Collections on Credit Report Your Guide to a Better Score

Seeing a "collection" pop up on your credit report is a jarring experience. It’s more than just a late payment; it’s a serious red flag that tells lenders a story you’d rather not have told.

So, what does a collection on a credit report actually mean? Simply put, it means an original creditor, like a hospital or credit card company, has given up on trying to get you to pay a bill. After several months of non-payment, they’ve sold your debt to a third-party collection agency.

What a Collection on Your Credit Report Really Means

Imagine you have an overdue medical bill. For a while, the conversation is just between you and the doctor's office. They send reminders, you might make a partial payment, but the account is still with them.

But if that bill goes unpaid for too long—usually around 120 to 180 days—the doctor's office might decide it’s no longer worth their effort. At this point, they can sell your debt for pennies on the dollar to a collection agency. That’s the moment a collection on credit report is born. It's no longer just a late bill; it’s a formal record that the original lender has written you off as a loss.

The Key Players Involved

When a debt enters collections, it can feel confusing with new company names suddenly contacting you. Understanding who’s who in this process makes it much clearer. It really boils down to three main parties.

The table below breaks down each player's role in this financial handoff.

Key Players in the Debt Collection Process

This transfer from creditor to collection agency is a big deal for your credit health. For any future lender pulling your file, that collection account screams "high risk." To see exactly where this information shows up, take a look at our complete guide on how to read your credit report.

And if you have a collection account, you're not alone. This is a surprisingly common issue. Nearly 30 million Americans—that's about 19.5% of adults with a credit file—have at least one debt in collections.

The bottom line is that a collection on credit report is a lasting scar. It's a record of a significant financial hiccup that can haunt your credit score for years, even after you’ve paid the debt in full.

The Journey of a Debt from Due Date to Collections

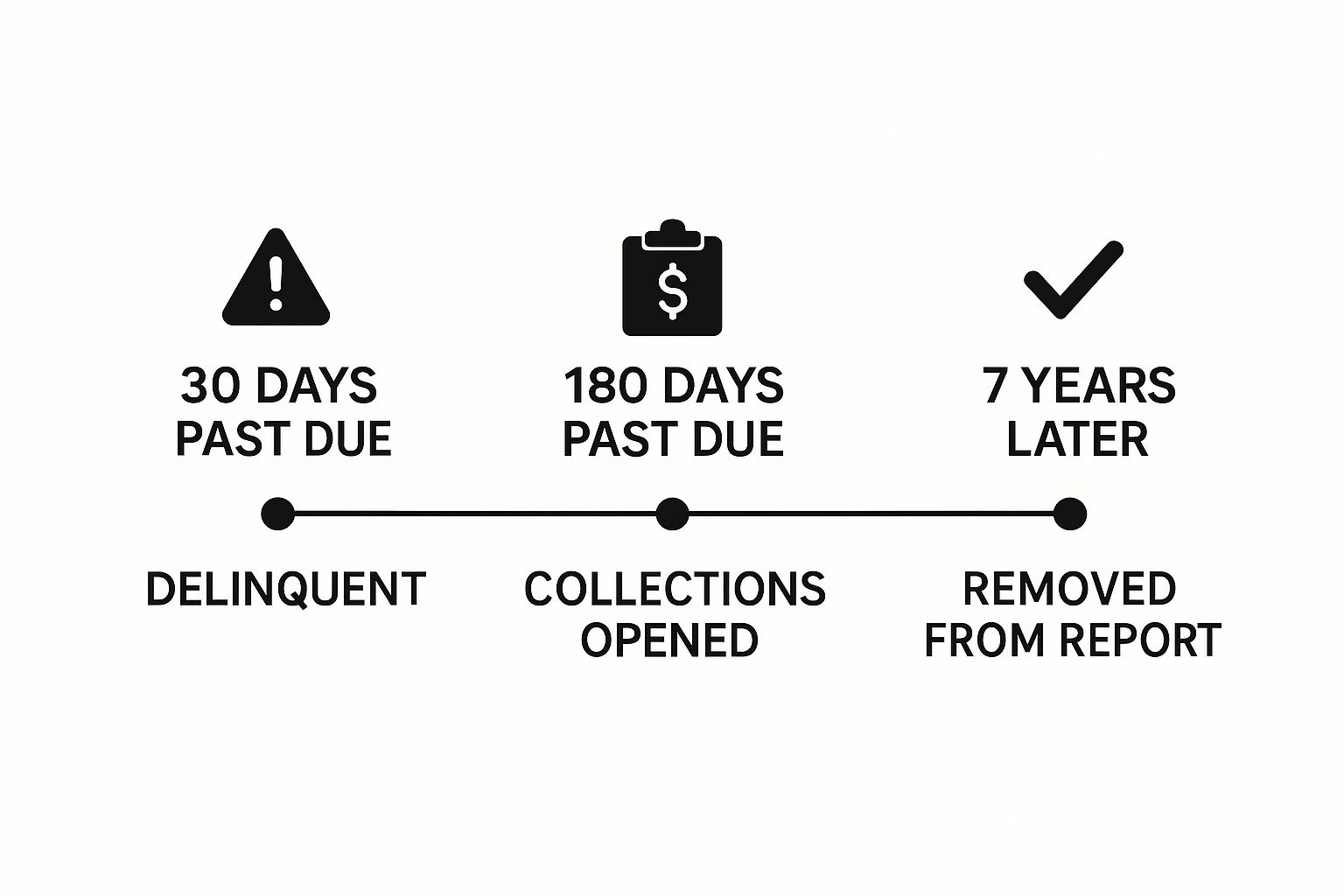

A collection account doesn't just appear on your credit report out of the blue. It's actually the last stop on a long road that starts with a single missed payment. If you understand this timeline, you'll see there are plenty of chances to step in and prevent serious damage to your credit score.

It all begins when a bill is due. Miss that date, and the account is officially delinquent. A few days late usually isn't a big deal, but once you cross the 30 days past due mark, the original creditor will most likely report it to the credit bureaus. That's your first negative hit.

If the debt continues to go unpaid, things get worse. Your account will be marked as 60, then 90 days past due, with each new delinquency report chipping away at your credit score. All the while, the original creditor is sending reminders, making calls, and mailing letters, hoping to get paid.

The Charge-Off Turning Point

After several months of no payments—usually around 180 days—the original creditor starts to lose hope. They decide they're probably not getting their money back. At this point, they'll make an accounting move called a "charge-off," which basically means they're writing the debt off as a loss for their own books.

But here’s the critical part: a charge-off doesn't mean your debt is gone. Not at all. It just signals that the creditor has given up and is about to sell your debt to a third-party collection agency, often for just pennies on the dollar. And that's the moment a new collections on credit report account is officially born.

This infographic breaks down the lifecycle from a simple late payment to a full-blown collection account.

As you can see, what starts as a minor slip-up can snowball into a major negative item that sticks to your credit report for a full seven years.

Common Debts That End Up in Collections

Technically, any unpaid bill can find its way to collections, but some types of debt show up far more often than others. Knowing what they are can help you keep a closer eye on your finances.

Credit card debt, in particular, has always been a major source of collection accounts. On a positive note, things seem to be getting better. TransUnion reported that serious delinquencies on credit cards in the U.S. fell to 1.62% in the first quarter of 2025, a nice drop from 2.26% the year before. This shift points toward healthier payment habits and maybe even more responsible lending.

How Collections Damage Your Credit Score

When a collection account shows up on your credit report, it’s not just a minor ding. It's one of the most serious negative marks you can have, and lenders take it very seriously.

Think of your credit score as a kind of financial trust score. When a lender sees a collection, it sends a clear signal: a previous creditor trusted you with their money, and you didn't pay it back. That broken trust is a huge red flag.

Just one collection can cause your score to plummet, sometimes by as much as 100 points or more. The exact drop depends on your score before the collection and what the rest of your credit profile looks like, but the damage is always significant.

Why is it so bad? Because it strikes at the heart of your credit score—your payment history, which makes up a massive 35% of your FICO score.

The Long-Term Impact on Your Score

The initial shock to your score is just the beginning of the problem. That collection account will linger on your credit report for up to seven years from the date the original debt first went delinquent. That's a very long shadow for one financial misstep to cast.

Over time, its direct impact on your score will fade a bit, but the entry itself remains visible to anyone who pulls your credit. This can make getting new credit cards, a mortgage, or a car loan incredibly difficult. Lenders see the collection and immediately classify you as a high-risk borrower, often leading to outright denials or sky-high interest rates if you are approved.

Paid vs. Unpaid Collections

People often assume that paying off a collection will make it disappear and fix the damage. It’s absolutely the right thing to do, but unfortunately, it doesn't wipe the slate clean.

Once you pay the debt, the account's status on your credit report will change from "unpaid" to "paid collection." This is better than leaving it unpaid, but it doesn't remove the history of the delinquency itself.

Newer scoring models like FICO 9 and VantageScore 3.0 and 4.0 are more forgiving and may even ignore paid collections. The problem is, many lenders—especially mortgage lenders—still rely on older FICO models that treat all collections, paid or not, as serious negative marks.

How a Collection Affects Key Score Factors

The damage from a collection account isn't isolated. It ripples across several factors that make up your credit score, which helps explain why it's so devastating.

Here’s a breakdown of how a single collection can impact the five main components of your FICO score.

Impact of Collections on Different Credit Score Factors

As you can see, a collection account is a serious issue that touches nearly every part of your financial reputation.

If you find a collection on your report that you don't recognize or believe is an error, you have the right to challenge it. It's crucial to ensure your report is accurate, and you can learn how to dispute credit report errors and win to protect your score.

When a collection agency starts calling, it's easy to feel overwhelmed and backed into a corner. The constant letters and phone calls can be incredibly stressful. But here’s something important to remember: you are not powerless. You have rights, and federal law provides a strong shield to protect you from harassment.

The key piece of legislation on your side is the Fair Debt Collection Practices Act (FDCPA). Think of it as the official rulebook for debt collectors. This federal law draws a very clear line in the sand, dictating exactly what they can and cannot do. Getting familiar with these rules is your first step toward regaining control.

You don't just have to put up with endless or aggressive calls. The FDCPA specifically limits when and how collectors can get in touch with you.

What Collectors Are Forbidden to Do

Under the FDCPA, a debt collector’s behavior isn't just a matter of professional courtesy—it's strictly regulated by law. They are flat-out prohibited from doing anything that counts as harassment, oppression, or abuse.

Here are some specific actions that are illegal for collectors:

Knowing these rules puts the power back in your hands. If a collector crosses any of these lines, you can and should report them to the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC).

How to Take Control of the Conversation

One of the most powerful things you can do is insist that all future communication happens in writing. This one move immediately stops the harassing phone calls and creates a paper trail of every interaction. Just send a simple letter stating your request. Once they get it, they can only contact you to confirm they received your letter or to tell you they're taking a specific legal action, like filing a lawsuit.

Next, you should send a debt validation letter using certified mail. This is a formal request that forces the collector to prove the debt is actually yours and that they have the legal right to collect it. You'd be surprised how often this step alone can end the matter, especially if the collector has sloppy records or is working with an old debt. It’s a simple but incredibly effective way to protect yourself.

Your Action Plan for Handling Collections

Seeing a collection on your credit report can feel like a punch to the gut. It's stressful, but it's not the end of the road. This is a solvable problem, and right now is the perfect time to build a smart, step-by-step plan to deal with it.

You absolutely can’t ignore it and hope it goes away—that only makes things worse. Instead, you need a clear-headed strategy. The four main ways to tackle a collection are to verify the debt, negotiate a settlement, ask for a pay-for-delete, or dispute errors. The best path for you really depends on your specific situation.

Start with Debt Verification

Before you even consider sending a penny, your very first move must be to verify the debt. The law is on your side here; you have the right to make the collection agency prove the debt is legitimate, the amount is correct, and that they actually own it.

Do this by sending a formal debt validation letter via certified mail. You need to do this within 30 days of when they first contacted you. This one simple step legally requires them to stop all collection activity until they can provide proof. You'd be surprised how often collectors with weak paperwork just drop the whole thing.

Negotiate a Settlement

Okay, so the debt is valid. Now what? Your next best move is to negotiate. Collection agencies almost always buy old debts for a tiny fraction of their original value. This gives them a ton of wiggle room to make a deal. It's not uncommon to settle a debt for as little as 30-50% of the original balance.

When you start negotiating, keep a few things in mind:

Request a Pay-For-Delete Agreement

This is probably the most powerful tool you have. A pay-for-delete is exactly what it sounds like: you agree to pay a certain amount, and in return, the collection agency agrees to completely remove the negative mark from your credit report.

Just like with a settlement, you must get this agreement in writing before any money changes hands. Not every collector will agree to it, but it's always worth asking. The potential upside for your credit score is just too big to ignore.

Dispute Inaccurate Information

Finally, comb through the details. If you spot any mistakes—a wrong balance, an incorrect date, or a debt you don't even recognize—you need to file a dispute with the credit bureaus (Equifax, Experian, and TransUnion) right away. The Fair Credit Reporting Act (FCRA) forces them to investigate your claim and get rid of any information they can't verify.

Working through these steps is a huge part of managing your credit, especially when you’re trying to build a better financial future. For ITIN holders, mastering this process is essential for establishing a solid financial reputation in the U.S. You can find more helpful strategies in our guide on how to build credit with an ITIN number.

Got More Questions About Collections on Your Credit Report?

Even after you get the basics down, dealing with a collection on your credit report can leave you with a lot of "what ifs." It's completely normal. Let's tackle some of the most common questions that pop up so you can move forward with confidence.

Think of this as your go-to guide for those tricky details. We'll get straight to the point about what happens after you pay, break down important legal deadlines, and give you the real story on credit repair services.

Does Paying a Collection Get It Removed from My Credit Report?

This is the big one, and the answer often surprises people: No, paying a collection doesn't automatically make it disappear.

When you pay off the debt, the collection account on your credit report gets updated. It will show a $0 balance and be marked as a "Paid Collection." While that's much better than leaving it unpaid—lenders and newer credit scoring models definitely see it as a positive step—the original negative mark from the account going to collections sticks around.

That blemish typically stays on your report for up to seven years from the date the account first went delinquent. The only ways to get it removed sooner are to negotiate a "pay-for-delete" deal with the collector before you pay or to successfully dispute an error you've found on your report.

What’s the Statute of Limitations on Debt?

Here's where things can get confusing. The statute of limitations is the legal time window a creditor or collection agency has to sue you for an unpaid debt. This is completely separate from the seven-year credit reporting time limit.

Every state has its own laws, and the time limit can be anywhere from three to ten years (or even longer), depending on the type of debt.

For instance, a debt might vanish from your credit report after seven years. But if your state has a ten-year statute of limitations, you could still be sued for it. Knowing the difference is key to protecting your rights.