Difference Between FICO and Vantage: Key Comparison You Need

When you start digging into your credit, you'll quickly notice two names pop up everywhere: FICO and VantageScore. They both try to do the same thing—boil down your credit risk into a single three-digit number—but they get there in slightly different ways, and lenders often have a clear preference for one over the other.

The biggest difference comes down to history and who's using them. FICO is the original, the one lenders have trusted for decades, especially for huge decisions like mortgages. VantageScore is the newer player, a joint effort by the three major credit bureaus (Experian, Equifax, and TransUnion) designed to be more inclusive and consistent across all three reports.

Because their underlying math is different, your FICO score and VantageScore can, and often will, be different. This isn't a mistake; it's just two different expert opinions on your credit history.

FICO vs. VantageScore: A Quick Comparison

Think of FICO as the long-established industry standard. Created by the Fair Isaac Corporation, it became the gold standard for lenders, and for a long time, it was the only score that really mattered. Its dominance, especially with mortgage lenders, is built on decades of trust and predictive data.

VantageScore, on the other hand, was developed to create a more unified system. The bureaus wanted a single model that worked consistently with data from all three of them, and one that could also score more people.

Core Differences: FICO vs. VantageScore

Let's break down the fundamental distinctions. This table gives you a high-level look at what sets these two scoring giants apart.

If you're wondering what separates a "good" score from an "excellent" one in either model, our guide on what credit score ranges explained offers a much deeper dive.

At the end of the day, both scores are analyzing the same core information from your credit reports. The variations you see come from the fact that they place different levels of importance on certain factors, which can influence which credit products you get approved for.

The History Behind Each Credit Score Model

To really get the difference between FICO and VantageScore, you have to look at where they came from. Their origins tell two different stories about credit reporting, and those stories explain a lot about the scores you see today.

The story starts with the FICO score. When the Fair Isaac Corporation rolled it out in 1989, it was the very first standardized credit scoring system. Before FICO, getting a loan was often a subjective process, depending heavily on a loan officer’s personal judgment, which could be inconsistent and even biased.

FICO turned the whole system on its head. It introduced a single, data-driven number that predicted how likely someone was to repay a loan. For decades, it was the undisputed king of credit scoring. This long-standing dominance is why FICO is so deeply woven into the American financial system, especially in the mortgage industry, where over 90% of lenders still rely on it.

The Rise of a Challenger

For years, the three big credit bureaus—Equifax, Experian, and TransUnion—used different versions of FICO's algorithm. This meant the same person could have slightly different scores from each bureau, which created a lot of confusion for lenders and consumers alike.

So, in 2006, these three rivals did something unusual: they teamed up. Together, they created their own model, VantageScore, designed to be a more consistent and inclusive alternative. The goal was simple: create a single, unified scoring system that would give you a similar score no matter which bureau’s data was being used.

This basic difference in origin—one created by an independent analytics company, the other by the credit bureaus themselves—is the foundation for all their other distinctions. FICO’s legacy gives it deep-rooted trust, while VantageScore's collaborative design was built from the ground up to solve modern problems like consistency and financial inclusion. While both models aim to measure risk, their unique histories shaped their algorithms and how they’re used by lenders everywhere.

Why Your Score Can Vary Between Models

Have you ever checked your score on a credit app, saw a 720, then applied for a loan only to have the lender say it’s a 705? It’s a classic, and often frustrating, situation. But it doesn't mean one score is "right" and the other is "wrong." This happens because you don't have just one single credit score.

You actually have many scores, and the number you see depends entirely on who is calculating it. Both FICO and VantageScore look at the exact same raw data from your credit report, but they interpret it through different statistical models.

Think of it this way: two expert chefs are given the same set of ingredients—flour, sugar, eggs. Their unique recipes and techniques will inevitably produce two slightly different cakes. It’s the same with your credit. FICO and VantageScore analyze your payment history, debt, and other data, but their proprietary algorithms weigh each factor differently, leading to a different final number. Understanding this is central to knowing what is a credit score in the first place.

Understanding Score Distribution

One of the key technical differences is how each model distributes scores across the population. FICO’s model, refined over several decades, tends to create scores that are more clustered around the national average. VantageScore, on the other hand, often produces a wider, more spread-out range of scores.

What does this mean for you? You might see bigger differences at the high and low ends of the credit spectrum. Someone with a fantastic credit history could see an even higher VantageScore than FICO score, while a person with a challenged history might get a lower one.

A 2025 study by Milliman revealed that VantageScore produces scores that are, on average, about 1.44% higher than classic FICO scores for the same group of people. The analysis also noted that VantageScore has a greater standard deviation, which confirms that wider spread. The most significant differences were for people with scores below 620 and above 780.

How Technical Models Create Different Outcomes

The specific formulas behind these scores are closely guarded trade secrets, but we know they prioritize data differently. For example, the latest VantageScore models incorporate something called "trended data." This doesn't just take a snapshot of your credit today; it looks at the trajectory of your financial behavior over time.

Here’s how that plays out in the real world:

These subtle differences in calculation are exactly why your score will always vary. The best approach isn't to fixate on one specific number. Instead, focus on the fundamental habits that build strong credit across the board: always pay your bills on time and keep your debt manageable. Those actions will lift all your scores, regardless of the model being used.

Comparing the Key Scoring Factors

Think of FICO and VantageScore as two chefs trying to bake the same cake—your creditworthiness—using the same five ingredients from your credit report. While the ingredients are identical, their recipes are slightly different. Each model gives a little more weight to certain factors, which is exactly why your F-ICO score might not match your VantageScore.

Knowing these subtle differences is key to understanding what's really happening behind the scenes. It explains how one financial move, like applying for a new credit card, can be viewed differently depending on which scoring model a lender pulls.

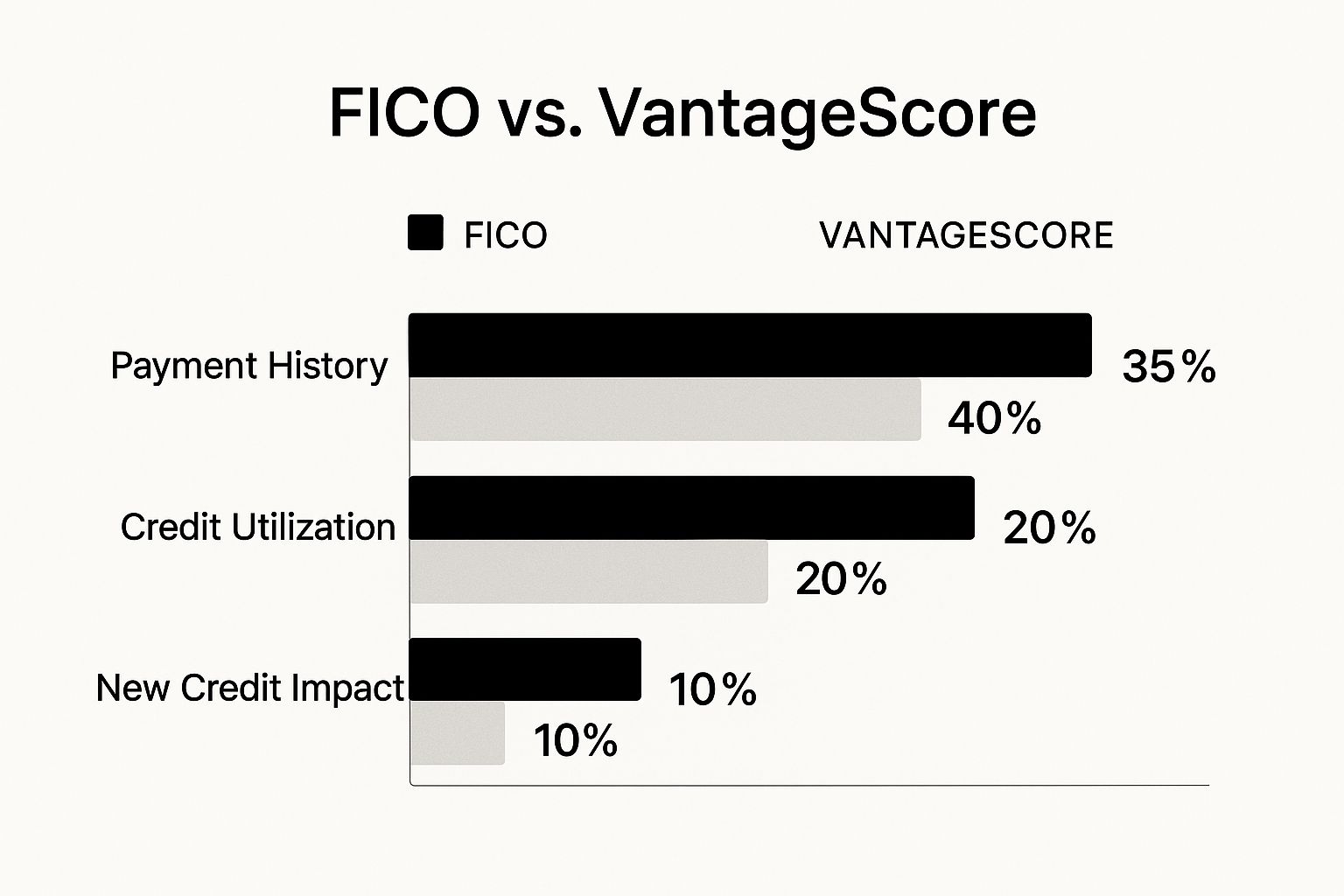

How Each Model Weighs Your Credit Behavior

FICO is pretty upfront about its recipe, giving us clear percentages for each scoring factor. VantageScore is a bit more descriptive, labeling factors by their "influence level"—think "extremely influential" or "highly influential" instead of hard numbers.

Let's break down how each model prioritizes your credit data.

Here's a look at how FICO and VantageScore weigh the key factors that determine your credit score. This table really highlights the subtle but important differences in their methodologies.

Factor Weighting FICO vs VantageScore

As you can see, both models agree that paying your bills on time is the most important thing you can do. But they start to diverge on things like how much debt you're carrying and for how long.

Payment History and Credit Utilization: The Big Two

No surprise here: your track record of paying bills on time is the heavyweight champion for both scoring models. It's the foundation of good credit. That said, VantageScore labels it "extremely influential," which experts often interpret as having a weight closer to 40%.

The image below gives a great visual of how the most impactful factors stack up against each other.

Seeing it laid out like this makes it clear. While the core principles are the same, the small shifts in emphasis are what lead to different scores from the very same credit report.

Credit Mix and New Credit: The Supporting Roles

Both FICO and VantageScore like to see that you can juggle different types of debt, like credit cards, an auto loan, or a mortgage. This is what's known as your credit mix. If you want to dive deeper into this concept, you can learn more about what credit mix is and why it matters.

Where they really part ways is in how they view new credit applications. VantageScore tends to be more forgiving when it comes to "rate shopping." For instance, when you're looking for the best deal on a car loan, you might apply with several lenders in a short time. Both models are smart enough to group these hard inquiries together within a 14-day window and treat them as a single event.

However, VantageScore's algorithm is often a bit more lenient with these grouped inquiries. This means you might see less of a temporary dip in your VantageScore than you would with your FICO score after shopping for a loan.

Which Score Do Lenders Actually Pull?

It's one thing to understand the technical differences between FICO and VantageScore, but what really counts is knowing which score a lender will actually look at when you apply for credit. The truth is, it's not a simple answer—it usually comes down to what you're applying for.

This split isn't random. It’s a result of decades of industry habit, risk modeling, and the slow but steady march of new technology.

FICO Still Reigns in Mortgage Lending

When it comes to the biggest financial decisions, FICO is still the undisputed king. Its long-standing presence in the market gives it a huge leg up, especially in industries that rely on deeply established risk assessment models.

If you're applying for a mortgage, you can bet the lender is pulling your FICO score. This isn't just a matter of preference; it’s a hard requirement from government-backed giants like Fannie Mae and Freddie Mac, which buy up most of the mortgages in the U.S.

Because these institutions demand classic FICO scores, nearly every mortgage lender in the country falls in line. For anyone hoping to buy a home, this makes tracking your FICO score an absolute must. A great FICO score is your key to getting approved and locking in a good interest rate.

