Build Credit With Rent Payments: Your Complete Guide

Why Your Rent Payments Are Credit Building Gold

Let's be honest, rent eats up a big chunk of your monthly budget, right? But what if I told you that you could be getting credit for that hefty payment? For ITIN holders, building credit can feel like an uphill battle, especially when traditional methods seem out of reach. Reporting your rent payments can be a game-changer, a real secret weapon for establishing a credit history in the U.S.

Think of it this way: you're already making this significant payment every month. Why not let it work for you? Reporting rent demonstrates consistent, on-time payments—music to the ears of credit scoring models! I've seen this strategy work wonders, giving credit scores a substantial boost. It's not just theory; it's a practical way to gain a real advantage.

Rent reporting is particularly helpful for those who are new to credit or haven't yet established a score. A TransUnion analysis found that reporting rent payments led to an average credit score increase of almost 60 points. That's huge! For those previously unscorable, this often means finally getting a score, with about 9% landing in the near prime range (VantageScore 3.0 of 601-660) with an average score of 631. This can unlock a world of possibilities, from qualifying for loans and credit cards to even getting lower insurance rates. Check out more details on the impact of rent reporting here.

Building credit with rent payments is a concrete, effective way to improve your financial health and open doors to new opportunities. So, let's dive into how to pick the right rent reporting service to maximize your credit-building potential.

Choosing The Right Rent Reporting Service

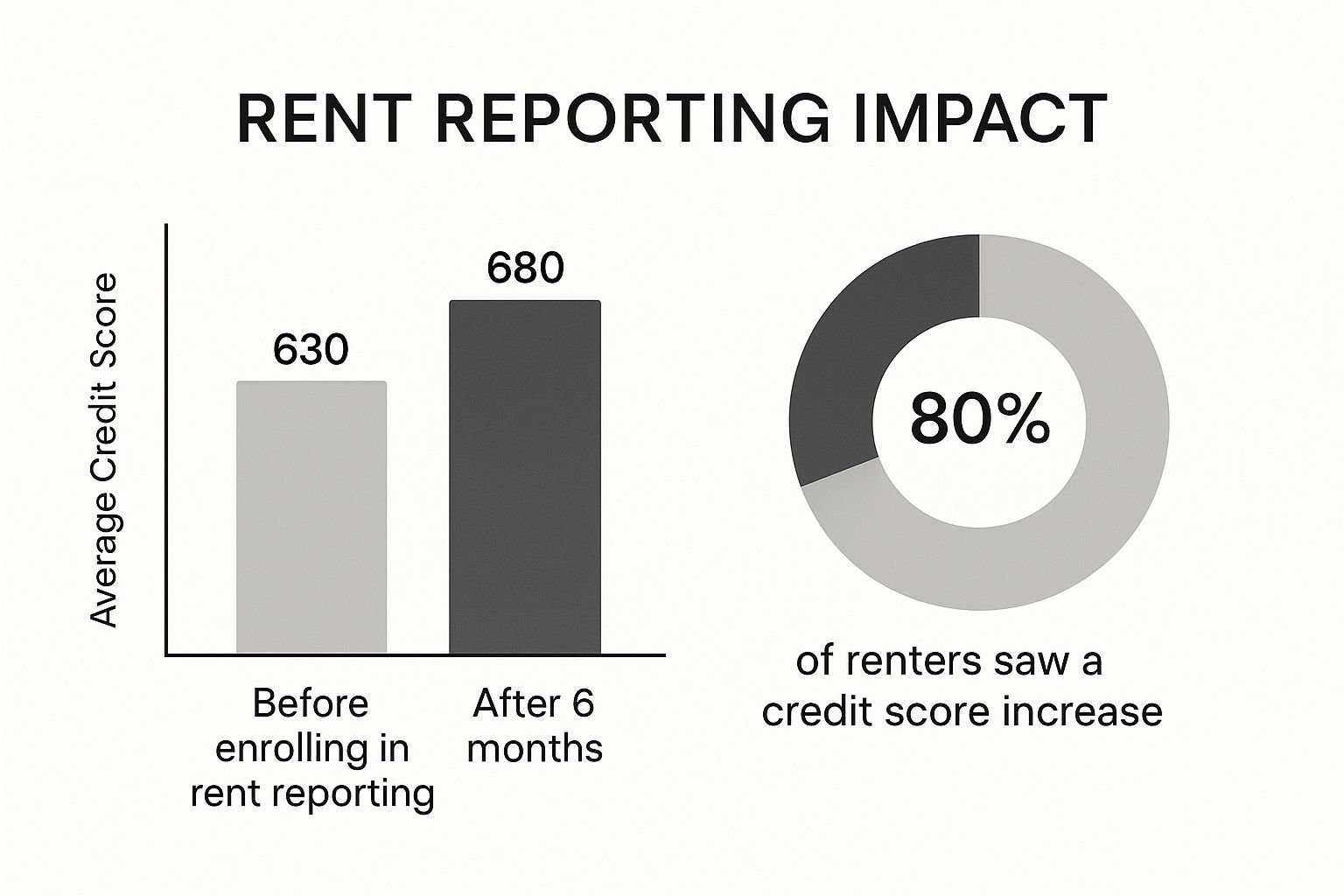

Picking the right rent reporting service can be a game-changer, but choosing the wrong one? That can feel like throwing money away. With so many options out there—from free to a significant monthly investment—it's easy to feel overwhelmed. This infographic really highlights the impact rent reporting can have. Take a look at the average credit score jump!

The data shows that 80% of renters see their credit score improve, with the average score going from 630 to 680 in just six months. That's a pretty compelling reason to explore rent reporting. Let me share some tips on how to choose a service that really works for you.

Key Factors to Consider

One of the biggest things to look at is which credit bureaus the service reports to. You want a service that reports to all three major bureaus: Experian, Equifax, and TransUnion. This gives you the best coverage and helps you build credit with rent payments across the board. Landlord participation is another important factor. Some services need your landlord’s okay, while others let you report independently. If your landlord isn't keen, find a service that lets you take the reins. You might also find this helpful: Check out our guide on checking your credit score with an ITIN.

Don't just look at the sticker price; dig a little deeper and watch out for hidden fees. Some services charge for setup, reporting past rental payments, or even canceling the service. Nobody likes surprises, right? Finally, the setup process should be easy. A complicated setup can be a real headache. Look for a service with a user-friendly interface and straightforward instructions.

To help you compare, I've put together a table summarizing the key features of some popular rent reporting services:

Popular Rent Reporting Services Comparison

This table compares major rent reporting services, focusing on costs, credit bureau reporting, landlord requirements, and setup time. It's a good starting point for your research.

(Please note: The data in this table is for illustrative purposes only. Be sure to check the latest information on the respective service websites.)

Looking at the table above, you can start to see the differences between services. Some are more expensive but report to all three credit bureaus, while others are cheaper but might require landlord participation. Weighing these pros and cons will help you find the perfect fit. Choosing the right rent reporting service is the first step to making your rent payments work for you by building your credit history.

Getting Your Landlord On Board Without Awkwardness

Chatting with your landlord about reporting your rent payments to the credit bureaus doesn't have to be a stressful event. Instead of thinking of it as asking for a special favor, try presenting it as a mutually beneficial arrangement. Most landlords are more than happy to lend a hand to responsible tenants, especially if it's easy for them. It’s really all in how you approach the conversation.

Start by focusing on what's in it for them. Highlight how rent reporting can lead to more on-time rent payments and lower tenant turnover. For example, explain how it can streamline their accounting and provide useful insights into tenant payment patterns. These are concrete benefits that landlords appreciate. You can also point them to our helpful guide on banks that accept ITINs.

It's interesting to note that reporting rent payments is becoming increasingly common among property managers. There's been a 37% jump in adoption just in the last year, with nearly half of those reporting having started in 2022, often using services like TransUnion's TruVision Resident Credit. Why the sudden surge? 86% of property managers say they do it to help their residents build credit. Check out more details on this trend.

What if your landlord is hesitant at first? Address their concerns head-on. Walk them through the simple setup process and reassure them it won't add to their workload. If they're still not on board, you have other options. Consider exploring alternative services that don't require landlord participation. You’ve got choices that put you in the driver’s seat of building your credit. Ultimately, building credit with your rent payments strengthens your financial profile, which can make you an even more attractive tenant down the line.

Setting Up Your Rent Reporting The Smart Way

So, you’ve decided on a rent reporting service and maybe even convinced your landlord to participate. Awesome! Now for the really important part: setting it all up correctly. Believe me, nothing’s worse than thinking your rent is being dutifully reported, only to discover months down the line that it hasn’t been. Let’s avoid that unpleasant surprise, okay?

This screenshot shows a sample Experian credit report. See how it lays out your payment history and accounts? Getting your rent payments included here, along with your other financial activity, gives lenders a more complete picture of your financial responsibility. This is especially helpful if you’re new to credit or building credit with an ITIN.

First things first: gather your paperwork. You’ll probably need your lease, proof of address, and bank statements. Having these ready will streamline the application process. Then, double-check every single detail you enter. Even a small typo in your address or account number can cause major delays. I had a friend whose application was stalled for weeks because of a wrong apartment number – talk about frustrating!

Make sure you understand how your chosen service reports payments. Some link directly to your bank account, while others need you to manually enter the information. If it’s manual, set reminders! Building credit with rent takes consistent reporting. After a month or two, check that your payments are showing up on your credit reports. You can often get a free report through the reporting service itself, or from one of the credit bureaus.

If you run into any problems, contact the service’s customer support. In my experience, they're usually pretty good at sorting things out quickly. A bit of proactive checking now can prevent a lot of hassle later on.

Maximizing Your Credit Impact Beyond Just Rent

Rent reporting is a fantastic foundation, especially with an ITIN, but it's not the whole story. Think of it like planting a tree – it’s a great start, but adding fertilizer and regular watering helps it thrive. Your credit is similar!

Rent reporting alone is good, but combining it with other strategies is where the magic happens. Think of it as layering different approaches to build a solid credit profile.

Supercharge Your Credit with Secured Cards

One powerful combo is pairing rent reporting with a secured credit card. These cards require a deposit that acts as your credit limit. Use it responsibly, pay it off in full each month, and watch your credit score grow. You’re building positive payment history and improving your credit utilization ratio—a major factor in your overall score. For a deeper dive into understanding your ITIN credit report, check out our guide: Learn more in our article about your ITIN credit report.

Become an Authorized User for a Credit Boost

Another option? Becoming an authorized user on a trusted friend or family member’s credit card. Their good credit habits can give your score a nice lift – I’ve seen boosts of 50-100 points! This can open up better financial opportunities down the road. However, be cautious: their negative habits can also affect you. Choose your authorized user relationship wisely!

Build Credit with Credit-Builder Loans

Credit-builder loans are another great tool. These loans are designed specifically for building credit. You make regular payments, which are reported to the credit bureaus, further strengthening your payment history. Combining this with rent reporting creates a powerful synergy, adding another layer of positive payment data to your credit report.

To give you a clearer picture of how these strategies can impact your credit over time, take a look at this table:

Credit Building Timeline and Expected Results Timeline showing expected credit score improvements when combining rent reporting with other credit building strategies

Note: These are estimated results and individual outcomes can vary.

This table illustrates how combining strategies can accelerate your credit-building journey. While rent reporting provides a solid base, incorporating secured cards, authorized user status, and credit-builder loans can significantly amplify your progress. The key is consistency and responsible credit management.

Troubleshooting Common Rent Reporting Issues

Okay, so even if you've got your rent reporting set up perfectly, things can still occasionally go wrong. Knowing how to handle these hiccups can keep your credit-building on track. Life gets in the way sometimes, right? We get busy, and things don't always go as planned. But a few little bumps shouldn't derail your credit journey.

One common problem is payments mysteriously disappearing from your credit report. If your rent payments aren't showing up, the first thing to do is double-check your account with the reporting service. Is all your payment information correct and current? If so, reach out to their customer support. In my experience, they're usually pretty good at helping track down missing payments. It's also a really good idea to keep detailed records of your rent payments, just in case. Think digital copies of checks, bank transfer confirmations—anything that proves you paid.

Another frustrating issue is inaccurate reporting. Imagine if your on-time payment was accidentally marked as late! That could really hurt your credit score. If you spot a mistake, contact both the reporting service and the credit bureau (Experian, Equifax, or TransUnion) right away. Document everything carefully and keep copies of every email or letter. Think of it as building a case file. The more organized you are, the smoother the process will be. And it’s worth mentioning, most renters want their on-time payments recognized. A Fannie Mae poll actually found that over 80% of renters want rent payments included in credit scores. Discover more insights into renter perspectives on credit.

Finally, what about when you move? You want to make sure your rent reporting continues without interruption at your new place. Contact your reporting service before you move to update your info and avoid gaps in your reporting history. Being proactive like this will ensure you're consistently building credit even during big life changes.

Your Personalized Credit Building Action Plan

Okay, so you've got the lowdown on building credit with rent payments. Now, let's map out a plan specifically for you. Forget one-size-fits-all; this is about creating a roadmap that works with your situation and goals.

Your Credit-Building Roadmap

First things first, take a good look at where your credit stands right now. Do you already have a credit score, or are we starting from the ground up? This is your baseline, and knowing this helps figure out the best strategies. If you're not sure where to even begin, we've got a guide on banks that work with ITINs—it can be really helpful for accessing financial services: Learn more about ITIN-friendly banks. And remember, building credit with an ITIN is totally doable with the right approach.

Next up, pick a rent reporting service that works for your budget and what you need. Think about things like which credit bureaus they report to, what your landlord needs to do, and any fees involved. Do your homework and choose the service that just fits. Building credit with rent is a marathon, not a sprint, so consistency is the name of the game.

Once you've picked a service, set it up carefully. Seriously, double-check everything to avoid headaches later. It's like setting up a new streaming account—you want it to work perfectly from the get-go! Then, keep an eye on your credit reports. Make sure your rent payments show up correctly. This way, you can catch any problems early and keep the momentum going.

Beyond Rent: A Holistic Approach

Rent reporting is great, but don't stop there. Think about other ways to build credit, like secured credit cards or becoming an authorized user on someone else's card. These can give your credit score an extra boost and open up more financial doors. Small, consistent actions make a big difference over time.

Finally, give yourself a pat on the back! Building credit takes work, so celebrate your wins along the way. This is about building a solid financial future, one step at a time.

Ready to take charge of your credit? itin score can help. We're the first credit-building platform built just for U.S. ITIN holders. We empower you to build and track your credit history safely and affordably. Sign up for free today and start building your financial future: https://www.itinscore.com