Check Credit Report for ITIN Holders: Easy Guide

For the millions of people in the U.S. who use an Individual Taxpayer Identification Number (ITIN), a credit report isn't just a document. It's your official financial footprint, the story of your life in this country told through numbers. Taking the time to check your credit report is one of the most important steps you can take to secure a loan, rent an apartment, and build a solid financial future. Honestly, it's a non-negotiable part of protecting yourself.

Your Financial Footprint as an ITIN Holder

Think of your credit report as your financial resume. It's what lenders, landlords, and even insurance companies look at to gauge your reliability. I've seen firsthand how crucial it is to review this document regularly. It helps you catch and fix errors (which happen more often than you'd think), shield yourself from identity theft, and make smart moves to build a positive credit history. When you're building a U.S. financial record from scratch, every single detail counts.

For a long time, just getting your hands on this data was a real headache for the ITIN community. That's exactly why platforms like ItinScore were created—to bridge that gap and make it simple for you to see and manage your own credit information.

Here’s a look at the ItinScore dashboard. We designed it to be as clear and straightforward as possible.

This isn't just data; it's a snapshot of your financial health. It puts you in the driver's seat, allowing you to control your financial story from day one.

Why Checking Your Report Is So Important

The world of credit reporting is growing, and fast. The global market for credit bureaus was recently valued at 109.59 billion** and is expected to hit **123.89 billion soon. This boom shows just how much weight this information carries. For ITIN holders, it means staying on top of your report is more critical than ever.

Once you understand what’s in your report, you can start making it better. For a more detailed guide, I highly recommend reading our post on how to check your credit score with an ITIN. This is your first step toward building a powerful financial identity in the United States.

Get Your Ducks in a Row: What You’ll Need

Think of checking your credit report like applying for a loan or a new apartment—you need to have your information ready. Getting everything in order beforehand makes the whole process faster and avoids those frustrating moments where you have to stop and hunt down a specific document.

This initial step is all about identity verification. Platforms like ItinScore and the credit bureaus need to be absolutely sure you are who you say you are before they show you sensitive financial data. It’s a crucial security measure that protects you.

Your Pre-Flight Checklist

Before you even open the website, take a few minutes to gather these key pieces of information. Trust me, having them at your fingertips will save you a ton of time.

Here’s what you should have ready:

One of the most common snags I see is an address mismatch. You might have just moved and enter your new address, but your credit card company or bank might still have your old one on file. This discrepancy can cause the system to fail your identity check.

Once you have these details handy, you're all set. A little preparation goes a long way in making this a quick, painless experience.

Navigating the ItinScore Platform with Confidence

Alright, you’ve got your documents ready. Let's dive into the ItinScore platform itself. We designed this tool from the ground up to take the anxiety out of checking your credit information. It’s built specifically for ITIN holders, so everything from the language to the layout is meant to be clear and straightforward.

Let's say you just got your first U.S. credit card. A great first move is to check your credit report to see if your on-time payments are showing up. That’s exactly the kind of smart financial habit we want to make easy for you. With ItinScore, you’ll see how this works without any guesswork.

Getting Started and Identity Verification

First things first: creating your account. This part is quick, but it's where our security really kicks in. You’ll use the information you gathered—your name, address, and ITIN—to get started. Think of this as the secure key to your financial story.

Next comes identity verification. I know from experience that this step can be a real headache for ITIN holders on other sites, but we've put a lot of effort into making it smooth. You’ll likely be asked a few security questions to confirm you are who you say you are.

These questions are usually pulled from public records and might touch on things like:

This is a standard security measure and a good thing. It’s what ensures only you get to see your sensitive data when you check your credit report. It’s all about building a secure foundation for your financial life here.

Finding the Information You Need

Once you’re logged in, you’ll land on your dashboard. This is your mission control. We’ve deliberately avoided confusing menus and jargon, putting your most important information front and center.

Curious if that new credit card is on your report? Just head over to the "Credit Accounts" section. You'll find a clear list of each account, its current status, and your payment history. You can quickly see the name of the lender, the date you opened the account, and—most importantly—confirm that your payments are all marked "on-time."

Seeing that immediate confirmation is a huge confidence booster. It’s the proof that your hard work to build good credit is actually paying off.

How to Read and Understand Your ITIN Credit Report

Getting your hands on your credit report is a great start, but the real power comes from knowing what you're actually looking at. Think of it less like a scary financial document and more like a detailed story of your financial journey. Each section reveals something important about your habits and history.

Start with Your Personal Details

The first thing you’ll probably notice is a section with your Personal Information. This includes your name, current and past addresses, and your ITIN. Take a moment here. Seriously. A simple typo in your name or an old address you don't recognize could just be a clerical mistake, but it could also be a warning sign of identity fraud. It’s always better to be sure.

Your Credit Accounts: The Heart of the Report

Next up is the core of your report: your Credit Accounts. This is where you'll find a complete list of your credit cards, car loans, personal loans, and any other debts you have. Lenders spend most of their time scrutinizing this section.

To make sense of it all, it helps to understand the different types of accounts you might see.

Understanding Your Credit Accounts

Each account listed will show you who the lender is, your complete payment history (the good and the bad), your current balance, and your total credit limit. Your payment history is the single biggest factor in your credit score, so making consistent, on-time payments is your best tool for building a strong financial future.

Diving Deeper into Your Account History

With the number of active credit cards in the U.S. soaring past 554.5 million—a jump of over 100 million since late 2020—it's more important than ever to keep a close eye on your accounts. This explosion in credit card use means there's more data to track and, unfortunately, more opportunity for errors or fraud to slip through.

Beyond your accounts, you’ll also find a section for Public Records. This is where things like bankruptcies would appear. Another area is Credit Inquiries, which is a log of every time a company has pulled your credit report. For a full breakdown of every little detail, you can explore our complete guide on how your credit report is explained.

