only game in town. Here are two other highly effective ways to build a positive credit history:

How to Choose and Use a Secured Credit Card

So, you're ready to stop wondering, "Do prepaid cards build credit?" and start taking control of your financial story. A secured credit card is the perfect tool for the job, but it’s not just about picking any card out of a hat. The key is to choose the right one and use it strategically.

Think of it this way: you're not just getting a piece of plastic. You're getting a powerful tool to build a strong financial foundation.

Your Secured Card Checklist

As you start comparing your options, there are a few must-haves that separate the great cards from the just-okay ones. Here’s what to look for:

Once you’ve found the perfect card, the real work begins. How you use it matters far more than the card itself.

The best strategy is simple: make small, manageable purchases you can easily pay off, like your monthly streaming subscription or a tank of gas. Then, the golden rule is to pay the balance in full every single month. This demonstrates responsible credit management and helps you avoid paying a dime in interest.

For a more detailed breakdown, dive into our complete guide on what a secured credit card is and how it works.

Alright, we've walked through the basics. But I know there are probably a few nagging questions still bouncing around in your head. Let's tackle those common points of confusion head-on.

Are Secured Credit Cards the Same as Prepaid Cards?

Not even close. Think of it this way: a prepaid card is like a reusable gift card. You load your own money onto it, and when you swipe it, you're just spending what you've already put in. No borrowing, no credit, no reporting.

A secured credit card, on the other hand, is a true credit card. You put down a small, refundable security deposit to "secure" the line of credit, but every time you make a purchase, you're actually borrowing from the bank. It's those timely repayments on the borrowed amount that get reported to the credit bureaus and build your credit history.

Can I Get a Secured Card with an ITIN?

Yes, you absolutely can. Secured cards were practically made for people who are just starting their credit journey or need to rebuild. Financial institutions know that plenty of people don't have a Social Security Number (SSN).

That's why many banks readily accept an Individual Taxpayer Identification Number (ITIN) on their applications. This makes secured cards one of the best and most accessible ways for ITIN holders to get their foot in the door and start building a solid U.S. credit file.

What Happens to My Security Deposit?

Your security deposit is just that—a deposit. The card issuer holds it for safekeeping, and it's 100% refundable. It is not used to pay your monthly credit card bills.

You typically get your deposit back in one of two ways:

Ready to build your credit the right way with your ITIN? itin score offers free credit monitoring and personalized tools designed specifically for ITIN holders. Take control of your financial future today.