Do Unpaid Medical Bills Affect Credit?

Yes, unpaid medical bills can absolutely impact your credit, but the rules of the game have changed significantly, offering some much-needed protection. While a large, unpaid bill can still lower your credit score, a series of new regulations now prevent smaller debts from showing up at all and ensure paid-off collections vanish from your report entirely.

The Short Answer: Yes, but the Rules Have Changed

Let's face it, navigating medical billing is a nightmare. It’s confusing, stressful, and the last thing you want to worry about when you're dealing with a health issue. For a long time, one surprise bill could torpedo your credit, making it tougher to get a mortgage, finance a car, or even open a new credit card.

Thankfully, that reality has started to shift in a big way. The three major credit bureaus—that’s Equifax, Experian, and TransUnion—have put some critical new policies in place for medical collection accounts. These aren't just minor adjustments; they fundamentally change how your medical and credit histories interact. Knowing how these protections work is your first line of defense.

New Protections for Your Credit Score

At their core, these changes are designed to give you breathing room. They prevent a minor medical issue or a billing dispute from causing years of financial damage.

Here’s a breakdown of what’s new:

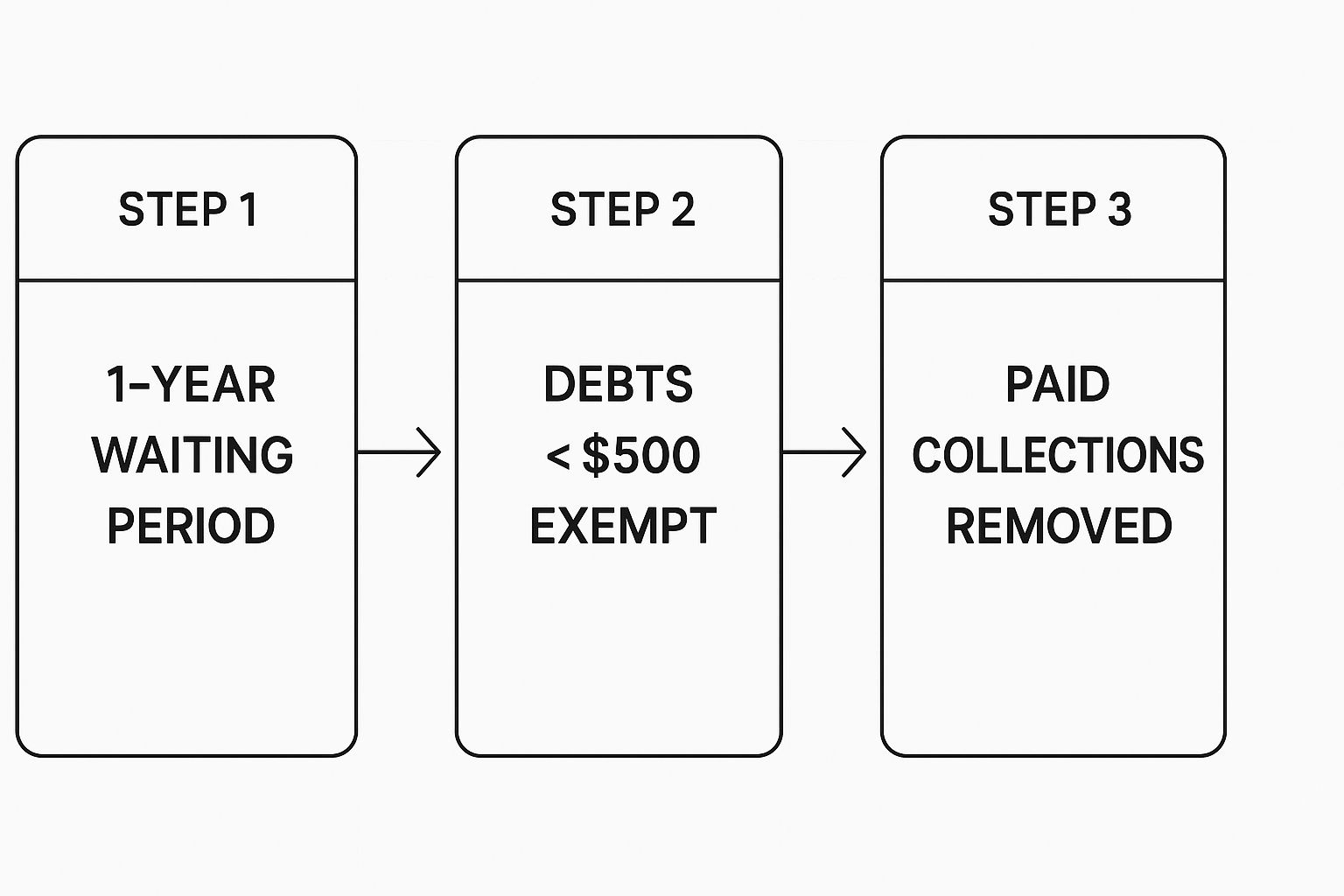

The infographic below really helps visualize this new, more forgiving process.

