Your Guide to a Credit Builder Account

Feeling stuck with a low credit score or, worse, no credit history at all? It’s a common problem, and it can feel like a major roadblock standing between you and your financial goals. But there's a powerful and accessible tool that can help you build the credit history you need: the credit builder account.

Your Path to a Stronger Financial Future

Think of a credit builder account as a savings plan and a loan all in one, designed to prove you're a responsible borrower. It’s a unique product that acts as a bridge, giving you a way to establish or repair your credit profile. This approach is especially helpful for anyone who finds traditional credit cards and loans just out of reach.

For millions of people in the U.S., including new immigrants and ITIN holders, the financial system can feel like a locked door. Without a credit history, even basic things like renting an apartment or getting a cell phone plan can turn into a frustrating cycle of rejection. A credit builder account offers a clear, structured way to break that cycle.

How Does It Empower You?

Here's how it works: instead of getting a lump sum of money upfront, you make small, regular payments into a locked account over a set period. Each of these payments is reported to the major credit bureaus as on-time loan activity. It's a simple, disciplined way to build good financial habits while also tucking away some savings.

This whole process is about more than just boosting a three-digit number. It’s about laying a solid foundation for your financial independence. When you use a credit builder account, you’re not just passively hoping your score goes up; you are actively shaping your financial identity. This is incredibly important for individuals who use an ITIN instead of a Social Security Number.

The key benefits really speak for themselves:

Ready to see how this empowering roadmap can lead to a better credit score? Let's dive into how it all works.

How a Credit Builder Account Really Works

So, what exactly is a credit builder account? It’s a bit different from a standard loan where you get a lump sum of cash upfront. Think of it more like a “reverse loan” or a forced savings plan that comes with a powerful credit-building benefit. It’s a smart, structured way to show lenders you’re financially responsible.

Here’s the breakdown. You’ll agree to a loan amount and a repayment timeline—say, 1,000** over **24 months**. The lender then puts that **1,000 into a locked savings account that you can’t access just yet. Your part of the deal is to make small, fixed monthly payments (in this example, around $42 plus some minor interest) for the full 24-month term.

The Reporting Process

This is where the real work gets done. Every single time you make a monthly payment, the lender reports it to the major credit bureaus: Equifax, Experian, and TransUnion. This shows up on your credit report as a successful, on-time payment for an installment loan.

Why does this matter so much? Because your payment history is the single biggest piece of your credit score, accounting for a massive 35% of the FICO Score model. This steady stream of positive reporting proves you can manage credit responsibly, adding a strong tradeline to your file and diversifying your credit mix.

Unlocking Your Savings and Your Future

Once you’ve made every single payment on schedule and the term is up, the locked funds are released to you. In our $1,000 example, after 24 months of on-time payments, that money is all yours. You've successfully built a positive credit history and, as a bonus, you’ve built up a nice little savings fund.

This product has been a true game-changer for anyone starting with no credit history or a thin file. It was specifically designed to help people who were invisible to the financial system get a foot in the door through a safe, tracked process.

Unlike a credit card, where you borrow first and can easily fall into high-interest debt, a credit builder account helps you develop disciplined financial habits without the risk. If you're starting from square one, our guide on how to build credit from scratch is a great resource. By the end of the term, you walk away with two incredibly valuable assets: a better credit score and a pot of cash you saved yourself.

A Practical Walkthrough of Your Credit Building Journey

Theory is great, but let's get into what really matters: how a credit builder account actually works day-to-day. It’s one thing to read about it, but seeing the process in action is what makes the concept click. Let’s walk through a simple, real-world example to see how these small, consistent steps can build a much stronger credit profile.

Picture this: you open a **600 credit builder account** with a 12-month term. All this means is that you’ve agreed to pay back a total of 600 over the next year. The math is straightforward—that comes out to a $50 payment each month, plus any small interest or admin fees.

Now, every time you make that predictable $50 payment, something important happens behind the scenes. Your lender reports that on-time payment to all three major credit bureaus: Experian, Equifax, and TransUnion. This creates a steady, positive track record on your credit reports, and that payment history is the single biggest piece of your credit score.

Your Journey Visualized

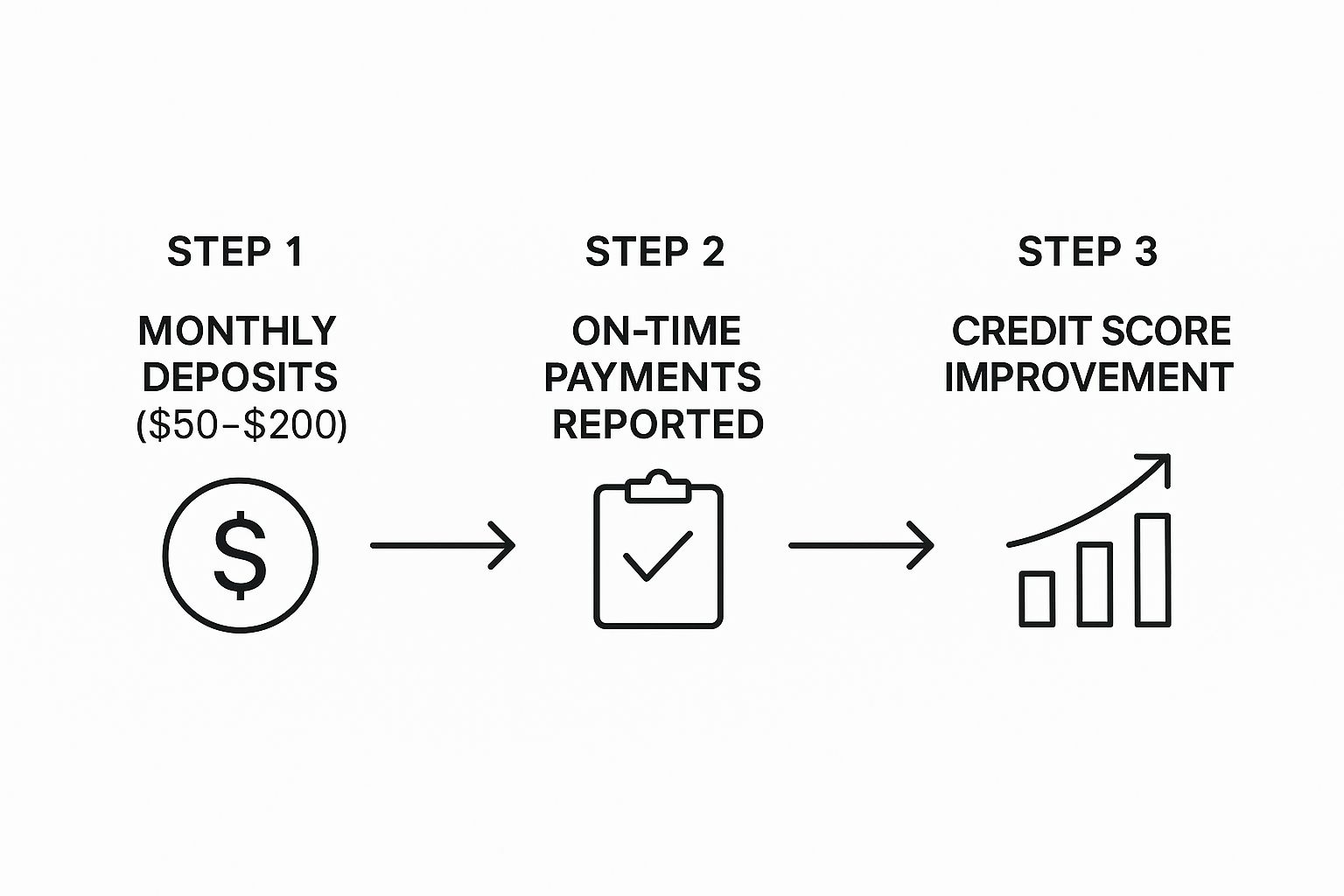

The entire process is designed to be simple and set you up for success. This visual breaks down exactly how your monthly payments translate directly into a better credit history.

As you can see, it’s a direct line from your consistent actions to a positive result. After those 12 months of making your payments, two great things have happened. First, you’ve built a solid year of positive payment history. Second, you get the full $600 back to use however you want.

How It Stacks Up Against Traditional Credit

To really understand why these accounts are so effective, it helps to compare them to other financial products you might be familiar with. The main difference is its structure—it’s built for safety and discipline, not for immediate spending. This makes it the perfect tool for anyone who is laser-focused on building or repairing their credit from the ground up.

This table lays out the key differences in how these products work, what they’re for, and the risks involved.

Credit Builder Account vs. Traditional Credit Products

Going Beyond Standard Reporting

Some of the more innovative providers are taking this a step further to make the process even more powerful. They’re starting to report alternative data, like your history of on-time rent payments, to the credit bureaus.

By adding this information to your file, they paint a much fuller picture of your financial responsibility. This comprehensive approach ensures all your good habits are recognized, helping you get the credit you’ve earned even faster.

The Real Benefits of Building Credit This Way

It's one thing to know how a credit builder account works on paper, but the real magic happens when you see why this approach is so powerful. These aren't just abstract benefits; they create real, positive ripples that can improve your entire financial life.

The most immediate win? You’re building a strong, positive payment history. This is the single most important factor in your credit score, hands down. Each on-time payment you make sends a clear message to lenders: you're reliable and can handle your financial obligations.

Diversify and Strengthen Your Profile

On top of a solid payment history, a credit builder account adds a healthy dose of variety to your credit mix. Lenders get a better picture of your financial responsibility when they see you can manage different kinds of credit. This account shows up as an installment loan—a loan with a fixed payment and a clear end date—which demonstrates a different kind of discipline than revolving accounts like credit cards.

This structured process also builds great financial habits. You're essentially forced to save money while getting into the rhythm of making regular payments. It's like financial training wheels, all without the risk of overspending on a credit card. You can learn more about the specific advantages in our complete guide on credit-building accounts.

Sidestep Predatory Financial Traps

Perhaps the most critical benefit is that a credit builder account helps you steer clear of high-cost, predatory loans. When your credit file is thin or damaged, your options can be grim—often limited to products with sky-high interest rates and terrible terms.

This method gives you a much safer, more affordable path forward. Instead of digging a deeper hole with high-interest debt, you're building a positive credit history and a nest egg at the same time. This is especially vital today, as recent data shows many households are leaning more heavily on high-interest credit cards. A recent Bank of America Institute report pointed out this very trend, suggesting that structured products like credit builder accounts offer a better way to improve credit without getting trapped.

By choosing a credit builder account, you’re not just getting a loan. You're making a strategic investment in a more secure financial future, one that opens doors to better rates, better products, and better opportunities down the road.

How Credit Builder Accounts Open Doors for Immigrants and ITIN Holders

For anyone new to the United States, the American credit system can feel like a catch-22. You need a credit history for almost everything—renting an apartment, getting a decent car loan, even signing up for a cell phone plan. But how do you build that history without a Social Security Number (SSN)?

This is a huge hurdle for millions, but it’s exactly where a credit builder account can be a game-changer.

Many forward-thinking providers have recognized this gap. They don't require an SSN, allowing you to apply with your Individual Taxpayer Identification Number (ITIN) instead. This one simple change makes all the difference, opening up a pathway to financial stability for immigrants and other non-citizens who were previously shut out.

Using a credit builder account that accepts an ITIN means you can start building your U.S. credit file from scratch. You're not just aiming for a number; you're creating a financial identity and proving your trustworthiness, one on-time payment at a time.

More Than a Score: Building Your Financial Identity

Having a good credit history is about so much more than just getting loans. It's your ticket to being recognized and trusted by the entire financial system. When you have a solid credit file, you can unlock:

This isn't just a local issue; it’s a well-known challenge for immigrants worldwide. People often arrive in a new country only to find their past financial discipline doesn't count for anything. Research has shown this has real-world consequences. For instance, the homeownership rate for foreign-born residents is 51%, a stark contrast to the 68% rate for native-born Americans, and a lot of that difference comes down to credit access.

A credit builder account tackles this problem head-on by giving you a clear, structured way to show lenders you're a reliable borrower. You can read the full research on credit access challenges to see just how significant these barriers are.

Instead of being invisible to lenders, you start building a real record of responsible payments. That track record is exactly what you need to go from being "credit invisible" to being a trusted borrower.

If you're ready to take that first step, check out our guide on how to build credit with an ITIN number for more in-depth strategies. It’s a proactive move that can lay the foundation for your long-term financial success in the U.S.

Common Questions About Credit Builder Accounts

Even after you see how a credit builder account works, it's totally normal to have a few more questions. Any financial decision, even one as safe as this, is a big deal. You want to feel confident. To help you get there, let's walk through some of the most common questions people ask before they dive in.

Getting simple, straight answers is the best way to clear up any lingering doubts and figure out if this is the right move for your financial future.

How Fast Will My Credit Score Improve?

This is usually the number one question, and for good reason! While everyone's credit journey is a little different, you can typically see the account show up on your credit report within a couple of months. Lenders report your payments every 30 days, so the first positive update could appear 30 to 60 days after you make your first payment.

It’s important to set realistic expectations. Sometimes, opening any new account can cause a tiny, temporary dip in your score. But don't worry—the positive power of consistent, on-time payments will quickly overshadow it. Most people start seeing real, gradual improvement after about six months of perfect payments. Patience and consistency are your best friends here.

Are There Any Hidden Fees or Costs?

A good financial product is an honest one, and any legitimate credit builder account should be completely upfront about its costs. There are generally just two costs you need to know about:

Always take a moment to read the terms and conditions before signing up. The best way to think about these costs is not as a loss, but as an investment in your financial health. They're almost always far, far lower than the sky-high interest you'd pay on other products aimed at people with poor credit. The payoff—a stronger credit score and a nice pot of savings at the end—is easily worth the small upfront cost.

What Happens If I Miss a Payment?

This is a critical point. Missing a payment on a credit builder account defeats the entire purpose of having one. The main goal here is to prove you're a reliable borrower by building a perfect track record of on-time payments.

If you miss a payment, the lender has to report it to the credit bureaus as late. That negative mark will hurt the very score you're trying so hard to build. It’s absolutely essential to treat these payments as a top priority and make them on time, every single time.

If you ever find yourself in a tight spot and think you might be late, don't just let it slide. Reach out to the provider right away. They might have options to help you out, but proactive communication is key. Remember, this tool only works for you if your payments are consistent.

Can I Get Approved with Bad or No Credit?

Yes! That’s exactly who credit builder accounts are made for. Since the "loan" is secured by the money you're paying into the locked account, the lender isn't taking on much risk. You're basically borrowing against your own future savings.

Because of this, most providers do not perform a hard credit check when you apply. This makes these accounts one of the most accessible credit-building tools you can find. It doesn’t matter if your credit has taken a few hits, if you have a "thin file" with little history, or if you're starting from absolute zero—a credit builder account is designed to give you a fresh start.

Ready to take control of your financial future and build the U.S. credit history you deserve? With itinscore, ITIN holders can finally access the tools they need. Sign up in minutes to get your free credit monitoring, a personalized action plan, and expert guidance to help you reach your goals.

Start building your credit today with itinscore