Top Credit Utilization Tips to Boost Your Score in 2025

Unlocking Your Financial Potential: Credit Utilization Tips for ITIN Holders

Building strong credit as an ITIN holder is key for financial success in the U.S. A critical factor influencing your credit score is your credit utilization ratio. This metric significantly impacts your access to loans, interest rates, and overall financial goals. This guide provides eight actionable credit utilization tips specifically for ITIN holders. These strategies will empower you to take control of your credit and build a brighter financial future. Learn how to maximize your credit potential with these targeted credit utilization tips.

1. Keep Credit Utilization Below 30%

Maintaining a healthy credit utilization ratio is paramount for building a strong credit history, especially for ITIN holders navigating the US credit system. This fundamental principle revolves around keeping your total outstanding credit card balances below 30% of your total available credit. Credit utilization is a significant factor influencing your credit score, comprising roughly 30% of your FICO score calculation. It's determined by dividing your total credit card balances by your total credit limits.

This ratio demonstrates to lenders how responsibly you manage your available credit. A lower ratio suggests you're not overly reliant on credit, which can signal lower risk to potential lenders. Conversely, a high utilization ratio, even with on-time payments, can imply financial strain and increase perceived risk. For ITIN holders, who may have fewer credit opportunities, managing credit utilization meticulously is even more crucial. Learn more about optimizing your ITIN and credit report at Learn more about....

Examples of Effective Credit Utilization Management

Actionable Tips to Maintain Healthy Credit Utilization

Why Prioritize Keeping Credit Utilization Below 30%?

This practice directly impacts your credit score, influencing your access to loans, credit cards, and even rental applications. By maintaining a low utilization ratio, you demonstrate responsible credit management, making you a more attractive borrower. For those with ITINs building a credit history in the US, consistent adherence to this principle can be particularly advantageous. This strategy is recommended by leading authorities such as FICO, VantageScore, and the Consumer Financial Protection Bureau (CFPB), highlighting its significance in the credit landscape.

2. Aim for Single-Digit Utilization (Under 10%)

While maintaining credit utilization below 30% is a good starting point, striving for single-digit utilization (under 10%) can significantly boost your credit score, especially for ITIN holders working to establish strong credit in the US. This advanced strategy is often employed by consumers aiming for excellent credit scores (750+). Studies reveal that individuals with the highest credit scores typically maintain utilization rates between 1-10%. This demonstrates exceptional credit management to lenders.

Examples of Effective Single-Digit Utilization

Actionable Tips to Achieve Single-Digit Utilization

Why Prioritize Single-Digit Credit Utilization?

For ITIN holders, demonstrating responsible credit management is paramount. Single-digit utilization signifies exceptional financial responsibility, making you a highly desirable borrower. This practice directly impacts your creditworthiness, improving access to loans, favorable credit card terms, and even better rental opportunities. This strategy, popularized by credit experts like John Ulzheimer and practiced within the MyFICO community, provides a significant edge in the credit landscape, particularly for those building credit with an ITIN.

3. Pay Balances Before Statement Closing Date

Strategically timing your credit card payments can significantly impact your credit utilization ratio. This technique involves paying your balances before your statement closing date, rather than waiting for the due date. Credit card companies typically report your statement balance to the credit bureaus. Paying early ensures a lower reported utilization, even if you use your cards frequently throughout the month. This is especially crucial for ITIN holders who are actively building their credit profiles.

This strategy allows you to maximize your purchasing power without negatively impacting your credit score. It provides a more accurate representation of your spending habits to lenders. For ITIN holders, demonstrating responsible credit management through this practice can be particularly beneficial in establishing a positive credit history. Learn more about how paying balances before your statement closing date improves your credit utilization ratio at Learn more about....

Examples of Effective Pre-Statement Payment

Actionable Tips for Pre-Statement Payments

Why Prioritize Pre-Statement Payments?

Paying before the statement closing date directly influences the utilization ratio reported to credit bureaus, which is a major factor in credit scoring. This strategy helps present a more favorable picture of your credit management to lenders, ultimately improving your chances of securing loans and other credit products. For ITIN holders, this can be a powerful tool in building a strong credit foundation in the US. This method is a proven technique advocated by many financial experts for optimizing credit utilization.

4. Use the All-Zero-Except-One (AZEO) Method

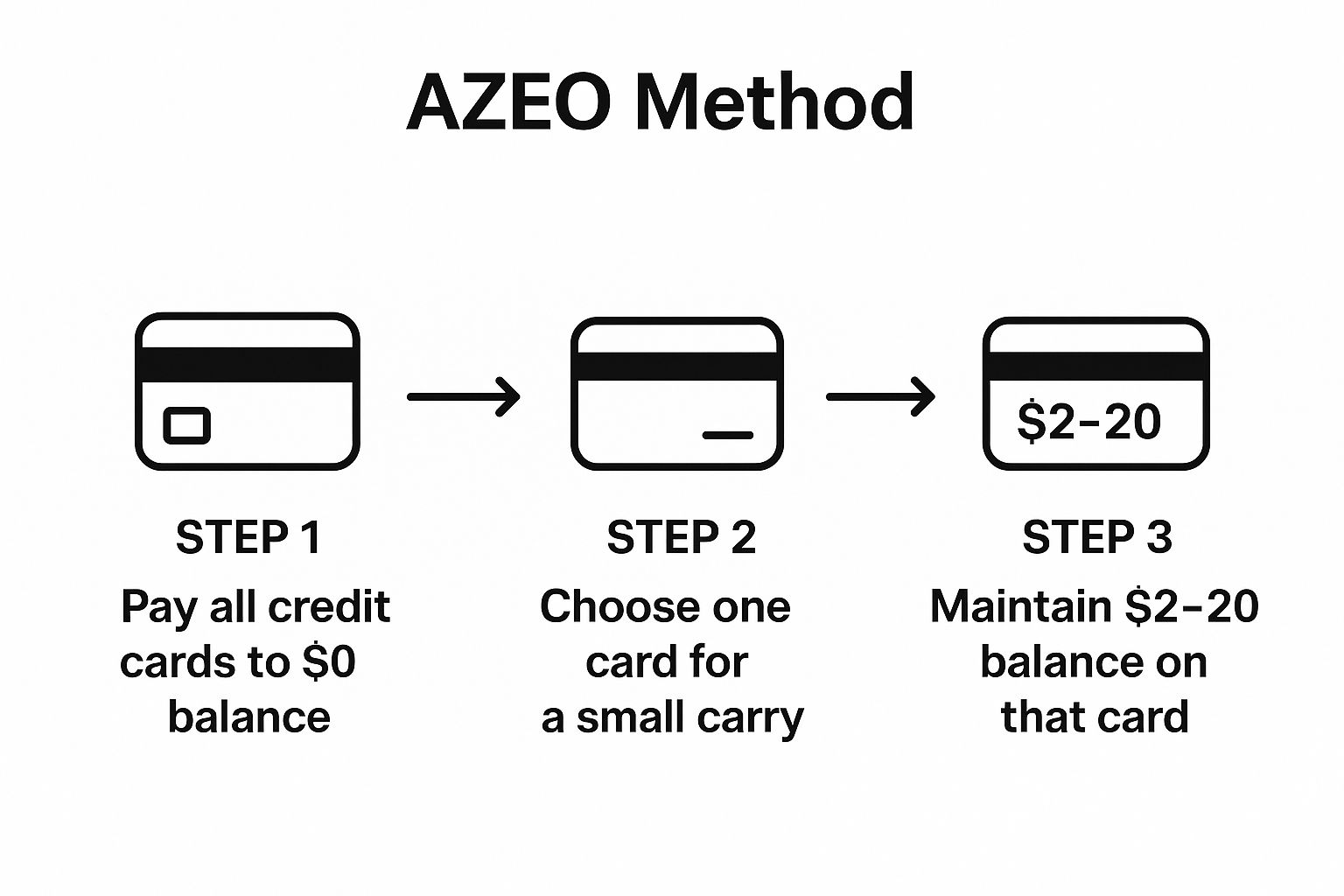

The All-Zero-Except-One (AZEO) method is an advanced credit optimization strategy for maximizing credit scores. It involves paying all credit card balances down to zero except for one card, which maintains a small balance, typically between 2 and 20. This demonstrates active credit use without high utilization, often resulting in higher credit scores. For ITIN holders, who might have a limited credit history, strategically leveraging AZEO can be especially beneficial in establishing a positive credit profile.

The infographic illustrates the three-step AZEO process: eliminating all but one card balance, selecting a card for a small remaining balance, and maintaining a minimal balance on that card. This simple visualization clarifies how to effectively implement the AZEO method for credit score optimization.

Examples of Effective AZEO Implementation

Actionable Tips for Using AZEO

Why Prioritize the AZEO Method?

The AZEO method directly addresses the credit utilization factor, a significant component of your credit score. By demonstrating responsible credit use while maintaining extremely low overall utilization, you signal financial stability to lenders. This can be particularly advantageous for ITIN holders building their US credit profiles. The AZEO method, popularized by credit experts and online communities, offers a proven strategy for maximizing credit scores.

5. Request Credit Limit Increases

Requesting credit limit increases is a proactive strategy to improve your credit utilization ratio without changing your spending habits. A higher credit limit with the same balance automatically lowers your utilization percentage. This is particularly beneficial for ITIN holders who may have started with lower credit limits. This strategy allows you to make necessary purchases without negatively impacting your credit score due to high utilization. Credit utilization is a significant factor in credit score calculations, so managing it effectively is crucial, especially for ITIN holders building their US credit history.

Examples of Successful Credit Limit Increases

Actionable Tips to Request Credit Limit Increases

