The Best Way to Rebuild Credit and Boost Your Score

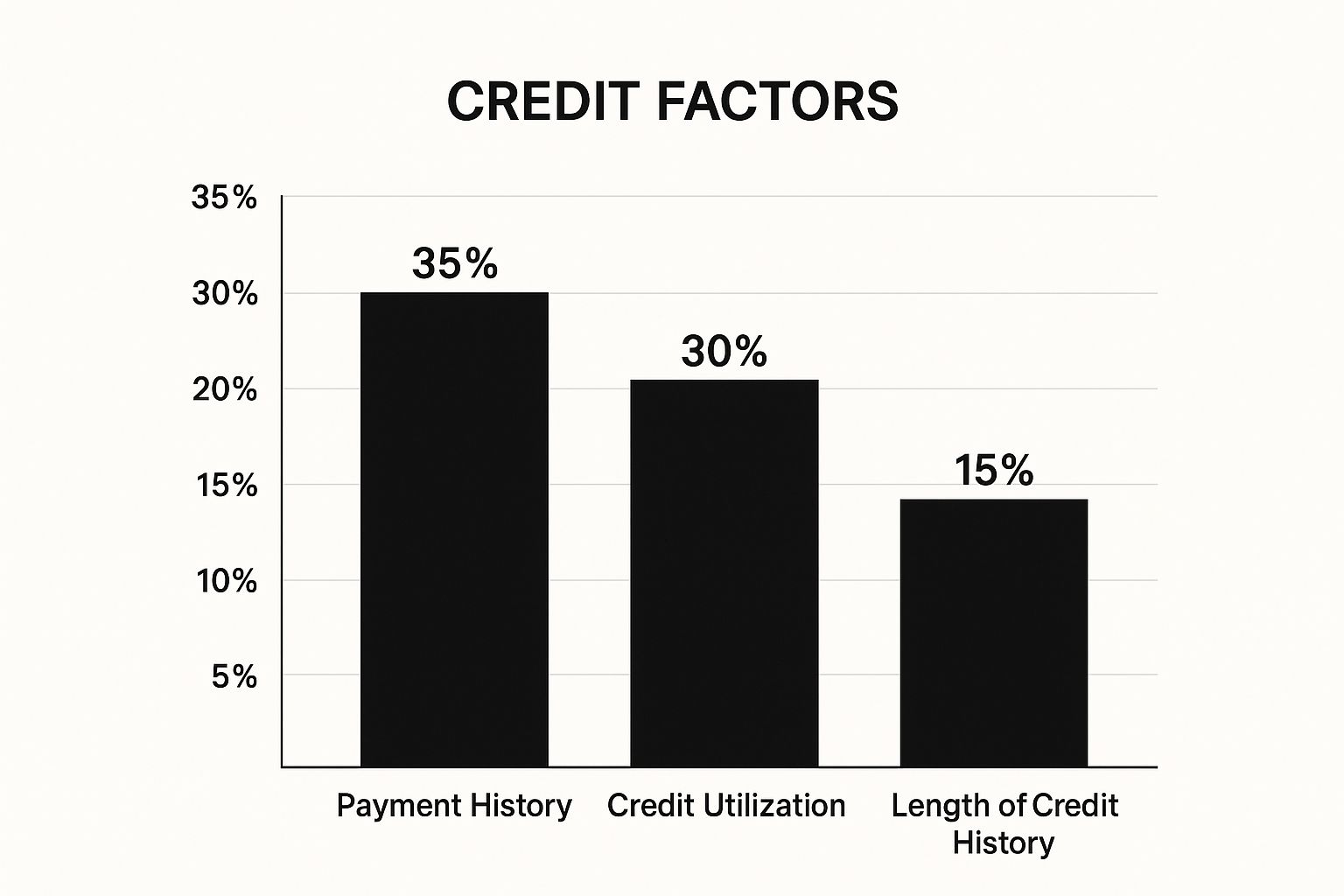

If you want to rebuild your credit, it really boils down to two core habits: always paying your bills on time and keeping your credit card balances as low as possible. Master these two, and you’re already ahead of the game, since they directly impact your payment history and credit utilization—two factors that make up a whopping 65% of your FICO score.

Your Realistic Starting Point for Credit Recovery

Before you can map out a successful comeback, you have to know exactly where you stand. Guesswork won't get you far. The real work begins with a deep dive into your credit files, which hold the story of your financial past and all the clues you need for a better future.

Your first move? Get your hands on your credit reports from all three major bureaus: Experian, Equifax, and TransUnion. You can get them for free every single week at the official government-backed site, AnnualCreditReport.com. Don't just pull one—lenders don't always report to all three, so each report might have slightly different information.

Pinpointing the Problem Areas

With your reports in front of you, it's time to play detective. You're searching for any negative items that are pulling your score down. This is the moment you stop feeling overwhelmed by a bad score and start feeling empowered, because now you can see exactly what needs fixing.

Here’s a checklist of what to hunt for:

Creating a Clear Path Forward

This initial review is the bedrock of your entire credit-rebuilding strategy. It gives you the clarity to decide what to tackle first. For example, maybe you'll discover that your debt is scattered across several high-interest cards, making it a nightmare to keep up with payments.

As you get a handle on your situation, looking into effective debt consolidation strategies could be a game-changer, helping you streamline everything into a single, more manageable payment. With this kind of detailed insight, you're no longer just wishing for a better score—you're strategically building one.

Lower Your Credit Utilization for a Quick Win

If you’re looking for the fastest way to give your credit score a boost, look no further than your credit utilization ratio. This is one of the most powerful levers you can pull.

Simply put, it’s the percentage of your available credit that you're currently using. Lenders see high utilization as a sign of financial strain—that you might be over-extended. That’s why bringing down your balances can have such a quick and positive impact.

Imagine you have a credit card with a 5,000** limit and a **4,000 balance. Your utilization on that card is a staggering 80%. Even if you're a champ at making on-time payments, that high ratio is a major red flag for credit scoring models.

As you can see, amounts owed—your credit utilization—accounts for a massive 30% of your FICO score. It's second only to your payment history. This means any effort you put into lowering it pays off, often in a matter of weeks.

How Your Credit Utilization Impacts Your Score

To give you a clearer picture, let's look at how lenders typically view different utilization levels. The lower your ratio, the less risky you appear.

Keeping your balances low signals that you aren't reliant on debt to manage your finances, which is exactly what creditors want to see.

Smart Strategies for Reducing Your Balances

Your main target should be to get your overall utilization below 30%. If you can get it under 10%, you’ll see an even more dramatic improvement.

So, how do you get there? Two of the most effective strategies are the "snowball" and "avalanche" methods.

Neither method is "better"—it's about what works for you. Pick the one that aligns with your personality and stick with it.

If you want to dig deeper into the numbers, we have a complete guide on how to calculate credit utilization.

Mastering Consistent On-Time Payments

If you think of your credit score as a building, your payment history is the foundation. It’s not just important; it's everything. This single factor makes up a massive 35% of your FICO score, making it the most critical piece of the credit puzzle.

The absolute golden rule for rebuilding credit is simple: pay every bill on time, every single time. There are no shortcuts around this.

Even one late payment can cause a significant dip in your score and will haunt your credit report for up to seven years. That damage isn't just an abstract number—it translates into very real consequences like higher interest rates and denied loan applications. Getting a clear picture of just how much late payments affect your credit score can be a powerful motivator to make timeliness a top priority.

This isn’t just a principle in the U.S.; it's a global standard for financial health. Lenders everywhere look at delinquency rates—the percentage of loans that are 90 days or more past due—to gauge risk. Recent 2024 data from global credit insights from Equifax shows that markets with low delinquency rates, like the United Kingdom, tend to have stronger economies. It’s proof that paying on time is a universally recognized strategy for building financial stability.

Building a Bulletproof Payment System

Forgetting a due date is a simple mistake, but it's an incredibly expensive one when you're rebuilding credit. The best strategy is to build a system that makes it almost impossible to miss a payment. Let technology do the heavy lifting for you.

When You Know a Payment Will Be Late

Life happens. Sometimes, despite your best efforts, you might see a due date approaching that you simply can't meet. The absolute worst thing you can do in this situation is ignore it.

Be proactive. Pick up the phone and call your lender before the due date passes. Calmly and honestly explain what's going on. You might be surprised by their willingness to help. Lenders often have options like a temporary hardship plan, waiving a late fee, or even agreeing not to report the missed payment to the credit bureaus.

This is especially true if you have an otherwise good payment history with them. Taking the initiative shows you're responsible and can go a long way in preserving both your relationship with the lender and your credit profile.

Putting New Credit to Work for You

It sounds counterintuitive, I know. Why would you open new credit accounts when you're trying to recover from past credit trouble? But here's the thing: strategically adding a new, well-managed account is one of the fastest ways to prove you’re now a responsible borrower.

This isn't about going on a spending spree. It’s a calculated move. You're giving the credit bureaus fresh, positive payment data to look at. Think of it as burying old mistakes with a new track record of on-time payments. Done right, this shows lenders that your past financial struggles don't define your present.

Start with a Secured Credit Card

For most people rebuilding their credit, a secured credit card is the absolute best place to start. It’s a game-changer. Unlike a regular credit card, you put down a small, refundable cash deposit—usually somewhere between 200** and **500. That deposit becomes your credit limit.

From the lender's perspective, this makes you a no-risk customer, which is why they are so much easier to get approved for. You use the card for small, everyday purchases (like gas or a streaming subscription), pay the bill in full and on time every month, and that positive activity gets reported to the credit bureaus. It's the most direct way to start generating the good history you need.

Look Into a Credit-Builder Loan

Here's another great tool that a lot of people overlook: the credit-builder loan. It works kind of like a loan in reverse. You don't get a lump sum of cash upfront. Instead, you make small monthly payments into a locked savings account held by the lender.

Once you’ve made all the payments—the term is typically between 6 and 24 months—the full amount is released to you. Every single one of those on-time payments gets reported to the credit bureaus. This is fantastic because it adds a positive installment loan to your credit mix, which can give your score a nice little boost.

Become an Authorized User (With Caution)

If you have a parent, spouse, or close friend with a stellar credit history, ask them about becoming an authorized user on one of their long-standing credit cards. This can be a powerful shortcut.

When they add you, the entire history of that account—its age, its high credit limit, and its perfect payment record—can suddenly appear on your credit report. This can instantly improve key factors like the average age of your accounts and your credit utilization.

But this strategy comes with a huge warning label. If the main cardholder ever maxes out the card or misses a payment, that negative mark will hit your credit report, too. Only do this with someone you have absolute trust in.

This tactic is particularly effective if you have a "thin file," meaning you don't have much credit history to begin with. We see this a lot with younger people. In fact, research shows that around 30% of young borrowers with thin files jump up to higher credit tiers by using smart strategies like this one. You can actually discover more about how young consumers are improving their scores on Fortune.com. By adding new, positive accounts, they're proving their creditworthiness much faster than just waiting.

Long-Term Habits for Maintaining Your New Score

Getting your credit score back on track is a huge win, but the real challenge is keeping it there. The journey isn't over once you hit your goal number. Now it’s all about shifting from a repair mindset to a maintenance mindset, making those good habits stick for good.

This means the fundamentals—like always paying your bills on time and keeping your credit card balances low—become permanent fixtures in your financial life. But a couple of other long-term strategies are just as important for protecting all the progress you've made.

Don't Close Your Oldest Accounts

It’s a common temptation: you finally pay off an old credit card and your first instinct is to close it and be done with it. You have to fight that urge. The length of your credit history is a surprisingly hefty factor in your score, accounting for about 15% of your FICO score.

Closing that old account can backfire in two ways:

A much smarter move is to keep the account open. Just use it for a tiny, recurring purchase every few months—like a coffee or a streaming subscription—to keep it active. Then, of course, pay it off immediately.

Become a Vigilant Credit Monitor

You've put in the hard work, and now it's time to protect your score from errors, inaccuracies, and even fraud. Getting into the habit of regularly checking your credit reports is non-negotiable.

I recommend setting a recurring reminder on your calendar to pull your free reports from all three bureaus at least a few times a year. You’re scanning for anything that looks off, like:

Catching these discrepancies early means you can file a dispute right away before they can do any real damage. This proactive habit is also your best defense against identity theft. The sooner you spot something fishy, the faster and easier it is to shut it down.

By making these habits part of your routine, you’re not just rebuilding credit—you’re building a foundation for lasting financial health.

Got Questions About Rebuilding Credit? We've Got Answers

Starting the journey to rebuild your credit can feel a little overwhelming, and it's totally normal to have questions. Let's tackle some of the most common ones I hear from people who are trying to figure out the best path forward.

How Long Does It Realistically Take to Rebuild Credit?

This is probably the number one question on everyone's mind, but the honest answer is: it depends entirely on where you're starting from. There’s no magic number.

If a couple of late payments are the only things holding you back, you could see a real difference in just three to six months by making consistent, smart moves.

On the other hand, if you're dealing with bigger challenges like a bankruptcy or accounts that have gone to collections, you need to be more patient. Think more in the range of 12 to 24 months, or sometimes even longer. Negative marks can hang around for up to seven years, but the good news is their sting lessens over time, especially as you pile on new, positive payment history.

If I Pay Off a Collection, Does It Disappear from My Report?

This is a huge point of confusion for many people. While paying off a collection account is absolutely the right thing to do, it won't make the account vanish from your credit report. That collection will stay on your report for seven years from the date the original account first became delinquent.

So, why bother paying it? Because the status of the account changes. It will be updated to show a $0 balance, which is a world of difference to a lender. An unpaid collection is a massive red flag, but a paid one tells them you made things right, even if it took some time.

Is It a Good Idea to Close Old Credit Cards I'm Not Using?

I know it’s tempting to close that dusty old credit card once you’ve paid it off, but my advice is almost always to leave it open. Shutting it down can actually damage your score in a couple of significant ways.

A much better approach? Use the card for a tiny, regular purchase—like a coffee or a subscription—every few months and pay it off right away. This keeps the account active and working in your favor. For a deeper dive, check out our complete guide on how to rebuild credit.