Credit Report vs Credit Score: Key Differences Explained

Think of it this way: your credit report is your detailed financial biography, while your credit score is the final grade at the top of the page. The report gives lenders the why behind your creditworthiness, while the score offers a quick what—a simple number that sums up your risk.

Your Financial Story: The Role of a Credit Report

Imagine your credit report as a comprehensive storybook of your life with money. It doesn't actually give you a grade. Instead, it lays out all the raw information that others—lenders, landlords, and sometimes even employers—use to form their own opinions about your financial habits.

This document is the bedrock of your credit identity, telling a detailed story of how reliable you’ve been over the years. The core difference is that a credit report is the historical record, while a credit score is just a numerical summary of that record. The score distills all that information into one simple number. For a deeper dive, you can explore more insights on consumer credit evaluation in a detailed issue brief.

What's Inside a Credit Report?

To really get the difference between a credit report and a credit score, you have to know what's in the report itself. It’s not just a single page; it's broken down into four main sections that together paint a full picture of your financial history.

This level of detail is precisely why the report itself is so powerful. A potential landlord might scan it to see if you have a history of paying your bills on time, while a mortgage lender will comb through every line to understand how you've managed debt long-term. It's the whole story, not just the headline.

The Three-Digit Grade: How Your Credit Score Is Calculated

If your credit report is the detailed story of your financial life, your credit score is the final grade. It’s a single, three-digit number that boils down that entire history into something a lender can understand at a glance. They use this score as a quick way to gauge your creditworthiness without digging into every last detail.

This number, which usually falls between 300 and 850, is generated by scoring models like FICO and VantageScore. These models run the data from your credit report through complex algorithms to produce your score. A higher number signals to lenders that you're a lower-risk borrower, which is why this little number packs such a big punch.

The Five Pillars of Your Credit Score

While the exact formulas used by scoring models are kept under wraps, the main ingredients are no secret. Getting a handle on these five factors is the key to building and maintaining a strong score. Keep in mind, they aren’t all created equal; some have a much bigger impact than others.

By understanding these five pillars, you can see exactly why your score is what it is. For a more complete picture, you can learn more about what a credit score is and how it works in our detailed guide. This knowledge helps you put your energy where it will make the biggest difference.

Credit Report vs Credit Score A Direct Comparison

It's easy to use the terms "credit report" and "credit score" interchangeably, but they're two very different things. Getting a handle on what each one is—and what it does—is a critical step in building a strong financial future, especially when you're starting out with an ITIN.

Think of your financial life as a detailed biography. Your credit report is that full biography, packed with every detail, chapter, and character. Your credit score is the one-sentence summary on the back cover. One gives you the full story; the other gives you a quick verdict.

Function: Historical Record vs. Risk Snapshot

At its core, a credit report is a historical document. It’s a detailed, running log of how you’ve managed debt over the years. Lenders pour over this report to see the why and how behind your financial habits, giving them a full picture of your track record.

A credit score, on the other hand, is all about the future. It’s a predictive tool that boils down all that historical data into a single, three-digit number. This number tells a lender, at a glance, how likely you are to pay back a new loan on time. For fast decisions, like getting approved for a store credit card, the score is often all they look at.

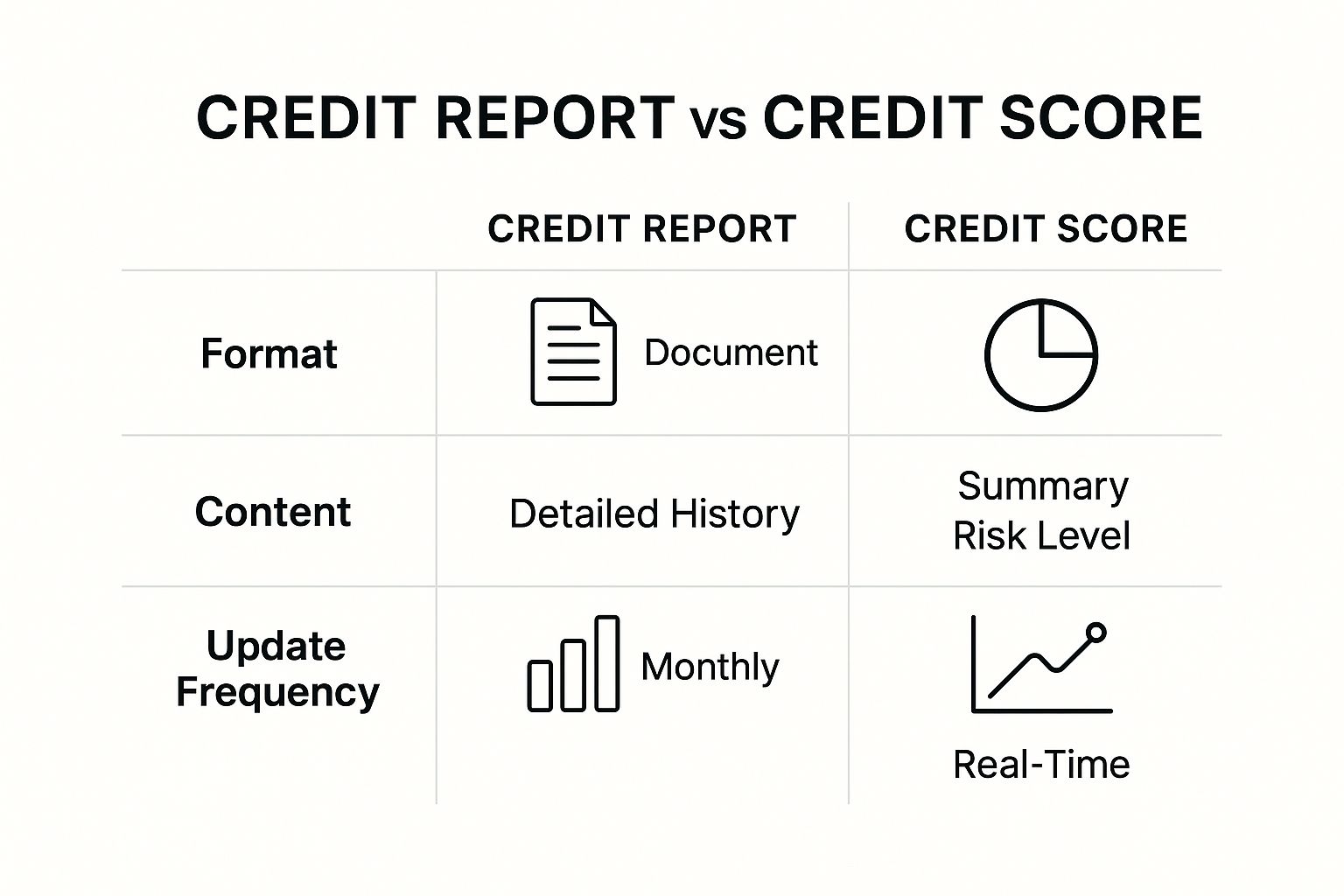

This breakdown shows just how different they are in purpose and presentation.

As you can see, the report is a comprehensive file, whereas the score is a simple, powerful number. Their content and how often they're updated reflect these distinct roles.

Content and Format: Detailed Text vs. Single Number

The most striking difference is how they look. A credit report is a multi-page document, meticulously organized into sections. You'll find personal information, every credit account you've ever had, payment histories, and any public records like bankruptcies. It’s all text and data—names, dates, and dollar amounts.

Your credit score is the polar opposite. It’s just one number, typically between 300 and 850. That simplicity is its superpower. It allows automated lending systems to make snap judgments and gives lenders a quick, standardized way to gauge risk without reading your entire biography.

To make this crystal clear, let's lay out the key differences side-by-side.

Credit Report vs Credit Score Key Differences at a Glance

This table breaks down the fundamental distinctions between the two, from what they contain to how they're used in the real world.

This at-a-glance view helps reinforce that while they are completely intertwined, they serve very different and specific purposes in the lending process.

Application: Deep Underwriting vs. Instant Approval

Because they are so different, reports and scores are used in very different situations.

When you're making a huge financial move, like buying a house, an underwriter will pull your full credit report. They are going to manually comb through every detail—your payment patterns, how much debt you carry, and the age of your accounts—to make a very careful, human-driven decision.

But for smaller, everyday credit needs, the credit score is king. Applying for a new credit card online? An automated system will likely use your score as the main gatekeeper for an instant "yes" or "no." A high score often means immediate approval, while a lower one might get you an instant rejection or flag your application for a closer look.

Why You Need to Pay Attention to Both

Knowing the difference between your credit report and your credit score is the first step. The real trick is understanding how they work together in your financial life. Both of them are constantly working for—or against—you, but they step into the spotlight in very different situations.

Focusing on one and ignoring the other is a classic mistake. It’s like a pilot watching their altitude but completely forgetting to check the fuel gauge. To get where you want to go financially, you have to keep an eye on both dials. A great score can open doors, but it’s a clean report that lets you walk through them.

The Score: Your Gatekeeper for Quick Decisions

In a lot of everyday financial situations, your credit score is the first thing a lender looks at. Sometimes, it’s the only thing. It acts as a quick, instant filter, especially for automated systems where speed is everything. This is where having a high number really pays off.

Think about these common scenarios:

In these cases, the score is just a simple summary of your credit risk. Lenders rely on it to make fast decisions when they don’t need to do a deep dive into your history.

The Report: Your Story for Major Commitments

While a good score gets your foot in the door, your credit report is what the lender reads once you're inside. For the big life moments—the ones that involve serious money—they will always look past that three-digit number to get the full story.

This is especially true during the underwriting process, when lenders dig deep to evaluate risk. A mortgage underwriter, for example, will see your 750 score and then immediately pull up your entire report to see what’s behind it.

This is where your report becomes the star of the show:

Ultimately, managing your credit is a two-part job. You need a high score to seize everyday opportunities and a clean report to secure life's biggest milestones.

Credit Scoring Fairness and Systemic Issues

The difference between a credit report and a credit score isn't just a technical detail—it has real-world consequences. While scoring models are designed to be objective, they don't exist in a vacuum. They function within a system that can mirror, and sometimes even worsen, existing societal inequalities, making it harder for some people to get ahead financially.

One of the biggest hurdles is something called credit invisibility. Millions of people in the U.S. don't have enough credit history to generate a score at all. Without that crucial three-digit number, simple things like renting an apartment, financing a car, or even landing certain jobs can feel impossible. This problem hits some communities harder than others, effectively shutting them out of the financial system before they even get a chance to start.

Disparities in Credit Data

If you look at the data, it's clear that credit access isn't the same for everyone. A 2021 study revealed stark differences in median credit scores across racial lines: Black consumers had a median VantageScore of 639, and Latino consumers had a median of 673. In contrast, the median score for white consumers was 730, and for Asian consumers, it was 752.

Digging deeper, the Consumer Financial Protection Bureau (CFPB) found that about 15% of Black and Latino consumers are credit invisible, compared to just 9% of white and Asian consumers. You can explore more of these credit scoring findings and their implications.

These gaps aren't just about individual financial decisions. They're often tied to bigger, systemic problems like historical barriers to building wealth, income inequality, and limited access to mainstream banking. All of this can lead to thin or damaged credit files, meaning the very data used to calculate a score can reflect these long-standing disadvantages.

The Push for a More Inclusive System

Thankfully, there's a growing recognition of these flaws. The industry is starting to push for a more equitable credit reporting system, and one of the most promising ideas is to bring alternative data into the mix.

This means looking beyond just loans and credit cards. A more complete picture could include:

By incorporating this kind of information, scoring models could get a much better sense of someone's financial habits. This is especially true for people who have been overlooked by the traditional system. The ultimate goal is to create a system where your financial identity is built on a broader range of responsible behaviors, opening doors for millions who have been unfairly left behind.

A great first step is to make sure the information already on your report is correct. Our guide on how to dispute credit report errors can walk you through that process.

Taking Control: Practical Steps to Manage Your Credit Health

Knowing the difference between a credit report and a credit score is the first step, but real financial power comes from what you do with that knowledge. Think of managing your credit health as an ongoing process—it’s all about keeping a close eye on your report and building habits that boost your score. This is your playbook for getting it done.

First things first: you need to see your complete financial story. You have the right to get a free copy of your credit report from each of the three main bureaus—Equifax, Experian, and TransUnion—once every year. Getting these reports puts the raw data that lenders see right in your hands.

Get Your Hands on Your Credit Reports and Review Them

Once you have your reports, it's time to put on your detective hat. Don't just give them a quick glance. Comb through every detail, looking for anything that seems off or unfamiliar. You'd be surprised how often errors pop up, and they can seriously damage your score without you even knowing.

Here's a quick checklist for your review:

Found a mistake? You have the right to dispute it directly with the credit bureau. By law, they have to investigate your claim and fix any proven errors.

Building a Stronger Credit Profile for the Long Haul

With an accurate report as your starting point, you can shift your focus to building a better credit score. The name of the game is consistency. You need to show lenders you’re a reliable borrower over time.

It's also worth noting that credit scoring models evolve. Research digging into data from the Great Recession showed that newer scoring models, which use more data points from your credit report, were better at predicting risk than older, more conventional scores. You can read the full research about these credit model findings to see just how much the details matter. This really drives home the point that managing what’s on your report is as crucial as the final score itself.

Ready to get started? Concentrate on the two things that have the biggest impact: