Your Guide to Credit Report Tradelines

When you look at your credit report, you’ll see a list of all your accounts—credit cards, car loans, student loans, a mortgage. Each one of these accounts is what’s known in the credit world as a tradeline.

Think of your credit report like your financial life story. Each tradeline is a chapter in that story, detailing your relationship with a specific lender and how you've handled that responsibility over time. Lenders read these chapters to get a sense of who you are as a borrower.

So, What Exactly Are Credit Report Tradelines?

Let's stick with that story analogy. An auto loan tradeline is like a long-term commitment, showing you can handle a steady, predictable payment for years. A credit card tradeline is more like an ongoing, flexible relationship, demonstrating how you manage day-to-day spending and revolving debt.

When a lender pulls your credit, they're not just counting how many accounts you have. They're digging into the details of each tradeline to see the full picture of your financial habits. Your entire credit history is built from these individual accounts.

The Building Blocks of Your Credit Score

Everything that makes up your credit score is pulled directly from the information in your tradelines. Once you grasp this, you can start taking control of your financial reputation. For a closer look at how all this information is laid out, check out our guide that explains your credit report in more detail.

Your score is calculated based on five key areas, and every single one is influenced by your tradelines:

It's all connected. When you pay your car loan on time, you're boosting your payment history. When you pay down your credit card balance, you're improving your amounts owed. Every small action you take on a single tradeline sends ripples across your entire credit profile, shaping the score that determines your financial future.

Decoding the Different Types of Tradelines

Think of your credit report like a storybook about your financial life. Each chapter, or tradeline, tells a potential lender something different about how you manage money. Not all accounts are the same; they each play a unique role in building your credit history. Understanding what they are and how they work is the first step toward taking control of your financial future.

For the most part, your credit report tradelines will be one of two types: revolving or installment. There's a third, less common type called an open account, but let's focus on the big two. Each one gives lenders a different piece of the puzzle.

Revolving Credit Tradelines

A revolving tradeline is essentially a flexible line of credit. You can borrow from it, pay it back, and borrow again without having to reapply. The classic example is a credit card. You're given a credit limit, and your balance and monthly payment will change based on what you spend and pay off each month.

What lenders really care about here is your credit utilization ratio. This is just a fancy term for how much of your available credit you're using. If you have a 1,000 credit limit and a 500 balance, your utilization is 50%. Keeping this number low (ideally under 30%) is one of the quickest ways to give your credit score a boost. For a deeper dive, it's worth understanding exactly how a revolving credit account works.

Installment Credit Tradelines

Installment tradelines are much simpler. These are loans you take out for a specific amount and agree to pay back in fixed, regular payments over a set period. Think of a car loan, a mortgage, or even a student loan. You borrow a lump sum and chip away at it with predictable payments until it's gone.

With installment loans, lenders are looking for one thing above all: consistency. A long track record of making every single payment on time shows them you're a dependable borrower. Unlike with a credit card, the initial loan amount doesn't hurt your score, as long as you stick to the payment schedule.

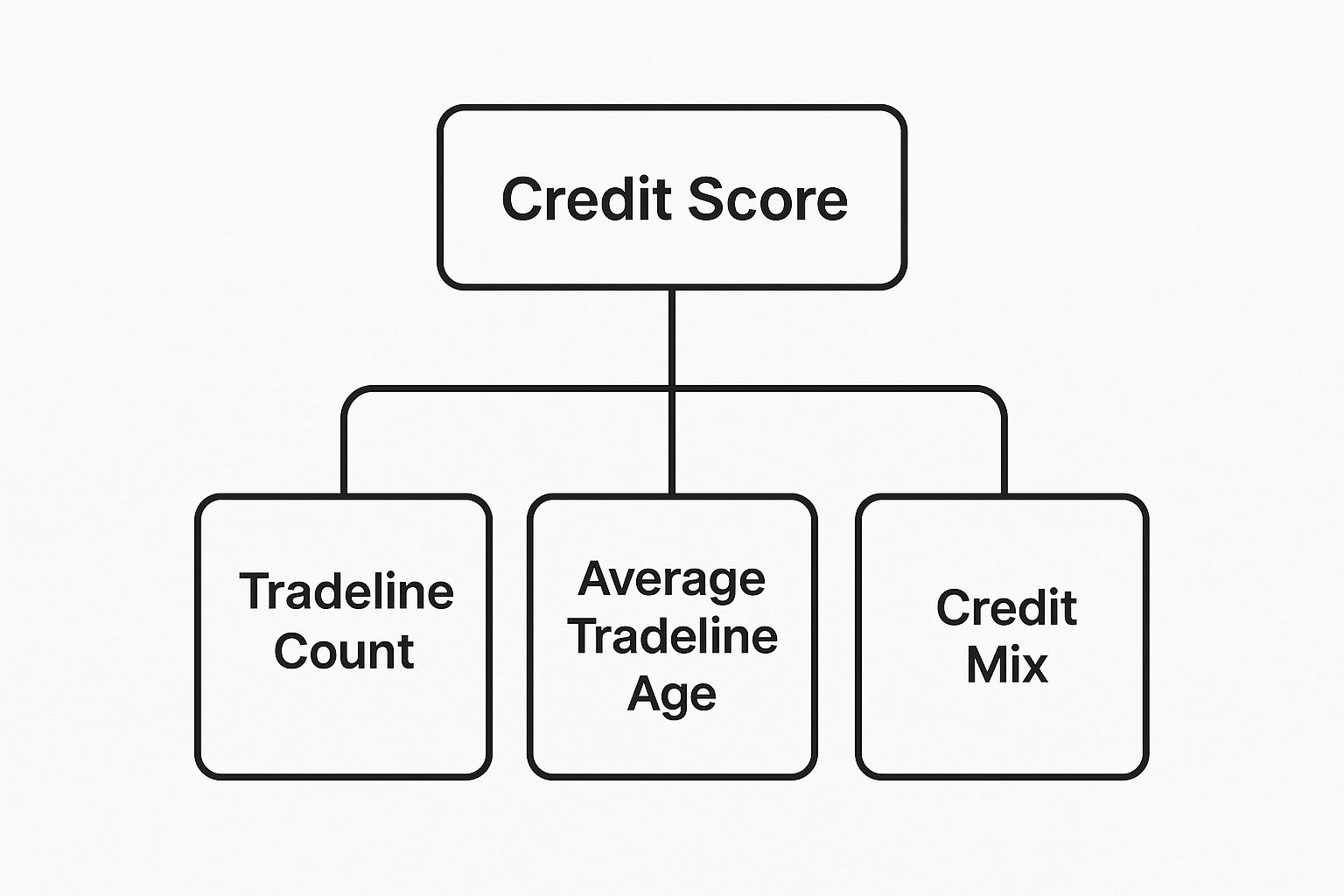

The image below breaks down how these different factors come together to build your credit score.

As you can see, your credit score is a blend of different elements, including the number of tradelines you have, their average age, and the variety of accounts.

Revolving vs Installment Tradelines at a Glance

To make it even clearer, here’s a simple table that highlights the key differences between these two common types of credit accounts. This should help you quickly spot which is which on your own credit report.

Understanding this distinction is crucial. Managing a low balance on a credit card sends a different signal than making steady payments on a car loan, and both are important for building a robust credit history.

How Tradelines Build or Break Your Credit Score

Think of your credit report as your financial story, and each tradeline is a chapter. Every account you open—a credit card, a car loan, a mortgage—adds a new chapter. Each one has the power to either build trust with lenders or raise some serious red flags.

When you consistently pay your bills on time and keep your balances low, you're writing a story of reliability. These positive credit report tradelines form a strong foundation for a great credit score. On the other hand, negative marks like missed payments or collection accounts can tarnish that story and damage your credit for years to come.

Let's look at a quick example. Imagine you have a credit card you’ve paid on time for five years and a car loan with a perfect payment history. To a lender, this story screams "responsible." It shows you can handle credit wisely, which often leads to better loan approvals and lower interest rates.

Now, picture someone else who missed a few payments a year ago and has a medical bill that went to collections. Even if they're back on track now, those old negative tradelines are like blemishes on their record. Lenders see them as signs of potential risk, which can unfortunately lead to loan denials or sky-high interest rates.

The Weight of Negative Information

Not all negative marks are created equal. Their impact on your score really boils down to two things: severity and recency.

A missed payment that just happened is going to hurt your score a lot more than one from five years ago. As negative items get older, their sting fades, but they can still hang around on your report for up to seven years.

Here’s a rough idea of how different negative items stack up:

This is exactly why keeping a clean payment history across all your credit report tradelines is so incredibly important.

A Closer Look at Collection Accounts

Collection accounts are particularly nasty because they send a clear signal to lenders: a previous creditor completely gave up on trying to get paid by you.

Interestingly, the way these accounts are reported has been changing. Recent data shows a big shift in how often collection agencies even report debts to the credit bureaus.

Between 2018 and 2022, the total number of collection tradelines on U.S. credit reports actually fell by about 33 percent. This doesn't mean people suddenly owed less money. Instead, it points to a strategic change in how debt collectors are doing business. If you want to dive deeper into why this is happening, you can check out the latest market snapshot on debt collection reporting.

But even with fewer collections being reported overall, having one on your record is still a major roadblock to a healthy credit score. Every single action you take—paying on time, keeping balances low, and steering clear of collections—directly shapes the story your tradelines tell. And ultimately, that story is what opens (or closes) doors to your financial opportunities.

Building Credit with an ITIN Number

If you have an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number, trying to build a strong credit history can feel like you're playing a game with no clear rules. Most traditional loans and credit cards are built for SSN holders, leaving millions of U.S. residents stuck on the sidelines as they try to get a financial foothold.

The real frustration? Without an SSN, your responsible financial habits—like paying rent and bills on time—often go unnoticed by the major credit bureaus. This means you aren't creating the positive credit report tradelines needed to build a credit score. It's easy to feel financially invisible, but there are absolutely things you can do to change that.

Starting Your Credit Journey

The most important first step is to find financial products made specifically for people with ITINs. When you're building credit from the ground up, the goal is to create new, positive tradelines that will actually show up on your credit report.

Here are a few proven ways to get the ball rolling:

For many people, navigating legal processes such as adjustment of status is a key part of their long-term plan, and building a strong financial profile can be an important piece of that puzzle.

Using Technology to Your Advantage

Today, powerful online platforms are putting ITIN holders back in the driver's seat. These services often provide free credit monitoring and personalized advice, showing you the exact next steps to improve your financial standing.

This example from ITIN Score shows how a dedicated platform can give you direct access to your credit report and a clear plan of action.

Tools like these let you watch your progress in real-time, see how each tradeline impacts your score, and make smarter financial choices. For a more detailed guide, check out this walkthrough on how to build credit with an ITIN number for even more strategies.

By actively opening and managing accounts that welcome ITINs, you start to write your own financial story, one positive tradeline at a time.

Why Tradelines Matter in a Global Economy

It's easy to think of your credit report as just a personal file, a private tally of your financial choices. But in reality, it’s a tiny piece of a massive, interconnected global financial system. Every single credit report tradeline isn't just an account—it's a data point that ripples outward, influencing everything from the interest rates you're offered to major international investments.

In a world where money zips across borders in an instant, your financial identity has become one of your most important assets. The industry that manages all this data is absolutely huge and expanding at an incredible rate.

Consider this: the global market for credit bureaus—the companies that collect and manage all those tradelines—was valued at a staggering 124.4 billion in 2023**. Analysts project it will skyrocket to an estimated **385.6 billion by 2032. This explosive growth isn't just about big numbers; it shows just how deeply credit data is now woven into the fabric of our modern lives.

The Expanding Definition of a Tradeline

Not too long ago, a "tradeline" usually just meant a loan or a credit card. But the financial world is changing, and thankfully, it's becoming more inclusive. One of the biggest shifts we're seeing is the use of alternative data to build a more complete and fair picture of someone's financial life.

This means that everyday payments, which used to be completely invisible to lenders, are finally starting to get the credit they deserve. These newer types of tradelines can include things like:

If you're interested in the bigger picture of how economic shifts affect personal finance, you can explore broader financial insights and trends.

This evolution is a game-changer, especially for people new to the U.S. financial system, like ITIN holders. It’s a recognition that being financially responsible isn't limited to having a credit card. By looking at a wider range of payment behaviors, the system can give more people a fair shot at getting the credit they need to buy a home, start a business, and build their lives.

Ultimately, your tradelines are your passport to participating in this global economic system.

Busting Common Myths About Credit Tradelines

The credit world is buzzing with advice—some of it good, some of it... not so much. When you're trying to manage your credit report tradelines, it's crucial to know what's real and what's just noise. Following the wrong tip can set you back for years.

Let's cut through the confusion and debunk a few of the most stubborn myths out there. Think of this as your personal fact-checker for building a strong credit profile.

Myth 1: Closing Old Credit Cards Is a Good Idea

This one feels so logical. You're not using that old card anymore, so why not tidy up your finances and close it? It seems clean and responsible. But in the eyes of credit scoring models, it's actually one of the worst moves you can make.

Closing an old account can sting you in two major ways. First, you instantly shorten your length of credit history, which accounts for a hefty 15% of your score. That old, well-managed tradeline is a testament to your long-term reliability. Second, you lose that card's credit limit, which shrinks your overall available credit and can send your credit utilization ratio skyrocketing.

A simple trick? Set up a small, recurring bill like a streaming service on the card and put it on autopay. Problem solved.

Myth 2: You Should Carry a Small Balance to Build Credit

This myth is incredibly persistent, probably because it sounds almost right. The thinking goes that by carrying a balance and paying interest, you're showing lenders you're an active, profitable customer. But that’s simply not how it works.

Lenders report your account activity every month, whether you pay the balance in full or not. As long as you make your payment on time, you get credit for that positive history.

The only thing carrying a balance does is cost you money in interest. Paying your statement in full every single month proves you’re a responsible borrower, saves you money, and builds your credit just as effectively—if not more so.

Myth 3: Buying Tradelines Is a Clever Shortcut

Ever seen those online ads promising to boost your score overnight? They often sell a service where you pay to become an authorized user on a stranger’s credit card—one with a perfect history. This is sometimes called "credit piggybacking," and it's a shaky foundation to build on.

While being an authorized user on a trusted family member's account can be a great way to start out, paying a company for the same service is a huge red flag for lenders. They've gotten very good at spotting this, and newer credit scoring models are designed to ignore the boost from these kinds of arrangements.

At the end of the day, there are no real shortcuts. The only surefire way to build a solid financial reputation is the old-fashioned way: by responsibly managing your own credit report tradelines with consistent, on-time payments over time.