Credit Monitoring Services Comparison: Find the Best Protection

Picking the right credit monitoring service from a crowded field can feel overwhelming. It really boils down to finding the perfect balance for your needs—comprehensive 3-bureau monitoring, solid identity theft insurance, and a price that makes sense for the features you get.

The best choice for you might be different from someone else's. It all depends on what you're trying to solve. Are you looking for coverage for your entire family? Do you need tools to help you build your credit score? Or are you looking for a service that works specifically with an ITIN?

Why Credit Monitoring Is No Longer Optional

Let's be honest, data breaches are just a part of life now. With our financial information floating around online, actively protecting your credit has gone from a "nice-to-have" to an absolute must. Think of a credit monitoring service as your personal financial security guard. Its main job is to keep an eye on your credit files with the big three bureaus—Experian, Equifax, and TransUnion—and flag any suspicious activity immediately.

This goes way beyond just catching a new credit card opened in your name. Today's identity thieves are a lot more sophisticated. They might try to change your address, add themselves as an authorized user, or apply for loans, all of which trigger hard inquiries you won't recognize.

The Baseline of Modern Protection

At the very least, any service worth your money should deliver on a few key promises:

Getting a handle on these basics is your first step. We dive deeper into this in our guide on how to monitor your credit, which can help you cut through the marketing noise and focus on what truly matters for your security.

This growing need for protection is clearly reflected in the market's explosive growth. Valued at roughly 15 billion** in 2025, the global credit monitoring industry is expected to hit an estimated **45 billion by 2033. According to industry research, this surge is directly tied to the rising rates of identity theft and financial fraud. You can find more details on this market expansion and its drivers. This trend highlights one thing: people are actively seeking out reliable security, making a smart, well-informed comparison more important than ever.

The Essential Criteria for Your Comparison

When you're comparing credit monitoring services, it’s easy to get lost in the marketing hype. To make a smart choice, you have to look past the flashy ads and dig into what really counts. After all, not every service is built the same, and the right one can make a world of difference for your financial health. A solid framework is your best tool for cutting through the noise.

Think of it like buying a car. You wouldn't just kick the tires; you'd pop the hood and take it for a test drive. You need to look at the engine, the safety features, and how it handles. In the same way, a good comparison means examining the core components of any credit monitoring service.

Monitoring Scope and Speed

First things first: what are they actually watching? A service that only keeps an eye on one credit bureau is leaving you exposed. Lenders don't always report to all three, so a single-bureau service gives you a dangerously incomplete picture. For any paid plan, three-bureau monitoring—covering Experian, Equifax, and TransUnion—is the absolute minimum you should accept. It’s non-negotiable.

Next up is the speed and usefulness of the alerts. A fraud alert that shows up a week after someone has already opened a credit card in your name is basically worthless.

A delay of just a few hours, let alone days, gives a thief a huge head start. The best services will hit your phone with a text and an email within minutes of a critical change hitting your credit file.

Protection Beyond the Score

Seeing your credit score go up and down is nice, but it's only one piece of the puzzle. A truly great service does much more than just show you a number.

Take a hard look at the identity theft insurance policy. A $1 million policy has become the industry standard, but the devil is always in the details. You have to read the fine print. Does it just cover the direct costs of fraud, or will it also reimburse you for lost wages, legal fees, and other expenses you rack up while cleaning up the mess?

Finally, there’s a crucial feature that many people overlook: accessibility. Most legacy services demand a Social Security Number (SSN) to sign up, which locks out millions of residents in the U.S. A key differentiator in any modern credit monitoring comparison is support for an Individual Taxpayer Identification Number (ITIN). This feature is a game-changer, ensuring that a significant and growing part of the population isn't left without essential financial protection.

Comparing the Top Credit Monitoring Services Side-by-Side

When you start digging into the details, you quickly realize that not all credit monitoring services are created equal. A company's website might flash a lot of impressive features, but the real test is how they perform when it matters most. A few hours' delay in an alert can be the difference between easily shutting down a fraudulent account and starting a long, stressful financial recovery.

This isn't just about ticking boxes on a feature list. We're going to break down what actually provides value—from how well a service watches your credit files to the quality of its support team if your identity is stolen. And for many people, a huge factor is whether a service works with an ITIN, not just an SSN.

Core Monitoring Capabilities

The absolute bedrock of any credit monitoring service is its ability to watch your files at all three major credit bureaus: Experian, Equifax, and TransUnion. Don't even consider a service that offers less. Why? Imagine a thief opens a credit card in your name, but the bank they used only reports to TransUnion. If your service only watches Experian, you'd be completely in the dark. It’s like having a home security system that only monitors the front door, leaving the back wide open.

But simply having access isn't enough. The speed and clarity of the alerts are just as important. When a hard inquiry hits your report, you need an instant, easy-to-understand notification that explains what happened and what your next steps should be. Vague or delayed alerts just cause more anxiety, completely defeating the purpose of paying for protection in the first place.

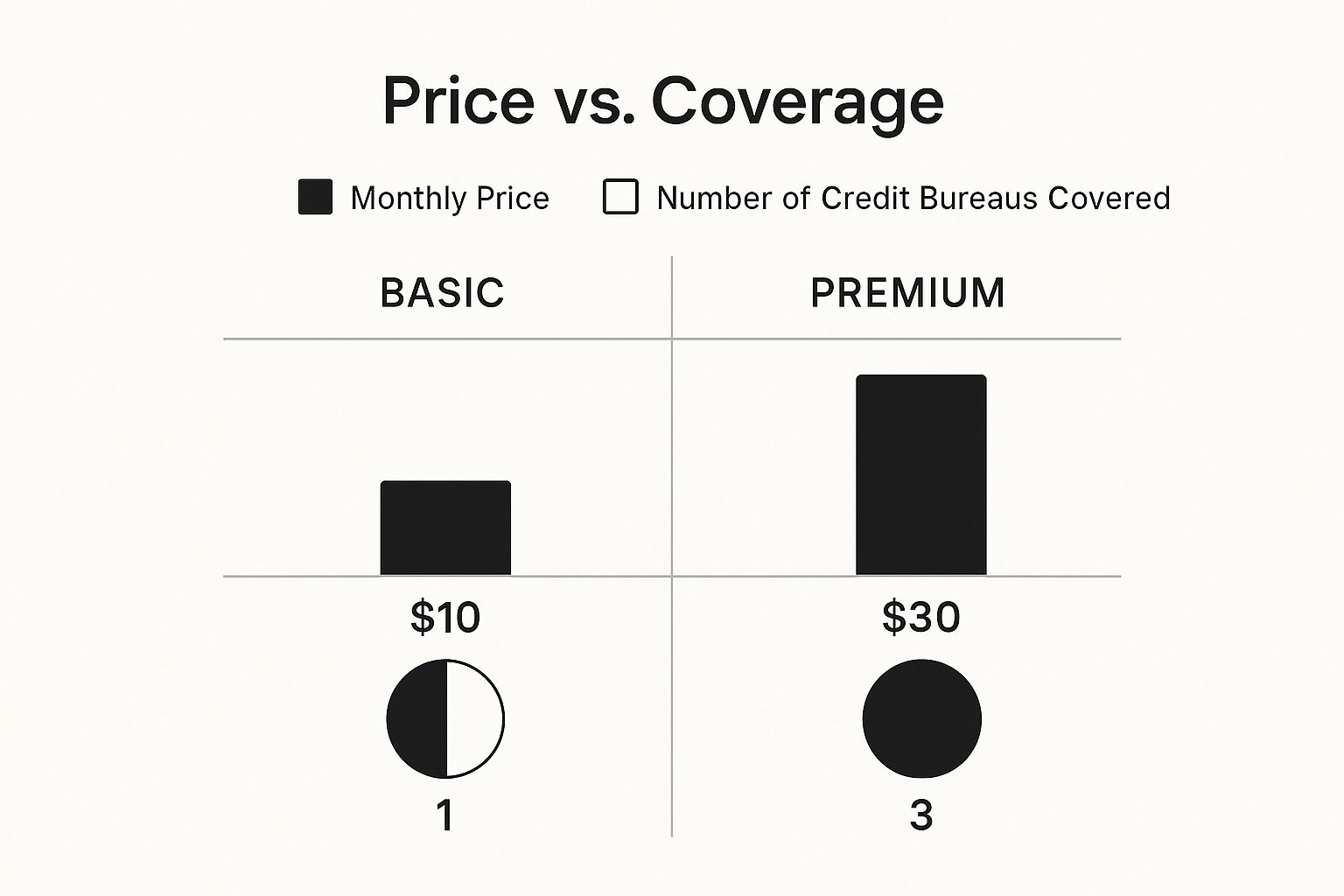

This image really highlights the common trade-off you'll find between what you pay and what you get.

As you can see, cheaper plans often mean you're only getting partial protection. For real security, comprehensive three-bureau monitoring from a premium plan is the only way to go.

Feature Breakdown of Top Credit Monitoring Services

To see how these differences play out in practice, this table offers a direct comparison of what you can expect from different tiers of service. It breaks down key features, from the scope of monitoring to the level of support you'll receive.

This table shows the clear progression in value. While a basic service is better than nothing, a premium option like "Service C" provides a dedicated case manager and full ITIN compatibility, offering a far more robust safety net.

Analyzing the Key Differentiators

Once you move past the basics, a few critical features separate the truly great services from the merely adequate ones. These are the things that justify a higher price and deliver genuine peace of mind.

Ultimately, choosing the right service comes down to your personal situation. A single person focused on building their credit score has different needs than a family of four worried about the broader risks of identity theft. By looking closely at these differentiators, you can find a service that doesn't just watch your credit, but actively protects your financial life.

Evaluating Advanced Identity Theft Protection

When you’re comparing credit monitoring services, it’s easy to get fixated on score tracking and basic credit reports. But the real game-changer, and what truly justifies paying for a premium plan, is the advanced identity theft protection that’s included. This is where a service shifts from simply watching your accounts to actively defending you when your information is stolen.

Understanding these features is key because they’re what separate a basic alert system from a genuine lifeline. A free or low-cost plan might tell you there’s a problem, but a top-tier service should give you the tools—and the expert help—to fix it. That support can save you from a world of stress and endless bureaucratic phone calls.

The Critical Role of Identity Restoration

This is one of the most important distinctions you'll find between plans, and not all "restoration" services are the same. The difference really boils down to whether you get hands-on help or just a list of instructions.

Unpacking Identity Theft Insurance Policies

That $1 million insurance policy you see advertised everywhere looks great on the surface, but you have to read the fine print to understand what it's really for. It’s not a blank check to reimburse you for stolen money. Instead, its main job is to cover the surprising and often significant costs that come with cleaning up the mess.

Before you sign up, you need to see exactly what the policy covers. A good one will reimburse you for things like:

There's a reason this market is growing so fast. The Federal Trade Commission (FTC) received reports of about 1.4 million identity theft cases in 2022 alone. It's no surprise the industry's revenue hit 6.2 billion** in 2024 and is on track to hit **12.8 billion by 2033. This explosion highlights the real-world threat we all face and why so many people are seeking solid protection. You can dive deeper into the identity theft market trends to see the full picture.

Matching a Service to Your Life Situation

When you're comparing credit monitoring services, it’s easy to get lost in feature lists. But the truth is, there's no single "best" service for everyone. The right choice is deeply personal and depends entirely on your financial life and what you need to protect.

What a family needs to feel secure is worlds away from what a recent grad building their first credit score requires. By pinpointing your specific situation, you can find a service that fits like a glove—and avoid paying for features you'll never use. Let's break down a few common scenarios.

For the Family Protector

When you have a spouse and kids, your focus expands. You're not just protecting your own identity anymore; you're safeguarding your entire family's financial future. An individual plan simply won't cover all your bases. You need a dedicated family plan, and child identity monitoring is a critical component.

Children are uniquely vulnerable to identity theft. Their Social Security numbers are blank canvases, and fraud can go undetected for over a decade until they apply for a loan or a job.

Look for a plan that specifically includes:

For the Credit Builder or ITIN Holder

If you're just starting out on your credit journey or you're an ITIN holder aiming to build a solid U.S. credit history, your needs are quite different. You're looking for more than just passive alerts; you need tools that actively help you grow.

Your ideal service should feel more like a financial coach. Prioritize platforms that offer score simulators, practical credit-building tips, and personalized advice. And for the millions of U.S. residents without a Social Security number, finding a service that works with an ITIN isn't just a preference—it's essential.

A service like itin score was designed from the ground up for this very purpose, providing free monitoring and AI-powered coaching specifically for the ITIN community.

For the Frequent Traveler

Constantly being on the move introduces its own set of risks. Think about connecting to unsecured public Wi-Fi in an airport or the nightmare of a lost or stolen wallet in a foreign city. While any credit monitoring is good, travelers need to look for a specific feature: lost wallet assistance.

This is a lifesaver. It allows you to cancel and reorder all your credit and debit cards with one quick phone call. It’s also worth looking at premium plans that offer deeper dark web monitoring. These can alert you if your passport number or other sensitive travel documents pop up for sale online, giving you a crucial heads-up when you're miles from home.

Is Free or Paid Credit Monitoring Better?

With so many free credit monitoring tools available now, it's easy to wonder why anyone would pay for it. The truth is, the right choice really boils down to how much protection you personally need and feel comfortable with. When you put free and paid services side-by-side, you'll find that free options are a great first step, but they only give you a narrow glimpse into your financial world.

Most free services will give you regular score updates and watch your file at just one of the major credit bureaus. That’s perfectly fine for keeping a casual eye on your credit score. The problem is, this creates huge blind spots. Imagine a fraudster opens a new credit card in your name with a bank that only reports to Equifax, but your free service only pulls data from Experian. You'd be completely in the dark.

The Hidden Costs of "Free"

Let's be clear about how these free services work. Their business model is often built on getting you in the door with a free plan and then trying to sell you on their premium, paid products. This isn't a scam, but it's an important trade-off to recognize. You get a free score, and in exchange, you'll probably see more ads for credit cards and loans.

More importantly, these services don't stop fraud—they just alert you after it has already happened. While getting an alert is better than nothing, free plans almost always lack the two features that give you real security and peace of mind.

How to Choose What's Right for You

Ultimately, choosing between a free and a paid plan is about your own risk tolerance. If you're just starting to build credit and want to watch your score grow, a free service is probably sufficient for now. But if you have established credit, a mortgage, or other significant assets, the small monthly fee for a paid plan is a smart investment.

The constant competition between free and paid services continues to shape the market, influencing everything from business strategies to data privacy policies. You can learn more about these market forces to understand the industry better. And if your main goal is to improve your financial standing, not just monitor it, you might want to explore ways to increase your credit limit as part of your overall strategy.

Got Questions? Let's Clear Things Up.

When you start digging into credit monitoring, a few questions always seem to pop up. Let's tackle them head-on.