How to Build Credit Score Without Social Security Number

Understanding Your Credit Options as an ITIN Holder

Building credit without a Social Security Number (SSN) might seem like climbing a mountain, but trust me, it's totally doable. I've been talking with financial advisors and ITIN holders alike, and it's clear that things are changing. Big lenders are actually looking for ITIN customers now, which means more competition and better options for you.

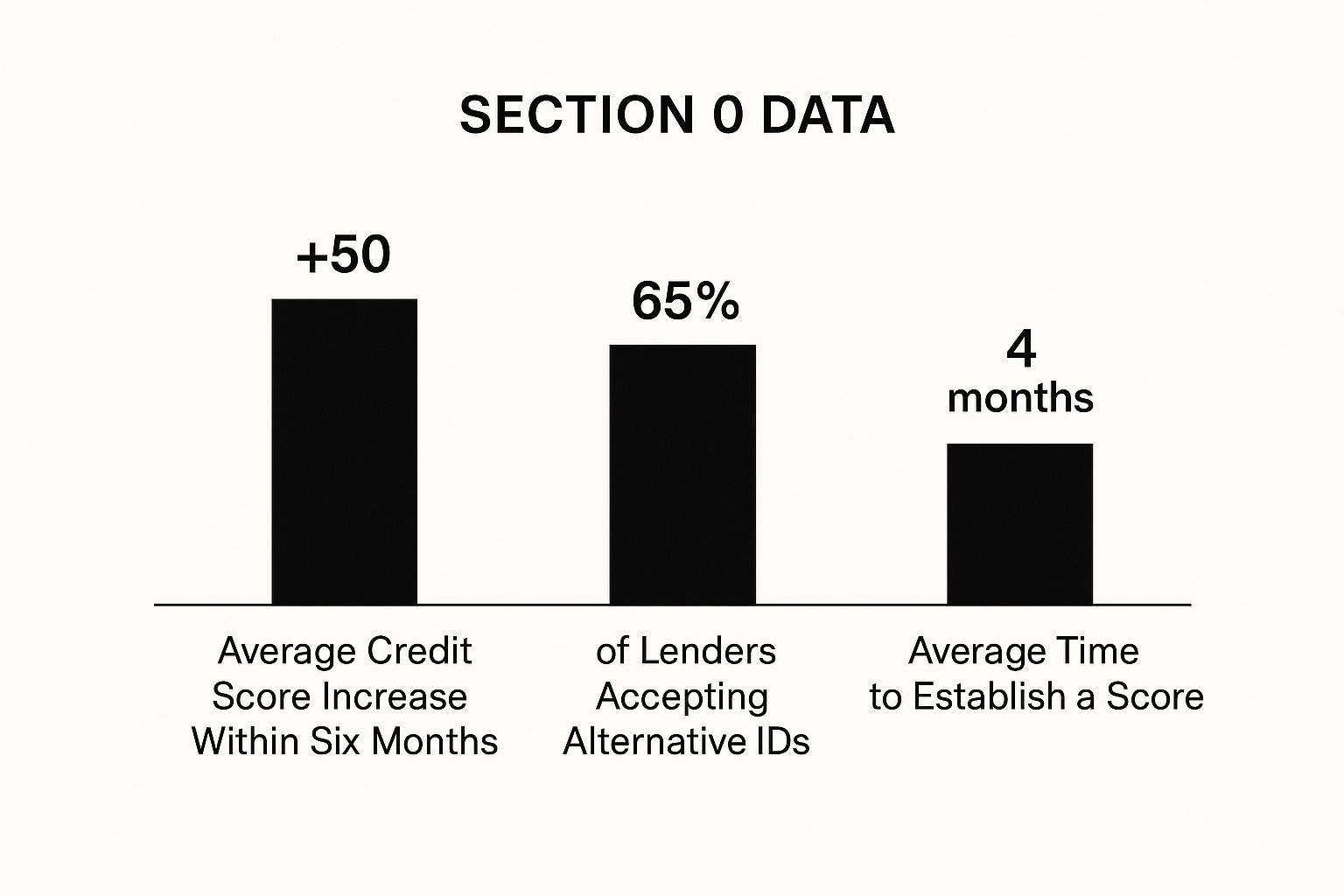

Let me show you something interesting: This infographic breaks down some key stats: how much your score can improve in six months, how many lenders accept alternative IDs, and the typical timeframe for getting a credit score established. It's totally possible to boost your score by 50 points in just six months, with 65% of lenders now welcoming alternative IDs. Getting a score up and running usually takes around four months. See? Building credit with an ITIN is a realistic goal.

