Do Soft Inquiries Hurt Your Credit Score? Find Out Now

Let's cut right to the chase: No, soft inquiries do not hurt your credit score. Think of them as a "just looking" peek at your credit file—they don't leave a mark like a formal application does.

Do Soft Inquiries Affect Your Credit Score? The Definitive Answer

A soft inquiry, sometimes called a "soft pull," is a type of credit check that isn't connected to a new application for credit. Because of this, the major credit scoring models from FICO and VantageScore don't even factor them into your score. They’re essentially invisible to lenders and have zero negative impact.

You can rest easy knowing that soft inquiries won't ding your credit score. They happen all the time for routine checks, like when you check your own score or a potential employer runs a background check. This is a world away from hard inquiries, which can actually cause your score to dip. For a deeper dive into how this works, platforms like Credit Karma offer great resources explaining the distinction.

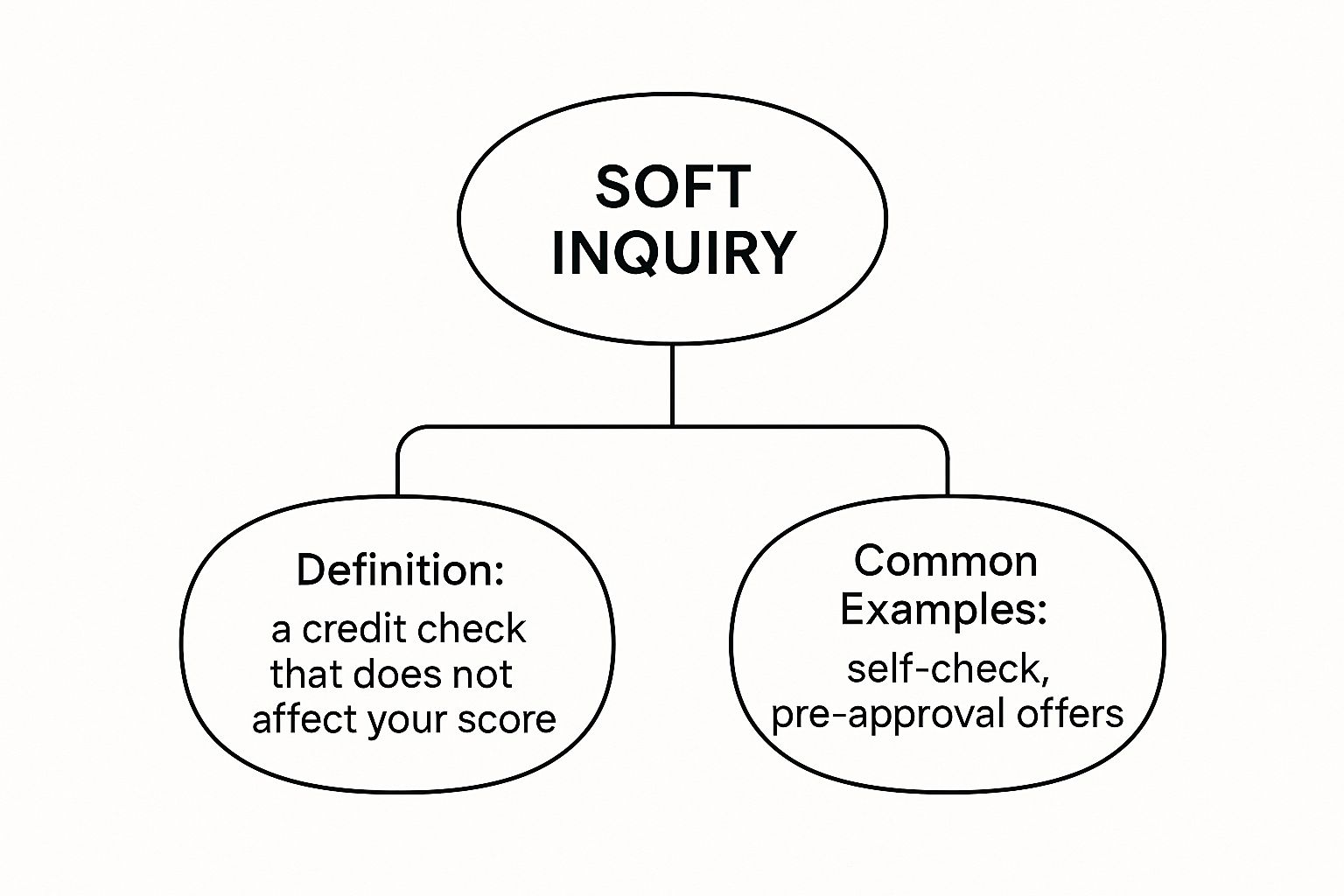

This image breaks down exactly what a soft inquiry is and where you're likely to see one pop up.

As you can see, a soft inquiry is a completely risk-free way for you or others to review your credit information without any penalty to your score.

Soft Inquiry vs. Hard Inquiry At a Glance

To really understand the difference, it helps to put them side-by-side. Soft pulls are harmless check-ins, while hard inquiries tell lenders you’re actively shopping for new credit, which can be seen as a slight risk.

This table gives you a quick snapshot of the key differences.

Ultimately, the takeaway is simple: soft inquiries are for informational purposes, while hard inquiries are part of a formal application process. Knowing the difference is key to managing your credit health.

Understanding the Two Types of Credit Inquiries

To get why the answer to "do soft inquiries hurt your credit score?" is a clear "no," you first have to know the difference between the two main types of credit checks. It’s a bit like window shopping versus actually buying something.

A soft inquiry is like a store owner just glancing at your shopping bag to get a general idea of your tastes. A hard inquiry, however, is you walking up to the counter and filling out an application for the store's credit card. One is a casual peek, the other is a serious request to take on new debt.

These two actions paint very different pictures for lenders and the credit bureaus. They’re triggered by completely different events, and one requires your direct say-so while the other often doesn’t. That distinction is everything when it comes to your credit score.

The Role of Permission and Intent

A soft inquiry (often called a "soft pull") can happen without you even knowing it. Think about those pre-approved credit card offers you get in the mail. To send you that offer, the card company performed a soft pull on your credit to see if you're a potential match for their product. Checking your own credit score also counts as a soft inquiry.

Since these aren't formal applications for new credit, they don't signal risk to lenders and don't require your explicit permission every single time.

A hard inquiry (or "hard pull") is a different beast entirely. It can only happen with your direct authorization. This is what happens when you formally apply for a new credit card, a mortgage, an auto loan, or any other form of credit. Your application is your permission slip for the lender to do a deep dive into your credit history.

This action tells the credit world you’re actively trying to borrow money. For a more detailed breakdown, you can check out our guide to soft pull credit checks.

This image from Experian does a great job of showing the difference visually.

As you can see, hard inquiries are tied directly to new credit applications, while soft inquiries are more for background checks or pre-screenings. This is the core reason why only hard inquiries can actually affect your credit score.

How Inquiries Actually Affect Your Credit Score

Let's clear up a common source of confusion: the real impact of credit inquiries. When people ask, "do soft inquiries hurt your credit score?" the answer is simple and direct. No. A soft inquiry has zero effect on your credit score, period. Think of it as a silent background check that future lenders can't even see.

A single hard inquiry, on the other hand, might cause a small, temporary dip. We're usually talking about a drop of just 1 to 5 points. It’s when you get several hard inquiries in a short amount of time that you might see a more noticeable effect, as scoring models can interpret that as a sign of financial distress.

But no matter how many you accumulate, soft inquiries will never cause your score to drop. You can dive deeper into how credit inquiries impact your score on CreditNinja to learn more.

The Bigger Picture of Your Credit Score

It's really important to see inquiries for what they are: a small piece of a much larger puzzle. Scoring models from FICO and VantageScore are far more interested in other aspects of your financial habits.

To put it in perspective, here’s a rough breakdown of what goes into your FICO score:

Soft vs. Hard Inquiries in Your Daily Life

It's one thing to talk about credit inquiries in theory, but where do you actually run into them? The truth is, they happen all the time. Knowing the difference between a "soft pull" and a "hard pull" in real-world situations is the key to managing your credit with confidence.

Think of soft inquiries as the friendly, background checks of the financial world. They’re happening behind the scenes and are totally harmless. The most important thing to remember is that soft inquiries do not hurt your credit score. So, don't sweat it when you see one pop up on your report.

Hard inquiries, on the other hand, are the real deal. They happen only when you formally ask to borrow money, and they signal to lenders that you're actively seeking new credit.

Common Triggers for a Soft Inquiry

These are the kinds of credit checks that don't represent a new application for debt, which is why they have zero effect on your score. You'll see them when:

When to Expect a Hard Inquiry

A hard inquiry only happens when you give a lender the green light by submitting an official application. Each one can cause a small, temporary dip in your credit score, usually for just a few months.

Here are the most common situations that trigger a hard pull on your credit report:

To make it even clearer, let's look at a few everyday financial activities and see which type of inquiry they typically generate.

Everyday Scenarios for Soft vs Hard Inquiries

As you can see, the critical moment is when you formally submit an application. That's the dividing line between a harmless peek at your credit and a formal request that impacts your score.

Why You Should Check Your Own Credit Report Often

So, we've established that checking your own credit is a soft inquiry and won't hurt your score. Now, it's time to put that knowledge into practice. Regularly looking at your credit report isn't just a good idea—it's one of the most powerful financial habits you can build.

Think of your credit report as your financial resume. You wouldn't apply for a dream job without proofreading your resume, right? Checking your report gives you a chance to see exactly what lenders see before you ask them for a loan. This simple step puts you back in the driver's seat.

Catch Errors Before They Cause Damage

Credit reports are packed with data from all your lenders, and let's be honest, mistakes happen. It could be something as small as a payment getting reported late when you paid it on time, but even minor errors can drag your score down.

When you check your report regularly, you can spot these slip-ups and get them fixed fast. This little bit of diligence protects the score you’ve worked so hard to build and ensures your report tells the true story of your creditworthiness.

Spot Early Signs of Identity Theft

See an account you don't recognize? Or a hard inquiry from a lender you've never heard of? These are classic red flags for identity theft. Thieves often start small, opening minor accounts in your name to see what they can get away with.

If you aren't checking, these fraudulent accounts can fester for months, doing serious damage to your credit. Regular reviews let you shut down suspicious activity immediately, stopping criminals before they can truly wreak havoc on your finances.

Apply for Loans with Total Confidence

Finally, knowing your credit report inside and out is a huge advantage. You'll walk into any loan application knowing exactly where you stand, which means you can apply for credit products you have a great shot at getting.

This smart approach helps you avoid the sting—and the temporary score dip—of a rejected application. To learn more about the best timing, check out our guide on how often to check your credit report. Ultimately, monitoring your credit isn't about being obsessive; it’s about being empowered.

A Deeper Dive Into Credit Inquiries

Now that you've got the basics of soft vs. hard inquiries down, let's get into the questions I hear most often. Digging into these details is what will give you the confidence to manage your credit profile like a pro, so you know exactly what’s happening behind the scenes.

We’ve already covered why soft inquiries are nothing to worry about. But it’s the hard inquiries that tend to trip people up and cause the most stress.

How Many Hard Inquiries Is Too Many?

There's no single magic number here—it’s all about context. A few inquiries spread out over a year usually isn't a big deal. What really raises a red flag for lenders is seeing a bunch of applications crammed into a short time frame. Applying for five different credit cards in a single month, for instance, can look like you're in financial trouble. It sends a signal that you're desperately seeking credit you might not be able to handle.

But don't worry, the credit scoring models are smarter than you think. They can tell when you're just shopping around for the best deal on a big loan.

As a general rule of thumb, it’s best to keep hard inquiries to a minimum. Aim for no more than one or two a year unless you're actively rate shopping for a major purchase.

How Long Do Hard Inquiries Stay on My Credit Report?

A hard inquiry will show up on your credit report for two years from the date of your application. But here’s the good news: while it hangs around on your report for 24 months, its actual impact on your score fades much, much faster.

For most scoring models used today, a hard inquiry only affects your credit score for the first 12 months. After that first year, it's still visible on your report for another year, but it’s no longer factored into your score calculation. So, while the record is there, the small point deduction it caused usually disappears after a year. For a deeper look at how this works, you can learn more in our detailed guide.

Can I Get an Unauthorized Hard Inquiry Removed?

Yes, and you absolutely should. A hard inquiry can only be added to your report if you give your permission, which happens when you officially apply for new credit. If you spot one you don’t recognize, it could be a simple mistake—or it could be a sign of identity theft.

If you find a hard inquiry that wasn't you, here’s what to do: