Master Your Finances With a Debt Repayment Calculator

A debt repayment calculator is your personal financial GPS. It takes all those confusing numbers and turns them into a clear, actionable roadmap for getting out of debt for good. By plugging in your specific loan details, it can project your debt-free date and, more importantly, show you how different payment strategies can get you there faster.

Why a Debt Calculator Is Your First Step to Freedom

Staring at a pile of debt can be paralyzing. I've seen it time and time again. But gaining clarity is the first real step toward taking back control. Instead of just guessing or feeling anxious, a good calculator provides a tangible plan, turning that anxiety into focused action. Think of it as your strategic partner, helping you see the light at the end of the tunnel.

The whole process starts with a bit of detective work: gathering all the key details for each of your debts. This information is the bedrock of your entire plan. Getting it right is the most critical part, because the calculator needs accurate data to give you a realistic projection.

Gathering Your Financial Puzzle Pieces

To get a reliable payoff schedule, you need to be precise. Even a small mistake in an interest rate or balance can throw off your timeline significantly. Before you start, you'll need to collect a few key pieces of information for every single loan and credit card you have.

The table below breaks down exactly what you need and why it's so important.

Essential Data for Your Debt Repayment Calculator

Having this data laid out gives you a powerful, bird's-eye view of your financial situation.

Understanding these core concepts is a cornerstone of personal finance. For those new to the U.S. financial system, building this foundation is especially crucial. Taking the time to master the basics of financial literacy for immigrants can give you the confidence you need to tackle debt head-on.

Once you have this information, the calculator can show you exactly how long it will take to become debt-free if you stick with your current payments. But the real magic happens when you start playing with the numbers to see how you can speed things up and save a ton of money in the process.

Building Your Complete Financial Inventory

Before you can start planning your escape from debt, you have to get brutally honest about where you stand right now. Accuracy is everything here. A debt repayment calculator is a powerful tool, but it's only as smart as the numbers you feed it. Think of this initial step as a fact-finding mission.

Your first job is to create a complete and detailed picture of every single dollar you owe. This goes way beyond just listing who you owe money to. To really make this work, you need to dig up the specific details that will fuel your payoff strategy.

Finding Your Key Debt Details

For every loan and credit card, you need to hunt down three critical pieces of information:

Most of the time, you can find all of this on the first page of your most recent statement, usually in a summary box. If you've gone paperless, just log in to your account online. I usually find what I need under a tab like "Account Details" or "Loan Information."

What if you have a variable APR that fluctuates? Just use the rate shown on your latest statement. It's the most accurate number you have for creating a solid plan.

It’s easy to hit a snag, especially with older loans where paperwork is scattered or with student loans that are split into multiple groups. If you're having trouble tracking down federal student loan details, the official Federal Student Aid website is your best bet. For anything else, don't hesitate to just call the lender directly. It might feel like a hassle, but a quick phone call is the surest way to get accurate numbers and build a plan you can trust.

Choosing Your Debt Payoff Strategy

This is where the magic really happens. A good debt repayment calculator lets you test-drive different payoff philosophies, so you can see what actually works for your budget and, just as importantly, your personality. Most people land on one of two powerhouse methods: the Debt Snowball or the Debt Avalanche.

Your choice really boils down to one question: What gets you fired up—quick wins or long-term savings? There’s no wrong answer here, only the one that you'll actually stick with.

The Debt Snowball Method

The Debt Snowball is all about momentum. Think of it as a psychological game-changer. You'll make the minimum payments on all your debts, but you'll throw every spare penny at the one with the smallest balance, completely ignoring the interest rate for now. Once that first debt is history, you take the entire amount you were paying on it and "roll it over" to the next-smallest debt.

Knocking out an entire account, even a small one, feels amazing. It's that feeling of progress that gives you the motivation to see the whole plan through.

The Debt Avalanche Method

On the flip side, the Debt Avalanche is pure math. With this strategy, you target the debt with the highest interest rate (APR) first, while still making minimums on everything else. It might take a bit longer to get your first "win" by paying off a full account, but this approach is guaranteed to save you the most money in interest charges over time.

Let's look at a quick example. Imagine you're juggling two debts:

If you go with the Debt Snowball, you’d attack the $2,500 credit card first simply because it's the smaller balance. If you chose the Debt Avalanche, you'd also attack the credit card first, but for a different reason—its sky-high 21% APR.

In this particular scenario, both roads lead to the same starting point. The real difference between the two methods becomes clear when you have several debts with a jumble of different balances and interest rates.

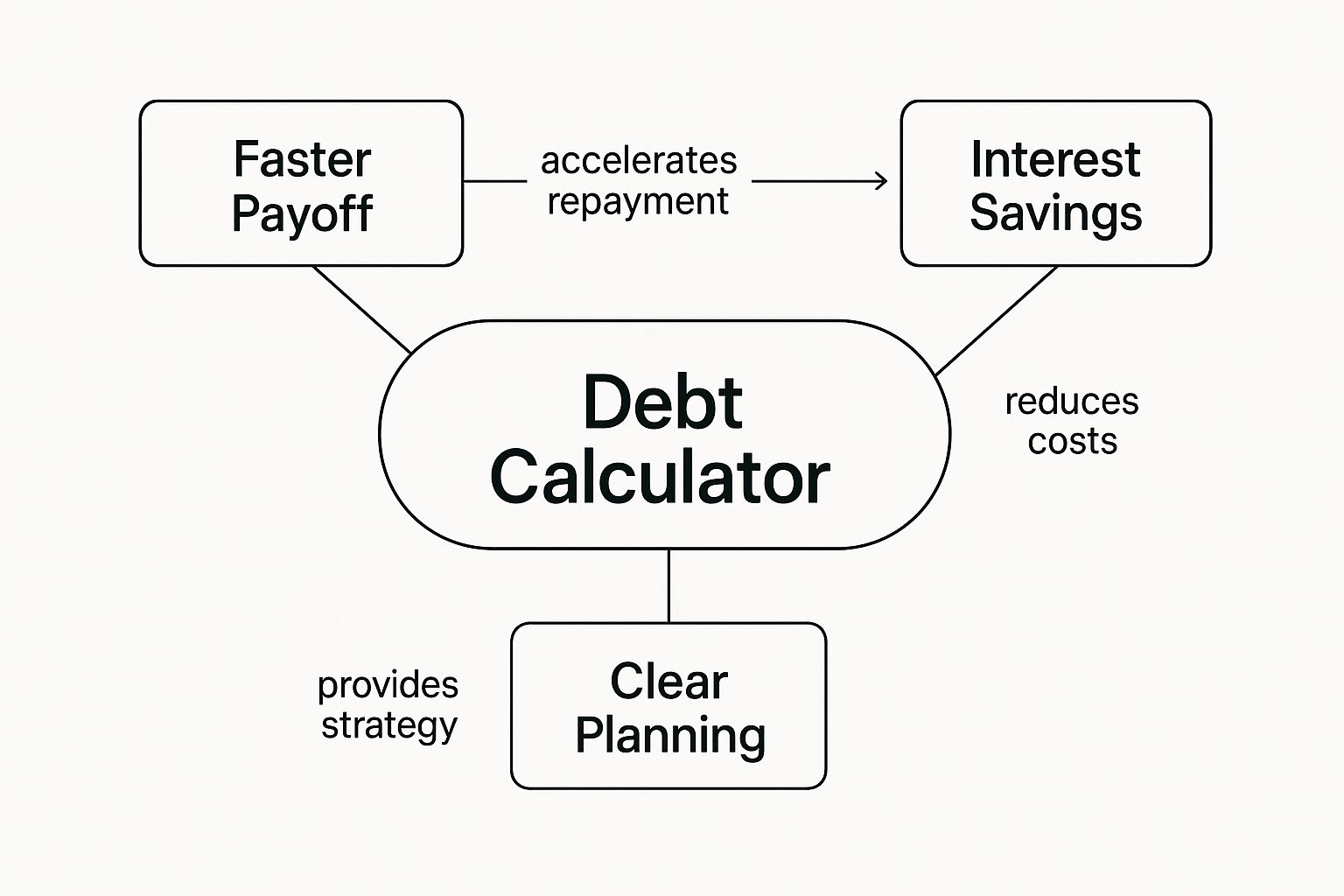

The calculator helps bring the benefits to life, showing exactly how a clear plan can speed up your payoff and save you a bundle in interest.

This visual really drives home the point: having a structured plan is your ticket to getting back in control. In a time when public debt has climbed to around $100 trillion globally, rising interest rates make every type of debt more expensive. This environment makes having a smart personal finance strategy more critical than ever. You can read more about this global financial pressure and the need for effective debt management to understand the bigger picture.

How to Speed Up Your Repayment Plan

Alright, you've picked your core strategy—avalanche or snowball. Now it's time to really kick things into high gear. A debt repayment calculator isn't just for plotting a course; it's a simulator. It gives you a crystal-clear preview of how the choices you make today will reshape your financial future.

This is where the real magic happens. By modeling how small, consistent extra payments affect your timeline, you can find the fast track to becoming debt-free. The results are often more dramatic than you'd expect.

The Impact of Small Extra Payments

Let’s try a quick experiment. Head back to your calculator and zero in on your highest-interest debt. Now, add just $75 to the monthly payment for that one account. See what happens? The payoff date moves up, and the total interest you’ll pay drops significantly.

I’ve seen clients shave years off their repayment schedules and save thousands in interest just by committing to a small extra payment like this. It transforms the calculator from a passive planning tool into an active weapon in your fight against debt.

The idea isn't to slash your budget to the bone. It's about making small, strategic adjustments that deliver a huge return for your financial well-being.

What to Do With Financial Windfalls

So, what happens when you get a one-time cash infusion? This could be a tax refund, a bonus from work, or even a small inheritance. Your gut reaction might be to splurge, but your calculator can reveal a much more powerful alternative.

Before that money even lands in your bank account, plug the amount into your calculator as a one-time extra payment. Apply it directly to your highest-interest debt and watch the payoff timeline shrink. Seeing that immediate, positive impact is incredibly motivating.

This kind of proactive planning is more important than ever. With global debt recently hitting a record $318 trillion, strong personal finance habits are essential. You can explore more about these global trends and what they mean for effective debt management on iif.com.

Being prepared also helps you handle unexpected financial shocks. A safety net is non-negotiable, which is why we created a guide on how to start an emergency fund. Use your calculator to see how building one fits into your overall plan to get out of debt for good.

Keeping Your Momentum: Staying Motivated and Adapting Your Plan

Let's be real: creating a plan with a debt repayment calculator is the easy part. The real work is sticking with it when life inevitably gets in the way. Your income might go up (or down), and unexpected expenses are always lurking around the corner. The best way to succeed is to think of your payoff plan not as a rigid contract set in stone, but as a living, breathing guide that can adapt with you.

I always tell people to treat their plan as a dynamic tool. I make it a point to revisit my own financial plans at least once a quarter, and definitely after any big life change—like a promotion, a new job, or a surprise expense. Pulling up your calculator and plugging in the new numbers lets you see exactly how your debt-free date shifts. This simple check-in keeps your goals grounded in reality and, more importantly, keeps you fired up to continue.

How to Handle Financial Curveballs

So, what do you do when the car breaks down or a medical bill lands in your lap, threatening to derail your progress? It’s incredibly easy to feel defeated in those moments. But a setback isn't a failure.

The number one rule is: don't abandon the plan. Pause your extra debt payments if you need to, handle the emergency, and then jump right back on track as soon as you're able. The goal here is progress, not perfection.

Even on a massive scale, financial plans need to be flexible. With global public debt projected to soar above 95% of GDP, you can see how crucial smart, adaptable planning is for everyone, from governments to individuals. You can read more about these worldwide financial shifts and the importance of fiscal discipline on imf.org.

This journey is also the perfect opportunity to build stronger financial habits for the long haul. As you get a handle on your debts, it’s a great time to learn how to establish credit. Building a solid credit history now will open up better financial opportunities for you down the road.

Common Questions About Using a Debt Calculator

Even the best tools can spark a few questions. When you're staring down your debt, it’s only natural to wonder if you're using your calculator to its full potential. Let's dig into some of the things people ask most often.

One of the biggest debates is always Snowball vs. Avalanche. The Debt Avalanche, where you tackle the highest-interest debt first, is the clear winner on paper—it will always save you the most money. But don't discount the psychological power of the Debt Snowball, where you knock out your smallest debts first for quick, motivating wins.

The best part about a calculator? You don't have to guess. You can run the numbers for both scenarios and see the exact difference in interest paid and the time it takes. This lets you choose the path that works for your wallet and your motivation.

How Often Should I Revisit My Payoff Plan?

Think of your debt payoff plan as a living document, not something you set in stone and forget. Life changes, and your plan should change with it.

A good rule of thumb is to check in and update your calculator at least quarterly. More importantly, you should fire it up immediately after any major financial shift, like:

Keeping your plan current ensures it reflects your real-world situation. This is how you stay on the most efficient track to becoming debt-free.

This is incredibly useful for navigating complex debt like student loans. Repayment plans can change, and proposed adjustments might drastically alter your monthly payments. A calculator gives you the clarity to compare your options and proactively manage your payments, rather than just reacting to them.

Take control of your financial future today. itin score provides the tools and insights ITIN holders need to build credit and unlock better financial opportunities. Get your free, personalized credit-building plan at https://www.itinscore.com.