Build Credit with a Credit Builder Loan Credit Union

A credit builder loan from a credit union is a clever financial product designed to help you build or fix your credit score. It works by using your own savings as collateral, turning the whole loan process upside down in your favor. Instead of getting cash upfront, the loan amount is held for you in a special account while you make small, regular payments that get reported to the credit bureaus.

The Reverse Loan: A Powerful Credit-Building Strategy

Think about this: it's like trying to prove you're a good driver without ever being allowed behind the wheel. That's the frustrating catch-22 many people face, especially if they're using an ITIN. A credit builder loan completely flips the script on traditional lending to solve this exact problem, offering a safe and effective way to get your foot in the door of the U.S. credit system.

Unlike a typical personal loan where you get a lump sum and then pay it back, a credit builder loan is more like a structured savings plan that reports to the credit bureaus. The money you're technically "borrowing" is locked away in a savings account at the credit union. All you have to do is make small, fixed monthly payments over a set period, which is usually 12 to 24 months.

How Each Payment Builds Your Profile

Every single time you make a payment on time, the credit union sends a positive signal to the three major credit bureaus: Equifax, Experian, and TransUnion. This creates a concrete, documented history showing you're a reliable borrower. Since your payment history makes up a whopping 35% of your FICO score, these consistent, on-time payments are the most powerful tool you have for building a strong credit profile from the ground up. Our guide on how to build credit with an ITIN number dives deeper into why this is so important.

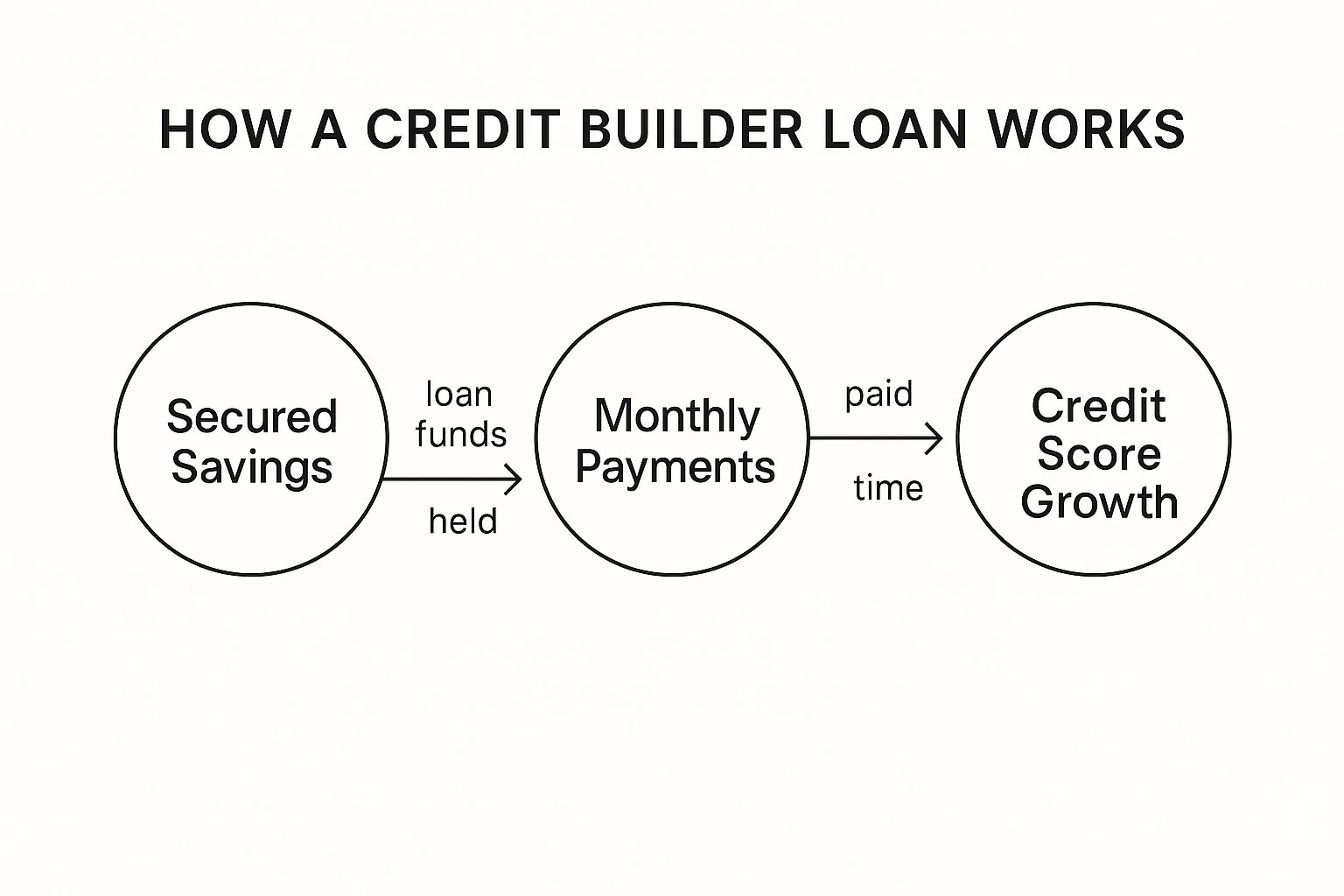

This image breaks down the simple but effective cycle of a credit builder loan.

As you can see, the process is straightforward: your own funds secure the loan, you make consistent payments, and your credit score grows as a direct result.

The Final Step: Unlocking Your Savings

After you've made all your scheduled payments, the credit union releases the full loan amount back to you. It's a win-win. You've not only established a positive credit history but also practiced a great savings discipline—and now you have a nice chunk of cash to show for it. This makes the credit builder loan from a credit union a fantastic tool for financial empowerment.

To make the distinction crystal clear, let's compare it directly with a standard personal loan.

Credit Builder Loan vs. Traditional Personal Loan

This table shows that while both are "loans," their purpose and mechanics are worlds apart. A credit builder loan is a tool for the future, not a solution for an immediate financial need.

Why Choose a Credit Union for Your Credit Journey?

When you’re starting out, picking a financial institution is just as crucial as picking the right financial product. Think of it like choosing a coach. You want someone who’s genuinely invested in your success, gets your unique situation, and gives you the support you need to win. For a lot of people, a credit union is that perfect coach.

Unlike massive, for-profit banks that answer to shareholders, credit unions are not-for-profit cooperatives. This is a game-changer. It means they're owned by their members—the people who actually bank there. This single difference shapes a "member-first" philosophy that puts your needs at the center of everything they do.

A Mission Beyond Profit

The main goal of a credit union isn't to rack up massive profits; it's to serve its members and the local community with affordable financial services. This focus almost always translates into real-world benefits, especially when you’re looking for a credit builder loan from a credit union.

Because they pour their earnings right back into the institution, credit unions can typically offer you a better deal.

This whole structure is built to be a supportive environment where your financial well-being truly comes first.

More Flexible and Inclusive Lending

Let’s be honest, big banks often rely on rigid algorithms. If you have a thin credit file, no history at all, or use an ITIN, their automated systems can shut the door on you before a human ever sees your application. It’s frustrating.

Credit unions, on the other hand, are known for their personal touch. They’re often willing to look beyond just a three-digit score. In fact, research from the Federal Reserve shows that smaller institutions like credit unions are the main source of the very secured, small-dollar loans designed to help people build credit.

This flexibility makes them an amazing ally for ITIN holders and anyone new to the U.S. financial system. They are far more likely to accept alternative forms of ID and proof of income, opening doors that might otherwise stay closed.

A Partner in Your Financial Education

Credit unions take their community role seriously, and that usually includes a deep commitment to financial literacy. They don’t just want to hand you a loan; they want to equip you with the knowledge to thrive financially for the rest of your life.

You’ll find that many credit unions offer fantastic free resources that are incredibly helpful when you're just starting to build credit. These often include:

When you get a credit builder loan from a credit union, you're not just getting a product. You're gaining a partner that’s genuinely dedicated to seeing you succeed.

The Real-World Benefits of a Credit Builder Loan

It’s easy to think of a credit builder loan as just a way to nudge a three-digit number upwards. But its real value goes so much deeper. Think of it as a key that unlocks actual, tangible opportunities, turning a simple financial product into a powerful tool for your future.

What makes it so effective is its brilliant one-two punch: you build a positive payment history while you build up your savings. While you're making those small, steady monthly payments—proving you're a reliable borrower—the loan amount is tucked away in a savings account, waiting for you. It’s a structured, almost effortless way to hit two huge financial milestones at once.

Opening Doors to Better Financial Products

In the U.S., a healthy credit history is the bedrock of your financial life. When you successfully complete a credit builder loan from a credit union, you're not just getting a better score. You’re gaining access to a better financial future, plain and simple.

Here’s a look at what that really means for you:

Building Financial Discipline and Confidence

Beyond the practical benefits, there's a huge psychological win here. A credit builder loan is basically a workout plan for your financial discipline. Making that small, manageable payment every single month builds the powerful habit of consistency.

This simple process takes the mystery out of credit and puts you in the driver's seat. For anyone new to the U.S. financial system, especially those using an ITIN, the whole concept of credit can feel pretty overwhelming. Completing a credit builder loan flips that script, replacing uncertainty with the confidence that comes from seeing real results. You learn firsthand that you have the power to shape your own financial story.

A Look at Lending Trends

Credit unions are increasingly focused on products just like this. After some major shifts in the lending world post-pandemic, many institutions are looking for new ways to serve their members. This has led to a renewed emphasis on tools designed to help people with developing credit profiles. You can dive deeper into these credit union lending trends on defisolutions.com.

All this means that a credit builder loan credit union is a fantastic and timely choice for anyone looking to get their financial footing.

Let's make it real. Imagine you take out a 1,000** credit builder loan for a 12-month term. Each month, you pay around **85. A year from now, you’ve not only built a perfect record of on-time payments and improved your credit score, but you also get that $1,000 back.

That small commitment today could be the very thing that helps you qualify for a fair car loan tomorrow, opening up better job opportunities and making life a whole lot easier. That’s the real-world power we're talking about.

Finding and Applying for Your Loan

Ready to get started? Finding a credit union with a great credit builder loan and going through the application is probably easier than you think. It really comes down to finding the right institution, pulling together a few documents, and taking that first step.

The journey starts with locating a credit union that feels like a good fit. Unlike the big national banks you see on every corner, credit unions have membership rules. But don't let that put you off—the requirements are often surprisingly broad. You might qualify simply based on where you live, your employer, or even by joining a partner organization.

How to Find Your Ideal Credit Union

Your best bet for finding the perfect credit-building partner starts with a bit of online digging. A fantastic place to start is the National Credit Union Administration’s (NCUA) Credit Union Locator. It’s an official government tool that helps you find federally insured credit unions in your area, so you know your money is safe.

Once you have a shortlist of local credit unions, hop over to their websites. Look for two things: their membership rules and any mention of "credit builder" loans. Many credit unions are proud of their work in the community and often feature programs designed for people new to the U.S. credit system, including ITIN holders.

Getting In: Membership and Loan Eligibility

Before you can get a loan, you have to join the club. Becoming a member is usually as simple as opening a basic savings account. This often requires just a small deposit—sometimes as little as $5—which buys you a "share" and officially makes you a part-owner of the credit union.

The good news is that the eligibility for a credit builder loan is usually very flexible. Since the loan amount is held as collateral, the credit union isn't as concerned with your past credit score. They're more focused on your ability to handle the small monthly payments. This is a huge advantage if you’re just starting out. For a deeper dive, check out our guide on how to establish credit from scratch.

Getting Your Paperwork in Order

Walking in prepared makes the whole process a breeze. While every credit union is a little different, they all ask for a few standard documents. For ITIN holders, having these ready is key.

Try to gather these items before you apply:

The Application: What to Do and What to Ask

The application form itself is typically short and simple. You'll fill out your personal details and hand over the documents you gathered. The credit union might run a credit check, but don't sweat it. For a credit builder loan, this is often just a formality to see where you're starting from, not a reason to deny you.

Before you sign on the dotted line, make sure you know exactly what you're agreeing to. This is your financial future, so don't be afraid to ask questions.

Here are the essentials to ask about:

By following these steps, you turn what might seem like a complicated process into a powerful and confident move toward building a strong financial future.

Choosing the Best Credit Builder Loan for You

Not all credit builder loans from a credit union are created equal. It’s a bit like shopping for a car—you have to look under the hood to make sure you’re getting a good deal that actually fits your life. Taking a little time to compare your options can make a huge difference in your credit-building journey.

The whole point is to find a loan that helps your credit score and works with your budget and long-term goals. Think of it like finding the right workout plan; the best one is the one you can stick with. A little homework now will help you pick a program that sets you up for success down the road.

Your Essential Comparison Checklist

When you first start looking at different credit builder loans, the details can feel a bit overwhelming. To keep it simple, just focus on the handful of factors that really matter. This checklist will help you cut through the noise and compare offers like an expert.

Here’s what you should be looking at:

Digging Deeper Than the Numbers

While the financial terms are critical, the best credit builder loan credit union will offer more than just a good rate. Remember, you’re not just a customer; you're a member. You want to find an institution that is genuinely invested in your financial health.

Think about these extra perks: