Top 9 Credit Score Improvement Strategies for ITIN Holders

Navigating the U.S. credit system with an Individual Taxpayer Identification Number (ITIN) can feel like trying to solve a puzzle with missing pieces. You know building credit is essential for securing loans, renting an apartment, and achieving long-term financial goals, but the path is not always clear. The good news is that establishing a strong financial footprint is entirely achievable with the right approach. A common misconception is that a Social Security Number is the only key to unlocking credit opportunities, but ITIN holders can build a robust credit history from the ground up.

This guide is specifically designed to demystify that process. We are moving beyond generic advice to provide a detailed, actionable roundup of nine powerful credit score improvement strategies tailored for the ITIN holder community. Whether you are starting with no credit file or looking to enhance an existing one, these methods are your essential building blocks. We will explore everything from mastering the fundamentals, like payment history and credit utilization, to leveraging more advanced techniques such as strategic negotiations with creditors.

A strong credit profile is a direct reflection of your financial reliability, opening doors to better interest rates and greater financial inclusion. By implementing the specific tactics outlined here, you are not just improving a number; you are taking tangible control of your financial future in the United States. Let's begin building that foundation, one strategic step at a time.

1. Pay Down Credit Card Balances (Credit Utilization Optimization)

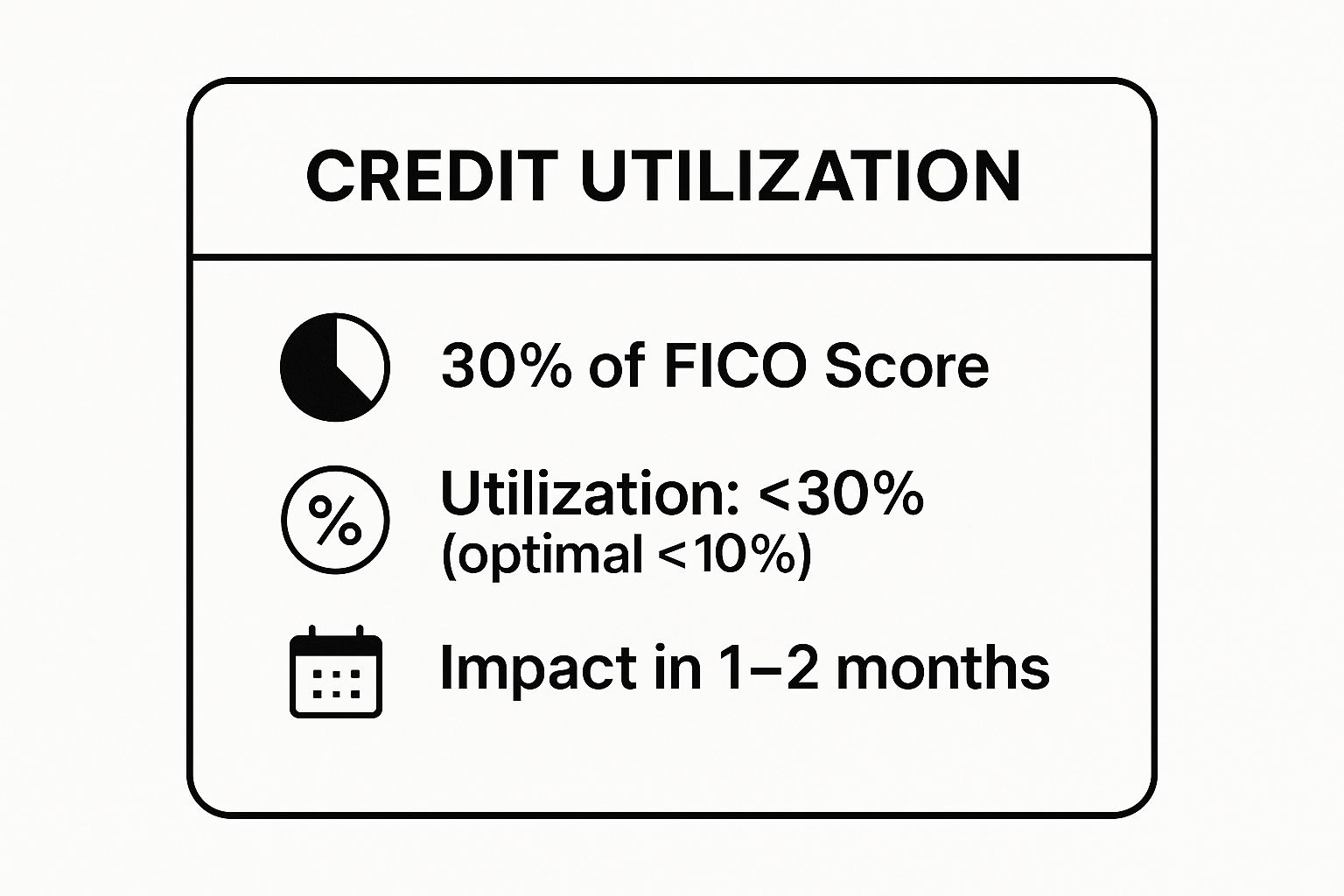

One of the most effective and fastest credit score improvement strategies involves actively managing your credit utilization ratio (CUR). This ratio measures the percentage of your available credit you are currently using, and it single-handedly accounts for 30% of your FICO score. Lenders view a low CUR as a sign of responsible credit management, indicating you aren't over-reliant on debt.

For ITIN holders building a new credit file, demonstrating low utilization is particularly powerful. It builds trust with lenders and shows you can handle credit responsibly, even with a limited history. The goal is to keep your overall utilization below 30%, with a target of under 10% for the best possible impact on your score.

How to Implement This Strategy

Lowering your utilization is straightforward: reduce your credit card balances relative to their limits. For example, if you have a card with a 5,000 limit and a 4,000 balance, your utilization is a high 80%. Paying that balance down to $500 would drop your utilization to an ideal 10%, likely resulting in a significant score increase within one to two billing cycles.

Here are some actionable tips:

The infographic below highlights the key metrics associated with credit utilization.

As the visualization shows, focusing on this one factor can yield rapid results due to its significant weight in your score calculation. For a deeper dive into how this metric is calculated and its importance, you can learn more about the credit utilization ratio on itinscore.com.

2. Strategic Credit Limit Increases

Another powerful credit score improvement strategy is to increase the amount of available credit you have, which directly lowers your credit utilization ratio (CUR) without you having to pay down a single dollar of debt. By strategically requesting credit limit increases on your existing accounts, you expand the denominator in your CUR calculation, instantly making your current balance look smaller in comparison. This method is particularly effective because it leverages your established history with a lender.

For ITIN holders, a successful credit limit increase sends a strong signal to the creditor that your financial standing is improving. It demonstrates positive financial momentum, such as a higher income or a consistent payment history, which builds further trust and strengthens your credit profile. This can be a faster path to a lower CUR than slowly paying down a large balance.

How to Implement This Strategy

The goal is to convince your current credit card issuer that you can handle more credit responsibly. For instance, if you have a 1,000 balance on a card with a 2,000 limit, your CUR is a high 50%. If the issuer increases your limit to $4,000, your CUR immediately drops to a much healthier 25% with the same balance, which will likely boost your credit score.

Here are some actionable tips:

3. Authorized User Strategy

One of the most powerful credit score improvement strategies for those with a limited credit file is becoming an authorized user on an established, well-managed credit card account. When you are added as an authorized user, the entire history of that account, including its age, payment history, and credit limit, can be reported to the credit bureaus and added to your own credit report. This can provide an almost immediate boost to your credit profile.

For ITIN holders starting from scratch, this strategy is particularly effective because it "piggybacks" on the positive credit history of a trusted family member or friend. It allows you to instantly add a seasoned account to your report, which can significantly lengthen your average age of credit and lower your overall credit utilization, two key factors in your FICO score.

How to Implement This Strategy

To implement this, you need to find a primary account holder, such as a parent or spouse, who is willing to add you to their credit card account. They simply need to contact their card issuer and provide your personal information. It's crucial that the account they add you to has a long history of on-time payments and a consistently low credit utilization ratio (ideally under 10%).

Here are some actionable tips:

4. Payment History Optimization

Your payment history is the single most influential factor in your credit score, accounting for a massive 35% of your FICO score. This credit score improvement strategy focuses on building an impeccable record of on-time payments, which demonstrates reliability to lenders. One late payment can significantly damage your score, while a long history of consistent, timely payments is the foundation of a strong credit profile.

For ITIN holders, establishing this perfect payment pattern is non-negotiable. It proves you are a low-risk borrower, even if your credit history is short. Lenders want to see that you meet your financial obligations consistently, and your payment history is the primary evidence of that behavior.

How to Implement This Strategy

Optimizing your payment history involves both preventing future missteps and addressing any past issues. The goal is to ensure every single payment on your credit report is marked as "on time." For example, if you have a credit card and a personal loan, setting up automatic payments for at least the minimum due on both accounts creates a safety net against forgetfulness.

Here are some actionable tips:

As the infographic highlights, consistently paying bills on time is the cornerstone of a healthy credit score. For more details on how payment history impacts your financial profile, you can learn more about managing credit payments at consumerfinance.gov.

5. Credit Report Dispute and Error Correction

One of the most overlooked yet powerful credit score improvement strategies is to meticulously review your credit reports for inaccuracies. A significant percentage of credit reports contain errors, from incorrect personal information to accounts that don't belong to you. These mistakes can unfairly drag down your score, and removing them can lead to a substantial and immediate improvement.

For ITIN holders, maintaining an accurate credit file is especially critical. Since you may have a thinner credit file to begin with, a single negative error can have a disproportionately large impact. Regularly auditing your reports from all three major bureaus (Experian, Equifax, and TransUnion) ensures that your score is a true reflection of your financial behavior, not someone else's mistake or a data entry error.

How to Implement This Strategy

The process involves obtaining your credit reports, identifying any discrepancies, and formally disputing them with the credit bureaus. By law, the bureaus must investigate your claim, typically within 30-45 days, and remove any information they cannot verify. For example, if an old collection account that you paid off is still listed as open, disputing it with proof of payment can get it corrected or removed, boosting your score.

Here are some actionable tips:

Systematically cleaning up your credit report is a foundational step in any credit-building journey. For a comprehensive walkthrough of the process, you can learn more about how to dispute your credit report on itinscore.com.

6. Debt Consolidation and Management

Managing multiple debts with varying interest rates and due dates can be overwhelming and lead to missed payments, negatively impacting your credit score. Debt consolidation is one of the more structured credit score improvement strategies that involves combining several debts into a single, more manageable loan. This simplifies your finances with one monthly payment and can often secure a lower overall interest rate, making it easier to pay down your principal balance faster.

For ITIN holders, consolidating high-interest debt, such as from multiple credit cards, into a single personal loan or balance transfer card can be a powerful move. It not only streamlines payments but also significantly improves your credit utilization ratio by paying off revolving balances. This demonstrates to lenders an ability to manage finances proactively, a crucial signal when building a U.S. credit history from scratch.

How to Implement This Strategy

The core idea is to obtain a new form of credit to pay off existing, more expensive debts. For example, if you have three credit cards with balances totaling 10,000 at an average 24% APR, you could take out a personal loan for 10,000 at a 9% APR. This single action simplifies your payments and saves a substantial amount in interest, accelerating your path out of debt.

Here are some actionable tips:

7. Credit Mix Diversification

Another key component in building a robust credit profile is diversifying your credit mix. This refers to the variety of credit accounts you have, such as revolving credit (like credit cards) and installment loans (like auto, personal, or mortgage loans). This factor accounts for 10% of your FICO score, and demonstrating that you can responsibly manage different types of debt is one of the more advanced credit score improvement strategies.

For ITIN holders, a healthy credit mix signals to lenders that you are a sophisticated borrower capable of handling various financial obligations. While it's not as impactful as payment history or credit utilization, it becomes increasingly important as you aim for the highest credit score tiers. Lenders prefer to see a track record of successfully managing both fixed monthly payments (installment loans) and variable payments (revolving credit).

How to Implement This Strategy

The primary goal is to naturally incorporate different types of credit into your financial life over time. You should never take on debt just for the sake of improving your credit mix. Instead, when you genuinely need a loan, recognize its potential to also benefit your credit score. For instance, financing a car or using a credit-builder loan can add a valuable installment account to your file.

Here are some actionable tips:

Ultimately, a good credit mix develops organically as your financial needs evolve. Focus first on mastering payment history and credit utilization, and then allow your credit mix to grow as you finance major life purchases. This approach ensures you build a strong, well-rounded credit profile without taking on unnecessary risk.

8. Goodwill Letters and Creditor Negotiations

One of the less-known but powerful credit score improvement strategies involves directly communicating with your creditors to request the removal of negative marks. This can be done through a goodwill letter, which is a formal request for a "goodwill adjustment" to remove a legitimate negative item, like a single late payment, from your credit report. Lenders are not obligated to honor these requests, but many will if you have an otherwise positive payment history.

For ITIN holders, this strategy can be especially effective when a minor mistake threatens to derail a carefully built credit file. A single 30-day late payment can drop a new credit score significantly. A well-written letter explaining the circumstance can reverse that damage, preserving the positive history you have worked hard to establish. It shows proactive financial management and a commitment to maintaining a good relationship with the lender.

How to Implement This Strategy

The core of this strategy is polite, professional, and honest communication. You are asking for a courtesy, not demanding a right. The key is to explain the situation that led to the negative mark and highlight your overall good standing as a customer. For more serious delinquencies, you may need to negotiate a settlement or a "pay for delete" agreement, where the creditor agrees to remove the negative account in exchange for payment.

Here are some actionable tips:

This approach humanizes your financial situation and can lead to positive outcomes that automated systems would never allow. To gain a deeper understanding of how to approach these conversations, you can learn more about how to negotiate with creditors on itinscore.com.

9. Strategic Account Management (Keeping Old Accounts Open)

One of the most overlooked credit score improvement strategies involves something you don't do: closing old credit accounts. The length of your credit history accounts for a significant 15% of your FICO score. Lenders value a long, stable history as it provides more data to assess your long-term reliability as a borrower. Closing an old account, especially your first one, can shorten this history and potentially lower your score.

For ITIN holders, whose credit histories are often newer, preserving every month of that history is critical. An older account acts as an anchor for your credit file, demonstrating a longer track record of managing credit responsibly. Closing it not only erases that history over time but also reduces your total available credit, which can increase your credit utilization ratio and further damage your score.

How to Implement This Strategy

The core of this strategy is to keep your credit accounts, particularly the oldest ones, active and in good standing. Even if you no longer use a card regularly, its age and credit limit contribute positively to your financial profile. Resisting the urge to "declutter" your wallet by closing cards is a key discipline for credit building.

Here are some actionable tips: