Build Your Credit Score Without SSN Using an ITIN

Yes, you absolutely can build a strong U.S. credit score without a Social Security Number. The key is your Individual Taxpayer Identification Number (ITIN). Think of it as your primary tool for tapping into the American financial system.

This guide will show you exactly how to establish and grow your financial identity using nothing more than your ITIN.

Your Path to a US Credit Score Without an SSN

Starting your financial journey in the United States without an SSN can feel like trying to open a locked door. The good news? You already have the key: your ITIN.

A lot of people get stuck on the myth that an SSN is the only way to build credit history, but that's just not true. The U.S. credit system is actually more flexible than you might think.

Building credit is a lot like creating a financial resume. Lenders and credit bureaus just need a reliable way to verify who you are and a method to track your financial behavior over time. While an SSN is the most common identifier, it's far from the only one they can use.

How Credit Bureaus Identify You

At their core, credit bureaus are massive data collectors. Their whole job is to gather information from banks and lenders and match it to the right person's file. This matching process is surprisingly sophisticated and never relies on just one piece of data.

Major bureaus like Experian use a combination of personal details to create and update your unique credit file. This is great news for ITIN holders, as it means your identity can be pieced together from several reliable sources.

When you open an account, the bureaus cross-reference information like:

The credit bureaus have a system for piecing together your identity even without the most common identifier, the SSN. This table breaks down the kinds of information they use to build and find your credit file.

Key Identifiers for Building Credit Without an SSN

As you can see, the ITIN serves as the central anchor, but providing consistent supporting details across all your accounts is what makes the whole system work.

Once you understand how the pieces fit together, the path forward becomes much clearer. Your ITIN, combined with consistent personal info, gives lenders everything they need to report your responsible financial habits to the bureaus. That's how you lay the foundation for a solid credit history.

Now, let's get into the actionable steps to make that happen.

Securing and Using Your ITIN for Financial Access

Your Individual Taxpayer Identification Number (ITIN) is so much more than a stand-in for an SSN on your tax returns. It's the key that unlocks the entire U.S. financial system, empowering you to build a strong credit history from the ground up. Think of it as the official proof of your financial identity for banks, lenders, and credit bureaus.

The first move, of course, is getting that number from the IRS. The process itself is pretty straightforward, but you’ll want to pay close attention to the details. It all starts with filling out and submitting Form W-7, which is the official Application for IRS Individual Taxpayer Identification Number.

To go with the form, you’ll need to provide documentation proving your identity and foreign status. The simplest way to do this is with a valid foreign passport—it’s the one document that can do both jobs at once.

Navigating the Application Process

Don't have a passport? No problem. The IRS also accepts a combination of two other documents. For example, you could pair a national identity card with a foreign birth certificate. The most important thing is making sure your documents are current and meet the specific IRS requirements.

Once your paperwork is in order, you have a few ways to submit it:

Patience is key here. Processing usually takes 7 to 10 weeks, so it’s a good idea to get started well in advance of when you might need it. When you're approved, the IRS will mail your official ITIN to you.

From ITIN to Bank Account

With your ITIN assignment letter in hand, you're ready for the most crucial first step in your credit journey: opening a U.S. bank account. This is the foundation for everything that comes next. A simple checking or savings account creates an official financial footprint that lenders can see, proving your stability and identity.

Many people are surprised to find out just how many major banks are happy to work with ITIN holders. In fact, millions of immigrants, international students, and non-citizens build a credit score without ssn every year using this exact method. The IRS created the nine-digit ITIN for this very reason—to allow people who can't get an SSN to file taxes, open accounts, and participate in the economy.

Picking the right bank matters. Big names like Bank of America, Chase, and Citibank have clear, established procedures for ITIN applicants. Don't overlook local credit unions, either—they often offer fantastic, personalized service. This single step is what turns your ITIN from just a tax number into a real financial tool. For more ideas on getting started, check out our guide on how to build credit with an ITIN number.

Choosing The Right Credit-Building Accounts With An ITIN

With a bank account set up, you're ready to start the most important part of this journey: actually building your credit history with your ITIN. This is where the rubber meets the road. The goal is to find financial products that will report your good habits to the major credit bureaus, creating the foundation of your financial identity in the U.S.

It's crucial to understand that not all credit products are built the same, especially when you're using an ITIN. You need to be selective and focus on accounts specifically designed to help people establish a credit file from scratch.

Secured Credit Cards: Your Best First Move

For most people starting out, a secured credit card is the single most effective tool. It's the most common and accessible entry point for a reason.

The idea is straightforward: you put down a refundable cash deposit, and that deposit typically becomes your credit limit. So, a 300** deposit gets you a credit card with a **300 spending limit. This deposit removes the risk for the bank, which is why they're often happy to approve applicants with no credit history at all.

Your job is simple: use the card for small, everyday purchases and pay the bill in full and on time every single month. No exceptions. This consistent, positive payment history is exactly what the credit bureaus look for.

Before you apply for any secured card, you must ask one critical question: "Do you report my payment history to all three major credit bureaus—Equifax, Experian, and TransUnion?" If the answer isn't a confident "yes," walk away. A card that doesn't report to all three won't help you build the comprehensive credit profile you need.

Credit-Builder Loans: A Different But Powerful Angle

Another fantastic tool is the credit-builder loan. These work a bit differently than a normal loan. Instead of getting a lump sum of cash upfront, you make fixed monthly payments into a locked savings account over a set term.

Once the term is complete (usually between 6 and 24 months), the full amount you paid is released back to you, sometimes with a little interest. The magic is that every single payment you made along the way was reported to the credit bureaus. It’s like a forced savings plan that also builds a solid credit history.

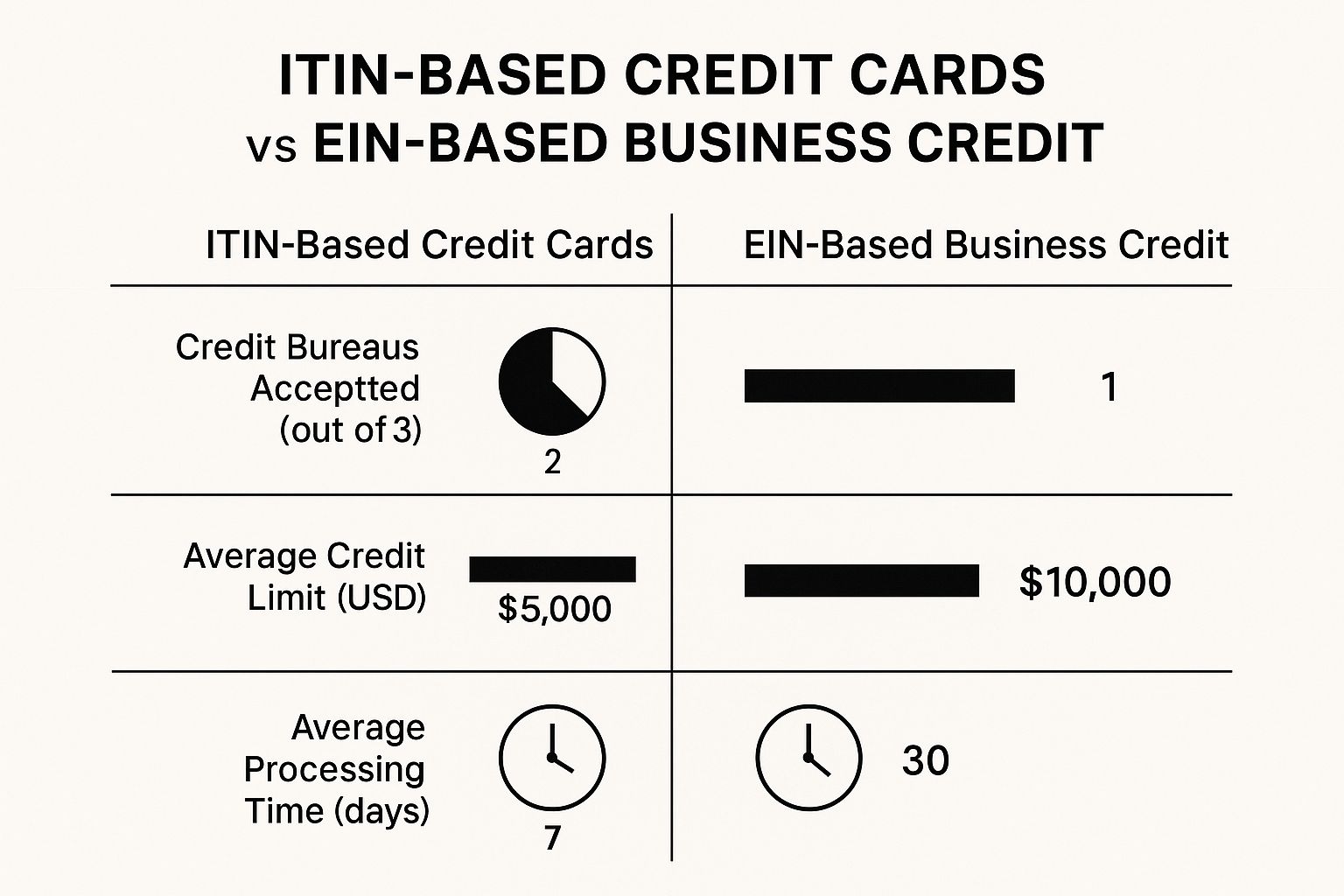

The image below gives a quick comparison of ITIN-based credit options versus those typically used for business credit.

As you can see, even though ITIN-based cards might start with lower limits, their wide acceptance by credit bureaus makes them perfect for building your personal credit score.

Comparing ITIN-Friendly Credit-Building Products

To help you decide, let's break down the most common tools available for ITIN holders. Each one serves a slightly different purpose, and understanding them is key to building a strong strategy.

Choosing the right mix from this table—often starting with a secured card and maybe adding a credit-builder loan—is the most critical decision you'll make at this stage.

Exploring Fintechs And Unsecured Cards

While secured products are the tried-and-true starting point, some newer financial technology (fintech) companies are shaking things up. A growing number of them, along with some forward-thinking credit unions, are beginning to offer unsecured credit cards directly to ITIN holders.

Instead of a security deposit, these companies often analyze your U.S. bank account history to gauge your financial responsibility. For instance, you might get approved for an unsecured card with a $500 limit just by showing three months of consistent income and responsible banking. These are great options because they let you keep your cash accessible.

To get a better sense of what's out there, you can explore a variety of credit builder products for ITIN holders and see which one aligns with your financial situation.

Smart Habits for Managing Your New Credit

Getting that first credit account is a huge step forward, but it's just the starting line. The real work of building a great credit score begins now. How you handle this new financial tool will make all the difference, especially when you're building a credit score without an SSN. Mastering these habits is everything.

You'll want to laser-focus on two things above all else: paying your bill on time, every single time, and keeping your reported balances as low as possible. These aren't just good ideas; they're the absolute foundation of a healthy credit profile. Your payment history makes up a massive 35% of your FICO Score—it's the most important piece of the puzzle.

The Power of On-Time Payments

Just one missed payment can tank your score, and that blemish can haunt your credit report for seven long years. To a lender, it’s a major red flag that you might be a risky borrower.

The easiest way to prevent this? Set up automatic payments. Seriously, do it right now. Have at least the minimum amount due automatically debited from your bank account each month. This is your safety net. You can, and absolutely should, pay the full balance off manually before the due date, but that autopay feature will save you if life gets busy and you forget.

Keep Your Credit Utilization Low

Right after payment history, the next biggest factor is your credit utilization ratio (CUR). This sounds technical, but it’s just the percentage of your available credit that you're currently using. When lenders see you maxing out your cards, they get worried it might be a sign of financial trouble.

The standard advice is to keep your utilization below 30%. But if you want to build an excellent score, aim to keep it under 10%.

This doesn't mean you can only spend $30 a month. You can charge more, but the trick is to pay down the balance before your statement closing date. That's the date the issuer reports your balance to the credit bureaus.

Building great credit is a marathon, not a sprint. It’s all about showing you can be consistent and responsible over a long period. Think of every on-time payment and every low-balance statement as another gold star on your financial record.

These are the habits that separate people with so-so credit from those with truly excellent scores. By locking them in from day one, you're guaranteeing the credit history you build with your ITIN will be a powerful asset.

How to Check Your Credit Score and Report Without an SSN

Building your credit is one thing, but actually seeing your progress is a whole different ballgame. If you're working to establish a credit score without an ssn, you’ve probably hit a wall with the popular instant-monitoring websites. Most are built for Social Security Numbers, which can be incredibly frustrating.

Don't worry, though. You absolutely have ways to get your hands on your full credit report and score. It just takes a slightly different approach.

Going Straight to the Source

Your most reliable bet is to contact the three major credit bureaus directly: Equifax, Experian, and TransUnion. They are the keepers of your credit file and are legally required to provide it to you. Since their online systems are often locked into the SSN framework, you'll likely need to use more traditional methods like mail or phone.

It's a bit more hands-on, but it works.

What You'll Need to Request Your Report

When you request your report by mail, the bureaus need to be certain it's really you. This means you'll have to send them copies of documents to prove your identity and address. It's a manual verification process, so be prepared with the right paperwork.

Here’s what you'll typically need to gather:

Once you have these documents, draft a simple letter for each bureau stating that you're an ITIN holder and would like a copy of your credit report. Mail everything together. It takes more patience than a few clicks online, but it’s a surefire way to get the information you need.

Using ITIN-Friendly Monitoring Services

Requesting reports by mail is solid, but it’s not exactly fast. For more frequent check-ins, you'll want to find services that are actually built for ITIN holders.

A growing number of fintech companies and credit unions that offer ITIN-based loans or credit cards also give their customers free access to credit score monitoring. It's a huge perk.

For instance, if you have a secured credit card from an ITIN-friendly bank, log into your online account. Many of them now have a dashboard feature that displays your FICO or VantageScore, usually updated once a month. This is the best way to track your progress without the headache of mailing letters.

Want to dive deeper into this? We've put together a whole guide on how to check your credit score with an ITIN. Seeing your score climb is great motivation and helps you spot any potential issues before they become big problems.

Common Questions About Building Credit With an ITIN

When you're first figuring out how to build credit with an ITIN, a lot of questions come up. It's totally normal. Let's walk through some of the most common ones I hear so you can move forward with confidence.

Can I Apply for Any Credit Card With an ITIN?

This is a big one, and it causes a lot of confusion. The short answer is no, not every credit card is available to ITIN holders. Many of the big, traditional banks have older systems that are hard-wired to require a Social Security Number for their mainstream credit cards and loans.

But that’s changing fast. A growing number of credit unions and, more importantly, modern fintech companies are building their services specifically for people like you. The smartest move is to focus your search on these ITIN-friendly institutions. If you just apply everywhere, you risk racking up unnecessary rejections, and each of those "hard inquiries" can cause a small, temporary dip in your score.