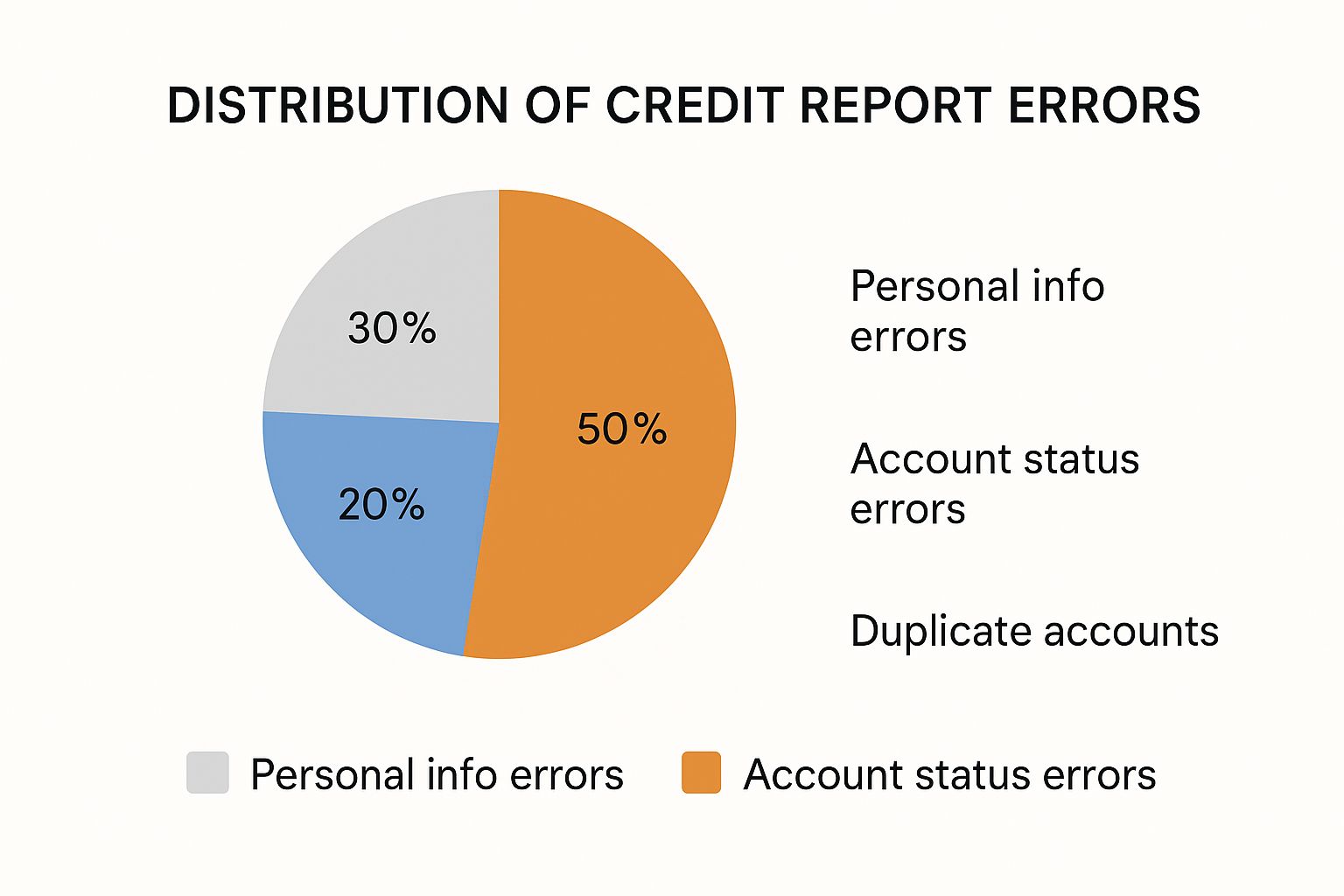

This visual gives a great summary of where mistakes tend to pop up most often.

As the chart shows, a whopping 50% of all errors are related to your account status. This makes it absolutely the most critical part of your report to double-check for accuracy.

Finding and Fixing Common Credit Report Errors

It's a frustrating but common reality: credit reports have mistakes. For an ITIN holder trying to establish a financial foothold in the U.S., even a tiny error can feel like a huge setback. When you pull up your report, you need to put on your detective hat and scan for anything that looks off.

I’m talking about more than just a simple typo. Look for things like a misspelled name, an old address you haven't lived at for years, or—the most alarming—accounts you never opened. That last one is a major red flag for identity theft.

The great thing is, you have the right to get these mistakes corrected. The key is to start by gathering your proof. Think of it like building a case.

Taking Action on Inaccuracies

Once you have your evidence organized, it’s time to formally dispute the error. If you’re using a service like ItinScore, the dispute process is often integrated right into the platform, making it much simpler. Otherwise, you’ll need to contact the credit bureaus directly.

Don't put this off. Keeping your report clean is more important than ever. We're seeing global trends where more people are struggling to keep up with payments. For example, in Canada, over 1.4 million consumers recently fell behind on at least one credit payment. While that’s a different country, it reflects a broader economic pressure that makes lenders extra cautious. A clean report helps you stand out.

For a complete step-by-step breakdown of the process, make sure to read our detailed guide on how to dispute credit report errors.

Got Questions? We've Got Answers

It’s completely normal to have a few questions when you first dive into your ITIN credit report. Let's tackle some of the most common ones we hear from people just like you.

What if I Don't Have Any Credit History Yet? Should I Still Check?

Yes, absolutely. In fact, it’s a brilliant first step. Pulling your report even before you have any accounts is a crucial defensive move.

This lets you confirm that a credit file is correctly set up with your ITIN. More importantly, it helps you make sure no one has fraudulently opened accounts in your name. You get to ensure you’re starting with a clean slate, which is invaluable.

Think of it as claiming your online profile before someone else does. You're securing your financial identity from day one.

How Often Should I Be Looking at My Report?

When you’re actively working on building your credit, checking in more frequently is a game-changer. We recommend taking a peek every one to three months. This rhythm allows you to:

Once you have a more established credit history, a yearly check-up is the bare minimum. While federal law gives you free access to reports from the main bureaus, a service like ItinScore provides continuous monitoring, which is a much more proactive approach.

Will Checking My Own Credit Report Lower My Score?

This is probably the biggest myth out there, and we're happy to bust it. The answer is a firm no.

When you check your own credit, it’s known as a “soft inquiry.” These are completely harmless. They’re visible only to you and have zero effect on your credit score.

A "hard inquiry" is different. That’s what happens when you apply for a new loan or credit card and the lender pulls your report to make a decision. Too many of those in a short period can cause a temporary dip in your score. So, feel free to check your own report as often as you like—it won't hurt a thing.

Ready to see your own financial story? ItinScore provides the tools you need to check and build your credit with confidence. Sign up for free today and start taking control.