Credit Score Ranges Explained: Understand Your Financial Health

Think of credit score ranges as a kind of financial report card. It’s a simple system lenders use to get a quick read on how you handle your money. At a glance, they can see if you're a reliable borrower.

Generally speaking, scores in the 800-850 range are considered top-tier, or excellent. Anything from 670-799 is typically seen as good.

Breaking Down The Credit Score Bands

Your credit score isn't just a number pulled out of thin air. It’s a reflection of your financial journey, neatly sorted into different levels. A great way to think about it is like leveling up in a video game. When you're just starting out, you face tougher challenges and have limited options. But as you climb to the higher levels, you unlock better gear and special perks.

It’s the same in the world of finance. Your "level"—or credit score band—determines what kind of credit cards, loans, and interest rates you'll be offered. The two biggest names in the credit scoring game are FICO and VantageScore. While both operate on that familiar 300-850 scale, the exact numbers for each band can vary a little.

Getting a handle on where you stand is the first real step to improving your financial future. If you're new to this, a great place to start is understanding what a credit score is and why it carries so much weight.

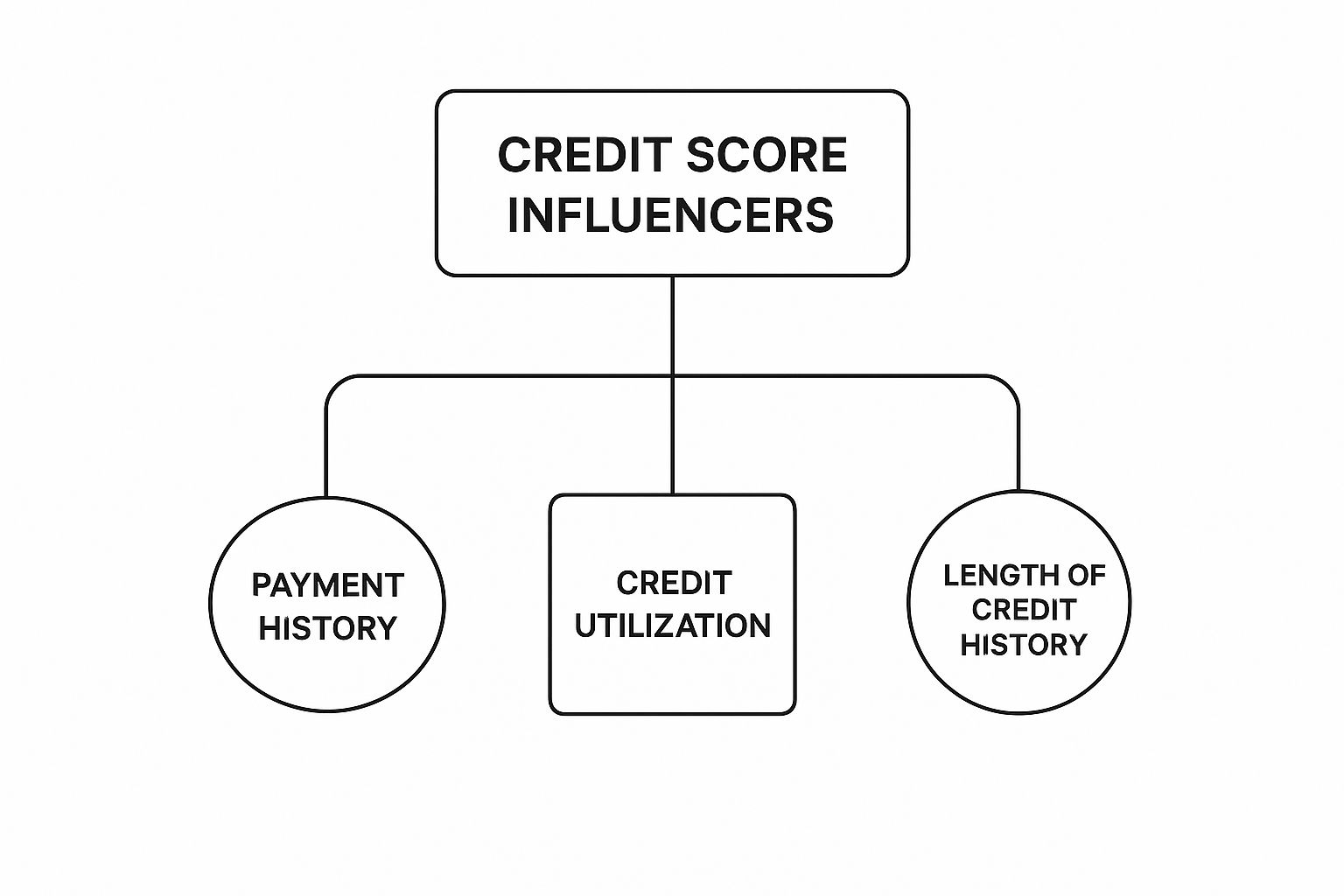

As you can see, things like your payment history and how much of your available credit you're using are huge factors. The length of your credit history also plays a major role.

FICO vs. VantageScore Ranges

Let's dig a little deeper into the two main scoring models. Most lenders in the U.S. will pull either a FICO Score or a VantageScore when you apply for credit. These models categorize your creditworthiness into clear tiers, from poor all the way up to excellent.

Think of it from the lender's perspective. A score between 800 and 850 signals a very safe bet. On the other hand, a score in the 580 to 669 range is considered fair, meaning there's a bit more risk involved for them. Anything below 580 is generally seen as poor, making it much tougher to get approved.

To make it even clearer, here’s how the two models stack up against each other.

FICO vs VantageScore Credit Score Ranges at a Glance

This table gives you a side-by-side look at the specific score bands for both FICO and VantageScore. Notice that while the general idea is the same, the exact numbers for each category can be slightly different.

While the bands aren't identical, the core message is. A higher number puts you in a better category, which in turn unlocks better interest rates and more financial opportunities. That's the name of the game.

What Your Credit Score Actually Means for Your Wallet

It's one thing to know the different credit score bands, but what do those numbers really mean for your day-to-day life? Think of your score as a key. A high score unlocks doors to better financial products, lower costs, and more opportunities. A lower score, on the other hand, can leave many of those same doors firmly locked.

Lenders use your score as a quick, standardized snapshot of your financial reliability. It’s their go-to tool for deciding who gets approved for loans, how much they can borrow, and, most importantly, the interest rate they’ll have to pay. That single number directly impacts your monthly budget and long-term financial health.

The Real-World Cost of Interest

Let's make this crystal clear with an example. Picture two friends, Maria and David, who are both looking to buy the exact same car for $25,000. They each need a five-year auto loan to make it happen.

The percentage difference might not seem Earth-shattering at first glance, but the financial impact is huge. Maria’s monthly payment comes out to about 472**, and over the five-year loan, she'll pay around **3,320 in total interest.

David’s monthly payment, however, is closer to 556**. Over those same five years, he’ll pay a staggering **8,360 in interest. That's over $5,000 more than Maria for the identical car, all because of his credit score.

This principle doesn't just apply to cars. It’s the same story for every type of loan. With something as large as a mortgage, even a single percentage point can mean tens of thousands of dollars more over the life of the loan.

It's About More Than Just Loans

The reach of your credit score goes far beyond just borrowing money. All sorts of businesses use it as a shorthand for how responsible you are.

At its heart, your credit score is part of a global language of financial trust. It's a system that underpins lending practices in major markets like the U.S., Canada, and the U.K., helping companies assess risk for everything from mortgages to car loans. You can dig deeper into these global consumer credit trends on Equifax.com.

Ultimately, a strong credit history proves you can handle your financial commitments, opening doors to better rates and easier approvals across the board.

The Five Ingredients of Your Credit Score

Your credit score might seem like some mysterious number pulled out of thin air, but it’s actually more like a recipe. To get a great result, you need the right ingredients in the right amounts. Your credit score is no different—it's built from five key components, and each one carries a different weight.

Once you understand this recipe, you can start taking real control of your financial story. Knowing what goes into the mix lets you focus on the ingredients that truly make a difference. Let's break down the five factors that shape your score.

Payment History: The Most Important Ingredient (35%)

If your credit score is a cake, then payment history is the flour. It's the foundation of the entire recipe, making up a massive 35% of your FICO score. Lenders are really asking one simple question: if we lend you money, will you pay it back on time?

A consistent track record of on-time payments paints you as a reliable borrower. On the flip side, late payments, accounts that go to collections, or major events like bankruptcy can do serious damage. A single late payment can haunt your credit report for up to seven years, so consistency is everything.

This is why making every single payment on time—whether it’s for credit cards, loans, or other bills—is the most powerful thing you can do to build and protect a strong credit profile.

Amounts Owed: How Much You Use (30%)

The next biggest ingredient is the amount of money you owe, which accounts for about 30% of your score. Now, this isn't just about the raw dollar amount. It's more about how much of your available credit you're actually using. This is what's known as your credit utilization ratio.

Let's say you have one credit card with a 10,000** limit. If your balance is **1,000, your utilization is a healthy 10%. But if that balance climbs to $5,000, your utilization shoots up to 50%.

For a deeper look into the nitty-gritty of what shapes your score, feel free to explore our guide on the primary factors affecting your credit score. Getting into the details can really help you fine-tune your financial habits.

Length of Credit History: The Test of Time (15%)

Making up about 15% of your score, the length of your credit history is all about proving your experience over time. Think about it: lenders feel much more comfortable with borrowers who have a long, steady history of managing credit well. This factor looks at a few things:

This is exactly why financial experts often advise keeping old credit card accounts open, even if you don't use them much anymore. Closing an old account can shrink your average credit age and ding your score. A longer history simply gives lenders more data to confirm you're reliable in the long run.

New Credit: How Often You Apply (10%)

Applying for new credit makes up roughly 10% of your score. Whenever you formally apply for a credit card or loan, the lender pulls your report, which results in a hard inquiry. One hard inquiry isn't a big deal and might only cause a small, temporary dip in your score.

The trouble starts when you apply for several new accounts in a short amount of time. To lenders, this can look like a red flag for financial distress or a sign that you're about to take on a pile of new debt. It’s always smarter to be strategic and only apply for credit when you genuinely need it.

Credit Mix: The Variety of Accounts (10%)

Finally, the variety of credit you have—your credit mix—accounts for the last 10%. Lenders like to see that you can successfully juggle different kinds of debt. There are two main types:

Having a healthy mix of both shows you’re a versatile and experienced borrower. While this factor isn't nearly as important as your payment history or utilization, it still adds the finishing touch to a well-rounded, robust credit profile.

Where Do You Stand Among Your Peers?

Knowing the different credit score ranges is one thing, but it really helps to see where you fit into the bigger picture. Your score isn't just some random number; it’s a living reflection of your financial journey. Understanding how you stack up against others can give you some much-needed perspective, especially when you're just getting started.

It's also worth remembering that credit scores aren't set in stone. They move and shift with the economy and even with policy changes. For example, the average FICO score in the U.S. sat at 715 in early 2025, which was a small two-point dip from the year before. A big reason for that dip? Changes in how federal student loan delinquencies were being reported. It just goes to show how national events can trickle down to individual scores. If you're curious about these trends, you can explore FICO's recent findings on their newsroom.

The Age and Experience Factor

If you look at the data, one of the clearest patterns you’ll find is the link between age and credit scores. As a general rule, the older someone gets, the higher their score tends to be. This isn't because older folks are magically better with money—it's because they've had more time to prove it.

Think back to the ingredients of a credit score. The length of your credit history is a significant piece of the puzzle, making up 15% of your FICO score. A long, positive track record gives lenders more data to work with, making them more confident that you can handle debt responsibly. Younger people, simply by being young, have a shorter history, which naturally keeps their average scores lower.

This is a totally normal part of building credit. Everyone starts somewhere, and having a lower score in your 20s is not just common; it's expected.

A Look at the Generational Divide

When you break down average scores by generation, the power of time becomes impossible to ignore. Younger generations are newer to the credit game, so they just haven't had the decades needed to build the kind of history that earns a top-tier score.

It's helpful to look at how FICO scores tend to stack up across different age groups. The table below shows a clear and predictable upward trend.

Average FICO Score by Age Group

This data tells a pretty straightforward story. The highest average scores belong to the oldest consumers, who have had decades to pay bills on time, manage different types of loans, and keep their accounts in good shape. On the flip side, the lowest average belongs to the youngest group, many of whom are just opening their first credit cards.

So, if you’re younger and your score is in the fair or even good range, you're right on track. It's a sign that your financial story is just beginning. With consistent, smart financial habits, your score has nowhere to go but up—just like it has for millions of people before you.

Your Action Plan for a Better Credit Score

Knowing where your credit score stands is one thing, but knowing how to improve it is where the real power lies. Climbing the credit ladder isn’t a matter of luck; it’s about making smart, consistent moves over time. This is your playbook for building a stronger score, whether you're just starting out or aiming for the absolute top.

Think of it like a home renovation project. If you're working with a house that needs a total gut job, you start with the foundation. But if your house is already in great shape, you’re probably focused on smaller, high-impact upgrades. The right strategy for your credit depends entirely on your starting point.

No matter where you are on the spectrum, the mission is the same: build a history that proves to lenders you’re a responsible borrower. With the right plan, you can take control and unlock better financial opportunities.

For Those in the Poor to Fair Range

If your score is currently in the poor (300-579) or fair (580-669) range, your job is simple: build a solid foundation. This is all about establishing positive credit habits and proving your reliability from square one.

Your first move should be to pull your credit reports from all three bureaus—Experian, Equifax, and TransUnion. Go through them with a fine-tooth comb. Look for errors like late payments that weren't actually late, or accounts you don't even recognize. Getting these mistakes fixed by disputing them can often give you a quick and significant score boost.

Next, you need to start building a positive track record.

For Those Moving from Good to Excellent

So, you’re already in the good (670-739) range and want to break into the very good (740-799) or even excellent (800-850) tiers? Your focus needs to shift from building to fine-tuning. You’ve already shown you’re a reliable borrower; now it’s about optimizing your profile to look exceptional.

Your most powerful tool at this stage is your credit utilization ratio. This is just a fancy term for how much of your available credit you're using. For instance, if you have a 10,000** total limit across all your cards and a **1,000 balance, your utilization is a very healthy 10%.

To really push your score into the elite category, try to keep that ratio under 10% at all times. A common mistake is to run up a high balance during the month and pay it off in full—the high balance can still get reported on your statement and temporarily ding your score. The pro move? Make a payment before your statement closing date to ensure a low balance is what gets reported. For more strategies like this, our complete guide on how to improve your credit score has a ton of extra tips.

You also need to protect the age of your credit history.

By keeping your balances low and preserving the length of your credit history, you’re essentially polishing an already strong profile. This is what signals to lenders that you aren't just a good risk—you're a great one.

How to Build Credit Using an ITIN

Getting started with U.S. credit without a Social Security Number (SSN) can feel like a roadblock, but it's absolutely achievable with an Individual Taxpayer Identification Number (ITIN). Think of your ITIN as your entry ticket into the American financial system. While it's true that not every lender will accept it, more and more are recognizing the importance of the millions of people who use an ITIN.

Your mission is to create a track record of on-time payments that the credit bureaus can see. This payment history is the bedrock of your credit score, and an ITIN is the tool you'll use to start laying that foundation. The journey is remarkably similar to anyone else's—it just starts with finding the right financial partners who work with ITIN holders.

Finding ITIN-Friendly Financial Partners

Your first move is to pinpoint the banks and credit unions that welcome ITIN applicants. Wasting time with institutions that don't is frustrating, so focus your energy on those known for serving immigrant and non-citizen communities. You'll find that many large national banks have programs, but don't overlook local community banks and credit unions—they are often fantastic partners.