To make sense of these new rules, here's a quick summary table that breaks down the most important updates.

Key Changes to Medical Debt on Your Credit Report

These changes effectively build a much-needed buffer between an unexpected medical expense and your credit score.

This is a critical development, especially when you consider that medical debt has been a massive problem for years. Back in 2021, it accounted for roughly 58% of all consumer debt in collections. If you want to dive deeper, you can find more insights about medical debt statistics and reporting timelines on PMC.

The Journey of a Medical Bill to Your Credit Report

It’s one of the most common questions I hear: do unpaid medical bills actually hurt your credit? The answer is a definite yes, but it’s not immediate. A bill from a doctor's visit doesn't just magically appear on your credit report the next day. It follows a specific, and frankly, often confusing path with several important stops along the way.

Think of it less like an express delivery and more like a package taking a long, winding road trip. Knowing the route is the key to stopping a simple medical bill from becoming a major credit headache. You have more time and power to step in than you probably think.

The whole thing kicks off the moment you receive care. Soon after, the provider’s billing department sends you the first statement. At this point, it’s just between you and them—it has absolutely no impact on your credit.

The Initial Billing Phase

This is your first, and best, chance to get ahead of things. For the first few months, the bill is handled entirely by the hospital or clinic. This is the perfect time to scan it for errors, double-check what your insurance paid, or call the billing office to work out a payment plan if you need one.

If the bill isn't paid, you'll start getting reminders. But here's the crucial part: the healthcare provider itself can't report you to the credit bureaus. To do that, they have to hand the debt over to a third-party collection agency.

The One-Year Grace Period

This is where a major consumer protection comes into play. As soon as a medical bill is sent to a collection agency, a brand new clock starts ticking. Federal rules give you a 365-day waiting period before that medical debt can legally show up on your reports with Equifax, Experian, or TransUnion.

This one-year grace period is a powerful safety net. It was put in place specifically to give you enough breathing room to sort out insurance mix-ups, dispute billing errors, or find financial help without your credit score being immediately on the line.

Only if the debt is still sitting there unpaid after that full year can the collection agency finally report it. At that moment, the "package" has arrived, and the unpaid bill can begin to affect your credit score. That’s why acting within that generous timeframe is so incredibly important.

Understanding Your New Protections Against Medical Debt

The good news? The ground rules for medical debt on your credit report have changed—and they've changed in your favor. A wave of new, consumer-friendly regulations has put up a much-needed shield, protecting your financial health from the often chaotic world of healthcare billing. These aren't just minor adjustments; they're major shifts designed to give you back control and provide some real breathing room.

To take full advantage of these changes, you first have to know what they are. Think of these new rules as your rights. Knowing them is the key to holding credit bureaus and collection agencies accountable. Let’s walk through the three biggest game-changers.

The $500 Small Balance Exemption

One of the most immediate and helpful changes is the new minimum reporting threshold. In short, any medical collection account with an original balance under $500 can no longer appear on your credit reports. This applies to both new and old debts.

This is a huge relief for millions of people. It means that a small, forgotten co-pay or a billing dispute over a couple hundred bucks no longer has the power to wreck your credit score.

Paid Medical Collections Are Now Deleted

This one is a massive win for consumers and arguably the most powerful reform of all. In the past, paying off a collection account didn't make it go away. It would just be updated to "paid," but it could still sit on your credit report for up to seven years, dragging down your score the entire time.

That's no longer the case for medical debt. Once you pay off a medical collection, the credit bureaus are now required to completely remove it from your credit history. It just vanishes, as if it was never there in the first place. This can help your credit score bounce back much faster and more significantly.

The Extended One-Year Waiting Period

The last piece of this new protective shield is a much longer timeline. A medical bill now has to be delinquent for a full 365 days with a collection agency before it can even be reported to the credit bureaus.

Taken together, these changes mark a huge step forward. Thanks to recent actions by the three major credit bureaus and the Consumer Financial Protection Bureau (CFPB), these protections are now in place. A sweeping CFPB rule was finalized to wipe an estimated $49 billion in medical debt from consumers' credit reports, directly helping around 15 million Americans. You can read the full CFPB announcement about removing medical bills from credit reports to get all the details.

While these protections are powerful, they don't eliminate every risk. Unpaid medical bills over $500 can still do some serious damage to your score. Getting familiar with the legal terminology related to medical debt can help clarify your rights even further. The goal here is to understand how these changes can improve your financial standing, which includes important metrics like your FICO score. You can learn more about what a FICO Score 9 is in our detailed guide.

The True Impact of Medical Debt on Your Credit Score

Even with the new rules offering some protection, a medical bill over $500 that’s been sitting unpaid for more than a year can still do some serious damage to your credit score. The exact hit you'll take depends on your entire credit history, but make no mistake—even one medical collection can be enough to send your score tumbling.

Let's put that in perspective. Say you have a pretty good credit score, around a 720. A single medical collection hitting your report could easily drop you into the mid-600s. For some people, that drop can be a staggering 100 points. This isn't just a number; it's a change that triggers immediate, real-world consequences that can cost you a lot of money.

From Score Drop to Financial Setback

When your credit score takes a dive, lenders start seeing you as a bigger risk. That hesitation translates directly into worse loan terms, or even getting denied for credit altogether.

Here’s how that can play out in your life:

It’s a nasty domino effect. One unexpected health problem can spiral into long-term financial stress, holding you back from major life goals. It’s important to understand how long late payments affect a credit score, because a collection account is essentially a late payment at its most severe stage.

How Different Scoring Models View Medical Debt

The good news? Not all credit scoring models are created equal, and the newer ones are much more understanding about medical debt. They’ve started to recognize that a medical emergency isn’t the same as irresponsibly running up a credit card bill.

Here's the catch, though. Many lenders, especially mortgage lenders, are still using older versions of the FICO score that don’t make this distinction. So while your credit score might look perfectly fine on a free credit monitoring app, the bank pulling your report for a home loan could be seeing a much uglier picture.

Proactive Steps to Manage Bills and Protect Your Credit

Understanding the rules is one thing, but taking decisive action is how you truly shield your credit score. Don't wait for a medical bill to become a major headache. The moment that envelope arrives, it’s time to get ahead of the problem.

Being proactive does more than just reduce stress; it can stop a medical debt from ever starting its journey to your credit report. Think of it like financial first aid. You’re addressing the issue immediately, stopping the "bleeding" before it gets worse. The goal here is simple: settle things directly with the provider long before a collection agency even knows your name.

Your Action Plan for Every Medical Bill

Never just glance at the total and toss the bill on a pile. You need to treat every single medical bill with a detective's eye. Billing errors are shockingly frequent, and it’s all too easy to be overcharged for services you never got or even billed twice for the same procedure. To see just how high the stakes are, it's worth understanding the financial risks of medical emergencies without insurance.

Your first move? Always request a detailed, itemized statement from the healthcare provider. This isn't the summary page—it’s the nitty-gritty, line-by-line breakdown of every single charge, from a simple aspirin to complex facility fees.

With the itemized bill in hand, here’s what to do next:

Negotiate and Look for Financial Help

What if the bill is 100% accurate but the total is just too much to handle at once? You still have options—good ones. The worst thing you can do is ignore it. That’s a one-way ticket to collections. Instead, open a dialogue.

Try these strategies to get the bill under control:

How to Get Medical Debt Off Your Credit Report

Finding a medical collection on your credit report can be alarming, but don't panic. It's a fixable problem, and with the right strategy, you can get it removed. This isn't about magic tricks; it's about clear communication, knowing your rights, and using the new industry rules in your favor.

The most powerful tool in your corner is the Fair Credit Reporting Act (FCRA). This federal law gives you the absolute right to challenge any information on your credit report you believe is inaccurate. This isn't just for huge, obvious mistakes—it applies to any debt you don't recognize or feel is wrong for any reason. Your first move should be sending a formal dispute letter to the collection agency demanding they validate the debt.

Start with a Dispute and Back It Up

When you send a dispute letter, you're putting the ball in the collection agency's court and formally asking them to prove the debt is yours. Keep your letter simple and to the point, explaining why you're questioning the account.

While you wait for their response, start gathering your own evidence to support your case. Look for things like:

If the collection agency can’t provide solid proof that the debt is legitimate and belongs to you, they are legally required to remove it from your credit report. This is your strongest line of defense against mistakes.

Pay It Off to Make It Disappear

So what happens if the debt turns out to be legitimate? This is where the new rules are a game-changer. Simply paying off the medical collection is now your best move.

Once a medical collection account is paid, the credit bureaus—Experian, Equifax, and TransUnion—are required to completely remove it from your credit report. This is a massive shift from how other debts work, making payment an incredibly effective way to clean up your credit.

You can also try negotiating a "pay-for-delete," where you offer to pay the debt (sometimes for a lower, settled amount) in exchange for their written promise to delete the collection from your credit files. Always get this agreement in writing before you send a single penny. To learn more about this and other strategies, check out our guide on how collections on a credit report work.

A Few Final Questions About Medical Debt

Let's wrap things up by tackling some of the most common questions that pop up when dealing with medical bills and your credit. Think of this as a quick-reference guide to clear up any lingering confusion.

How Long Does Medical Debt Stay on Your Credit Report?

This is where things have gotten a lot better for consumers. Technically, an unpaid medical collection account over $500 can hang around on your credit report for up to seven years. That clock starts ticking from the date the bill first became delinquent.

But here’s the game-changing part: once that collection is paid off, it has to be completely deleted from your report. It vanishes. This is a huge win compared to other types of debt, which can haunt your report for years even after you've paid them.

Will Paying a Medical Collection Improve My Score?

Yes, absolutely. Because the credit bureaus are now required to remove paid medical collections entirely, paying off that debt gets rid of the negative mark for good.

When a negative item is removed, your score should see a lift. The exact number of points you'll gain depends on everything else in your credit history, but it's one of the clearest paths to repairing the damage.