Dispute Credit Report Errors: Proven Tips to Fix Mistakes

Why Your Credit Report Is Probably Wrong (And Costing You)

Let me tell you something: your credit report probably has errors. Seriously. I’ve been working in this field for a while, and the number of mistakes I see is astounding. I once helped a nurse, Sarah, who discovered a defaulted car loan on her report… for a car she never even owned! That single error added an extra $30,000 to her mortgage. Crazy, right?

These things happen more than you think. The credit reporting system, despite its importance, is flawed. Simple data entry slip-ups, mistaken identities, old information that just won't go away – these errors are a daily occurrence. And the worst part? They can snowball. A small problem today can become a massive financial headache down the road, impacting everything from apartment hunting to getting a business loan.

So, how can you tell if your report is messed up? First, check for accounts you don't recognize. This could be identity theft, or just a clerical error. Then, look at the dates and amounts on accounts you do recognize. A late payment that you know you paid on time can really ding your score. Lastly, double-check all your personal info. Something as simple as a wrong address or misspelled name can cause problems. For ITIN holders, specific considerations apply. You might find this helpful: itin credit report.

It’s important to understand just how common these errors are. A Federal Trade Commission (FTC) study revealed that 10 million Americans—that’s about 5% of the 200 million with credit reports—have errors serious enough to affect their loan or insurance rates. Check out the study! These mistakes happen because the credit bureaus process a massive amount of data, which creates a lot of room for error. Outdated systems and inadequate verification processes also contribute to the problem. Fixing these errors is vital for your financial health, so learning how to dispute them is a must-have skill.

Getting the Right Reports (Not Just the Free Ones Everyone Knows)

Most people grab their free annual credit report or check Credit Karma and think they’ve got the full picture. Honestly, it’s like looking at one piece of a giant jigsaw puzzle. You're missing crucial information! The credit world is more complex than it used to be, with all these niche bureaus and specialized agencies popping up. They might have data on you that you don’t even know exists.

Timing matters too. There’s a real strategy to when you pull your reports to make your dispute efforts as effective as possible. Some services are genuinely helpful; others just want to sell you expensive monitoring services you don’t need. The real trick is knowing which reports lenders actually use for the specific type of credit you're applying for. Mortgage lenders, for example, often look at different reports than credit card companies. Knowing this can save you so much hassle.

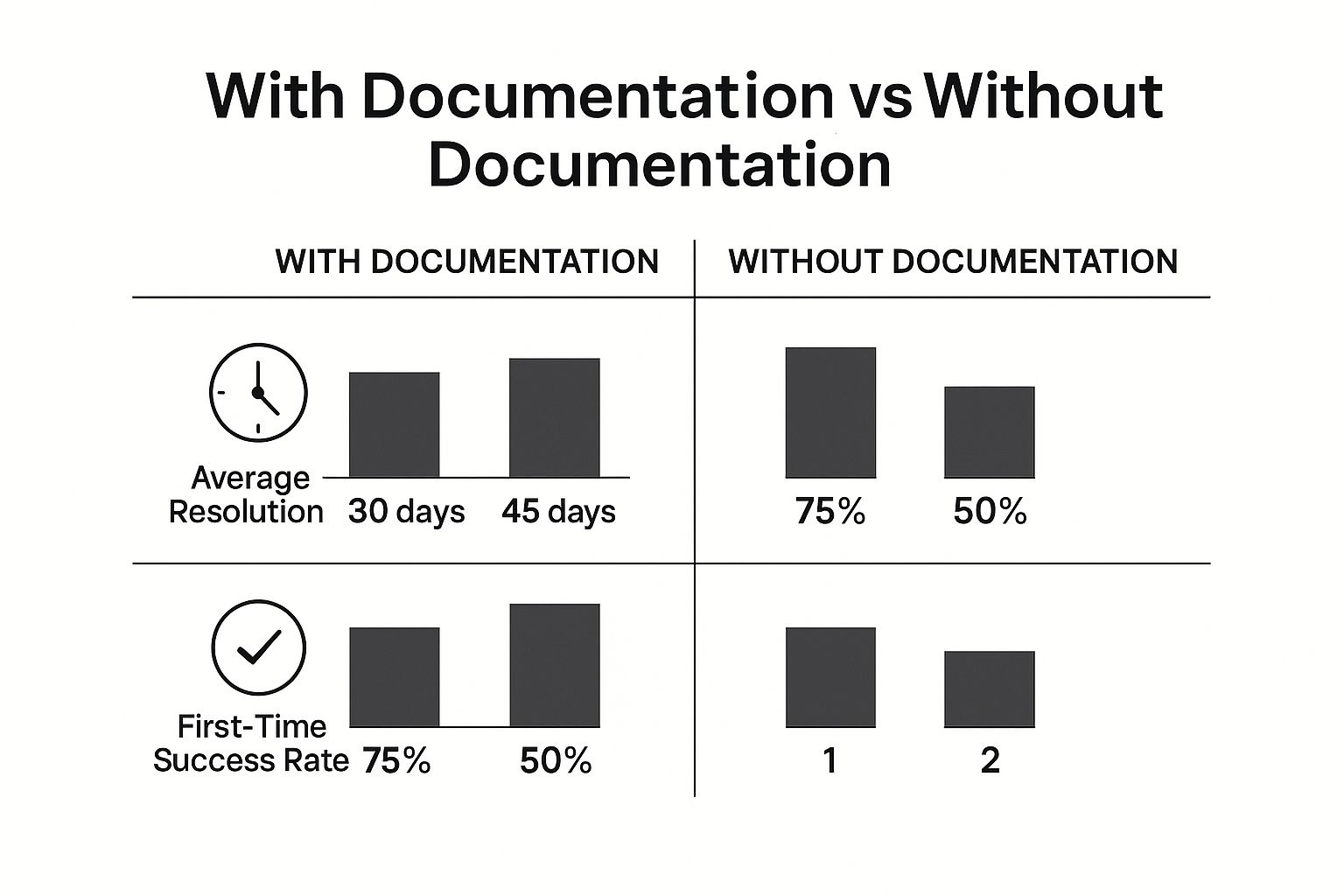

This infographic shows how much documentation helps when resolving disputes. It compares the average resolution time, first-time success rate, and the number of follow-up calls you'll need to make when you have documentation versus when you don't. Providing solid documentation significantly boosts your chances of a quick and successful resolution. You're looking at a 75% first-time success rate with documentation compared to only 50% without. Plus, you’ll spend way less time chasing updates.

Navigating the Credit Bureau Maze

So, where do you start? Begin with the big three – Experian, Equifax, and TransUnion. Requesting your reports directly from these bureaus (Experian, Equifax, and TransUnion) gives you the most complete overview. But don't stop there.

Depending on your situation, you might need to check specialized reports, like those used for employment screening or tenant background checks. And heads up! Big changes are coming to how credit is managed in 2025, including new scoring models and shifts in FICO scores. This video offers some good insights. These changes make it even more important to stay informed and proactive about your credit health.

Now, let's dive into a comparison of the major credit bureaus to help you understand their unique quirks and which ones you should prioritize.

Knowing the strengths and weaknesses of each bureau can help you target your dispute efforts effectively. Here's a table breaking down the key differences:

Credit Bureau Comparison: What Each Report Actually Covers A detailed breakdown of what information each major credit bureau tracks, their dispute quirks, and which one to prioritize based on your situation.

This table provides a general overview, and the actual response times and dispute processes can vary. It's always a good idea to check the specific bureau's website for the most up-to-date information.

We’ll get into the specifics of getting these reports and setting up a smart monitoring system later on.

Reading Your Report Like a Pro (What Others Miss)

Let's be honest, going through a credit report can feel like trying to understand a foreign language. I've looked at thousands of these reports, and I can tell you, most people miss important stuff. They get hung up on the obvious errors—like an account that isn't theirs—but completely overlook the sneaky little inaccuracies that can really tank their scores. Think incorrect dates that make your credit history look shorter, or a random late payment you know you paid on time.

I even had a client once who was listed as deceased on one of the bureau reports. Try getting a loan when you're officially dead! It sounds crazy, but it happens. That's why having a systematic way of reading your report is so important for disputing errors effectively. Don’t just skim; really dig into every single section.

Key Areas to Scrutinize

Here's what you absolutely need to examine, plus some real-life examples of errors I've actually seen:

Knowing Which Battles to Fight

Not every error is a five-alarm fire. Some, like incorrect personal information or serious payment history errors, demand immediate action. Others, like small differences in account balances, might fix themselves over time as reporting updates. Knowing which discrepancies to focus on first will make your dispute efforts much more effective. Some errors just point to bureaucratic mistakes, while others could be something much worse – like identity theft. Knowing the difference helps you figure out the best way to respond and protect yourself financially.

Writing Dispute Letters That Get Taken Seriously

Forget those generic online templates. Seriously. The credit bureaus can spot them a mile away, and they often end up in the digital equivalent of a dusty filing cabinet. I've seen it happen time and time again – folks use these templates, expecting miracles, and then wonder why their credit reports remain unchanged. The secret? Understanding how the bureaus operate and what actually catches their eye. A winning dispute letter is like a well-told story – clear, concise, packed with specific details, and backed up by rock-solid, easy-to-verify evidence.

Instead of simply stating "this account is wrong," dive into the specifics. Explain exactly what's incorrect, when the information should have been updated, and provide the documentation that proves your point. Let's say a payment is marked late, but you have a bank statement showing it was made on time. Boom. There's your proof. This level of detail demonstrates that you're not messing around and that you've done your homework.

Take a look at this screenshot from the Consumer Financial Protection Bureau (CFPB) website. It showcases sample dispute letters and stresses the importance of including precise details, such as account numbers and the dates of any incorrect information. The CFPB also recommends sending your dispute letter via certified mail. This not only allows you to track its delivery but also provides solid proof that the bureau received it. This screenshot offers some really useful insights into maximizing the effectiveness of your dispute.

Crafting a Compelling Narrative

Think of your dispute letter as a mini-legal brief. You're presenting a case, and you need to be convincing. Here's what makes a dispute letter stand out:

Common Mistakes That Can Hurt Your Case

Just as there are things that can strengthen your dispute, there are things that can weaken it. Here are some common pitfalls to avoid:

Remember, the key is persistence combined with professionalism. By following these guidelines, you’ll significantly improve your chances of getting those credit report errors corrected and boosting your overall credit health.

Following Up Without Losing Your Sanity

This is where so many people just give up. I totally understand. Disputing credit report errors can feel like a never-ending battle against form letters, slow responses, and investigations that seem to vanish into thin air. It can be incredibly frustrating. But honestly, hanging in there is often the key to winning this fight.

Think of credit bureaus as massive customer service departments drowning in a sea of data. Knowing how they operate internally can help you navigate the system effectively. There's a sweet spot between persistent and pesky. Push too hard, and your disputes might end up getting less attention, which defeats the purpose.

Tracking Your Disputes: Stay Organized

So, how can you keep track of everything without pulling your hair out? Organization is your best friend. A simple spreadsheet or even a notebook can work wonders. Just jot down the date you submitted the dispute, which credit bureau you contacted (Experian, Equifax, or TransUnion), the specific error you're challenging, and any reference numbers they provide. This creates a clear timeline of your efforts.

Decoding Bureau Responses: What They Really Mean

When you finally hear back, the responses can be confusing. Let me break down some of the most common ones:

When to Escalate: Getting Help From the Big Guns

Sometimes, even with rock-solid evidence, bureaus will still verify incorrect information. If you’ve hit a wall, it’s time to bring in reinforcements. The Consumer Financial Protection Bureau (CFPB) https://www.consumerfinance.gov/ is a powerful resource. They can help resolve disputes that the bureaus are dragging their feet on. Contacting your state's Attorney General is another option.

Handling Persistent Errors: Don't Give Up

Even after escalating, some errors might stubbornly stick around. Here are a few more strategies:

Remember, keeping detailed records and knowing when to apply pressure are your strongest tools. Disputing credit report errors is a marathon, not a sprint. Don’t give up. Your persistence can absolutely make a difference.

Understanding the System Behind the Madness

Your credit report dispute isn't just some random thing you're doing. It's actually part of this huge, complex financial system. And knowing how this system works can really help you make your dispute more effective. For example, did you know credit bureaus make most of their money selling your data to lenders, not helping consumers like us? That tells you a lot about what's important to them. If you’re an ITIN holder, this might be particularly relevant: Banks That Accept ITIN.

Also, there's more pressure on credit bureaus these days to be more accurate because of increasing regulations. This is great news for us! It's like the referees are finally paying attention to the game, so now's the perfect time to point out the fouls. Knowing the rules and how they’re enforced gives you a real leg up.

The Shifting Landscape of Credit Reporting

The credit world is always changing. New ways of calculating credit scores and different sources of data are changing how disputes are handled, too. Some new technologies claim to make things more transparent, which is fantastic. But they can also introduce brand new types of errors we’ve never even seen before. Think of it like a software update – sometimes it fixes bugs, but sometimes it creates new ones!

So, keeping up with these changes in the industry can help you pick the right time to file a dispute. You can also make arguments that regulators are more likely to pay attention to. For example, if regulators are focusing on medical debt reporting accuracy, make sure to point out any problems in that section of your report. It shows you know what they care about.

Even though about 80% of global banking groups had stable ratings as of early 2025, disputing errors on credit reports, especially for large groups of consumers, still has a real impact on the financial system. Discover more insights. This just shows how important it is to see the bigger picture when you're disputing something on your own report.

Seeing the Bigger Picture

Understanding these bigger trends helps you be more strategic with your dispute. You’re not just fixing one mistake; you’re part of something bigger—a movement toward more accurate credit reporting. Think of it as a collective effort to hold credit bureaus accountable and make the system better for everybody. This can really keep you motivated and persistent, even when the process feels long and frustrating. Knowing your efforts are part of a larger goal can make a huge difference.

To help you visualize how credit report corrections can affect your life, take a look at this table:

Impact Timeline: How Credit Report Corrections Actually Affect Your Life

A realistic timeline showing when different types of credit report corrections typically impact your score and open up new financial opportunities.

This table illustrates how different errors can have varying impacts and timelines for correction. While some errors, like incorrect payment history, can have a significant and relatively quick impact on your score, others, like incorrect personal information, might have less immediate effects. The key takeaway here is to understand that each correction plays a role in improving your overall credit health over time.

Your Personal Action Plan for Credit Success

Okay, let's talk about creating a realistic action plan for dealing with those pesky credit report errors. I know life gets busy, so this isn’t about some fantasy where you have hours to spare. Think of it as a marathon, not a sprint! Trying to fix everything at once usually just leads to burnout and, honestly, more mistakes.

We’re going to map out a practical timeline, focusing on the disputes that’ll make the biggest difference right away. Think of it like triage for your credit report. I'll share some checklists and point out things to watch for along the way. Even more importantly, I'll help you get into the right mindset for this process. Some fixes will be quick, but others could take months. Knowing that upfront keeps you from getting discouraged.

Prioritizing Your Disputes

First, zero in on the errors that directly impact your ability to get a loan, rent an apartment, or even get a new cell phone plan. Things like incorrect payment history, accounts that don't even belong to you, and balances that are way off the mark—those are your top priorities. They have the biggest impact on your credit score. After that, we can tackle stuff like incorrect personal info or smaller discrepancies. Those are still important for accuracy, but they’re not as urgent.

Creating Your Timeline

Don’t try to do everything at once! Break it down into bite-sized pieces you can actually handle. For example, maybe dedicate one evening a week to working on your credit. Set realistic goals, too. Maybe you focus on disputing just one item per week, or reviewing one section of your report each time. The secret sauce here is consistency. Trust me, small, regular efforts are way more effective than sporadic bursts of activity.

Building Healthy Credit Habits

Fixing current errors is a great start, but preventing future ones is just as important. Get in the habit of regularly checking your credit reports from all three major credit bureaus: Experian, Equifax, and TransUnion. Set up alerts for changes to your accounts—this can help you catch errors early on before they snowball. Also, good financial habits like paying your bills on time and keeping your credit card balances low will not only improve your credit but also make your financial life so much smoother.

Look, this whole process is about making progress, not achieving perfection. Every step you take towards a more accurate and healthy credit report brings you closer to better financial opportunities and, honestly, more peace of mind. Ready to take control of your credit journey? Itin Score has the tools and support you need to build a strong credit history, even without a Social Security number. Sign up today and start building a brighter financial future.