Does Checking Credit Hurt Score? The Complete Truth

The Credit Check Fear That's Holding You Back

Picture this: you want to know your credit score, but a nagging thought gives you pause. Someone once told you that the simple act of checking your credit could actually lower your score. This common myth keeps many people from monitoring their own financial health, creating unnecessary anxiety and preventing them from making informed decisions. So, does checking your credit hurt your score? The answer isn't a straightforward yes or no—it all comes down to who is doing the checking and why.

This confusion usually comes from not knowing about the two different kinds of credit checks. We’ll break them down, but the most important thing to understand right now is that you can check your own credit safely, and it won't cost you a single point.

Separating Fact from Fear

The heart of this myth is mixing up your own personal peek at your credit with a formal review by a lender. Think of it this way: looking in the mirror to check your outfit doesn't change how you look. But going for a physical exam for a new insurance policy gets officially recorded. Credit checks operate on a similar principle.

When a lender pulls your report for something big like a mortgage or car loan, that’s a hard inquiry. These inquiries can cause a small, temporary dip in your score, usually by five points or less. On the other hand, when you check your own score through a monitoring service or when a company sends you a pre-approved credit card offer, that's a soft inquiry, which has zero impact on your credit score. You can find out more about how credit inquiries affect your score on Bankrate.com.

Grasping this difference is the key to managing your credit with confidence. Regularly reviewing your own report is a smart financial habit because it helps you catch potential errors early. If you do find any mistakes, you can learn how to dispute credit report errors in our guide.

Hard Vs Soft Inquiries: The Game-Changing Difference

This is where the answer to “does checking your credit hurt your score?” becomes crystal clear. The key is understanding the difference between two types of credit checks: soft inquiries and hard inquiries. Think of it like a friendly conversation versus a formal job interview. A casual chat about your work experience has no real stakes, but a job interview is an official evaluation that goes on your record.

A soft inquiry is that friendly chat. It happens when you check your own credit score, when a company pre-approves you for a credit card, or when a potential employer runs a background check. These are considered passive reviews of your credit file, and they have zero impact on your credit score.

A hard inquiry is the formal interview. This occurs only when you actively apply for new credit, like a mortgage, auto loan, or a new credit card. By submitting an application, you give the lender explicit permission to pull your full credit history to make a lending decision. Because applying for new credit can signal increased financial risk, each hard inquiry can temporarily lower your score by a few points.

To make these distinctions clearer, let's break down the key differences between hard and soft inquiries in a simple table.

Hard vs. Soft Credit Inquiries Comparison

A detailed comparison showing the key differences between hard and soft inquiries, including examples and credit score impact.

The table above shows that while hard inquiries are a necessary part of applying for credit and are visible to lenders, soft inquiries are harmless actions that help you stay informed without any negative consequences.

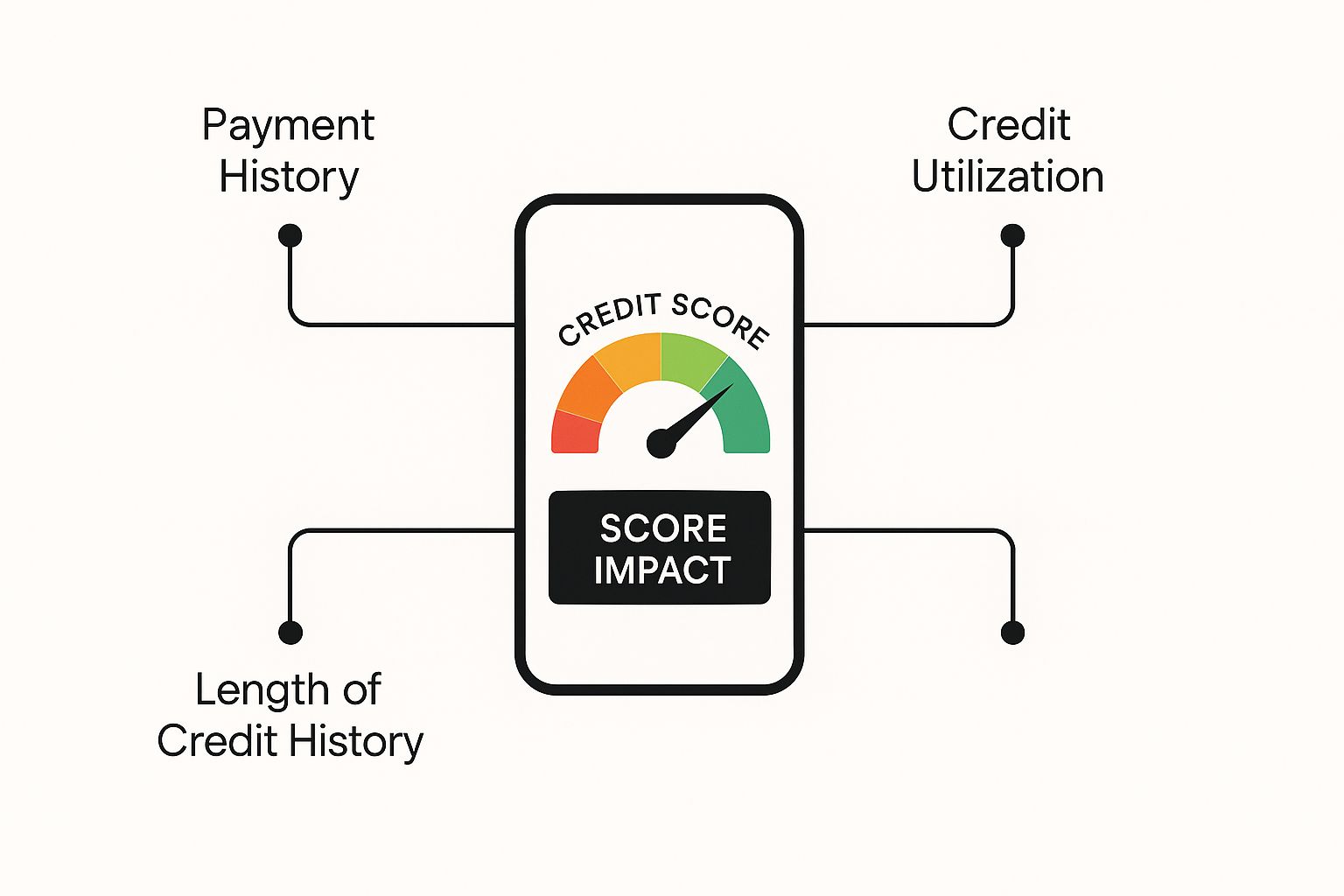

The Impact You Can See (And The One You Can’t)

The infographic below illustrates how different actions can affect your credit score, highlighting the safety of checking it yourself.

As the visual shows, checking your own credit falls firmly into the no-impact zone. This confirms that monitoring your own credit is a safe and smart financial habit.

This distinction is crucial because it means you can and should monitor your credit regularly without fear. Interestingly, while you can see soft inquiries on your own credit report, they are invisible to potential lenders. For example, when a company sends you a "pre-qualified" offer, that soft pull doesn't show up for other banks to see. This system allows you to stay informed about your credit without signaling financial distress to lenders. To understand more about this divide, you can get further details on credit inquiries from Bankrate. Knowing this difference empowers you to take control of your financial journey with confidence.

The Real Numbers: What Actually Happens To Your Score

While the fear surrounding credit inquiries is common, the actual impact is often much smaller than you might think. So, when answering "does checking credit hurt score," let's look at the data. For most people with established credit, a single hard inquiry from a new credit application typically results in a minor, temporary dip. It's like a small ripple in a large pond—noticeable, but it quickly settles.

How Many Points Will It Drop?

The most common question is about the exact number of points. According to research from FICO, the creator of the most widely used credit scores, a single hard inquiry will likely lower your score by less than five points. This small deduction is a standard part of their risk assessment model.

However, this isn't a one-size-fits-all rule. The impact can be more significant for individuals with a shorter credit history or very few accounts. For these profiles, a new inquiry represents a larger change in their overall credit picture, making it seem riskier to lenders.

Why Your Credit Profile Matters

Think of it this way: a seasoned marathon runner can handle a short sprint with ease, but for a new runner, that same sprint is a major effort. Similarly, a robust credit profile can easily absorb a new inquiry. The impact of an inquiry is just one of many factors affecting your credit score, alongside payment history and credit utilization. For most, the score recovers within a few months, provided you continue managing your credit responsibly.

To give you a clearer picture, this table breaks down how a hard inquiry might affect different types of credit profiles.

Credit Score Impact by Profile Type

Statistical breakdown showing how hard inquiries affect different credit profiles and score ranges

As you can see, the stronger and more established your credit is, the less a single hard inquiry matters. Conversely, those with newer or more fragile credit files should be more strategic about when and how often they apply for new credit to protect their scores.

Smart Rate Shopping: When Multiple Inquiries Don't Hurt

Here's a concept that savvy shoppers should embrace: credit scoring models are built to reward you for smart financial behavior, not penalize you. When you’re looking to make a major purchase like a car or a house, comparing offers from several lenders is the only way to lock in the best interest rate. The system understands this and gives you a "shopping window" to protect your credit score from taking a hit for each application.

This means if you're shopping around for a mortgage, auto loan, or student loan, you can collect multiple quotes without each one dinging your score. Think of it as the credit bureaus giving you a hall pass to find the best deal.

The Rate Shopping Window Explained

So, how does this actually work? Most current credit scoring models, like those from FICO and VantageScore, group multiple hard inquiries for specific loan types into a single event. This works as long as you submit all the applications within a certain period, which is typically 14 to 45 days. While you might see each individual inquiry on your credit report, the scoring formula bundles them up and counts them as one.

It's important to know that this protection doesn’t apply to every type of credit. For example, applying for several credit cards in a short time is not considered rate shopping. Each application will count as a separate hard inquiry and can have a greater impact on your score. By understanding these distinctions, you can confidently search for the best loan terms. To learn more, you can discover more insights about rate shopping windows from MyFICO.

Safe Credit Monitoring: Check Without Consequences

Now that you know not all inquiries are created equal, you can check your credit without worrying about damaging your score. Checking your own credit is a soft inquiry, which means it has no impact on your credit score. Think of it like looking at your own report card—it’s for your eyes only and doesn't change your grades. This is why the answer to "does checking credit hurt score?" is a firm "no" when you're the one looking.

There are a few completely safe ways to keep an eye on your financial health. This helps you stay informed about your credit standing and catch potential problems, like mistakes or fraud, before they grow.

Your Right to Free Credit Reports

The most direct way to check your credit is to get your free reports, a right granted to you by federal law. The only official, government-authorized source is AnnualCreditReport.com. Through this site, you can request a free copy of your credit report from each of the three main credit bureaus—Equifax, Experian, and TransUnion—every single week. These reports give you a detailed history of your credit activity, though they don't include your actual credit score.

Here is what the official website looks like so you can be sure you're in the right place. This screenshot shows the legitimate portal where you can request your free weekly credit reports from all three bureaus, highlighting its status as the only source authorized by federal law.

Ongoing Credit Monitoring Services

For more frequent updates and to track your score, credit monitoring services are a fantastic choice. Services like itinscore are built to give you regular, unlimited access to your credit information through an easy-to-use dashboard. They use soft inquiries to pull your data, so you can check your report and score as often as you wish—even daily—with no negative effect.

These tools are helpful because they don't just give you a number; they help you make sense of it. By using a monitoring service, you can:

Using these safe methods changes credit monitoring from something to be nervous about into a proactive step toward building a stronger financial future.

Strategic Application Timing Like A Credit Pro

Knowing when to apply for new credit is just as critical as understanding which type of inquiry will show up on your report. Timing your applications thoughtfully can reduce the impact on your score and increase your chances of getting approved. Think of your credit profile as a garden. After you plant a new seed (apply for a loan), the soil needs time to settle before you plant another one right next to it. Applying for credit too often can look like a sign of financial trouble to lenders, making them reluctant to offer you more.

A good rule of thumb is to space out new credit applications by at least six months. This buffer period gives your score a chance to recover from the small dip a hard inquiry can cause. It also allows your new account to establish a positive payment history, which strengthens your overall credit profile.

Reading the Warning Signs

Before you submit that next application, check for these signals that it might be better to wait:

Lenders look closely at the number of recent inquiries because it's linked to risk. Research shows that people with six or more inquiries on their reports are statistically more likely to experience financial difficulties. While inquiries remain on your report for two years, FICO's scoring models only factor in those from the past 12 months. You can learn more about how inquiries influence risk assessment from MyFICO. For those using an ITIN, it's also important to know how these inquiries are recorded. Our guide on how to read your ITIN credit report can help you see how this information is displayed.

Your Confidence-Building Credit Action Plan

It's time to move from learning to doing. This practical roadmap builds on everything we've covered, turning knowledge into real power over your credit. Instead of worrying, "does checking my credit hurt my score?", you'll have the tools to confidently monitor your financial health and take control.

Your Immediate Steps

Ready to take control without the confusion? Sign up with itinscore today and get free, unlimited access to your credit information.