Check My Credit Report Free – Official All Bureaus Method

Believe it or not, you have the right to check your credit report for free every single week. This isn't some limited-time offer; it's a permanent benefit provided by the three major credit bureaus, all accessible through one official, government-authorized website.

Why You Get a Free Credit Report Every Week

Knowing your right to a free credit report helps you confidently monitor your financial health without falling for paid services you don't need. It's a consumer protection backed by federal law.

The key piece of legislation here is the Fair Credit Reporting Act (FCRA). At its core, the FCRA is all about ensuring the information credit agencies collect on you is fair, accurate, and private. It puts you in the driver's seat by giving you the right to review that information firsthand.

The Three Major Credit Bureaus

In the U.S., your credit history is primarily tracked by three nationwide credit bureaus:

These companies collect data from your lenders—think banks, credit card issuers, and auto finance companies. Since not every lender reports to all three bureaus, the details on each report can vary. That’s why it’s so important to check all three; it's the only way to get a complete picture of your credit.

Your Right to Weekly Access

Originally, the FCRA only required the bureaus to provide one free report every 12 months. But things changed after the COVID-19 pandemic. In a major move for consumers, the bureaus made free weekly online reports a permanent fixture. You can find more details on this consumer protection directly from the FTC. This shift gives you an incredible opportunity to stay on top of your credit like never before.

To help you tell the real deal from the lookalikes, here’s a quick comparison of the official source versus other services you might encounter.

Comparing Free Credit Report Sources

The key takeaway is that the only website authorized by federal law for your free reports is AnnualCreditReport.com. Watch out for those imposter sites with similar-sounding names. They're often designed to sell you a credit score or lock you into a subscription you don't need. Stick with the official source to keep your information secure and your access truly free.

Getting Your Hands on Your Credit Reports

Believe it or not, the process of pulling your credit reports is pretty simple when you know where to go. The only official, federally authorized place to get your free reports is AnnualCreditReport.com. Head over to their website to get started.

You'll need to have some standard personal information ready. This includes your full name, date of birth, and both your current and previous addresses. Most importantly, where the form asks for a Social Security Number, you can almost always enter your ITIN. This is the key piece of information the credit bureaus use to find your specific file.

Acing the Identity Verification Quiz

This is the part that can trip people up, but it’s manageable if you’re prepared. After you enter your basic details, each credit bureau (Equifax, Experian, and TransUnion) will serve up a short, multiple-choice quiz. It's their way of making sure you're really you.

These questions are pulled directly from the data in your credit file. They're designed so that only you would know the answers. You might see questions like:

Once you correctly answer the questions for a specific bureau, you’ll get instant access to that report. You can then repeat the process for the other two.

Don't Forget to Save Your Reports

After you've passed the quiz, your credit report will appear right on the screen. This is a critical moment: you need to save a copy for yourself.

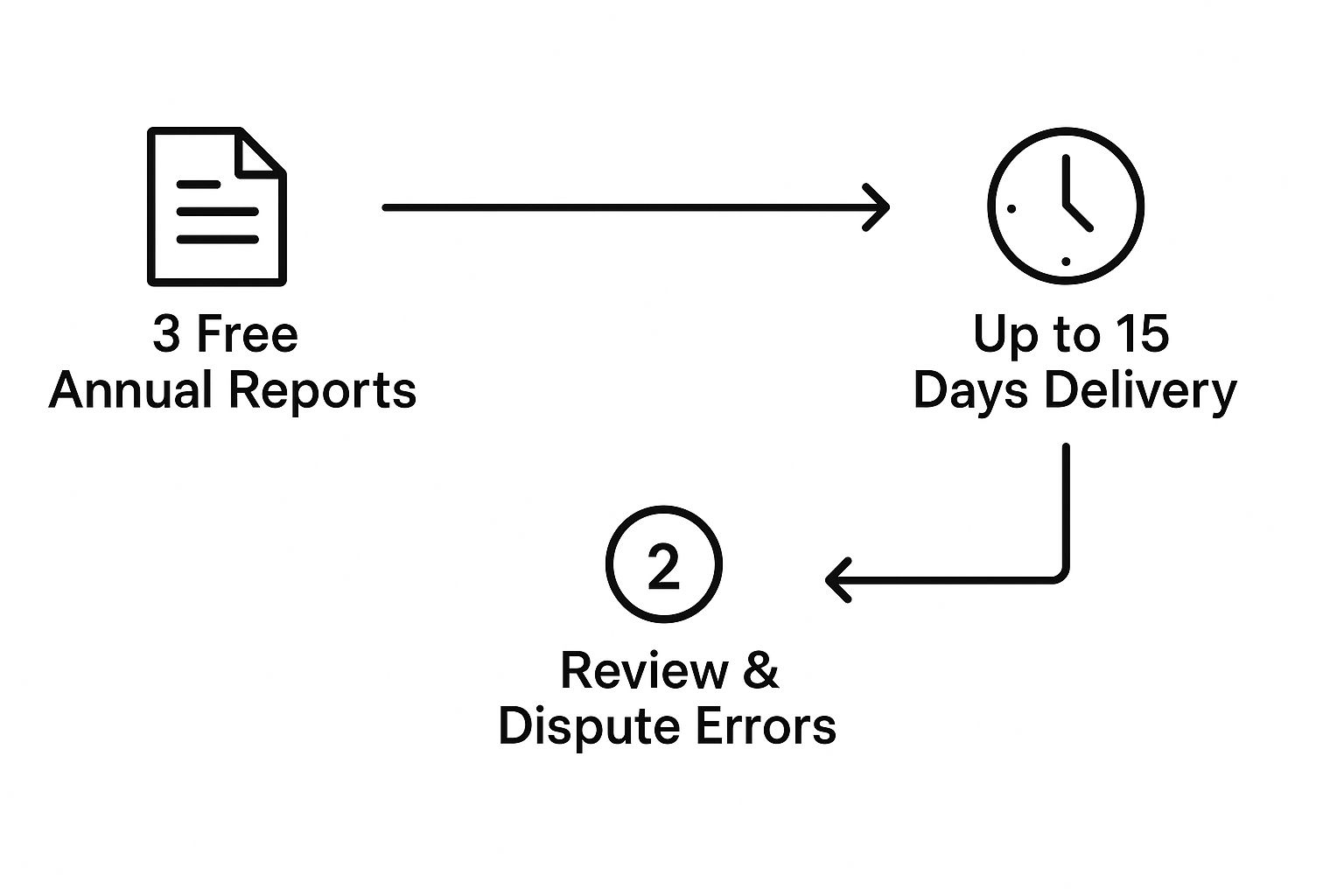

The infographic below shows the simple journey from requesting your reports to checking them for any issues.

As you can see, the path to check my credit report free is all about getting access, saving a copy, and then carefully reviewing it.

The website will give you an option to download each report as a PDF file. I highly recommend doing this. Save the files somewhere secure on your computer. To make life easier later, give them clear names, like "Experian Report - Oct 2024." Having these on hand makes it much simpler to track your progress over time or gather evidence if you need to dispute an error.

How to Read Your Credit Report Like a Pro

So, you've got your credit reports in hand. Great. Now comes the part that can feel a little intimidating. At first glance, they often look like a jumble of codes, dates, and jargon. Don't worry, it's not as complicated as it seems.

Once you know what you're looking for, you can break it down pretty quickly. Think of it less like a test and more like giving your financial history a regular checkup. We'll walk through the four key sections so you can spot issues and stay in control.

The first thing you’ll see is your Personal Information. This is the basic stuff: your name, current and past addresses, and your ITIN. Look this over very carefully. A simple typo might seem harmless, but it can cause problems down the line. An address you've never heard of is a much bigger deal—it could be a simple data entry mistake, but it's also a classic red flag for identity theft.

Your Credit Accounts and Public Records

This is where the real action is. The Credit Accounts section is the core of your report, detailing all your lines of credit. This includes everything from credit cards to car loans, both open and closed. It's a running history of your financial life.

For each account, you should see the lender's name, your payment history, the balance you owe, and your total credit limit.

So, what are you looking for here?

Next is the Public Records section. This is where you'd find major financial events like bankruptcies or tax liens. For most people, this section will be empty. And trust me, an empty Public Records section is a good thing.

Understanding Credit Inquiries

The final piece of the puzzle is the Credit Inquiries section. This is simply a log of who has recently requested a copy of your credit file. These requests fall into two different camps: soft inquiries and hard inquiries.

Soft inquiries don't impact your score at all. These happen when you check your own credit or when a company sends you a pre-approved offer in the mail. No harm, no foul.

Hard inquiries are different. These are triggered when you actively apply for new credit, like a loan or a credit card. A flurry of hard inquiries in a short period can temporarily lower your score because it might signal to lenders that you're in financial distress. Scan this list for any applications you didn't personally authorize—an unexpected hard inquiry is a clear signal that it's time to investigate for potential fraud.

When You Can Get Additional Free Credit Reports

Getting your free weekly credit report is fantastic, but sometimes life throws you a curveball and you need to see what's going on right now. Thankfully, the law agrees.

The Fair Credit Reporting Act (FCRA) carves out specific situations where you’re legally entitled to an extra free report. Knowing these rights is key, as it means you don't have to wait when you suspect a problem or have been turned down for something important.

Special Circumstances for an Extra Free Report

So, when exactly can you ask for another report? The most common trigger is something called an adverse action notice.

If you've ever been denied credit, a job, or an insurance policy because of what’s in your credit report, you should receive this official notice. Once you have it, a clock starts ticking—you have 60 days to request a free copy of the very report that led to the denial.

There are other important scenarios where you can get an extra report, too. You have the right to a free copy if you are:

These rules exist for a simple reason: your credit information is most critical when you're financially vulnerable. The FCRA ensures you can access your report when it matters most. For a deeper dive into these rights, Equifax provides more details.

And if you pull one of these extra reports and find a mistake? Acting fast is crucial. We have a guide that walks you through how to dispute credit report errors effectively.

While getting your full report from AnnualCreditReport.com is a fantastic way to do a deep dive, you often need a more frequent, "what's happening right now?" view of your credit. This is where the tools offered directly by the credit bureaus come in. Think of them as the perfect complement to your more detailed annual check-up.

These services are built differently. They don't just hand you a dense report; they typically offer user-friendly dashboards, track your score over time, and—most importantly—send you alerts. If you're actively building or repairing your credit, this kind of immediate feedback is invaluable.

Get Proactive with Real-Time Monitoring

Think of these tools as a security system for your credit. Bureau platforms can ping you with a real-time alert the moment something important happens, like a new credit card being opened in your name or an unexpected hard inquiry. This is often your first line of defense against identity theft, letting you act immediately.

This kind of proactive mindset is key. For more tips on this, our guide on how to monitor your credit breaks down more strategies to help you stay ahead of any issues.

For example, TransUnion provides a free service that gives you daily access to your credit report and score. It’s more than just data; it actually gives you letter grades on the key factors influencing your score and shows you offers you might qualify for, creating a clear path for improvement.

This level of detail is a game-changer. You can literally watch how paying down a credit card balance affects your credit utilization or see your score nudge upward after a string of on-time payments. It turns credit management from a passive, once-a-year chore into something you can actively influence day by day.

Answering Your Top Questions About Free Credit Reports

Once you have your free report in hand, it's pretty common for a few more questions to surface. That's totally normal. Let's walk through some of the things people often ask so you can feel completely comfortable managing your credit.

The biggest fear I hear from people is about whether checking their own report will actually cause their score to drop. Let's clear that one up right away.

Will Checking My Own Credit Hurt My Score?

The short answer is no, not at all. When you request your own credit report from a place like AnnualCreditReport.com, it's considered a soft inquiry.

You can think of a soft inquiry as a personal review—it's just for you. It has absolutely zero impact on your credit score. Hard inquiries are different. Those happen only when a lender pulls your credit because you've applied for something new, like a car loan or a credit card.

So go ahead and check your report as often as you need to. It's a healthy financial habit. For a deeper dive into the mechanics, our guide explains why checking your credit doesn't hurt your score.

What's the Difference Between a Credit Report and a Credit Score?

This is another point that often trips people up. They sound similar, but they serve very different purposes.

While AnnualCreditReport.com gives you the full report for free, it typically doesn't include your score. However, many other services, including those offered directly by the bureaus, will provide a free score along with report information.

What Should I Do If I Find a Mistake?

Finding an error on your report can be stressful, but don't panic. The Fair Credit Reporting Act (FCRA) gives you the legal right to dispute any information you believe is wrong.

You'll need to file a dispute directly with the specific credit bureau (Experian, TransUnion, or Equifax) that is showing the incorrect information. You can do this online, by mail, or sometimes over the phone. Be prepared to clearly identify the error and provide any documentation you have to support your claim.

By law, the bureau must investigate your dispute, usually within 30 days. If they find the information is indeed inaccurate, they are required to remove it.