Credit Building Accounts: Boost Your Credit Score Effectively

Why Credit Building Accounts Are Your Financial Game-Changer

Think of a financial training ground where you can build a positive payment history without the high stakes of traditional lending. That’s the core idea behind credit building accounts. Unlike typical credit cards or loans that demand a solid credit history for approval, these accounts are made for people starting from zero or rebuilding their credit. They offer an accessible entry point instead of a roadblock, creating a safe space to learn the credit game and show you're financially responsible.

Your Personal Credit Laboratory

You can think of credit building accounts as your own personal credit lab. The principle is straightforward: prove you can make small, regular payments, and that positive behavior gets reported to the major credit bureaus. For many people, this is the first move toward getting approved for big life purchases, like a car or a home.

The need for these tools is clear. As of early 2025, there were over 566.3 million open credit accounts in the United States, with total consumer debt climbing to $17.68 trillion. This data shows just how essential credit is in today's economy. You can find more details on these consumer credit trends from Equifax.

Dispelling the Myths

There's a common myth that credit building accounts aren't as legitimate or powerful as traditional credit products. This couldn't be further from the truth. Millions of people have successfully used these accounts to lay a strong foundation for their credit reports.

These accounts aren't a shortcut; they are a structured pathway. By consistently making on-time payments, you create a concrete record of your reliability—exactly what lenders want to see. This positive payment history is the bedrock of your credit score, proving your creditworthiness and opening doors to better financial opportunities down the road.

Finding Your Perfect Match: Types of Credit Building Accounts

Just like you wouldn't use a hammer to saw a piece of wood, picking the right tool for building credit is crucial. Choosing the account that best fits your financial reality is your first major step toward establishing a solid payment history. Some accounts are perfect for total beginners, while others are better designed for those on a path to rebuilding their credit score.

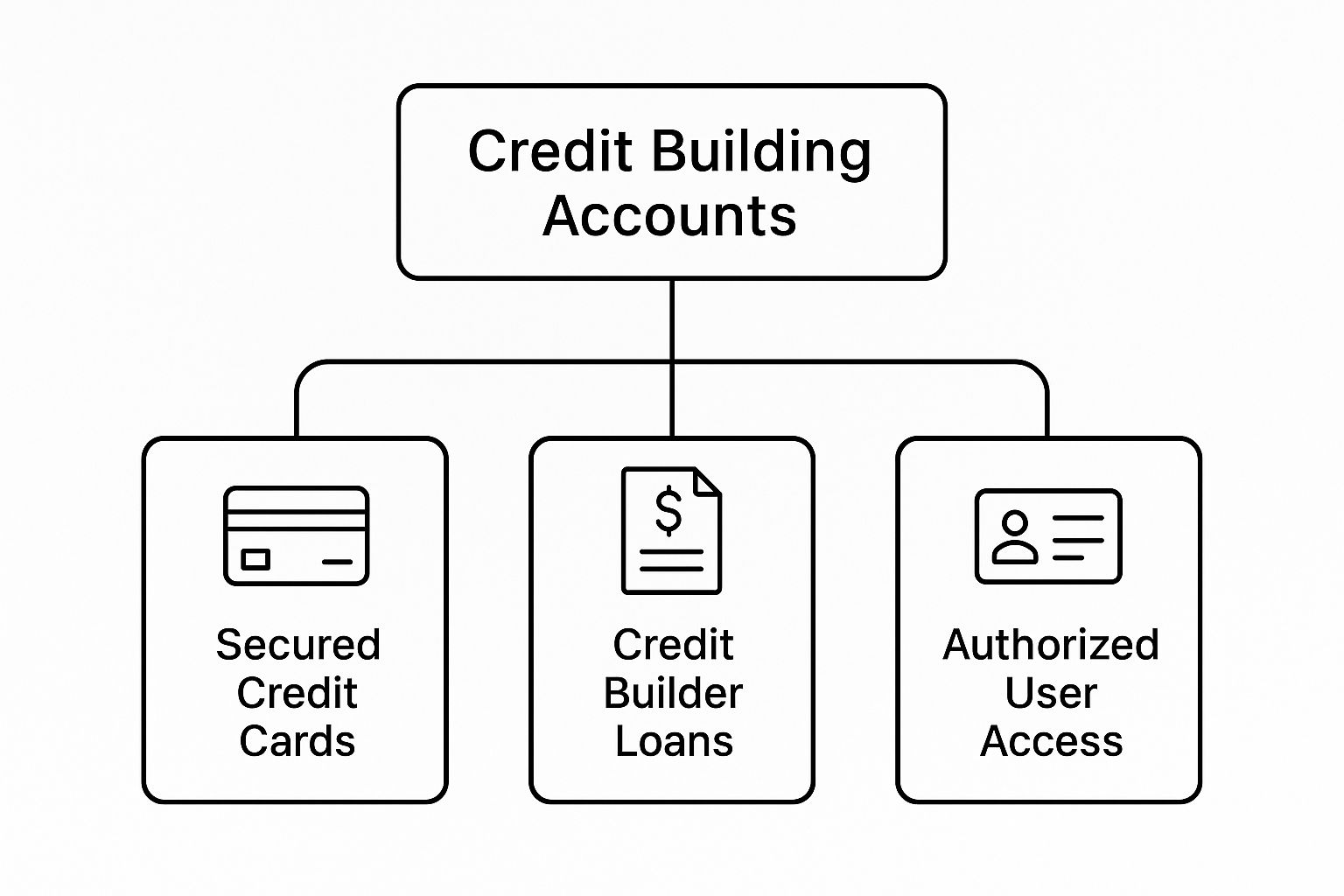

The infographic below outlines the most common pathways you can take.

As you can see, while all these roads lead to the same destination—a better credit history—they start in very different places. Let's dig into these options so you can make a choice that works for you.

Secured Credit Cards and Credit-Builder Loans

The two most common and direct routes to building credit are secured credit cards and credit-builder loans.

A secured credit card works like putting a security deposit down on your credit future. You provide a small cash deposit, which then typically becomes your credit limit. For instance, a 200** deposit usually gets you a **200 credit limit. You use the card for purchases just like any other, and your on-time payments get reported to the major credit bureaus, proving you can handle revolving credit.

Credit-builder loans flip the script on traditional lending. Instead of receiving money upfront, the "loan" amount is placed into a locked savings account that you can't touch. You then make fixed monthly payments over a specific term. Once you've paid off the loan in full, the money is released to you. This process is a fantastic way to show lenders you can responsibly manage installment debt.

To help you decide which path is right for you, here’s a quick comparison of the most common account types.

Credit Building Account Types Comparison A detailed comparison of different credit building account types, their requirements, benefits, and typical timelines for credit improvement

This table shows that your initial financial situation and long-term goals play a big part in your choice. A secured card is great for hands-on practice, while a credit-builder loan builds both credit and savings.

Alternative Paths to Credit

Beyond these core products, other methods can help fill out your credit profile. For example, becoming an authorized user on a trusted family member's or friend's credit card can give your credit a jumpstart. Their positive payment history gets added to your report, but be careful—their missteps could also hurt your score.

Additionally, newer services now allow you to get credit for bills you’re already paying. Consistent, on-time payments for things like your rent or utilities can be reported to the credit bureaus. Understanding these different options is the key to choosing the best credit building accounts for your unique journey.

The Credit Building Revolution: What Market Growth Means for You

The world of credit building accounts has grown considerably, and this expansion is great news for anyone looking to improve their financial standing. In the past, your options were few and often expensive. Now, a competitive market driven by new financial technology and greater consumer awareness has made building credit easier and more affordable than ever.

This rivalry between traditional banks and modern fintech companies puts you in the driver's seat.

Why Competition Is Your Best Friend

Imagine you're shopping for a new phone. When multiple brands are vying for your business, they tend to offer better deals, more features, and lower prices. The exact same principle applies to credit building accounts today. This healthy competition leads to direct benefits for you, such as:

A Safer, More Transparent Process

This market growth isn't just about having more choices; it's also about creating a safer environment for consumers. Stricter regulatory oversight has made the entire credit-building process more transparent and secure. A critical part of this system is the credit bureaus, which have also seen massive growth.

The global credit bureaus market was valued at 109.59 billion** in 2024 and is projected to reach **123.89 billion by 2025. This surge highlights the growing importance of accurate credit reporting and risk management. For you, this means a more dependable system for building your financial future. You can see more details about this trend in a report from The Business Research Company. Understanding these industry dynamics can help you pick the right product at the right time for your credit-building journey.

Smart Shopping: How to Choose Credit Building Accounts That Work

Choosing the right tool to build your credit isn't about guesswork; it’s about having a clear strategy. The very first step is to take an honest look at your financial health and your goals. Are you starting from zero, trying to build your first credit file? Or are you on a mission to rebuild your credit after a few financial bumps in the road?

Knowing your "why" is crucial because it points you directly to the right "what." Think of it like a doctor diagnosing a condition before writing a prescription—your specific financial situation determines the best course of action. Once your goals are clear, you can start looking at your options with a sharp eye, moving beyond flashy ads to focus on what really matters.

Decoding the Fine Print

Not all credit building accounts offer the same value. Some might look good on the surface but come with hidden fees or tricky terms that could set you back. To make a smart decision, you need to dig into the details.

Here are the most important things to look for:

Choosing the right account requires careful thought. To help you weigh your options, here is a breakdown of the key criteria to consider.

In short, the best credit building account is one that reports to all three bureaus, keeps costs low, and offers features that support your financial goals. By carefully examining these factors, you can avoid costly mistakes and choose a tool that truly helps you build a stronger financial future.

Reading the Economic Tea Leaves: Timing Your Credit Building Journey

When you decide to build credit, it's not just about which account you open, but also when you open it. Think of the economy as a current in a river; understanding its direction can help you navigate your financial journey much more effectively. Economic cycles, especially those involving interest rates, have a direct impact on both the cost and availability of credit building accounts.

A great time to act is when interest rates are low. During these periods, lenders are generally more willing to offer credit, which often translates into better terms for you. This creates a prime opportunity to apply for a secured card or a credit-builder loan with more favorable conditions.

Seizing Opportunities in Economic Uncertainty

It might sound strange, but economic downturns can sometimes present unique chances to build credit. When lenders tighten their standards for traditional loans, they often look for other ways to attract new customers. This can make them more competitive in the credit-building market, leading to lower fees or enhanced features on accounts designed for people starting their credit journey.

It's also wise to keep an eye on global financial trends. For example, forecasts suggest that worldwide credit markets could feel the squeeze from rising interest rates in 2025. Understanding these larger movements, like those detailed in global credit outlooks from S&P Global, can give you a better sense of how the terms for credit building accounts might change, even at a local level.

By paying attention to these economic signals, you can time your applications to your advantage. This strategic approach helps you turn market conditions into a personal win on your path to a stronger credit history.

Mastering Your Credit Building Accounts for Maximum Results

Opening a credit-building account is a bit like getting a new gym membership. You have the tool, but seeing real results depends on using it correctly and consistently. The single most important habit you can develop is creating a perfect payment history. This one factor makes up a massive 35% of your FICO score, so paying on time, every time, is essential. A simple way to ensure this is by setting up automatic payments; it's a "set it and forget it" strategy that builds a crucial track record of reliability.

Beyond punctuality, how you use your available credit is just as important. This brings us to credit utilization, which is the percentage of your credit limit you're currently using. A good rule of thumb is to keep this ratio below 30%, but getting it under 10% is even better for your score. For example, on a secured card with a 200 limit, this means your balance should stay below 60. High utilization can suggest to lenders that you're financially stretched, which can lower your score even if your payments are always on time.

Strategic Account Management

To speed up your credit-building journey, think of your accounts as a team working in harmony. Effectively managing different types of credit building accounts—like a secured card (which is revolving credit) and a credit-builder loan (an installment credit)—shows lenders you can handle diverse financial products. This credit mix contributes about 10% to your score.

Here are a few professional tips to get the most out of your accounts:

By applying these techniques, you can turn your credit-building accounts from simple financial tools into a powerful engine for achieving your long-term financial goals.

Your Credit Building Action Plan: From Zero to Credit Hero

Starting your credit journey is a powerful move toward financial independence. Think of this action plan as your personal roadmap, guiding you from picking your first account all the way to earning a strong credit score. Success begins with a clear plan: choosing the right tools, setting achievable goals, and keeping a close eye on your progress.

Setting Milestones and Monitoring Progress

Your first major milestone is to open one of the credit building accounts we've discussed, making sure it reports to all three major credit bureaus. After three to six months of steady, on-time payments, you should start to see your credit score take shape or begin to climb. A vital part of your plan is to actively track these changes.

Free services are a fantastic way to watch your score develop. Here’s a typical credit monitoring dashboard.

This kind of dashboard lets you see your score and the key elements affecting it, like your payment history and how much credit you're using. As you stick to your plan, you'll see these factors improve, which is great motivation to keep going. For more detailed guidance on getting started, take a look at our guide on how to establish credit.

From Building to Graduating

After about a year of responsible credit management, you can begin to think about the next step: moving on to unsecured credit cards with better rewards or applying for larger loans. The solid payment history you’ve built with your first account is your ticket to accessing these more advanced financial products.

Ready to take the first step? itin score offers free, real-time credit monitoring and a personalized plan created specifically for ITIN holders. Sign up in minutes and start your journey to financial freedom today.