Do Late Payments Affect Credit Score? A Simple Guide

Yes, late payments absolutely affect your credit score, and the impact can be pretty harsh. A single late payment can be like a major crack in your financial foundation, signaling to lenders that you might be a risky borrower. This is why protecting your payment history is one of the most important things you can do for your financial health.

The Undeniable Impact of a Single Late Payment

Think of your credit score as a trust rating with lenders. Every time you pay a bill on time, you're building that trust and proving you’re a reliable borrower. A missed payment, on the other hand, breaks that trust.

Credit scoring models are built to notice this immediately. Lenders live and die by consistency, and they want to see a dependable pattern of on-time payments because it's the best predictor of your future behavior. A single slip-up disrupts that pattern and raises a big red flag.

Why Payment History is King

When it comes to your credit score, nothing matters more than your payment history. It's the single biggest factor, making up a massive 35% of your FICO® Score. Because this category carries so much weight, even one payment reported as 30 days past due can cause a serious drop in your score.

This is especially true if you had a great score to begin with. The higher your score, the more a single mistake can hurt. No amount of good behavior in other areas—like keeping low balances or having a long credit history—can completely erase the damage from a late payment.

Essentially, when you miss a payment, you're confirming the very risk that lenders are trying to avoid. To get a better handle on the basics, our guide on what a credit score is is a great place to start. This foundational knowledge really drives home why every single payment counts.

To quickly see how a late payment can affect your finances, here's a simple breakdown.

Quick Guide to Late Payment Impact

This table shows that the consequences aren't just a one-time thing; a late payment has a ripple effect that can follow you for years.

How a Late Payment Ends Up on Your Credit Report

When you miss a payment, it doesn’t instantly get zapped onto your credit report. There's actually a bit of a buffer. The process involves your lender communicating with the three major credit bureaus—Experian, Equifax, and TransUnion—which are essentially the keepers of your financial track record.

Your creditors, whether it's your credit card company or your mortgage lender, report your account activity to these bureaus every month or so. This regular update is how all your responsible, on-time payments build a strong credit history. It's also, unfortunately, the same channel used to report a misstep.

The 30-Day Reporting Threshold

Here’s the key piece of information: the 30-day threshold. If you're just a few days late on a bill, you'll probably get hit with a late fee from the lender, but it shouldn't show up on your credit report. You have a small grace period before things get serious.

The real trouble starts once a payment is officially 30 days past its due date. At that point, your creditor can report it as delinquent. This is the moment a simple late payment becomes a damaging mark on your credit report, one that can stick around for a long time. The only major exception is for federal student loans, which typically aren't reported until they're 90 days overdue.

This system gives you a brief window to fix a simple mistake before it hurts your long-term credit. But once that window closes, the reporting process kicks into gear.

Understanding Delinquency Statuses

The longer a payment goes unpaid, the worse it looks on your credit report. Lenders use a kind of shorthand to note how late you are, and each stage sends a louder warning signal to anyone reviewing your credit.

Here’s how it typically breaks down:

The Severity Scale of Credit Score Damage

Think of a late payment not as a single, fixed penalty, but as something that lands on a "severity scale." The damage to your credit score isn't a one-size-fits-all situation. Instead, a few key factors determine just how much a single slip-up will cost you.

The most critical factor? How late the payment actually is. A bill that’s 30 days past due is a problem, but one that hits the 90-day mark is a full-blown catastrophe for your score. The longer you let an account go unpaid, the more it signals to lenders that you're a significant credit risk.

How Much Your Score Can Drop

The exact number of points you'll lose depends heavily on where your score started. It’s a bit counterintuitive, but someone with an excellent credit score has far more to lose from one mistake than a person who already has a fair or poor score.

For example, a person starting with a stellar 780 FICO score could see it plummet by a staggering 90 to 110 points after just one 30-day late payment is reported.

Why such a dramatic drop? Because a high score is built on a flawless payment history. A single late payment is like a major crack in that perfect foundation, and the damage is disproportionately severe.

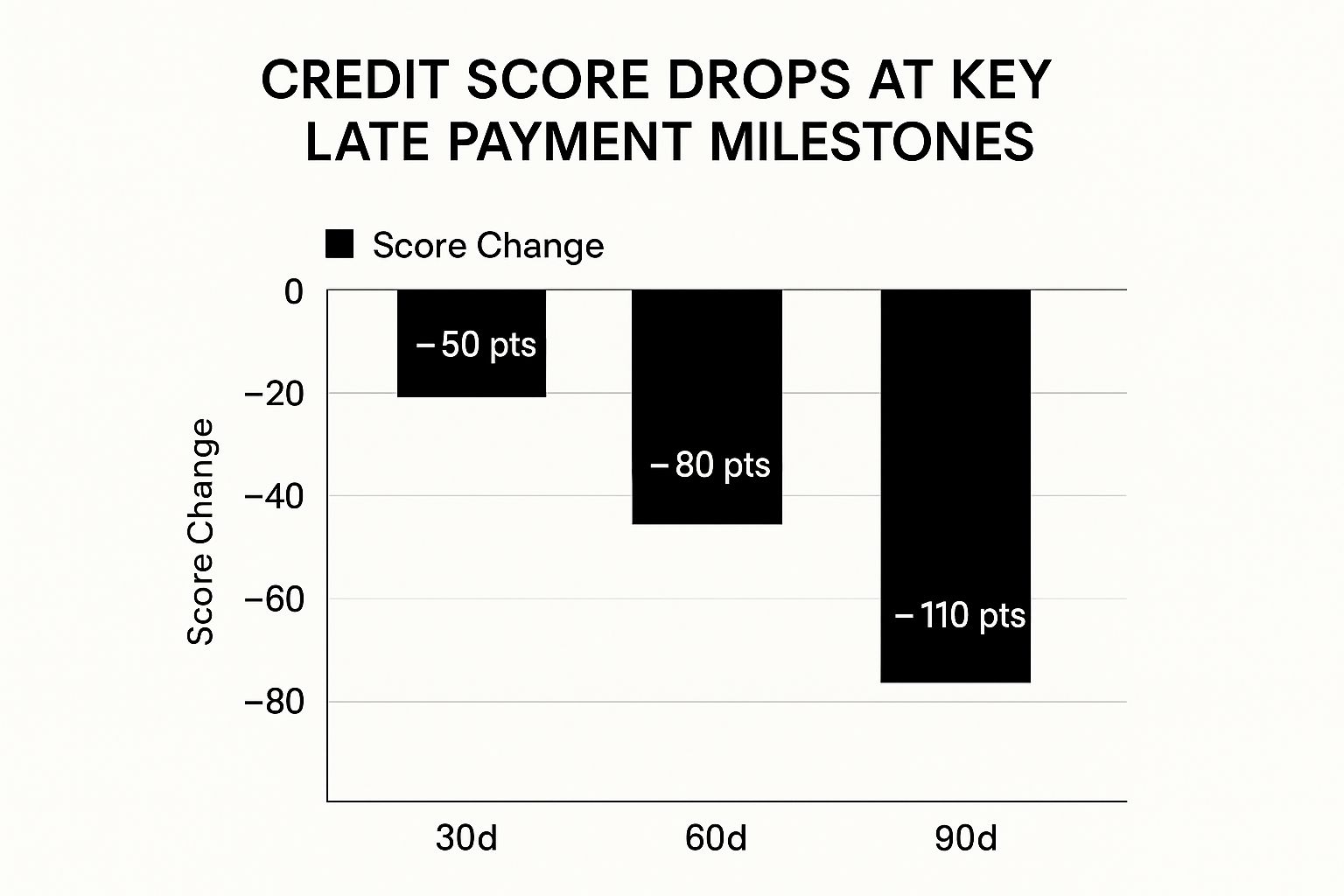

This visual gives you a clear idea of how the point drop gets worse as a payment ages.

As you can see, the hit for being 90 days late isn't just a little worse—it can be more than double the impact of a 30-day delinquency. This shows just how quickly lenders' perception of risk escalates.

To put this into perspective, here’s a breakdown of what you can expect. This table illustrates the estimated score damage for someone starting with a high credit score (above 780).

Estimated Credit Score Drop by Delinquency Level

The takeaway here is clear: the longer a payment remains past due, the more aggressively it will drag your score down.

Other Factors That Determine the Damage

Beyond the number of days a payment is late, a few other elements play a big role in the final impact.

Sadly, this is an increasingly common problem. Recent data reveals a troubling rise in Americans with credit card payments overdue by 30 days, and that trend continues for the more severe 90-day delinquencies. On top of the credit score damage, these late payments often trigger penalty APRs that can jump as high as 29.99%, digging the financial hole even deeper. You can dig into these trends and their consequences in more detail over at Credit Karma.

How Long Late Payments Haunt Your Credit Report

If only a late payment disappeared the moment you finally paid the bill. Unfortunately, that negative mark settles in on your credit report for the long haul, shaping how lenders see your reliability for years. Knowing just how long it sticks around is the first step in understanding your road to recovery.

So, what's the official timeline? Under federal law, a late payment can legally stay on your credit report for a full seven years from the date you first missed the payment. That's a long time for one slip-up to follow you around and potentially influence major financial decisions.

The Seven-Year Scar

I like to think of a late payment as a scar. When it’s fresh, it’s impossible to ignore and hurts the most. A brand-new delinquency will have the sharpest, most immediate negative impact on your credit score, making lenders nervous and possibly costing you an approval or a decent interest rate.

But just like a real scar, the sting of a late payment fades with time. As the delinquency gets older, its influence on your credit score starts to shrink. Credit scoring models are built to prioritize your recent habits, meaning a mistake from five years ago is far less damaging than one from five months ago—even though both are still technically on your report.

This gradual decline in impact is your best friend during credit repair. While you can't just wipe the slate clean, you can actively bury that old mistake under a new, solid track record of positive history.

The Long-Term Impact on Major Loans

Even a faded scar can still be seen. A late payment sitting anywhere in that seven-year window can create obstacles, especially when you're applying for life's biggest loans. Mortgage and auto lenders don't just glance at your score; they comb through your entire credit history.

Here’s what they might be looking for:

Your credit history tells a story about your financial habits. The most powerful thing you can do is make sure the newest chapters are filled with consistent, on-time payments. That's how you ensure an old mistake doesn't stand in the way of your future goals.

The Ripple Effect of a Single Missed Payment

The damage from a late payment goes a lot deeper than just a ding to your credit score. Think of it like a domino—the first one to fall can set off a chain reaction, creating much bigger financial headaches down the road. It’s in this ripple effect where the true cost of a missed payment really starts to stack up.

The Immediate Hit: Penalty Rates

One of the most immediate and painful consequences is the dreaded penalty APR. Buried in the fine print of most credit card agreements is a clause that lets the issuer jack up your interest rate—often to a staggering 29.99% or more—after just one late payment. All of a sudden, any balance you're carrying becomes way more expensive, digging you into a deeper hole.

It doesn’t stop there. A single slip-up can also make you lose valuable perks, like a 0% introductory APR on a new card. One delinquency and poof—it's gone, replaced by a high standard interest rate. These secondary hits can quickly create a vicious cycle.

The Downward Spiral of Debt

When you combine late fees, penalty interest rates, and a lower credit score, getting back on track can feel like an uphill battle. The higher APR makes your balance swell faster each month, and your minimum payment might even go up, stretching an already tight budget. This kind of financial pressure makes it that much easier to miss another payment, and the problem just keeps compounding.

This domino effect can seriously jeopardize your long-term financial goals. For instance, the fallout from that one late payment can easily impact your mortgage rates and buying power when you're ready to buy a home.

And the data backs this up. Consumers who are late on even one account are between 36% and 64% more likely to have a subprime credit score three years later. If that spirals into two or more delinquent accounts, the likelihood of having a subprime score shoots up by 77% to 112%. You can dig into the full findings on this topic to see just how delinquency impacts long-term credit health.

The key takeaway is pretty clear: a late payment is rarely a one-and-done event. It's often the starting point of a much tougher financial journey unless you tackle it head-on.

What to Do When a Payment is Late

So you missed a payment. The first thing to remember is not to panic. A single late payment is a setback, but it’s far from a financial death sentence. With a clear head and a few strategic moves, you can get things back on track and start minimizing the damage right away.

First, Pay the Bill Immediately

The second you realize you've missed a due date, your absolute first priority should be to pay the bill. Think of it as stopping the clock. If you can get the payment in before it's officially 30 days past due, you can often prevent it from ever being reported to the credit bureaus in the first place. No report means no damage to your score.

If you’re already past that 30-day window, paying up is still critical. Settling the account prevents a 30-day delinquency from escalating into a much more damaging 60- or 90-day late payment.

Next, Ask for a Goodwill Adjustment

Once you've paid the bill, it's time to pick up the phone and call your creditor. This is where you ask for something called a "goodwill adjustment." Essentially, you're asking them to do you a favor and remove the negative mark from your credit report as a one-time courtesy.

The key here is your history. If you've been a reliable customer for years and this is just a one-off mistake, your odds are much better. Be polite, be honest about why it happened, and gently remind them of your positive payment history. Lenders are often willing to help out a loyal customer who made an honest error. The worst they can say is no, and a successful removal can completely erase the damage.

Of course, sometimes a late payment is reported by mistake. If you're sure you paid on time and the delinquency is an error, you'll need to formally dispute it. For a step-by-step walkthrough, check out our guide on how to dispute credit report errors and win.

Finally, Prevent It From Happening Again

Let this slip-up be a powerful lesson. The easiest and most effective way to safeguard your credit score is to set up automatic payments for at least the minimum amount due on all your accounts.

This simple action acts as your safety net, ensuring that even if life gets hectic, your bills will always be paid on time. It's the single best thing you can do to build and maintain a perfect payment history from this point forward.

Your Top Questions About Late Payments Answered

Let's dig into some of the most common questions people have about late payments. We'll clear up a few myths and give you some practical ways to handle them.

Will a Payment That's Just a Few Days Late Hurt My Credit Score?

Thankfully, no. Your creditors typically won't report a payment as late to the credit bureaus until it's officially 30 days past its due date. But don't get too comfortable—you'll almost certainly get hit with a late fee from your lender and could even lose a promotional interest rate.

How Late Does a Payment Have to Be to Show Up on My Report?

There are specific timeframes when creditors report delinquencies, and each one carries more weight than the last.