Your Credit Utilization Ratio Calculator and Guide

A credit utilization ratio calculator is a straightforward tool that gives you a quick snapshot of your financial health. It calculates the percentage of your available credit you're currently using, showing just how much you rely on borrowed funds.

What Is Credit Utilization and Why Does It Matter So Much?

Your credit utilization ratio—often just called CUR—is a critical piece of your credit profile. Simply put, it compares the total amount you owe on your credit cards to your total credit limits. Lenders look at this number to get a sense of how you manage your debt.

A low ratio is a good sign. It tells lenders you're using credit responsibly without needing it to cover daily expenses. On the other hand, a high ratio can raise red flags, suggesting you might be experiencing financial stress and making lenders hesitant to approve you for more credit. This single percentage can have a surprisingly big impact on your financial opportunities.

Its Heavy Influence on Your Credit Score

Your CUR isn't just a minor footnote in your credit report; it's a major player. In fact, your credit utilization makes up about 30% of your credit score, whether it's from FICO or VantageScore. That makes it the second most important factor, right behind your history of making payments on time.

You can dive deeper into this topic by exploring our detailed guide, What Is a Credit Utilization Ratio?.

Because it carries so much weight, even small shifts in your utilization can make your credit score jump or fall. Credit bureaus track this metric very carefully because it helps them predict how likely you are to pay back any new debt you take on.

Why Lenders Pay Such Close Attention

From a lender's point of view, a high credit utilization ratio is a warning sign. Imagine you have a total credit limit of 10,000** across all your cards, but your combined balance is **8,000. That's an 80% utilization rate. To a bank, this looks like you might be overextended and could struggle to manage any additional debt.

Now, let's flip that scenario. If you kept that same 10,000** limit but only had a balance of **2,000, your utilization would be a much healthier 20%. This demonstrates that you have access to credit but aren't dependent on it—making you a far more appealing candidate for a mortgage, car loan, or new credit card.

To give you a clearer idea, here's a quick breakdown of how lenders typically view different utilization levels.

Credit Utilization Impact At-A-Glance

As you can see, the goal is to stay as low as possible, with the under-30% range being a great target and under-10% being the gold standard for anyone serious about maximizing their credit score.

How to Calculate Your Credit Utilization Ratio

Figuring out your credit utilization ratio is easier than you might think. You don't need any fancy software—just a little bit of basic math. Your first task is to round up two numbers for each credit card you have: the current statement balance and the total credit limit.

Where can you find this info? Just log into your credit card’s online portal or pull up the mobile app. Your balance and limit are usually front and center on the account dashboard. If you're more old-school, you can also find them on your latest paper or PDF statement.

Pulling Your Numbers Together

Once you've got the balance and limit for every single one of your credit cards, it’s time for some simple addition. You need two main totals:

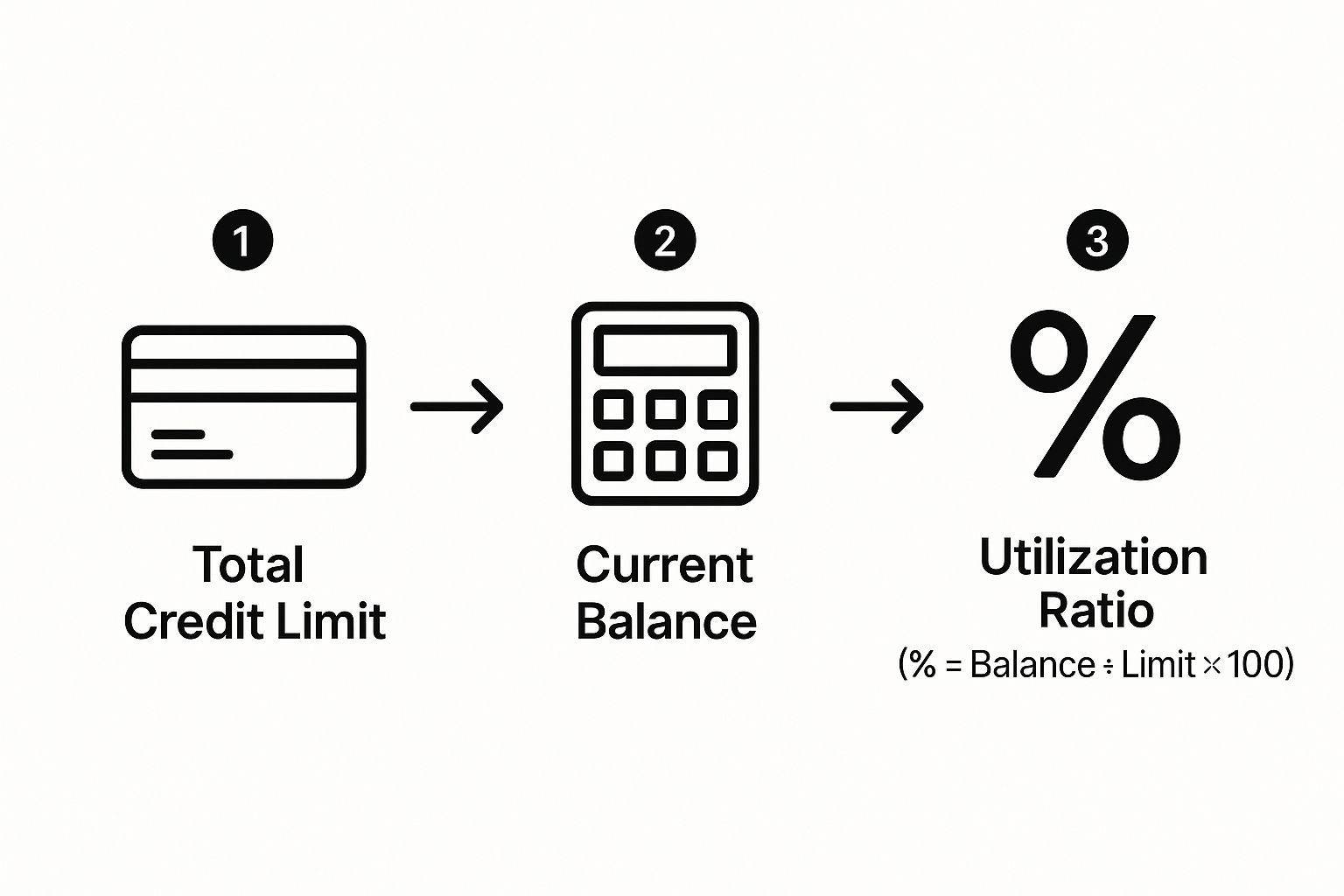

This simple infographic gives you a great visual of how these two figures work together.

As you can see, the formula is straightforward: divide your total combined balance by your total combined credit limit. That's it.

A Real-World Calculation Example

Let's walk through a practical example. Remember, your credit utilization ratio shows what percentage of your total available credit you’re actually using.

Imagine you have three credit cards:

First, you’d add up all the balances, which comes to **5,000** (1,400 + 1,100 + 2,500).

Next, you add up all the credit limits, which gives you **15,000** (4,000 + 4,000 + 7,000).

Finally, divide the total balance by the total limit: 5,000 / 15,000 = 0.3333. To get the percentage, multiply by 100, which gives you a credit utilization ratio of 33.33%.

For a more detailed walkthrough, check out our guide on how to calculate credit utilization step-by-step.

What Your Calculator Results Really Mean

So, the credit utilization ratio calculator has given you a percentage. It’s tempting to see it as just another number, but from my experience, it’s a powerful story about your financial health. Lenders look at this figure to get a quick snapshot of how you manage debt, and seeing your credit through their eyes is the first step to improving it.

Think of your ratio as falling into one of a few key brackets. Each one sends a very different message.

High Utilization in the Real World

Let's look at how this plays out in a practical example. Calculating your overall ratio isn't just about one card; it’s the total of all your balances divided by the total of all your limits.

Imagine someone has four credit cards. Their balances are 2,500, 1,000, 10,000, and 500. Their respective credit limits are 5,000, 3,000, 12,000, and 4,000. Adding it all up, they have a total balance of 14,000** against a total credit limit of **24,000.

Do the math, and their credit utilization comes out to a staggering 58%. If you want to dive deeper into these calculations, achieve.com has some great insights on how credit utilization is calculated.

Knowing your number is one thing. Understanding what it signals to the financial world is what gives you the power to change it. Once you know where you stand, you can take concrete steps to improve your financial future and avoid these kinds of setbacks.

Getting Your Credit Utilization Down: Real-World Strategies

Okay, so you've punched your numbers into a credit utilization ratio calculator. Now you have a real, hard number staring back at you. What's next? It's time to get that percentage down. This isn't about generic advice like "pay your bills"—these are specific, proven tactics I've seen work time and again for people building their credit.

Pick a Repayment Plan That Works for You

The most straightforward way to lower your ratio is to pay down what you owe. But how you do it matters. Having a system keeps you focused.

Pay More Than Once a Month

This is a simple trick that has a huge impact. Most people don't realize that card issuers typically report your balance to the credit bureaus only once a month—usually right after your statement closes.

This means even if you pay your bill in full, a high balance on that single reporting day can make your utilization spike.

I always tell people to try making smaller payments throughout the month, especially a few days before the statement closing date. Did you just make a big purchase? Hop online and pay it off right away instead of waiting for the bill. It's a small change in habit that keeps your reported balance consistently low.

Ask for a Higher Credit Limit

Another angle of attack is to increase your total available credit. Think about it: if your balance stays the same but your credit limit goes up, your utilization ratio automatically goes down.

You can simply call your credit card company or use their app to request a credit limit increase.

A word of caution: Before you ask, find out if they'll do a "hard" or "soft" credit pull. A hard inquiry can cause a small, temporary dip in your score, so you want to be strategic. A soft pull won't affect your score at all.

For ITIN holders who want a deeper dive, we've put together more credit utilization tips for building a strong score in another article.

Think About Debt Consolidation

If you're juggling several high-interest credit card balances, a personal loan for debt consolidation can be a powerful move. You're essentially taking out one loan to wipe out all your credit card debt at once.

Here’s why this works so well for your utilization ratio:

This can give your credit score a significant boost. The crucial part? You have to resist the temptation to run up the balances on those newly cleared credit cards.

Here are some common slip-ups I see all the time that can accidentally push your credit utilization ratio into the danger zone. It's not always about big, obvious blunders. Sometimes, it's the small, seemingly smart moves that end up hurting your score.

Closing an Old Credit Card

This one feels so counterintuitive, but it's a classic mistake. You pay off an old credit card you no longer use and decide to close the account to be tidy and responsible. It seems like the right thing to do, right?

Wrong. When you close that card, you're not just closing an account—you're erasing its credit limit from your total available credit. Your overall credit pie just got a lot smaller. So, even if your balances on other cards stay exactly the same, your utilization percentage will instantly jump up.

Maxing Out a Single Card

Another common pitfall is thinking only about your overall utilization. You might have one card that’s nearly maxed out while your others sit empty. You do the math and think, "Hey, my total ratio is still low, I'm fine."

Lenders don't see it that way. They scrutinize both the big picture and the details of each individual account. For instance, having one card at 95% utilization and two others at 0% looks much riskier than having all three cards sitting around 32%. A maxed-out card sends a major warning signal to lenders, suggesting you might be in a tight spot financially, even if your other accounts are clear.

Confusing Your Due Date and Statement Date

This is probably the most frequent and easily avoidable error. We're all conditioned to focus on the payment due date to dodge late fees and interest charges. That's a great habit for your payment history, but it doesn't help your utilization ratio.

Here's the inside scoop: Credit card companies usually report your balance to the credit bureaus on your statement closing date, not your payment due date.

Think about it. If you make a big purchase at the start of your billing cycle and wait until the due date to pay it off in full, that high balance is what gets reported. For a whole month, it looks like you're carrying a heavy debt load. The simple fix? Make a payment before your statement closes, not just before your bill is due. This ensures a lower balance gets reported to the credit bureaus.

Common Questions About Credit Utilization

Let's tackle some of the most common questions people have about credit utilization. Getting a handle on these details can really change the game for your credit health.

Will Using a Credit Utilization Calculator Hurt My Score?

Not a chance. Think of a credit utilization ratio calculator as your own personal financial tool, like a budget spreadsheet. It's completely private and for your eyes only.

You're just plugging in numbers you already know—your current card balances and total credit limits—to do some quick math. Since this doesn't create a credit inquiry or get reported to any credit bureau, it has zero impact on your score. Feel free to calculate it as often as you need to stay on top of things.

How Often Should I Be Checking My Utilization?

Making it a habit to check your utilization weekly or every couple of weeks is a smart move. But the absolute most important time to check is right before you apply for new credit—whether that's a car loan, a mortgage, or another credit card.

Your ratio is just a snapshot at the moment a lender pulls your credit report. By checking it beforehand, you give yourself a chance to make a quick payment and lower your balance. That single action can dramatically improve how you look to a lender and could be the key to getting approved.

Does My Debit Card Usage Factor In?

This is a really common point of confusion, but the answer is a firm no. Your debit card pulls money directly from your checking account. You're spending your own cash, not borrowing anything.

Credit utilization is only about revolving credit products where you borrow and pay back money, like credit cards or lines of credit. Since debit card spending isn't a form of debt, it doesn't touch your utilization ratio or your credit score.