Why Prioritize Requesting Credit Limit Increases?

This proactive approach to credit management empowers ITIN holders to improve their credit utilization without necessarily reducing spending. It provides greater financial flexibility and can positively impact credit scores by demonstrating responsible credit behavior. Consistent efforts to increase credit limits, coupled with responsible credit usage, can significantly benefit ITIN holders building their financial standing in the US. This strategy aligns with the recommendations of financial experts who emphasize the importance of healthy credit utilization for long-term financial well-being.

6. Monitor Per-Card Utilization

Maintaining a healthy overall credit utilization ratio is crucial, but managing utilization on individual credit cards is equally important for ITIN holders building credit. Credit scoring models assess both your total utilization across all cards and the utilization on each individual card. Maxing out even one card can negatively impact your score, even if your overall utilization remains below the recommended 30%. This individualized approach is essential for demonstrating responsible credit management to lenders.

Examples of Effective Per-Card Utilization Management

Actionable Tips to Monitor Per-Card Utilization

Why Prioritize Monitoring Per-Card Utilization?

This practice directly impacts your credit score by demonstrating responsible financial behavior. By maintaining low utilization on each card, ITIN holders showcase their ability to manage multiple credit lines effectively. This can significantly influence access to better loan terms, higher credit limits, and other financial opportunities. Credit monitoring services, personal finance apps, and credit counseling organizations all emphasize the importance of per-card utilization, highlighting its significance for building a strong credit profile.

7. Use Multiple Cards to Spread Utilization

Strategically using multiple credit cards can be a powerful tool for managing credit utilization, especially for ITIN holders building their US credit history. Rather than concentrating spending on a single card, distributing purchases across several cards helps maintain lower individual utilization rates while keeping overall utilization low. This approach allows you to access more credit without negatively impacting your credit score.

This strategy is particularly beneficial when combined with the 30% rule. By spreading spending, you can leverage the combined credit limits of multiple cards while keeping each card's balance well below its individual limit. This can be especially advantageous for ITIN holders who may have lower credit limits on individual cards.