VantageScore's Growing Footprint

While FICO has a firm grip on the mortgage world, VantageScore is quickly gaining ground everywhere else. It's becoming especially popular in sectors that need to make fast, high-volume lending decisions.

You’re most likely to see VantageScore used by:

This visibility has made VantageScore a household name. It gives millions of people an easy, free way to keep an eye on their credit. This, in turn, has given more lenders the confidence to adopt it as a trustworthy measure of credit risk, which only strengthens its position in the market.

So, which score should you track? Honestly, both. Use the free apps to monitor your VantageScore for a regular gut check on your financial health—the actions that move one score will almost always move the other.

But if a big-ticket item like a house is in your future, make sure you know your FICO score. That's the number your mortgage lender will be laser-focused on. At the end of the day, building solid credit habits will lift both scores over time.

How Each Model Handles Financial Inclusion

Here's where we see a major philosophical difference between FICO and VantageScore: their approach to financial inclusion. While both models want to predict risk, VantageScore was built from the ground up to score millions of people who are essentially "credit invisible" to older, more traditional FICO models.

This group includes people with thin credit files—think young adults just starting out, recent immigrants building their financial lives, or even someone who simply hasn't needed credit in years. An older FICO model might not generate a score without at least six months of credit history, but VantageScore can often do it with just a single month of reported activity. It sounds like a small tweak, but the impact is massive.

This single change opens up access to mainstream financial products, like credit cards and personal loans, for millions of people who were previously locked out. For lenders, that translates to a much larger pool of potential borrowers.

Expanding Access Without Sacrificing Accuracy

The obvious question is, does scoring more people automatically mean taking on more risk? VantageScore’s answer is a firm no. They tackle this by pulling in a wider range of data and using more sophisticated analytics to keep their predictions sharp, which is good news for everyone involved.

One of their key tools is trended data. Instead of just looking at a single snapshot of your debt, this method analyzes the trajectory of your financial habits over time. It can see if you're consistently paying down balances, which tells a much richer story about your responsibility than a single number ever could. This allows the model to spot low-risk individuals, even if their credit files aren't very thick.

And this isn't just theory—the numbers back it up. In a massive 10-year study on mortgage lending, VantageScore 4.0 proved to be more accurate than classic FICO. It identified 11.2% more mortgage defaults among the highest-risk group, which represents a 3.5% relative improvement in predicting which loans would become seriously delinquent.

Ultimately, VantageScore’s inclusive design creates a win-win. It empowers lenders to grow their customer base safely while giving underserved communities a vital pathway to build credit and work toward financial stability.

Answering Your Top Credit Score Questions

Getting to grips with credit scores can feel like learning a new language. Let's clear up some of the most common questions that pop up when you're looking at your FICO and VantageScore numbers.

Why Do I Have Different FICO and VantageScore Numbers?

It’s completely normal to see different numbers from FICO and VantageScore. Think of it like two expert mechanics inspecting the same car—they're both looking at the same engine, but they might have slightly different opinions on its performance because they prioritize different things.

While both models analyze the same credit report from Equifax, Experian, or TransUnion, they use their own secret sauce—proprietary algorithms. They weigh factors like your payment history, how much debt you're carrying, and the age of your accounts differently. This difference in calculation is the main reason your scores don't match up perfectly.

VantageScore also has a reputation for being a bit more inclusive. It's often able to generate a score for people with less credit history, sometimes called a "thin file." So, you might find you have a VantageScore even before you have enough data for FICO to calculate one.

Which Score Matters More?

This is the big question, and the answer really depends on what you're trying to do. If a mortgage is on your horizon, your FICO score is king. The vast majority of mortgage lenders rely on FICO models to make their decisions, so that’s the number you’ll want to watch closely.

For other types of credit, it's a mixed bag. Credit card issuers, auto lenders, and personal loan companies use both FICO and VantageScore models, so either one could come into play. Many of the free credit monitoring apps you use on your phone will show you a VantageScore. It’s smart to keep an eye on both to get a well-rounded view of where you stand.

How Can I Improve Both My FICO and VantageScore?

Here’s the good news: you don't need two separate game plans. The fundamental habits that build a strong credit history are universal. What helps one score will almost always help the other.

Instead of obsessing over a specific model, focus on these core credit-building behaviors: