Getting Credit Cards Without Social Security

Let's clear up one of the biggest myths in U.S. personal finance: you absolutely do not need a Social Security Number to get a credit card. It’s a common misconception that stops many people from even trying, but the reality is much more welcoming.

If you have an Individual Taxpayer Identification Number (ITIN), you have a direct path to building your U.S. credit history. Major banks, including giants like Bank of America and American Express, have adapted their processes to welcome ITIN holders.

Yes, You Can Get a Credit Card Without an SSN

For millions of non-citizens living and working in the United States—from international students to new immigrants—the ITIN is the key that unlocks the door to the American financial system. You don't have to be shut out of building credit just because you don't have an SSN.

Financial institutions have come to recognize the massive economic contributions of a diverse population. As a result, more and more of them are creating specific pathways for individuals to establish their financial footing without an SSN.

Of course, getting your financial life in order often starts with understanding your legal status. If you're new to the country or planning a long-term stay, familiarizing yourself with the general US visa requirements is a smart first step.

How Credit Bureaus Track Your History Without an SSN

So, how do credit bureaus like Experian, Equifax, and TransUnion keep track of your credit history without that nine-digit SSN? It's simpler than you might think. The system is surprisingly flexible and doesn't rely on a single number.

Credit bureaus can build a comprehensive file on you using other key pieces of personal information to match your financial activity. This includes:

When you apply for a credit card using your ITIN, the bank uses this collection of details to either find your existing credit file or create a brand new one. From there, every on-time payment you make helps build a positive history tied to your name and ITIN.

To give you a clearer picture, it's helpful to see how these two numbers function in the world of credit applications.

SSN vs ITIN for Credit Card Applications

This table offers a quick comparison of the two primary identification numbers used for credit card applications in the U.S., highlighting their purpose and how widely they are accepted by card issuers.

Ultimately, while an SSN is the most common key to unlocking credit, an ITIN serves the same fundamental purpose for those who qualify for one. The bottom line is that a pathway exists, and building your credit is well within reach.

Getting Your ITIN from the IRS

Before we even get to credit cards, there’s a crucial first step: getting your Individual Taxpayer Identification Number, or ITIN. Think of the ITIN as your key to unlocking the U.S. financial system when you don't have a Social Security Number. It's issued by the Internal Revenue Service (IRS), and while it sounds official and maybe a little intimidating, the process is quite manageable.

It all starts with a single document: IRS Form W-7, the Application for IRS Individual Taxpayer Identification Number. You’ll need to fill this out carefully, but you can't just send it in alone. It has to be attached to a valid federal income tax return.

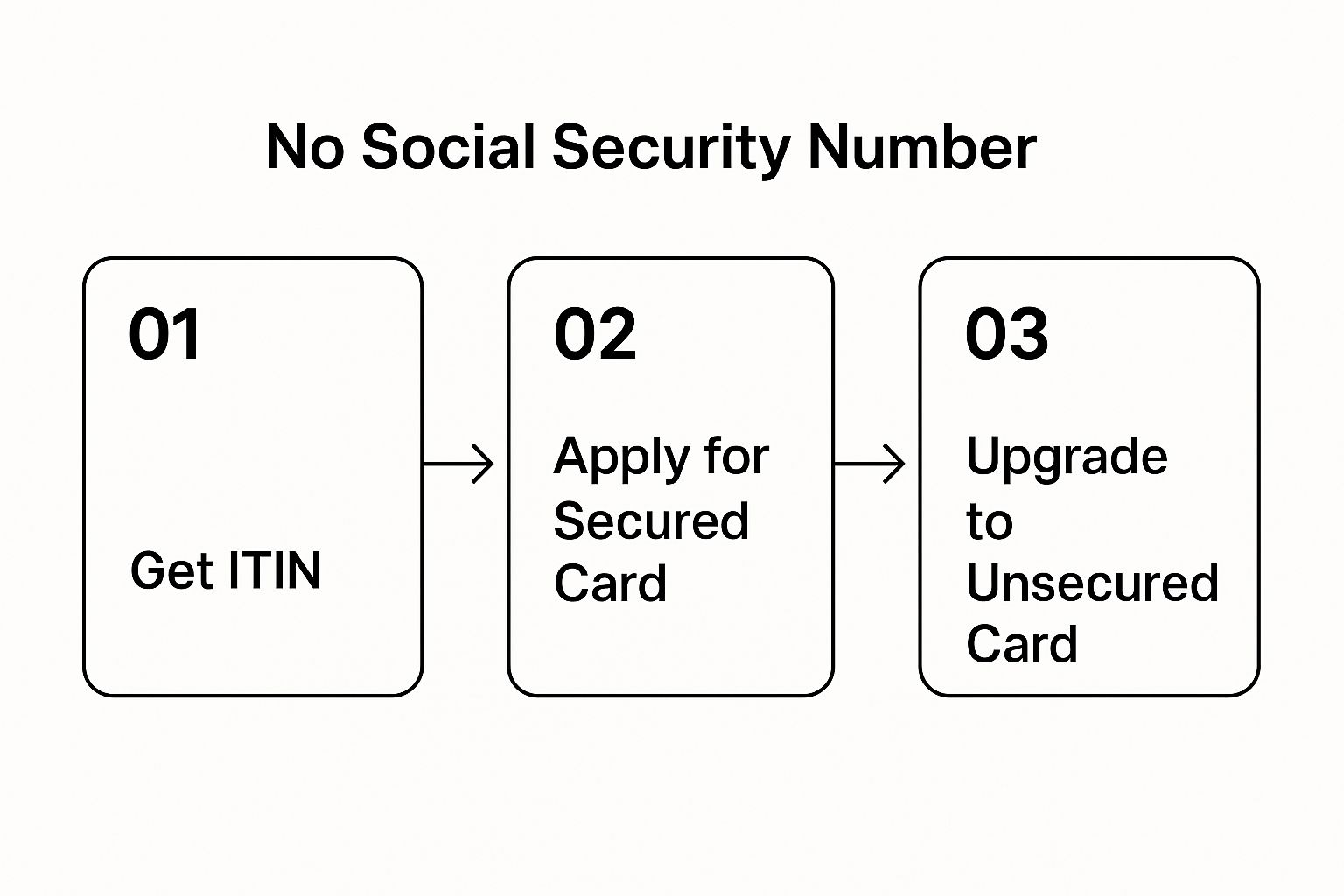

This is the very foundation of building credit in the U.S. without an SSN.

As you can see, your ITIN is the launchpad. Without it, you can't really get started.

What Documents You'll Need

When you submit Form W-7, the IRS needs you to prove two things: who you are (identity) and your foreign status. They are very specific about the documentation they accept, so getting this part right is essential. You have to submit either the original documents or certified copies directly from the agency that issued them.

Here are some of the most common documents people use:

For a complete rundown of every document the IRS accepts, take a look at our detailed guide on ITIN application requirements.

Submitting the Paperwork and the Waiting Game

Once your Form W-7, tax return, and supporting documents are ready, you have three ways to submit everything. You can mail the package to the IRS service center in Austin, Texas, work with an IRS-authorized Acceptance Agent, or make an appointment at a designated IRS Taxpayer Assistance Center.

Now, it’s important to be patient. Getting your ITIN isn't an overnight process. After the IRS receives your complete application, you should expect it to take about six to ten weeks for them to process it and issue your number. But that wait is worth it. With an ITIN in hand, you open up a world of financial opportunities.

Finding ITIN-Friendly Credit Card Issuers

Alright, you have your ITIN. Now comes the real work: finding a financial institution that will actually partner with you. This is where a lot of people get stuck. It’s incredibly frustrating to spend time filling out applications only to get rejected because the bank’s system isn't set up to handle anything but an SSN.

The trick is to be strategic. You're looking for banks that don't just accept ITINs but actively welcome applicants like you. A little focused research upfront will save you a ton of headaches and dramatically boost your chances of getting approved. Thankfully, some of the biggest national banks have already recognized the need and have processes in place.

Let's break down how to find them and what to look for.

Pinpointing Banks That Welcome ITIN Holders

Your search for credit cards without social security should start with the big guys. Major players like Bank of America, Chase, and Citibank are well-known for working with ITIN holders. Their size and resources mean they often have more established procedures for non-traditional applicants.

But don't stop there. Smaller community banks and local credit unions can be hidden gems. They often offer a more personal touch and might have more flexibility in their underwriting process.

Here’s how to efficiently vet your options:

Distinguishing Between Card Types

As you start finding issuers who will work with you, you'll notice they offer a couple of different types of cards. Understanding the distinction is key to starting off on the right foot. You’ll mainly come across two categories: secured and unsecured.

A secured credit card is your most likely entry point. It works by having you put down a refundable cash deposit, and that deposit amount typically becomes your credit limit. For example, a 300 deposit** will get you a card with a **300 credit limit. For banks, this removes the risk, making it the perfect tool for someone building their U.S. credit history from scratch.

An unsecured credit card is what most people think of as a "normal" credit card—no deposit required. These are generally for people who already have a solid credit history. Don't worry, this is the end goal. Many banks will allow you to "graduate" from a secured card to an unsecured one after you've shown a pattern of responsible use for several months.

Building Your US Credit History from Scratch

Think of your ITIN as your official key to the U.S. financial system. It gets you in the door, but it doesn't automatically create a credit history for you. It's a lot like getting a driver's license—it gives you permission to drive, but it says nothing about whether you're a good driver. Your ITIN makes you eligible, but you'll still need to tackle the challenge of having a "thin" or nonexistent credit file.

This is where a little strategy goes a long way. You have to be proactive and show lenders that you're a reliable borrower. Luckily, there are a couple of tried-and-true methods that work wonders: starting with a secured credit card or becoming an authorized user on someone else's account.

Start Strong with a Secured Credit Card

For anyone building credit from the ground up, a secured credit card is one of the most dependable tools you can find. The idea is simple: you put down a refundable security deposit, and that amount typically becomes your credit limit. So, if you deposit 500**, you get a card with a **500 spending limit.

This deposit makes a world of difference to the bank because it dramatically lowers their risk. From their point of view, if you happen to miss payments, they can use your deposit to cover the debt. This built-in safety net makes them much more comfortable approving applicants who don't have a credit history yet.

What’s really important here is that your payment activity gets reported to the three major credit bureaus—Experian, Equifax, and TransUnion. This is exactly how you build your credit file. Every single on-time payment, even on a card with a small limit, builds a positive track record that future lenders will see. After about 6 to 12 months of responsible use, many banks will even refund your deposit and "graduate" you to a regular, unsecured card.

Leverage an Existing Account as an Authorized User

Another fantastic strategy is to become an authorized user on a credit card held by a family member or a trusted friend. When the primary cardholder adds your name to their account, the entire history of that account can show up on your credit report.

This can be an incredible shortcut. If the account you're added to has a long history of on-time payments and a low balance, those positive marks can give your own credit profile a significant, almost immediate boost. You essentially get to benefit from their good financial habits without having to apply for a new card yourself.

Not having an SSN usually means your U.S. credit history is limited or completely blank, and that's the biggest hurdle for getting approved. To get around this, people often use secured cards, where a deposit acts as collateral, or they become authorized users to piggyback on an existing credit profile. For more on this, NerdWallet.com offers great insights on getting credit cards without an SSN.

Both of these methods are proven paths for getting credit cards without a social security number. If you want to explore more specific tactics, take a look at our complete guide on how to build credit with an ITIN number. The most important thing is consistency. Small, responsible steps taken over time are what will build a solid financial foundation for your future in the U.S.

Navigating the Application Process with an ITIN

So, you're ready to apply for a credit card with your ITIN. This is where a little strategy goes a long way. Simply filling out a standard online form often leads to an automatic rejection because many of these systems are built to recognize Social Security Numbers only. Your ITIN application might get tossed before a human ever lays eyes on it.

That’s why heading to a physical bank branch is often your best bet. While some banks have finally started updating their online portals, nothing beats a face-to-face conversation. Sitting down with a banker gives you the chance to explain your situation, present your documents, and make sure your application gets the attention it deserves from the get-go.

Preparing Your Documentation

Before you step foot in the bank, get your paperwork in order. Walking in with everything you need shows you’re organized and serious, which can make a surprisingly big impression on the banker. It’s a simple move that can smooth out the entire process.

Pull together a folder with these key items:

Having these documents ready avoids frustrating back-and-forth and empowers the banker to push your application through. To get a better sense of how the bank will review your financial standing, it’s helpful to get familiar with understanding the underwriting process.

Communicating with the Banker

When you sit down with a representative, be direct and confident. A great opening line is, "I'd like to apply for a credit card today. I have an ITIN instead of an SSN, and I've brought all my supporting documents with me." This immediately clarifies your situation and sets a professional tone.

It also helps to show you know a thing or two about credit in the U.S. Mentioning your goal is to build a positive payment history signals that you're a responsible borrower. After all, your payment activity is the single most important factor in creating a solid ITIN credit history.

Your Questions Answered: Getting a Credit Card Without an SSN

Even with a clear plan, it's natural to have a few questions rolling around in your mind. The path for ITIN holders is a bit different, and sorting out the details before you apply is always a smart move. Let's tackle some of the most common concerns I hear from people in your exact situation.

Will Applying with an ITIN Hurt My Approval Chances?

This is probably the biggest worry I see, but let me put it to rest: no, it won't. As long as you're applying with a bank that has a known policy of accepting ITINs, your application is on equal footing. For these lenders, your ITIN is just as valid as an SSN for identification.

What the bank really wants to know is whether you can handle the credit. They're looking at your income, your current debts, and your overall financial picture. The real hurdle isn't the number you use to apply; it's proving you're a good risk when you don't have a U.S. credit file yet. This is exactly why a secured card is such a brilliant starting point—it removes that risk for the bank and lets you prove yourself.

Can I Really Get a Premium Travel Rewards Card with an ITIN?

Absolutely, you can. Just don't expect it to be your first card.

Those high-perk cards, like the Chase Sapphire Preferred® or an American Express Gold Card, are designed for people who already have a strong credit history. We're talking scores of 690 or higher. If you're starting from zero, you'll need to build up to that level.

After about 6 to 12 months of making consistent, on-time payments with a starter card, your responsible behavior will start to show up as a solid credit score. Once you've established that track record, applying for those top-tier rewards cards with your ITIN is a very realistic next step.

What Documents Do I Need Besides My ITIN?

Your ITIN is the key that unlocks the application, but you'll need a few other things to get through the door. Banks need to verify who you are and that you can pay your bills, so having your documents ready will make everything go much smoother.

Before you start filling out forms, I'd suggest gathering these items: