Credit Cards for ITIN Holders to Build US Credit

Yes, you absolutely can get a credit card with an ITIN. It's not just possible; it's one of the most important first steps you can take to build a real financial life in the United States. While you don't have a Social Security Number (SSN), your Individual Taxpayer Identification Number (ITIN) is the key that opens the door to credit products from many well-known banks.

Your Pathway to US Credit with an ITIN

There's a persistent myth that you can't build credit without an SSN. I've seen this misconception hold people back for years, preventing them from making financial progress. The truth is, your ITIN, which the IRS issues for tax purposes, is a perfectly legitimate form of identification for many banks and lenders.

For foreign nationals in the U.S. who aren't eligible for an SSN—like immigrants, international students, and certain nonresident workers—the ITIN has become essential. It’s the tool that allows you to legally apply for credit cards for ITIN holders and start building a strong U.S. credit history. If you're new to this, we break it all down in our guide on what an Individual Taxpayer Identification Number is.

Why Building Credit Matters So Much

Let’s be clear: establishing a credit history is about far more than just getting a credit card. It's the bedrock of your financial future in America. A thin or non-existent credit file can create some serious roadblocks.

Without a good credit score, you'll likely find it difficult to:

Navigating the System with an ITIN

Applying for credit with an ITIN is a little different than with an SSN, but it's completely doable. The banks that accept ITINs have their own specific ways of verifying your identity and income. The trick is knowing which banks are ITIN-friendly and how to put together an application that's too good to turn down.

That’s what this guide is for—to give you a clear roadmap. We'll walk you through finding the right cards, gathering the documents you'll need, and successfully navigating the application process. By following these steps, you can confidently take control of your financial journey and build the credit you need to achieve your goals here in the United States.

Putting Together a Winning Application

Before you even start looking at credit cards, the single most important thing you can do is get your paperwork in order. Think of it this way: a complete, organized application shows lenders you’re a serious and reliable person. It's your first, best chance to prove you’re a good candidate for credit.

This isn’t just about having your ITIN letter handy. Banks need to confirm who you are, where you live, and that you have the money to pay your bills. Getting everything together ahead of time saves a lot of headaches and shows you’re on top of your finances.

The Must-Have Document Checklist

To make the application process go smoothly, you’ll need to prove three main things: your identity, your address, and your income. Each document helps paint a clear picture for the bank.

Here’s a simple breakdown of what you should have ready to go:

What If You Don't Have Traditional Pay Stubs?

Many people—freelancers, small business owners, or those paid in cash—don't have typical pay stubs. If that's you, don't sweat it. You can absolutely still prove your income.

The trick is to create a clear paper trail. The best way to do this is by depositing your cash earnings into a U.S. bank account consistently. After a few months of this, your bank statements will show a reliable pattern of income that lenders can easily see and verify.

Another great option is to provide a copy of your most recent tax return, which officially documents your yearly earnings. For more detailed advice, our guide on how to organize your financial documents is a fantastic resource for building a solid financial profile. Having these documents prepared makes you look professional and proves your financial stability.

Finding the Right ITIN-Friendly Credit Cards

Knowing where to even begin your search for an ITIN-friendly credit card is half the battle. Not every bank has a process for applications without a Social Security Number, so it pays to be strategic. My advice? Focus on financial institutions known for being more flexible and community-focused.

This is where smaller, local players often have a huge advantage over the massive national banks.

I always suggest starting with community banks and local credit unions. Their approval processes are often less rigid and automated, which means you have a real shot at talking to an actual person who can look at your whole financial picture. They're built on relationships, not just algorithms.

Secured vs. Unsecured: Which Is the Smart Start?

When you're building credit from square one, you’ll run into two main types of cards: secured and unsecured. Getting this part right is crucial for making a good first move.

For new applicants, understanding the difference between secured and unsecured credit cards is the first step. Here’s a quick breakdown to help you decide which path is right for your credit-building journey.

Secured vs. Unsecured Cards for ITIN Holders

For almost everyone just starting out, a secured card is the way to go. It’s a powerful tool designed specifically for building a credit history. After you’ve shown you can use it responsibly for six to twelve months, many banks will "graduate" you to an unsecured card and send your deposit back.

Key Features to Compare in ITIN Credit Cards

Once you've found a few banks that work with ITINs, it's time to dig into the details. Don't just grab the first card that approves you—think about the long-term value and cost.

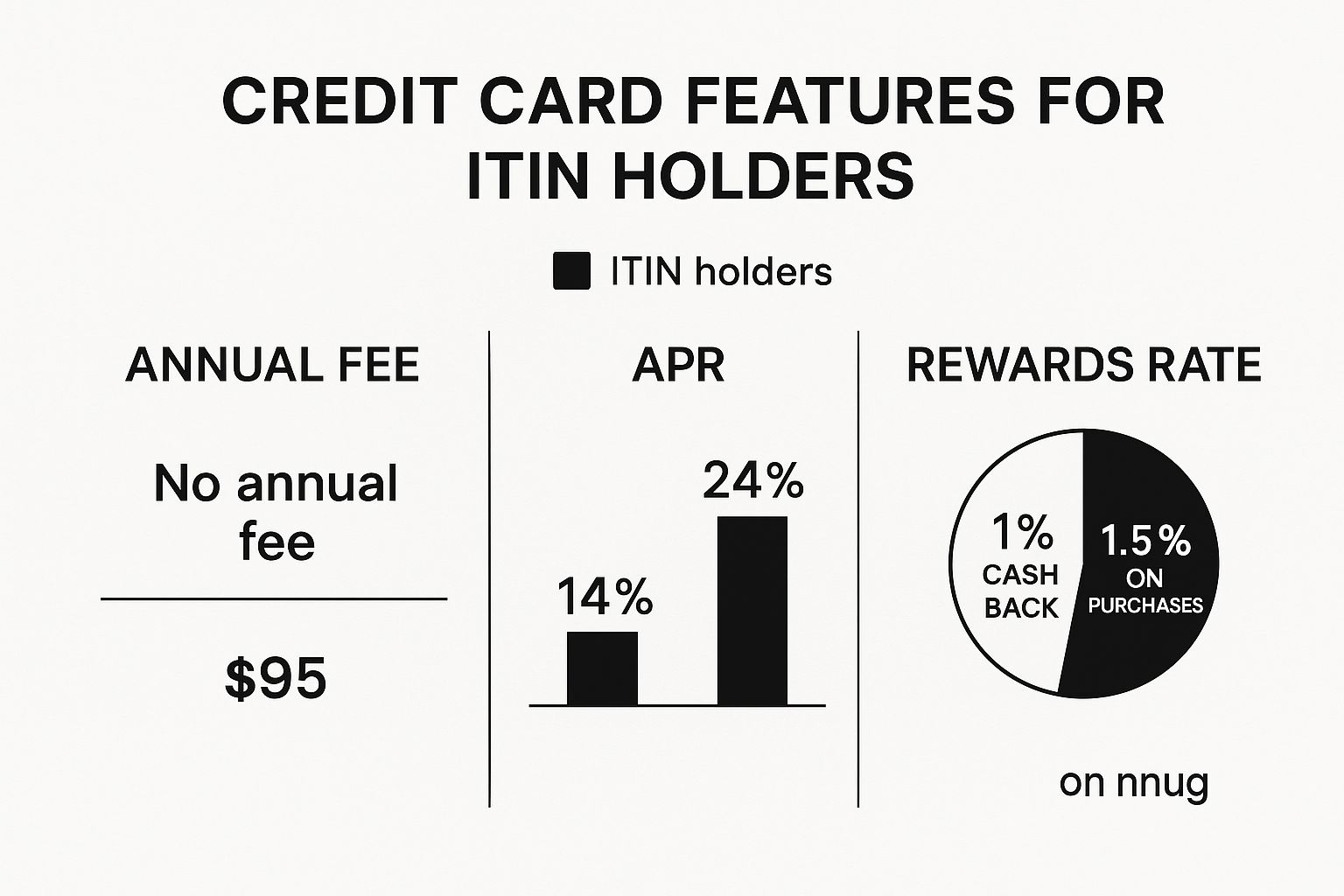

This graphic gives a great overview of the main features you should be weighing against each other.

As you can see, a card with no annual fee and a lower interest rate can save you a lot more money over time, even if another card dangles slightly better rewards in front of you.

Pay close attention to these key details:

In-Person vs. Online Applications: Which is Right for You?

Okay, you’ve gathered your documents and you're ready to pull the trigger. We live in an online-first world, so your first instinct might be to just fill out a web form. But when you’re applying for a credit card with an ITIN, I’ve found that the old-school approach of walking into a bank branch can be a game-changer.

The problem with online forms is that they are rigid. They're just code. A computer can’t understand your unique circumstances or make a judgment call. A human banker, on the other hand, can. They can actually look at your documents, listen to your story, and help push your application through the system.

The Power of an In-Person Application

I’ve seen it happen countless times: an ITIN holder gets an automatic rejection online simply because the system’s "SSN field" wasn't built to recognize a number starting with a 9. It’s a frustrating, but common, technical roadblock.

When you go into a physical branch, that roadblock often disappears. A banker can typically override the system or use an internal process designed specifically for ITIN applicants.

Here’s why it’s worth the trip:

Tips for a Smooth Application Process

Whether you decide to apply in person or take your chances online, how you actually fill out the form is critical. The biggest point of confusion is usually the lack of a dedicated ITIN field.

Here’s the right way to approach it:

Submitting your first application is a huge milestone. Choosing the right channel—which, in my experience, is often an in-person visit—and being prepared to follow up can be the difference between a quick approval and a frustrating dead end.

How to Build an Excellent Credit Score With Your New Card

Getting that first U.S. credit card approval is a fantastic milestone, but don't celebrate for too long—the real work starts now. Your goal isn't just to have a card in your wallet; it's to turn that piece of plastic into a tool that builds an excellent credit score, unlocking better financial opportunities down the road.

This is where your daily habits come into play. Out of all the factors that make up your credit score, two carry the most weight by far: your payment history and your credit utilization ratio. If you can master these two, you'll be well on your way to building a strong credit profile.

Never, Ever Miss a Payment

If there’s one golden rule in the world of credit, this is it: always pay your bill on time. That's it. It sounds simple, but even one late payment can tank your score and linger on your credit report for up to seven years. It's the first thing lenders check to see if you can be trusted with their money.

The easiest way to avoid a mistake is to set up automatic payments through your bank's app or website. You can set it to pay the minimum, the full statement balance, or another fixed amount.

Keep Your Balances Low (This One Surprises People)

The second pillar of a great score is your credit utilization ratio. Fancy name, simple concept: it’s just the percentage of your available credit you’re using at any given time. If your card has a 500** limit and you have a **250 balance, your utilization is 50%.

Here’s the catch: even if you pay your bill in full every month, a high utilization ratio can still hurt your score. It signals to lenders that you might be relying too heavily on credit. As a general rule, try to keep your utilization below 30%. For the best possible score, aim for under 10%.

Let's look at a real-world example:

The key takeaway is that the reported balance is what matters for your score, not just whether you pay it off.

Keep an Eye on Your Progress

You can't improve what you don't measure. As an ITIN holder, you can request your free annual credit reports from the major bureaus—Experian, Equifax, and TransUnion—by mail. This is your chance to see your hard work pay off, check for any errors, and make sure your on-time payments are being reported correctly.

Building credit as an ITIN holder is a huge step toward becoming part of the U.S. financial system. With over 800 million credit cards now in circulation in the United States, your responsible use contributes to this growing landscape of financial access. You can see more fascinating figures in these credit card statistics on use.expensify.com.

By using your new card responsibly—especially if it's a secured card to start (and you can learn more about what a secured credit card is here)—you’re not just spending money. You're building a powerful financial reputation from the ground up.

Got Questions About ITIN Credit Cards? You're Not Alone.

Jumping into the U.S. credit system for the first time can feel like learning a new language. It’s totally normal to have a ton of questions, and getting straight answers is the best way to move forward with confidence. Let's break down some of the most common things people wonder about when they start this journey.

My goal here is to clear the air so you can focus on what really matters: building a solid financial foundation for your future.

Can I Just Apply for Any Credit Card with My ITIN?

You can, but you probably shouldn't. The real question isn't "can I apply?" but "which application will actually get approved?" And the answer to that is a bit more specific.

Most of the big, national banks rely on automated online systems that are hard-wired to look for a Social Security Number. When you type in your ITIN, which always starts with the number 9, their system often flags it and rejects the application on the spot. A real person never even lays eyes on it.

This is exactly why it's smarter to focus your energy on banks and lenders that are known to work with ITINs. Think smaller community banks, local credit unions, and a handful of fintech companies. They're more likely to have a human review your application and are familiar with the process for credit cards for ITIN holders, which massively boosts your chances of getting a "yes."

Why Do I Have No Credit Score Instead of a Bad One?

This is a really common point of confusion. When you're new to the U.S. credit system, you don't start with a "low" or "bad" score. You start with no score at all.