The Shifting Landscape of ITIN Credit

This increasing acceptance of ITINs is part of a larger trend. Since 2021, over 70% of major U.S. credit card issuers have updated their systems to accept ITINs. This opens up credit access for so many people who didn't have it before and has led to more and more people in previously underserved groups getting their credit reported. You can dig deeper into average credit scores and ITIN acceptance at Experian. Keep in mind, though, that there are still some bumps in the road, like lower match rates and the occasional reporting error.

Exploring Your Credit-Building Toolkit

So, what can you actually do to build credit? Secured credit cards are a great place to start. You put down a security deposit that becomes your credit limit, which makes it less risky for the lender. Credit-builder loans are another good option. These loans get reported to the credit bureaus, helping you build a solid payment history. And don't forget about ITIN-friendly banks and credit unions. We've actually put together a handy guide on banks that accept ITINs if you want to explore that route.

To give you a clearer picture of the differences between building credit with an ITIN versus an SSN, check out this comparison table:

ITIN vs SSN Credit Building Comparison | | | |---|---|---|---|---| Credit Product | ITIN Acceptance | SSN Standard | Typical Requirements | Approval Timeline | Secured Credit Cards | Growing (Many issuers now accept ITINs) | Widely Accepted | Security deposit, proof of address, valid ID | 1-2 weeks | Credit-Builder Loans | Available through select lenders | Widely Accepted | Proof of income, valid ID, may require a checking account | 1-2 weeks | Unsecured Credit Cards | Limited, but increasing | Widely Accepted | Good credit score, proof of income, valid ID | 1-2 weeks | Mortgages | Available through select lenders | Widely Accepted | Substantial down payment, proof of income, valid ID | 4-6 weeks | Auto Loans | Available through select lenders | Widely Accepted | Proof of income, valid ID, down payment may be required | 1-2 weeks |

This table highlights some of the key differences and similarities you'll encounter as an ITIN holder. While SSN holders have more readily available options, the landscape for ITIN holders is steadily improving.

Choosing the right path depends on your individual circumstances, but by understanding your options, you can confidently begin building your credit. Don't let the lack of an SSN hold you back from your financial goals. You've got this!

Getting Your First Credit Account That Actually Works

Getting that first credit approval with an ITIN can sometimes feel like climbing a mountain. I’ve been there, and from talking to others in the same boat, I know the frustration. It's not just about finding banks that accept ITINs—it’s about understanding how they really evaluate those applications. Some lenders make it surprisingly easy, while others… well, let’s just say they throw up a few roadblocks. So let me share some insights that might help you smooth the process.

Presenting Your Financial Narrative

Think of your application as telling a story about your financial stability. Underwriters want to see responsible behavior, not just a perfect credit score (which you're building, right?). Show them consistent income. Even if it's from multiple sources—freelancing, a side hustle, whatever—it demonstrates your ability to manage money.

Having a U.S. bank account is also a big plus. Even if the balance isn’t huge, it shows you’re plugged into the system. Simple things like providing proof of residence (utility bills, for example) further reinforce that stability. These details build a picture of reliability.

Consider adding a personal touch with character references. A letter from an employer, a community leader, or even a landlord can make a difference. Think of it like adding a personal recommendation. It’s a way to build trust beyond just the numbers.

Choosing the Right Starting Point

For many ITIN holders, a secured credit card is a great first step. The deposit you put down acts as your credit limit, which lowers the risk for the lender. Make sure the card reports to all three major credit bureaus—Experian, Equifax, and TransUnion—to maximize the impact on your credit.

Credit-builder loans are another solid option. These are designed specifically to help people establish credit. Your payments are reported to the bureaus, and even a small loan, say $500, paid responsibly over a year, can give your credit a nice boost.

Some lenders are also offering credit scores without an SSN. It's interesting to note that according to LASER Credit Access, only about 10-15% of loan applications are from borrowers without SSNs. This lower volume also affects credit report matching, with hit rates dropping by 40-60% when SSNs are missing. For a deeper dive into the unique challenges (and opportunities) of credit building without an SSN, Discover more insights.

Beyond Traditional Options

Don’t be afraid to think outside the box! Some fintech companies are now catering specifically to ITIN holders with alternative credit-building products. They might focus on things like rent and utility payments. These programs can add valuable positive data to your credit profile. Also, check out this article on ITIN credit reports—it's packed with helpful information.

Picking that first credit account is a big decision. By understanding what lenders look for in ITIN applications and exploring all your options, you'll be well on your way to building a solid credit history.

Monitoring Your Credit When Apps Keep Failing You

Let's be real, trying to keep tabs on your credit progress as an ITIN holder can be a nightmare. Seeing that "no record found" message is beyond frustrating, especially when you've been diligently paying your bills and managing your accounts responsibly. I've been there, and I've helped countless ITIN holders navigate this confusing process. Trust me, I know the methods that actually work and which ones are just a waste of your time.

Reliable Ways to Actually See Your Progress

Believe it or not, the old-school mail-in method can be surprisingly effective. But here's the key: be incredibly specific in your request. Don't just give them the bare minimum. Include absolutely everything you can think of: your full name (exactly as it appears on your financial accounts), your current address, any previous addresses, your date of birth, and any other identifying information you have. This extra effort drastically increases your chances of the credit bureaus finding a match.

Some online platforms are finally getting on board and recognizing ITINs. Itinscore, for example, is specifically designed for ITIN holders and offers free, unlimited credit monitoring. The real-time dashboard updates daily, so you can actually see how your credit-building efforts are paying off. It's a major upgrade from the constant "record not found" messages.

Now, according to Experian policy as of 2021, you can absolutely check your credit report and score without an SSN by mail, using alternative identification. However, matching your information without an SSN can still be a challenge. Duplicate detection is also trickier, which is why those "NO RECORD FOUND" messages pop up so often. This is where meticulous record-keeping on your part becomes absolutely crucial. Keep a file, use a spreadsheet, whatever works for you – just make sure you have a clear and organized record of your financial activities.

Interpreting Your Credit Reports

Remember, traditional credit scoring models weren’t designed with ITIN holders in mind. So, don't freak out if your reports don't look exactly how you expect. Instead, focus on the factors you can control:

Troubleshooting Those Annoying Glitches

Technical issues are bound to happen. Here's what to do when they inevitably crop up:

Finally, don't drive yourself crazy checking your credit every single day. Monthly monitoring is usually enough. Focus on making smart, responsible financial decisions, and over time, your credit will reflect those good habits.

Accelerating Your Progress Beyond Basic Advice

So, you've opened your first credit account—awesome! Let’s dive into how to really boost your credit score, even without a social security number. Sure, paying on time is important—it's the bedrock, really—but it’s not the whole story. There are some real insider tips that can make a huge difference, and I’m excited to share what I’ve learned from credit counselors who specialize in this area.

Mastering Credit Utilization

One of the biggest factors influencing your credit score is credit utilization. This is simply how much of your available credit you’re actually using. Let's say your credit limit is 1,000 and you have a balance of 300. Your utilization is 30%. Keeping this low is crucial. Shoot for under 30%, but ideally even lower, like the 10-20% range. This shows you’re handling credit responsibly and can really give your score a nice bump.

Strategic Credit Limit Increases

Asking for a credit limit increase can be a good move, but timing is key. Don't jump the gun. Wait until you've built a solid track record of on-time payments—at least six months. Then, when you do ask, be ready to show why you deserve it. A higher income or a reduction in other debts makes a strong case. The goal here isn't just to have access to more credit, it’s to improve that all-important utilization ratio.

The Power of Multiple Accounts (Used Wisely)

Having a few credit accounts can be helpful, but be careful. Opening too many at once can actually hurt your score. I recommend starting with one or two and managing them well for several months before adding more. A mix of credit types—like secured cards and credit-builder loans—shows you can handle different kinds of credit responsibly. For more information, you might want to check your credit score with an ITIN.

Building Relationships with Lenders

Here’s an inside tip that most people don't know: Some banks have internal advocates specifically for ITIN customers. Connecting with them can unlock some serious perks, like quicker approvals and personalized help. Just call your bank's customer service and ask about resources for ITIN holders. Believe me, building these relationships can be game-changing.

These strategies can help you reach a good credit score much faster. But be mindful of common pitfalls that can set you back. Avoid maxing out your cards, missing payments, or applying for too much new credit all at once. Consistency and responsible credit management are the keys to winning the long game.

Solving Problems That Derail Most People

Building credit with an Individual Taxpayer Identification Number (ITIN) can sometimes feel like navigating a minefield. I've worked with many ITIN holders, and I've seen firsthand the unique challenges they face. Frustrating roadblocks that don't seem to faze people using Social Security Numbers (SSNs) can be a major headache. For example, duplicate credit files are a much bigger issue than most lenders will admit, and unraveling the mess can be a real nightmare.

Sometimes, you might find that your accounts are only showing up on one credit bureau report. Other times, information gets mixed up, creating inconsistencies that impact your credit score. I've even seen perfect payment histories disappear and individuals discover they have multiple credit profiles under slightly different variations of their name. It can be incredibly disheartening.

Common ITIN Credit Reporting Issues and Solutions

To help you navigate these tricky waters, I've put together a table summarizing the most common issues ITIN holders encounter with credit reporting. I've also included practical steps you can take to resolve them and, importantly, how to prevent them in the first place. This table should give you a solid starting point for tackling these challenges head-on.

So, what's the key takeaway here? Documentation is your best friend. The more organized you are, the easier it will be to resolve these issues.

Taking Action and Protecting Your Credit

Don't be discouraged if a lender claims they can't find your credit history. Be persistent! Provide them with as much information as you can: your ITIN, previous addresses, anything that might help them locate your file. If you encounter errors that keep popping up on your reports, dispute them with the credit bureaus again and again. Sometimes, it takes escalating the issue to a higher level within the bureau to finally get it resolved. Trust me, I've been there.

Protecting yourself against identity mix-ups is also essential. Use a consistent format for your name and address on all financial documents and applications. Double-checking everything before you hit submit can save you months of headaches down the road. It’s much easier to prevent these problems than to fix them later. Building credit with an ITIN requires extra vigilance, but I promise it's absolutely achievable with the right strategies.

Getting Help When You Need It

Navigating the credit system can feel overwhelming, especially with the added complexities of using an ITIN. But remember, you don't have to do it alone. Consumer advocates and organizations specializing in ITIN credit issues can offer valuable guidance and support. They understand the unique challenges you face and can help you find the right solutions. Don't hesitate to reach out – it can make a world of difference in your credit-building journey.

Advanced Strategies That Separate Success Stories

Ready to take your credit-building to the next level? The ITIN holders I’ve seen achieve truly impressive credit scores aren’t just covering the basics. They’re using advanced techniques that most people don't even know about. I've picked up a lot of these strategies from financial advisors specializing in alternative credit building, and I'm excited to share these insider tips with you.

Authorized User Strategies for ITIN Holders

Becoming an authorized user on a friend or family member's credit card can be a powerful tool, but it needs a strategic approach, especially with an ITIN. Find someone you trust with a long history of responsible credit card use and a card that's been open for a while. The crucial part? Make absolutely sure the card issuer reports authorized user activity to all three credit bureaus (Experian, Equifax, and TransUnion). If your activity isn't being tracked, it won't help you. Keep in mind, this isn’t an overnight fix. It takes time for the positive payment history to really make a difference.

Diversifying Your Credit Mix

Even with fewer options available to ITIN holders, diversifying your credit mix is still within reach. Don't just stick to secured credit cards and credit-builder loans. Look into ITIN-friendly credit unions and community banks. They often have more wiggle room in their lending requirements. Adding a small installment loan, maybe a personal loan from a credit union, can show you can manage different types of credit. The key here is responsible management. Don't borrow more than you can comfortably repay.

Exploring Business Credit Opportunities

If you're an entrepreneur, building business credit can indirectly boost your personal credit, even with an ITIN. A solid business credit profile showcases financial responsibility, which strengthens your overall financial standing. Plus, good business credit opens doors to better loan terms and business credit cards. Just remember to keep your business and personal finances separate to avoid any headaches.

Rent and Utility Reporting: Finding ITIN-Compatible Services

Reporting your rent and utility payments has become a popular way to build credit. But not all services work smoothly with ITIN-based credit files. Do your homework! Look for services that specifically state they're ITIN-compatible and report to all three major credit bureaus. These consistent, on-time payments add valuable positive information to your credit report.

Positioning Yourself for Premium Credit Products

You might be surprised to hear this, but premium credit products could be closer than you think, even with an ITIN. The foundation is key: build a strong base with secured cards and credit-builder loans. Once you've established a positive credit history, even a short one, research lenders who are known to work with ITIN holders. Look for cards with reasonable fees and interest rates. Focus on consistently demonstrating responsible credit behavior, and you’ll be surprised at the opportunities that open up.

Preparing for Major Purchases

Planning for a big purchase, like a house or car, can feel overwhelming with an ITIN. The best advice? Start early! Begin working on your credit well in advance of when you’ll need it. Research lenders who specialize in mortgages and auto loans for ITIN holders. Understanding their specific requirements and connecting with loan officers can significantly improve your chances. Consistent on-time payments across all your credit accounts are essential. It shows lenders you can manage your finances responsibly.

Timing Your Moves for Maximum Impact

Strategic timing is essential for getting the most out of your credit-building efforts. Don’t rush into applying for a bunch of credit products at once. Space out your applications to avoid hurting your credit score. Keep an eye on your credit reports regularly to track your progress. Be patient—building strong credit takes time. As your credit profile improves, you'll unlock better opportunities and reach your financial goals.

Your Practical Next Steps to Credit Success

Let's chat about building your credit over the next six to twelve months. Forget cookie-cutter advice – this is about creating a personalized action plan based on what's worked for other ITIN holders, just like you. Whether you’re just starting out or rebuilding, we'll focus on the strategies that make the biggest difference.

Setting Realistic Milestones and Expectations

First things first: building credit takes time, especially with an ITIN. Don't expect miracles overnight. It's more like a marathon than a sprint. I've seen so many people get discouraged by slow progress, but trust me, it's completely normal. Consistency is key here. Small wins add up over time.

Recognizing Warning Signs and Making Adjustments

There will be bumps in the road – that’s normal. Here's how to tell the difference between a minor hiccup and a real red flag:

If you encounter a problem, don't throw in the towel. Take a step back, reassess, maybe chat with a credit counselor specializing in ITIN credit building, and tweak your strategy. There are resources out there specifically for ITIN holders – use them!

Celebrating Your Wins and Staying Motivated

Building credit is a long-term project. It's easy to lose motivation when things slow down. Set small, achievable goals, and celebrate each milestone. Got approved for your first card? That's awesome! Saw a 20-point score increase? Time to celebrate! These small victories will keep you going and remind you of the progress you're making. Remember, this isn't just about a number – it's about building a secure financial future. Having the right tools and support makes all the difference.

Ready to take charge of your credit journey? itinScore is designed specifically for ITIN holders. Free, unlimited credit monitoring, personalized tips, and a supportive community – you’ll have everything you need to build a strong credit history and reach your financial goals. Sign up today and start building a brighter financial future!