How to Get Your Credit Report with ITIN | Easy Guide

Absolutely. Getting a credit report with an ITIN is not only possible, it's a critical step toward building a solid financial foundation in the U.S. While the process isn't as automated as it is for those with a Social Security Number, the three major credit bureaus—Experian, Equifax, and TransUnion—absolutely maintain credit files for ITIN holders. You just have to know how to ask for them.

Your Guide to Credit Reports for ITIN Holders

Think of your credit report as your financial resume. It’s the first document lenders, landlords, and sometimes even employers look at to understand your financial habits and reliability. For an ITIN holder, this report is your proof that you’re an active and responsible part of the U.S. financial system.

Your credit history has a real impact on your life. A strong report can open doors to better interest rates on loans, help you get that credit card you’ve been wanting, or make the difference in getting approved for a new apartment. Without a report, you’re often considered "credit invisible," which can make achieving these goals feel like an uphill battle.

How Credit Bureaus Handle ITINs

The big three credit bureaus are the keepers of your credit information. They gather data from banks, credit card companies, and other lenders you work with. When you use your ITIN to open an account, that activity gets reported to the bureaus, which is how your unique credit file is born.

But here’s where the path diverges for ITIN holders. If you have an SSN, you can often pull your reports online in minutes. With an ITIN, the process is a bit more old-school and requires a more hands-on approach.

This manual process exists for your own protection. It might seem like a hassle, but it’s designed to keep your sensitive financial data secure. The trick is to know what’s required and get your paperwork in order from the start to avoid any frustrating delays.

Why This Process Matters for You

Getting a handle on this system is more than just checking a box. It's about taking control of your financial future and building stability. By regularly reviewing your credit report, you can:

Ultimately, getting and understanding your credit report puts you in the driver's seat. It gives you the information you need to make smart moves. Our detailed guide on how to build credit with an ITIN number lays out a clear roadmap for this entire journey.

While ITIN holders face unique hurdles, the fact that the major U.S. credit bureaus maintain your files means access is achievable. For more on the specific challenges ITIN holders can encounter, you can find helpful information on platforms like Self.inc.

Gathering Your Documents for a Smooth Request

Before you do anything else, let’s get your paperwork in order. This is honestly the most important step in getting your credit report with an ITIN, and rushing it is the fastest way to get your request rejected.

Because you have to do this by mail, the documents you send are the only proof the credit bureaus have to confirm you are who you say you are. Think of it like building a case file—the stronger your evidence, the quicker they'll release your sensitive financial information. Getting it right the first time will save you weeks of frustration.

Your Core Identification Documents

Let's start with the basics. You absolutely need to have these two items on hand. They are the foundation of your entire request.

Here’s your essential checklist:

Proof of Your Current Address

Next up, you have to prove you live where you say you live. This is a common trip-up. The address on your request letter must perfectly match the address on the document you provide.

You’ll need to send a recent copy of one of these documents showing your full name and current address:

I've seen it happen countless times. Imagine your passport says "Maria Elena Gonzalez," but your utility bill is addressed to "M. E. Gonzalez." To you, it's the same person. To a verification system, it's a red flag.

Before you seal that envelope, lay every single document out on your table. Compare them side-by-side. Does the name match exactly? Is the address identical, down to the apartment number? This five-minute check can literally save you from having to start this entire process over from scratch.

How to Get Your Report from Each Credit Bureau

Getting your hands on your credit report when you have an ITIN isn't as simple as hopping online. Since portals like AnnualCreditReport.com are built around Social Security Numbers, you'll need to go a more traditional route: requesting your reports directly from the three major credit bureaus by mail.

Don't let the manual process intimidate you. It's really just a security measure to keep your financial information safe. Think of it less as a hassle and more as a hands-on way to manage your credit profile. With a bit of preparation, you can get it done smoothly. You’ll just need to send a formal request letter and some proof of who you are to Experian, Equifax, and TransUnion.

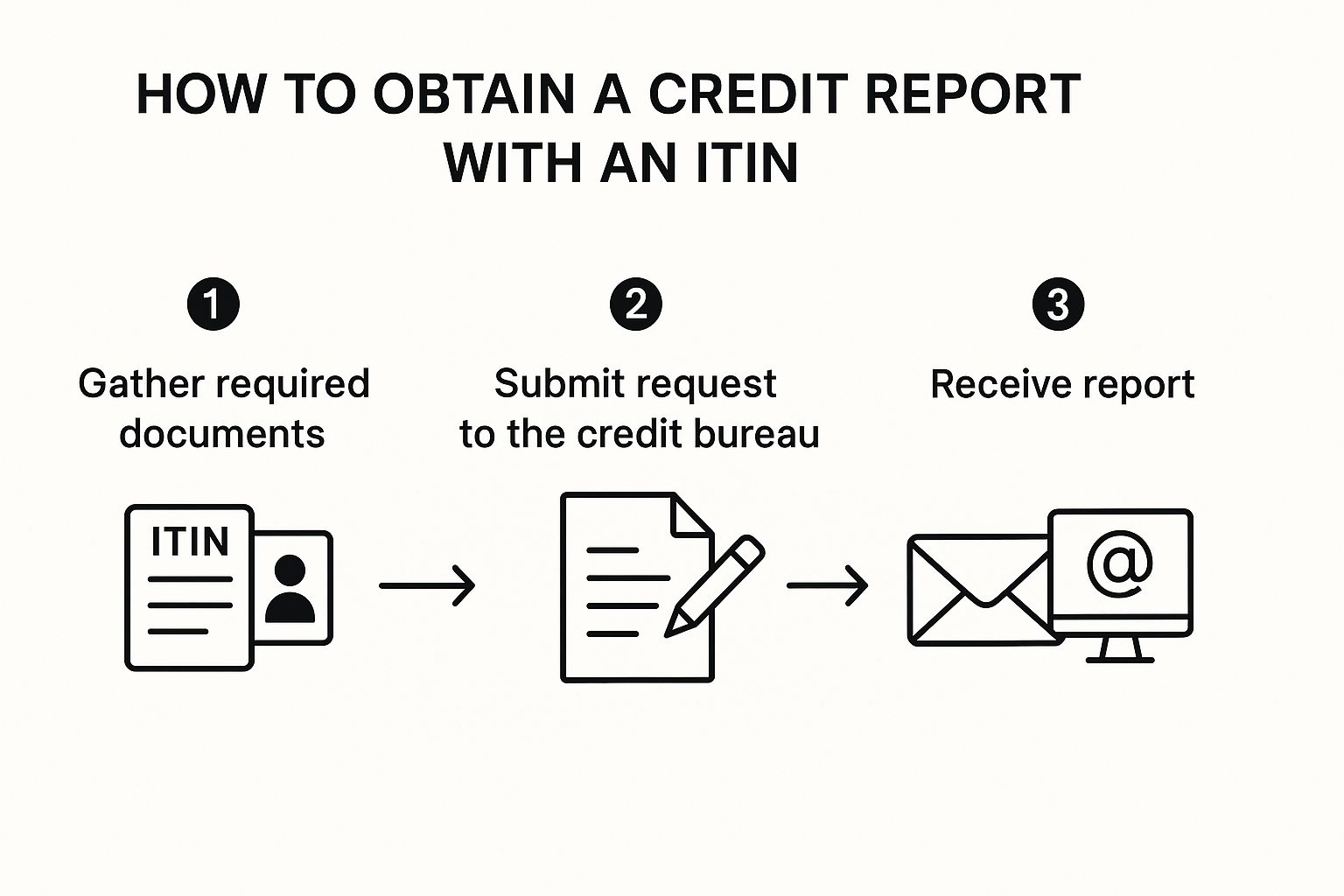

The image below breaks down the whole process into three key parts. As you can see, getting everything organized before you mail your letters is the real secret to success.

Putting Your Request Letter Together

You don’t need to write a formal essay. Your goal is a clear, direct letter asking for a copy of your credit report, which you're entitled to for free once a year under the Fair Credit Reporting Act (FCRA).

Here's a straightforward template you can use. Just fill in your details and print out a separate, signed copy for each of the three bureaus.

This letter gives the bureaus everything they need. The most important part? Remember to physically sign each copy before mailing it. An unsigned letter will be rejected immediately.

Sending Your Requests to the Right Place

Sending your letter to the right address is critical. Each credit bureau has a specific P.O. Box just for handling these kinds of consumer requests. If you send it to their main corporate headquarters, it will get lost in the shuffle and cause major delays.

To make it easy, here's a quick reference table with the correct mailing addresses and contact numbers you'll need.

Credit Bureau Contact Information for ITIN Holders

Always use these exact addresses to ensure your requests are processed correctly.

What Happens Next? A Pro-Tip and a Timeline

Here’s a piece of advice I always give my clients: send each letter via certified mail with a return receipt. Yes, it costs a few extra bucks at the post office, but it’s worth every penny. You get a tracking number and, more importantly, a signed receipt proving the bureau received your documents. This little piece of paper can be a lifesaver if you need to follow up.

After you've mailed everything, it's time to be patient. This isn't an overnight process. You should expect to receive your paper credit reports in the mail within 30 to 45 days. If more than six weeks go by and you still haven't seen anything, it's time to take action. Grab your certified mail receipt and call the bureau's customer service number to check on the status.

Making Sense of Your ITIN Credit Report

So, your credit report has arrived in the mail. That's a huge step forward. But opening that envelope is just the beginning—the real power comes from knowing what all that information actually means.

A credit report with an ITIN can look pretty intimidating at first, almost like it's written in a different language. Don't worry. Once you know what to look for, it tells a clear story about your financial history. Let's break it down into manageable pieces so you can read it like a pro.

The Four Main Sections of Your Report

Think of your credit report as having four key sections. Each one gives lenders a different piece of the puzzle they use to assess your creditworthiness.

A Closer Look at Your Credit Accounts

You'll probably spend most of your time reviewing the credit accounts section, and for good reason. It’s packed with details. For each account, you’ll see the lender's name, when you opened it, your credit limit or the original loan amount, your current balance, and—most importantly—your complete payment history.

You'll notice two main categories of credit listed:

Having a healthy mix of both types of credit often looks good to lenders. It demonstrates that you can successfully manage different kinds of financial obligations.

Finding and Fixing Mistakes on Your Credit Report

Let's be honest—finding an error on your credit report feels like a punch to the gut. It's not just a minor typo; a mistake can tank your credit score, making it harder to get a loan, rent an apartment, or even get a good rate on insurance. For anyone building a financial life with an ITIN, learning to spot and squash these inaccuracies is a critical skill.

Think of yourself as a detective when your report arrives. The first place to look is the personal information section. Is your name spelled right? Do you recognize every address listed? A strange address you've never lived at can be a major red flag for identity theft.

Once you've cleared your personal details, it's time to dig into the accounts. Go through them one by one. Check account numbers, balances, and payment histories. Keep an eye out for anything that looks off, like an account you never opened, a payment marked "late" that you know you paid on time, or a credit limit that seems wrong. These are the kinds of errors that can do real damage.

Common Errors to Watch Out For

Getting your credit report with an ITIN can be a bit intimidating with all the data packed into it. To make your review easier, focus on these common trouble spots first:

Your Rights and How to Start a Dispute

Found a mistake? Don't stress. The law is on your side. Thanks to the Fair Credit Reporting Act (FCRA), you have the legal right to challenge any information you believe is inaccurate. The credit bureaus are required to investigate your claim.

This is especially important for ITIN holders. The system isn't always perfect. Since the program started, over 25.1 million ITINs have been issued, and IRS audits have occasionally found administrative hiccups like duplicate applications. You can see the details for yourself in the full Treasury Inspector General report. This just goes to show how vital it is to make sure your own information is 100% correct.

Once you’ve sent in your dispute, the credit bureau usually has 30 days to investigate. They'll contact the creditor that reported the information and figure out what happened. After their investigation, they must send you the results in writing. If they fix the error, you'll get a free, updated copy of your report.

For a complete, step-by-step guide, take a look at our article on how to dispute credit report errors effectively. Taking this step is all about taking back control of your financial story.

Answering Your Top Questions About ITIN Credit

If you’re using an ITIN to build your financial life in the U.S., you've probably got questions. That's completely normal. Getting a handle on how credit reports work with an ITIN is one of the most important steps you can take. Let's walk through some of the things people ask me about most often.

Are ITIN and SSN Credit Reports Different?

This is probably the biggest point of confusion, so let's clear it up right away: structurally, they are identical. When a lender pulls your report, they see the same exact sections you'd find on a report tied to a Social Security Number.

You'll have your personal information, a rundown of your credit accounts, any public records, and a list of who has recently checked your credit. Lenders are looking for the same thing in both scenarios—a solid track record of paying your bills on time. The only real difference is the nine-digit identification number used to tie it all together.

What Are My Rights and What Happens Next?

A crucial question that always comes up is whether you can get your annual credit reports for free. The answer is a clear and simple yes. Federal law gives you the right to a free report from each of the big three bureaus—Experian, Equifax, and TransUnion—every 12 months.

Now, here's the catch. You can't just hop onto the standard AnnualCreditReport.com website. That portal is set up to verify users with an SSN. For ITIN holders, the process is a bit more manual. You’ll need to request your reports directly from each bureau by mail, following the steps we outlined earlier.

This doesn't happen on its own. It's on you to reach out to each of the three credit bureaus. You'll need to provide them with documentation for both your ITIN and your new SSN and explicitly ask them to merge your files. Taking this step ensures all your hard work—your on-time payments and established accounts—is consolidated under your SSN. It's the key to not having to start building your credit all over again from square one.

Can I Actually See My Credit Score?

So you can get your report, but what about that all-important three-digit number? This is another common hurdle. While getting the full report with an ITIN is straightforward (by mail), accessing a credit score can be a bit more hit-or-miss. Some scoring models and services just aren't set up to generate a score from an ITIN.

The good news is that many ITIN-friendly banks and financial services can provide a score once you're a customer. But even if you can't see the number, your credit report gives you all the ingredients that go into it.

Your report shows lenders everything they need to know, including: