12 Best Credit Building Sites to Boost Your Score in 2025

Navigating the U.S. financial system without a strong credit history can feel like a significant barrier, especially for those with an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number. The challenge is real: how do you build credit when many traditional financial products seem out of reach? This is precisely the problem that modern credit building sites are designed to solve. These platforms offer innovative pathways to establish and grow your credit score, often without requiring a hard credit check or an SSN.

This guide is built to be your definitive resource for finding the best credit-building platform for your specific situation. We've gone beyond surface-level descriptions to provide a comprehensive analysis of the top options available. You won't find generic marketing copy here. Instead, you'll get an in-depth look at how each service actually works, its specific features, pricing structures, and honest pros and cons. We’ll cover a range of tools, from credit builder loans and secured cards to rent reporting services. As you begin your journey to improve your credit score, remember that the foundation lies in strong financial habits, including effective cash flow management to ensure timely payments and responsible debt handling.

Our goal is to cut through the noise and give you clear, actionable information. Each review includes practical use cases, implementation guidance, and screenshots to show you exactly what to expect. We also highlight which services are ITIN-friendly, a critical detail for many new immigrants, international students, and self-employed individuals. By the end of this article, you will have a clear understanding of which credit building sites align with your financial goals, enabling you to choose the right tool to start building a strong financial future in the United States.

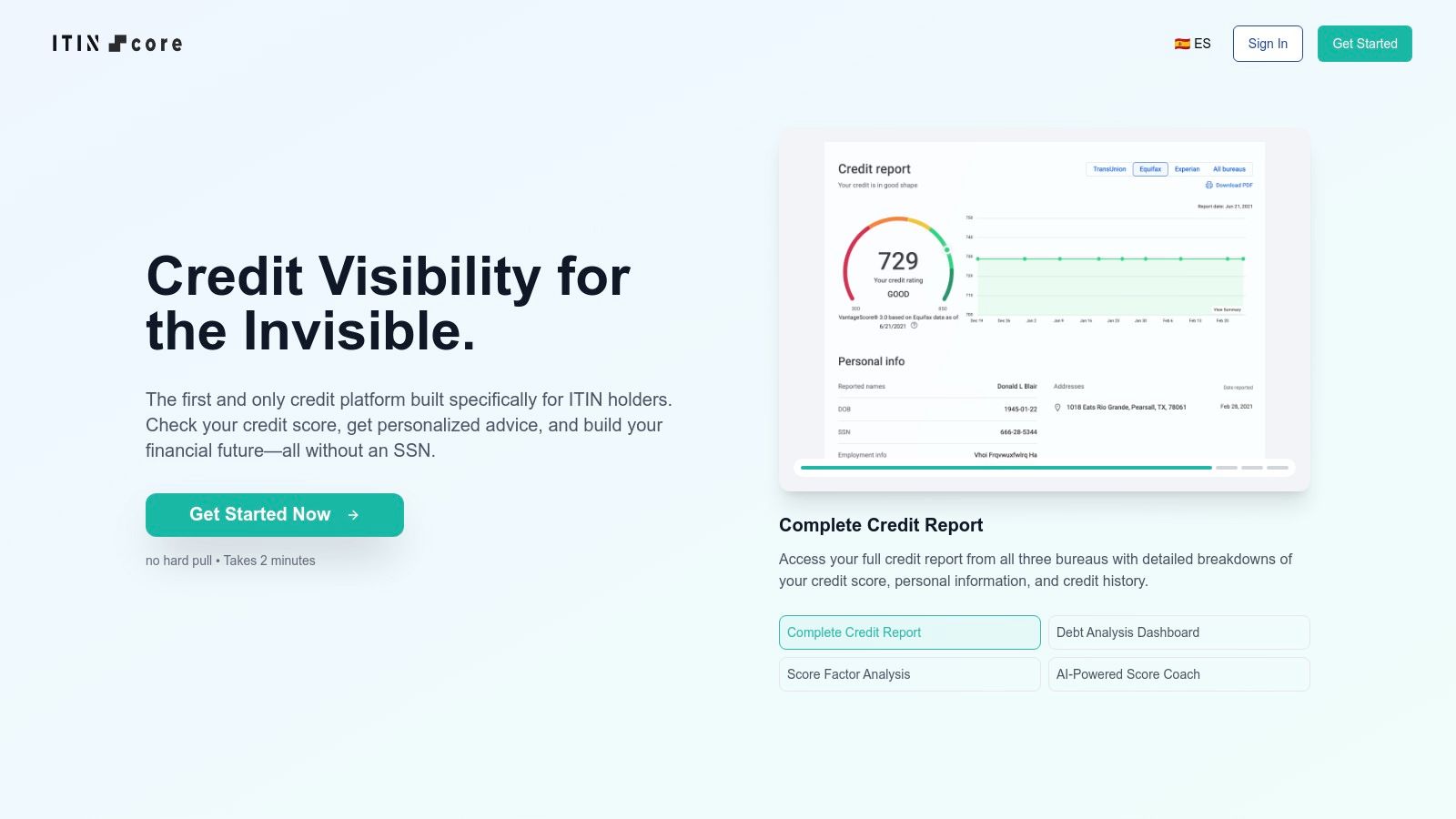

1. itin score

Best For: ITIN Holders Seeking Full-Featured Credit Management

ITIN Score establishes itself as a premier destination among credit building sites by dedicating its entire platform to a historically underserved audience: U.S. ITIN holders. This singular focus allows it to address the specific challenges faced by noncitizens, recent immigrants, and international students when trying to build a financial identity in the United States. Where many mainstream services require a Social Security Number, ITIN Score provides a direct, secure pathway to access and manage credit profiles using an Individual Taxpayer Identification Number.

The platform delivers a comprehensive suite of tools typically reserved for premium services, yet offers them completely free. Users gain access to full credit reports from all three major bureaus (Experian, TransUnion, and Equifax), a real-time dashboard with daily updates, and unlimited credit monitoring. Its AI-powered credit coach is a standout feature, providing personalized, step-by-step action plans to improve credit health.

Key Features & Analysis

Practical Considerations

The service is most effective for users who already have some credit history associated with their ITIN. If you are starting from zero, the platform’s tools will become more valuable once you establish an initial tradeline. While ITIN Score provides the tools to monitor and improve your file, ultimate success still depends on external lenders reporting your activity to the credit bureaus.

Website: https://www.itinscore.com

2. Self

Self tackles credit building from two powerful angles: installment loans and revolving credit. Instead of requiring you to save for a security deposit upfront, Self’s core product is a Credit Builder Account. This is essentially a small, locked installment loan where your monthly payments are reported to all three credit bureaus: Equifax, Experian, and TransUnion.

The platform’s standout feature is its integrated upgrade path. After making several on-time payments and accumulating savings in your account, you may become eligible for the Self Visa® Secured Credit Card. This card uses your loan savings as the security deposit, allowing you to open a revolving credit line without a hard credit check. This dual-action approach makes Self one of the most efficient credit building sites for establishing both major types of credit history simultaneously. For a deeper analysis of this unique product, you can learn more about the Self Credit Builder Loan.

How Self Works & Pricing

The process is straightforward and designed for accessibility. You apply for a Credit Builder Account with no hard inquiry, choosing a payment plan that fits your budget. Plans typically range from 25 to 150 per month over 12 or 24 months.

Best For: Individuals with no credit or thin files, including ITIN holders, who want a structured, all-in-one system to build both installment and revolving credit history without a large initial security deposit.

3. Chime Credit Builder

Chime offers a unique and accessible entry into credit building through its Credit Builder Visa® Secured Credit Card. Unlike traditional secured cards, it doesn't require a minimum security deposit. Instead, the money you move into your linked Credit Builder secured account becomes your spending limit. This design eliminates the barrier of a large upfront deposit and simplifies money management within Chime’s ecosystem.

The card’s standout feature is how it reports to the credit bureaus. While it reports your on-time payments to Equifax, Experian, and TransUnion to build positive payment history, it does not report your credit utilization. This is a significant advantage, as it protects your score from the fluctuations often caused by high balances on other cards, making it one of the most forgiving credit building sites for those new to managing credit. For more details on how it functions, you can visit the official Chime Credit Builder page.

How Chime Credit Builder Works & Pricing

To get the card, you first need a Chime Checking Account and must have received a qualifying direct deposit of $200 or more. Once eligible, you can apply for the Credit Builder card without a hard credit check. You then move money from your Checking Account to the Credit Builder secured account to set your spending limit.

Best For: Individuals, including ITIN holders, who already have or plan to open a Chime Checking Account and want a fee-free, interest-free secured card that simplifies payment history building without the risk of high utilization impacting their score.

4. Experian Boost

Experian Boost offers a unique and direct way to potentially increase your credit score by leveraging the on-time payments you already make. Instead of opening a new account, this free service connects to your bank account to identify positive payment history for utilities, telecom, rent, and even streaming services. These payments are then added to your Experian credit file, providing a more complete picture of your financial responsibility.

The platform’s key differentiator is its ability to provide an instant re-score based on Experian data. This makes it one of the fastest credit building sites for seeing a potential impact, especially for those with thin or young credit files. By giving you credit for bills not traditionally reported, Experian Boost helps demonstrate a longer history of consistent payments without requiring you to take on new debt. The service is operated directly by one of the major credit bureaus, adding a layer of credibility.

How Experian Boost Works & Pricing

The process is simple and entirely free, requiring no hard credit inquiry. You create a free account with Experian, securely link the bank account(s) you use to pay bills, and confirm the positive payment history you want to add to your file. Experian then provides an updated FICO® Score instantly.

Best For: Individuals with limited credit history or a "thin file," including ITIN holders, who want to potentially see a quick score increase on Experian-based models by getting credit for their existing on-time bill payments.

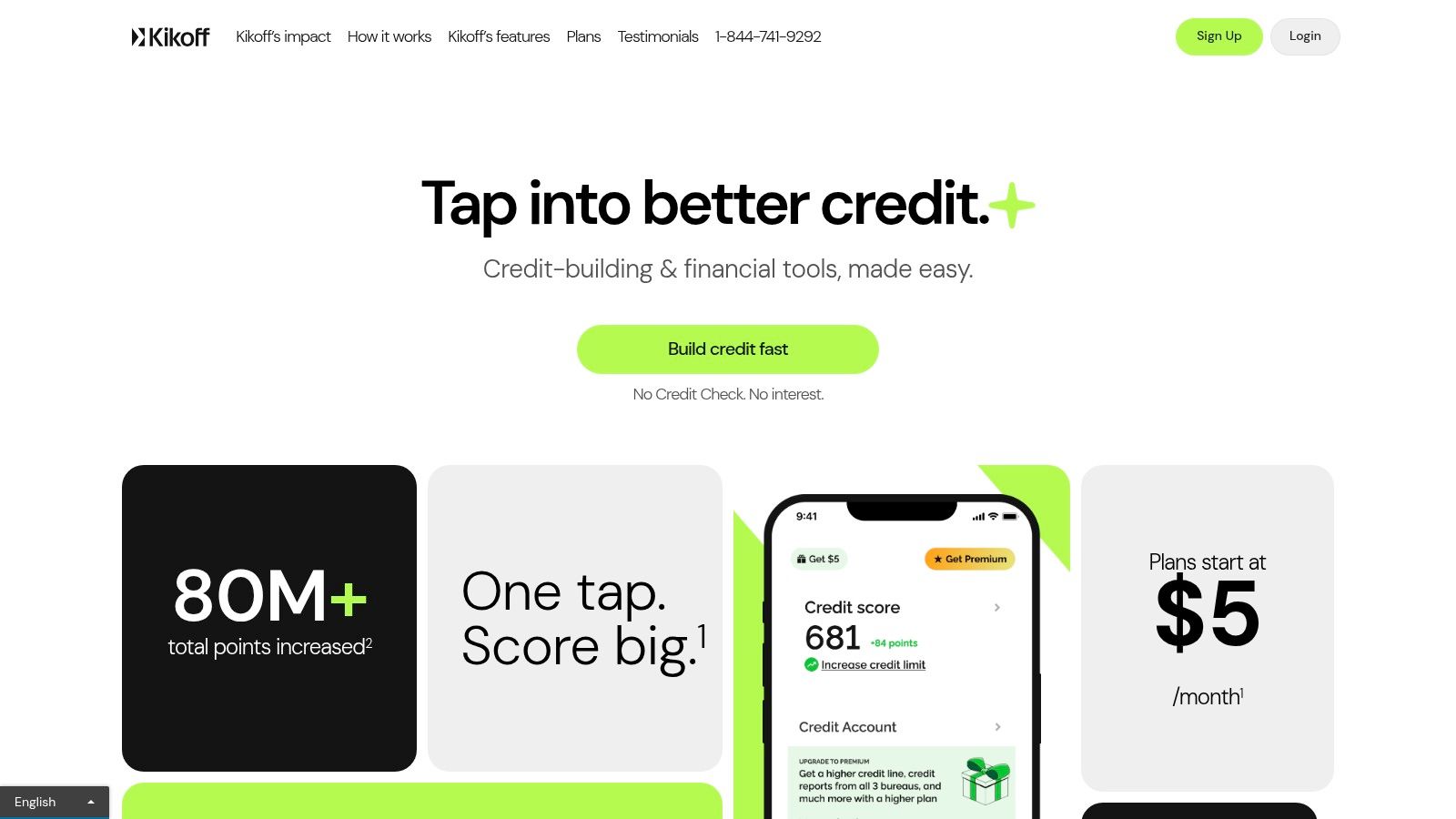

5. Kikoff

Kikoff offers one of the most accessible and low-cost entry points into the world of credit building. Its core product is a simple, no-interest revolving line of credit that you can use exclusively in the Kikoff online store. This approach focuses on establishing a positive payment history and maintaining low credit utilization, two of the most significant factors in credit score calculations, without the complexity of a traditional loan or credit card.

The platform’s major differentiator is its sheer simplicity and affordability. There is no hard credit check for approval, and the service is designed specifically for individuals with thin or nonexistent credit files. By reporting your on-time payments to major credit bureaus, Kikoff provides a straightforward path to building a foundational credit history. This makes it an excellent starting point among credit building sites for those who are new to the U.S. financial system or wary of taking on debt.

How Kikoff Works & Pricing

The process begins with an instant approval for a line of credit with no hard inquiry. You can use this credit to make a small purchase in the Kikoff store (e.g., an e-book) and then pay it off over time. Your consistent, on-time payments are the key to building credit.

Best For: Individuals with no credit history, including ITIN holders, who need a very low-cost and simple way to establish a positive payment history and low credit utilization without undergoing a hard credit check.

6. Grow Credit

Grow Credit offers a unique and accessible approach to building credit by leveraging bills you already pay. Instead of a traditional loan or credit card, the platform provides a virtual Mastercard designed specifically to pay for eligible subscription services like Netflix, Spotify, and even phone plans. Your monthly subscription payments made with the Grow card are then reported as on-time payments to all three major credit bureaus: Experian, Equifax, and TransUnion.

The standout feature of this platform is its focus on automating positive payment history without the risk of overspending. By linking your existing subscriptions (from a catalog of over 100 services), Grow essentially transforms them into a tradeline on your credit report. This automated process makes it one of the simplest credit building sites for those who want to establish a payment history without altering their spending habits or managing a new line of credit for everyday purchases. For more details on their service, you can visit the Grow Credit website.

How Grow Credit Works & Pricing

The process begins by applying for a plan with no hard credit check. Once approved, you link your bank account via Plaid and are issued a virtual Mastercard. You then update your payment method on your chosen subscription services to use the Grow card. Grow pays the bill and automatically withdraws the amount from your linked bank account.

Best For: Individuals who want to build credit by leveraging their existing subscription and utility bills, especially those wary of traditional credit cards and the temptation to overspend. Ideal for ITIN holders looking for a simple, automated solution.

7. CreditStrong

CreditStrong, backed by Austin Capital Bank, offers a powerful suite of cash-secured credit builder accounts designed to build both installment and revolving credit history. Its core products, like Instal and the high-limit MAGNUM, function as savings-secured installment loans that report your monthly payments to all three major credit bureaus. This makes it a robust option among credit building sites for establishing a strong payment record.

The platform’s key differentiator is its product flexibility and the inclusion of a revolving credit option, Revolv. This allows users to add a revolving line of credit to their profile, often a crucial step for building a well-rounded credit history. By offering different account types under one roof and providing a monthly FICO® Score 8, CreditStrong gives users clear visibility and control over their credit-building journey without requiring a hard credit pull to get started.

How CreditStrong Works & Pricing

The process is designed for easy enrollment. You choose a credit builder account that aligns with your financial goals, make your monthly payments, and the account unlocks your savings at the end of the term, minus any applicable fees and interest.

Best For: Individuals, including ITIN holders, seeking bank-backed, flexible credit-building products to establish both installment and revolving credit lines, with the added benefit of tracking their FICO® score progress.

8. MoneyLion Credit Builder Plus

MoneyLion's Credit Builder Plus membership blends a small loan with a suite of digital financial tools, positioning itself as more than just a loan product. The core offering is a credit-builder loan of up to $1,000. A portion of these funds may be available to you immediately, while the rest is held in a secured account, which you receive upon repaying the loan in full.

The platform’s key distinction is its all-in-one app experience. Members not only get their loan payments reported to all three credit bureaus but also gain access to weekly credit score updates, personalized financial insights, and other banking features. This integrated approach makes it one of the more comprehensive app-based credit building sites, ideal for those who want to manage their credit and finances in a single digital hub. For those interested in the membership model, you can learn more about MoneyLion Credit Builder Plus.

How MoneyLion Works & Pricing

The process begins by applying for the Credit Builder Plus membership, which involves a soft credit pull that won’t impact your score. Once approved for the loan, your payments are scheduled automatically within the app.

Best For: Tech-savvy individuals, including ITIN holders, who value an integrated app experience with credit monitoring and are comfortable with a monthly membership fee in exchange for access to a small loan and other financial tools.

9. Brigit Credit Builder

Brigit Credit Builder integrates an installment-style credit-builder account directly into its popular financial wellness app. The service is designed for simplicity, bundling credit building with budgeting tools and cash advances. Your monthly subscription payments for the Brigit Plus or Premium plan are reported as on-time payments to all three credit bureaus, building a positive payment history without a traditional loan structure.

The key distinction for Brigit is that the credit-building feature is an embedded benefit of its subscription rather than a standalone loan product. This approach appeals to users who already want the app’s other features, like cash advances, credit monitoring, and identity theft protection. It’s one of the more seamless credit building sites because it operates in the background, making it an excellent "set it and forget it" option for those who want to build credit while managing their day-to-day finances within a single ecosystem.

How Brigit Works & Pricing

Enrolling is done through the Brigit app and does not require a hard credit check. You must subscribe to one of the premium tiers to access the Credit Builder feature. The monthly fee itself is what gets reported to the credit bureaus.

Best For: Individuals looking for an all-in-one financial app who can benefit from cash advances and budgeting tools in addition to a passive, easy-to-use credit builder that doesn't require a hard inquiry or a separate loan application.

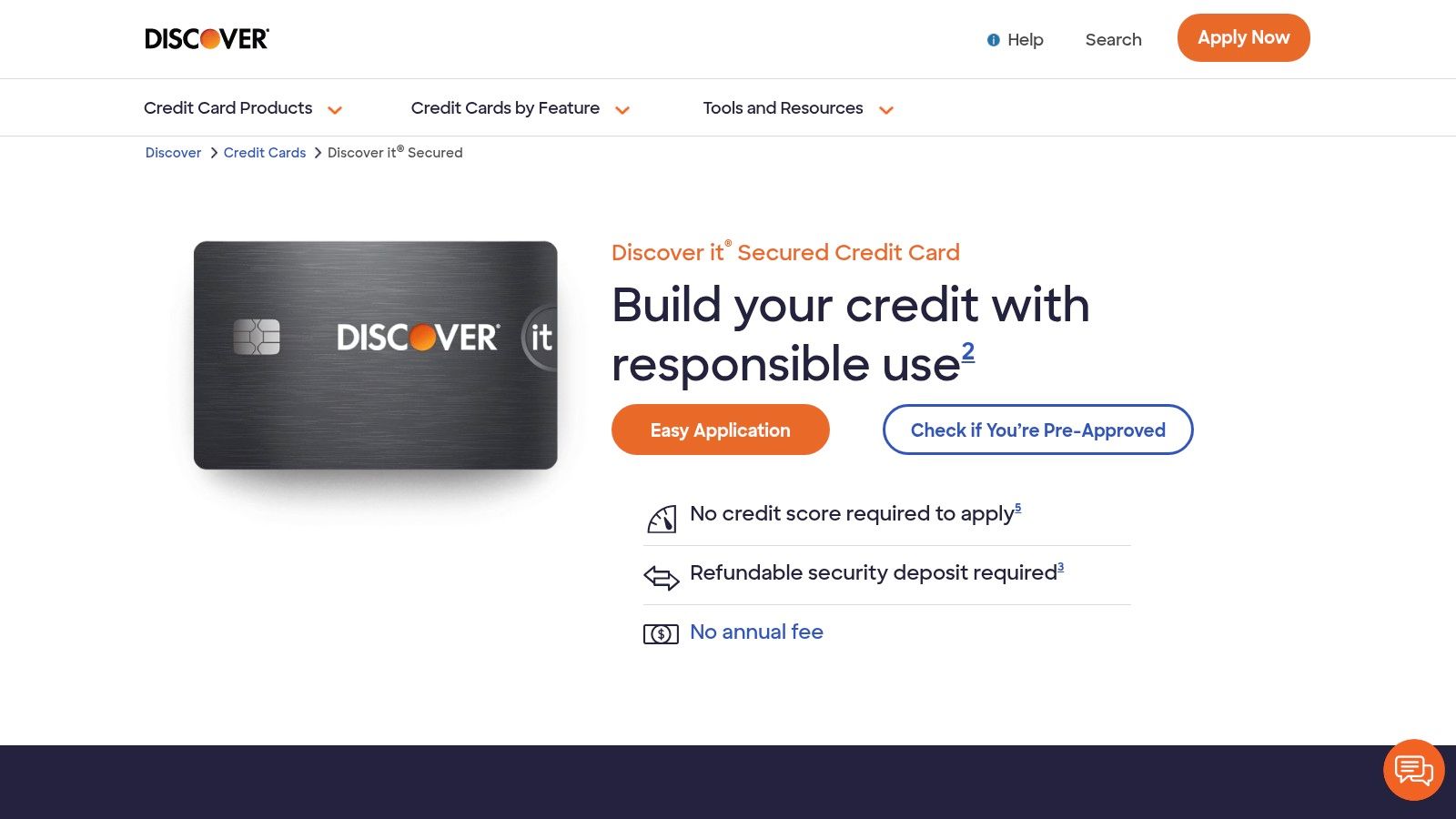

10. Discover it Secured Credit Card

The Discover it Secured Credit Card stands out among credit building sites by offering a full-featured credit card experience with no annual fee. Unlike many credit-building products that are purely functional, this card provides valuable perks typically reserved for unsecured cards, such as cash-back rewards. It reports your payment history to all three major credit bureaus (Equifax, Experian, and TransUnion), establishing a robust credit file.

The card’s most compelling feature is its clear path to an unsecured credit line. Discover automatically reviews your account starting at seven months to see if you qualify to have your security deposit returned while keeping your account open. This graduation potential, combined with its rewards program, makes it an excellent long-term tool for those serious about building credit history. You can explore how it compares to other options by reviewing the best secured cards for building credit.

How Discover it Secured Works & Pricing

You apply for the card and, if approved, provide a refundable security deposit. This deposit, typically starting at $200, sets your credit limit. Your responsible use is then reported monthly to build your credit.