12 Best Secured Cards for Building Credit in 2025

Building a strong credit history is a crucial step toward financial freedom, unlocking better interest rates and opportunities. For those starting from scratch, recovering from past financial mistakes, or new to the U.S. financial system, secured credit cards are one of the most effective tools available. Unlike traditional unsecured cards, they require a refundable security deposit that typically sets your credit limit. This deposit reduces the lender's risk and makes these cards accessible to a wider range of applicants, including those with Individual Taxpayer Identification Numbers (ITINs).

This guide cuts through the noise to provide a detailed analysis of the best secured cards for building credit. We'll focus on the features that matter most: which credit bureaus they report to, annual fees, deposit requirements, and potential pathways to an unsecured card. While secured cards are excellent for establishing credit, some individuals also explore personal loans for bad credit as part of their financial recovery strategy.

Our goal is to help you find the right card for your specific needs. Each review will dive into the pros and cons, highlight unique benefits like rewards programs, and clarify eligibility, especially for ITIN holders. We provide a straightforward comparison to help you choose wisely and begin building a positive credit history from the ground up.

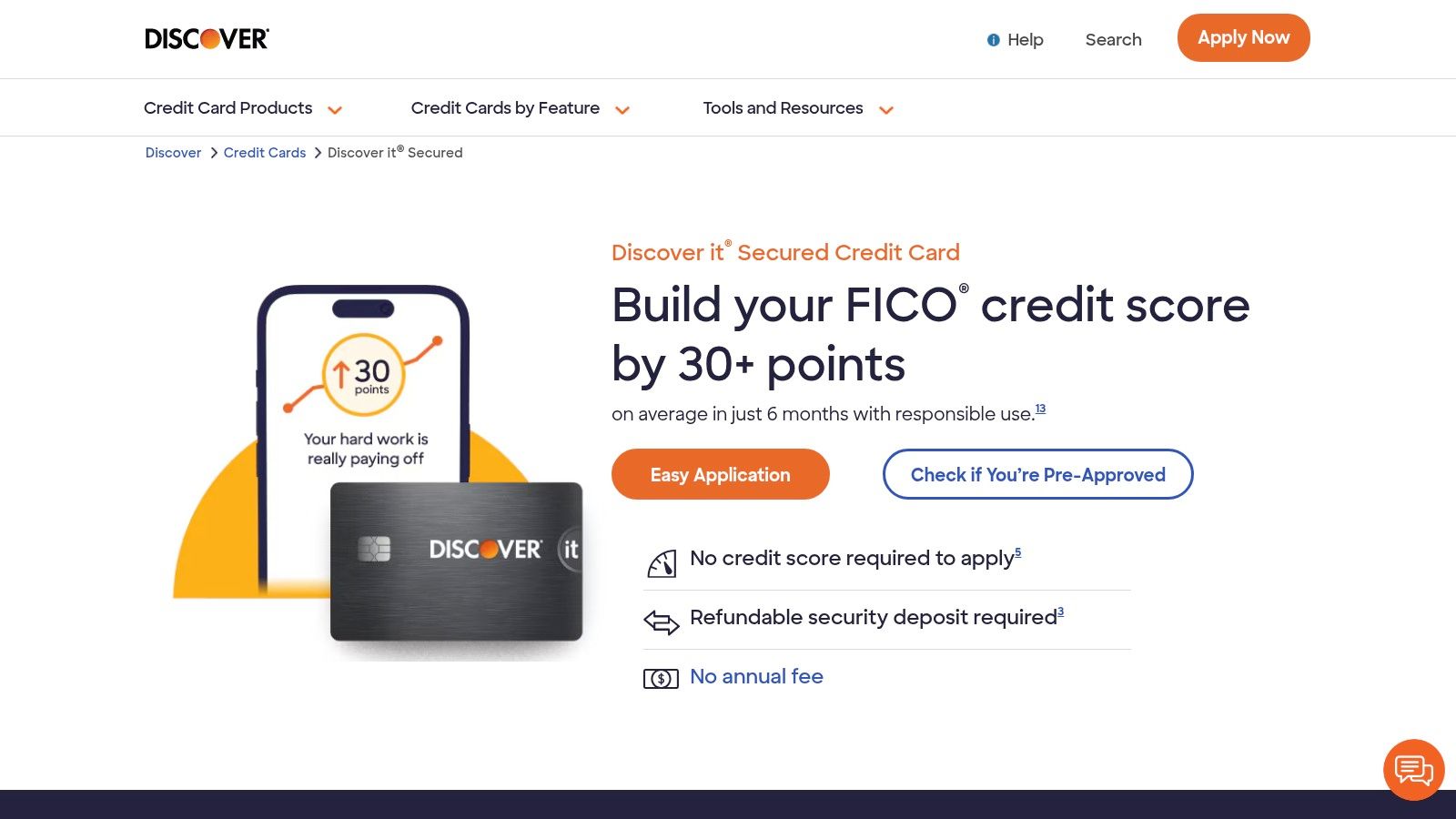

1. Discover it Secured Credit Card

The Discover it Secured Credit Card stands out as one of the best secured cards for building credit due to its rare combination of rewards and a clear path to an unsecured card. It's a top choice for individuals who want their credit-building efforts to earn them cash back, a feature uncommon in the secured card market. You secure your credit line, from 200 to 2,500, with an equivalent refundable deposit.

This card reports your payment history to all three major credit bureaus (Equifax, Experian, and TransUnion), which is crucial for establishing a solid credit profile. One of its most significant advantages is the automatic review process. Discover starts reviewing your account at seven months to see if you're eligible to graduate to an unsecured card and have your deposit returned. For those new to this financial tool, it's helpful to understand the fundamentals of a secured card. You can explore a detailed explanation of what a secured card is and how it works to better grasp the benefits.

Key Features and User Experience

Website: https://www.discover.com/credit-cards/secured/

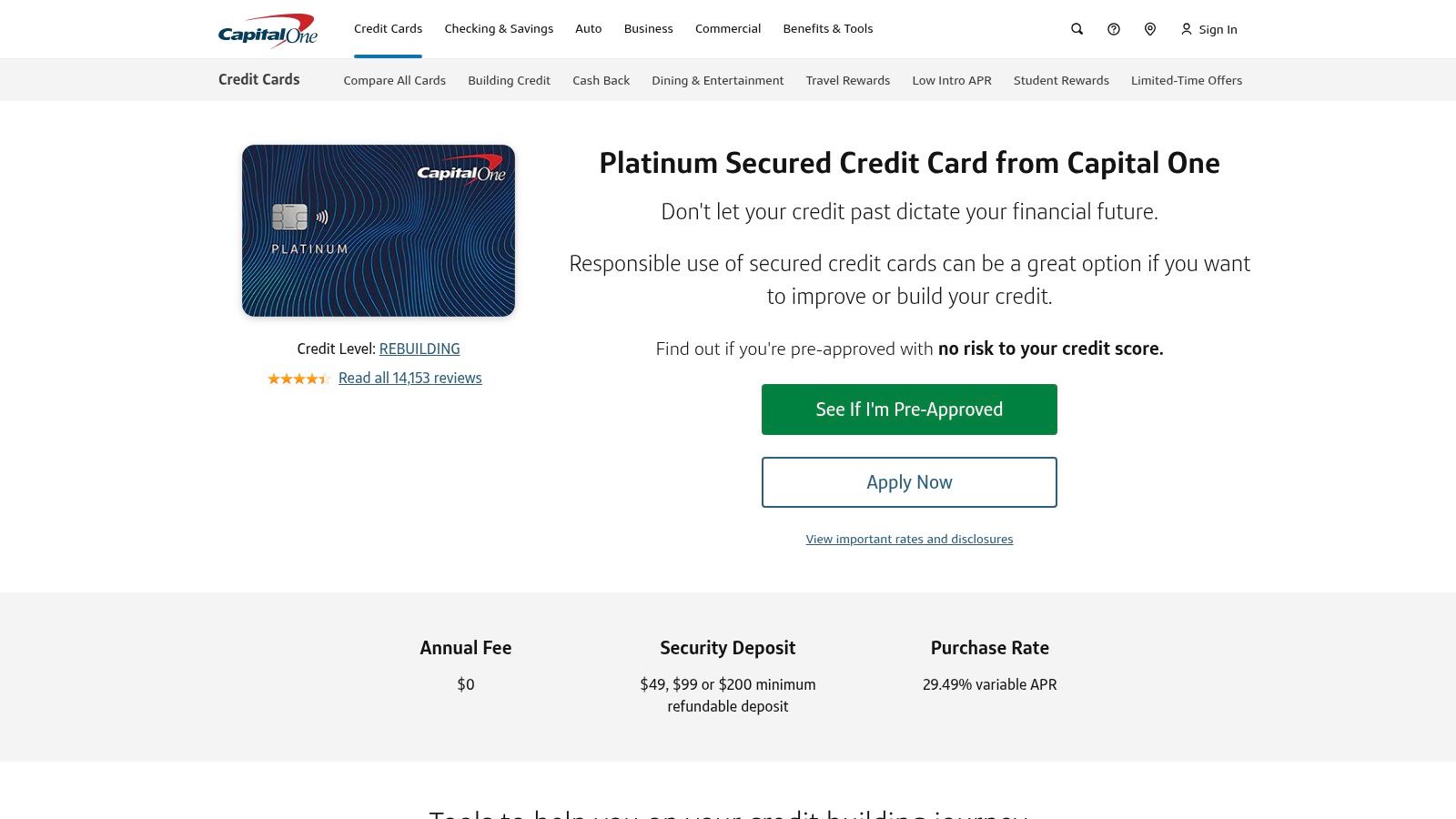

2. Capital One Platinum Secured Credit Card

The Capital One Platinum Secured Credit Card is a leading choice among the best secured cards for building credit, particularly for those concerned about high upfront costs. Its standout feature is the potential for a lower security deposit. Depending on your creditworthiness, you could secure a 200 credit line with a refundable deposit of just 49, 99, or 200, making it more accessible than many competitors that require a dollar-for-dollar match.

This card is a powerful tool for credit building because Capital One reports your payment activity to all three major credit bureaus. A significant advantage is the early opportunity for a credit line increase. Your account is automatically reviewed in as little as six months, potentially boosting your credit limit without an additional deposit. The well-regarded Capital One mobile app also provides a seamless user experience for managing your account, tracking spending, and monitoring your credit score.

Key Features and User Experience

Website: https://www.capitalone.com/credit-cards/platinum-secured/

3. Citi Secured Mastercard

The Citi Secured Mastercard is a straightforward and reliable choice from one of the largest banks in the U.S., making it an excellent tool for those focused purely on building credit. It’s designed for individuals with limited or no credit history who want a simple, no-frills card to establish responsible payment habits. You secure your credit line with a refundable security deposit, starting from a minimum of $200.

As a major card issuer, Citi reports your account activity to all three major credit bureaus, which is essential for developing a strong credit profile. While the card lacks a rewards program or an automatic graduation review process like some competitors, its strength lies in its simplicity and the backing of a major financial institution. Using this card responsibly is a direct way to establish a solid credit history. This card is one of the best secured cards for building credit due to its accessibility and focus on the fundamentals.

Key Features and User Experience

Website: https://www.citi.com/credit-cards/understanding-credit-cards/what-is-a-secured-credit-card

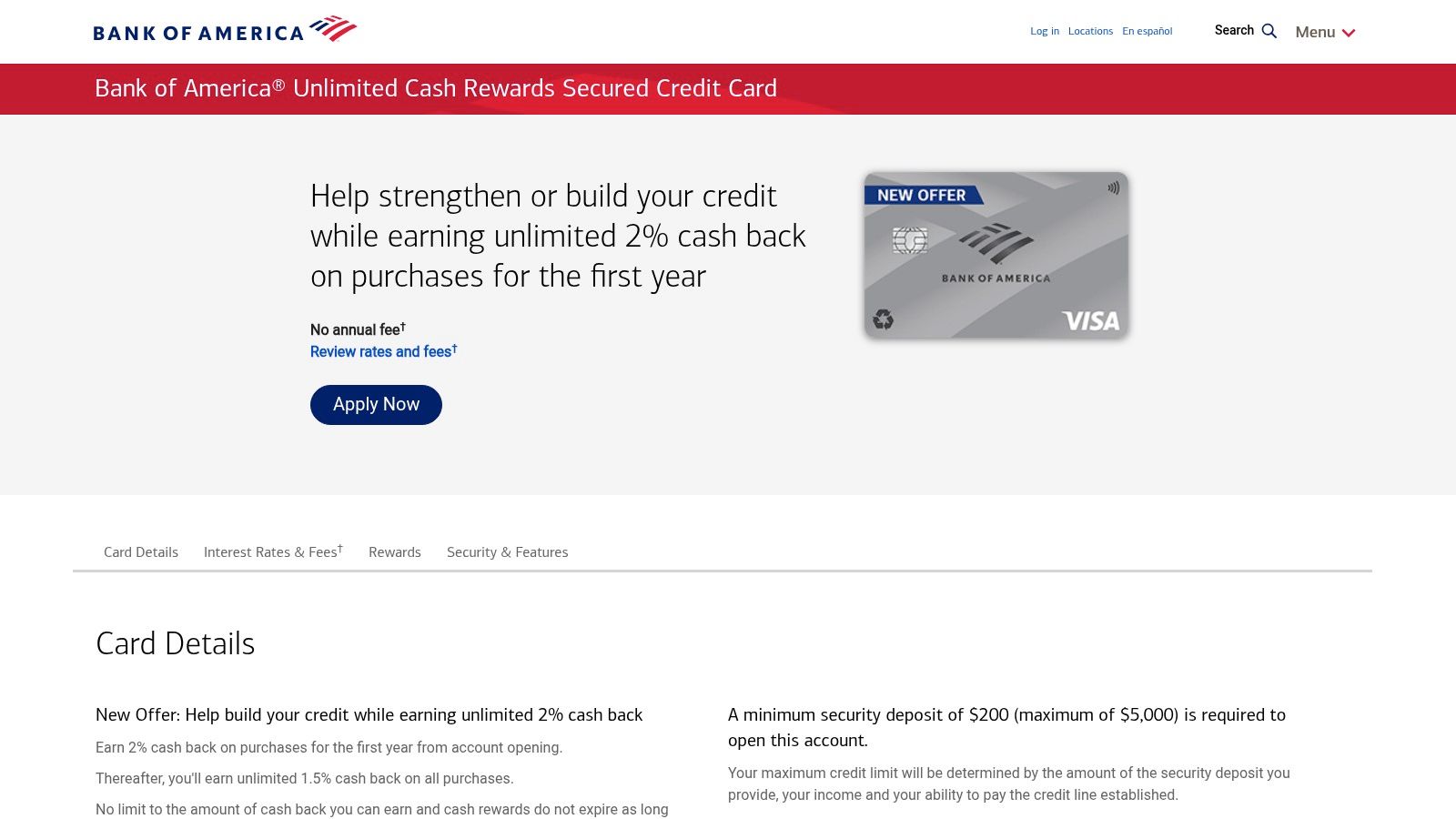

4. Bank of America Unlimited Cash Rewards Secured

The Bank of America Unlimited Cash Rewards Secured card is a strong contender for those wanting to build credit with a major financial institution. It offers a straightforward, flat-rate rewards program, making it an excellent choice for individuals who value simplicity and the stability of a large bank. You secure your credit line, ranging from 200 to 5,000, with an equivalent refundable security deposit, providing a clear path to establishing your financial footing.

This card reports to all three major credit bureaus, ensuring your responsible usage helps build a comprehensive credit history. What sets it apart is its integration with the Bank of America Preferred Rewards program. If you have qualifying balances with Bank of America or Merrill, you can earn a 25% to 75% rewards bonus, boosting your cash back rate significantly. Bank of America periodically reviews your account and overall credit history to determine if you are eligible to have your deposit returned.

Key Features and User Experience

Website: https://www.bankofamerica.com/credit-cards/products/unlimited-cash-back-secured-credit-card/

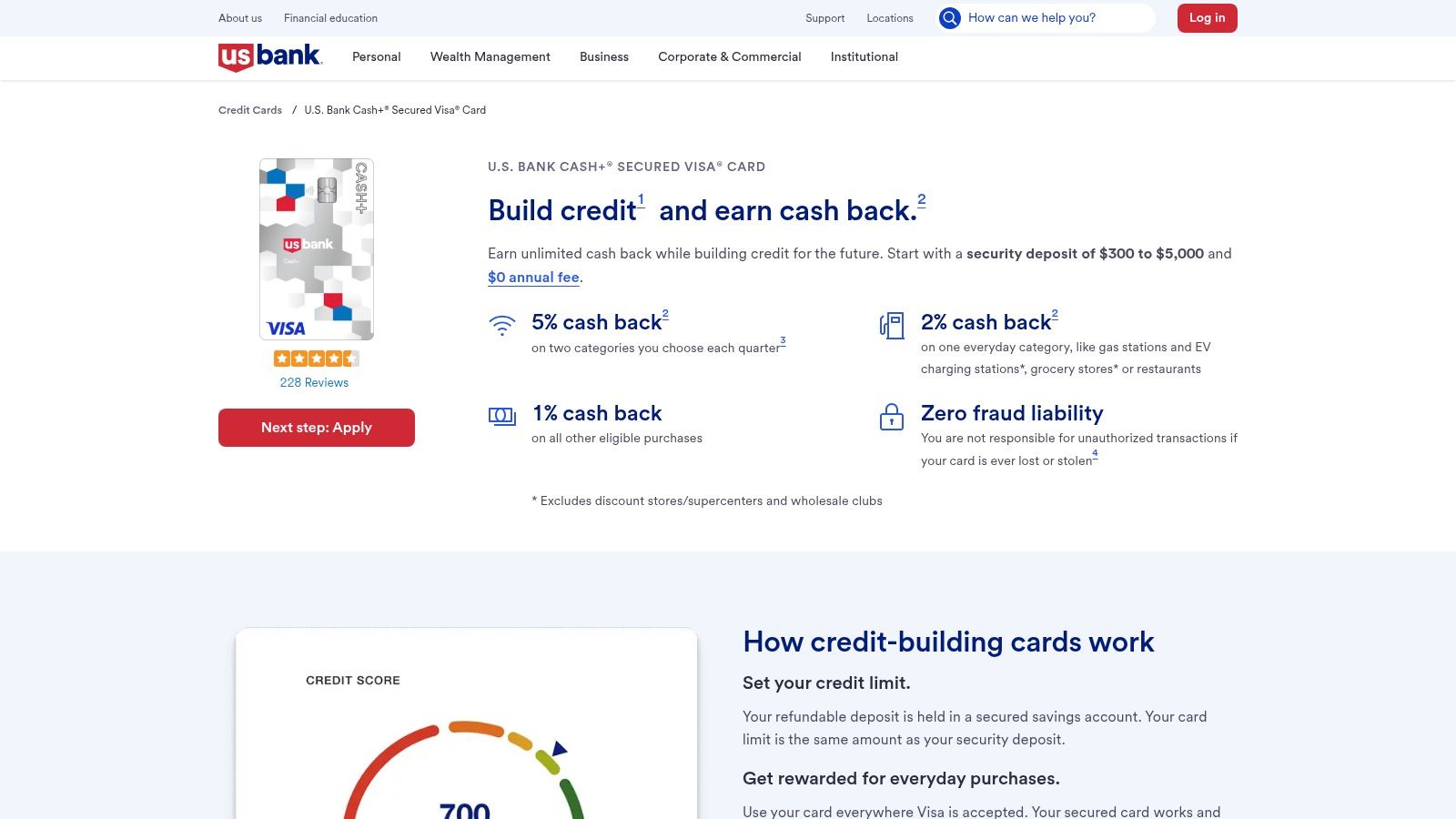

5. U.S. Bank Cash+ Secured Visa

The U.S. Bank Cash+ Secured Visa card is a powerhouse for individuals looking to maximize rewards while building their credit history. It stands out by offering a rewards structure that rivals many unsecured credit cards, making it an excellent choice for disciplined spenders who want their credit-building journey to be lucrative. You secure your credit line with a refundable deposit, which can range from 300 up to 5,000, determining your credit limit.

This card diligently reports your payment activity to the three major credit bureaus, which is fundamental for anyone serious about improving their credit score. U.S. Bank periodically reviews your account for potential graduation to an unsecured card, although the timeline is not as explicitly defined as some competitors. The main draw here is the ability to earn significant cash back in categories you actually use, a rare and valuable feature for a secured card.

Key Features and User Experience

Website: https://www.usbank.com/credit-cards/cash-plus-secured-visa-credit-card.html

6. OpenSky Secured Visa (Capital Bank, N.A.)

The OpenSky Secured Visa Credit Card from Capital Bank, N.A., carves out a unique niche as one of the best secured cards for building credit by eliminating a major barrier: the credit check. This makes it an invaluable tool for individuals with severely damaged credit, no credit history, or those who wish to avoid a hard inquiry on their report. Its accessibility extends to those without a traditional bank account, offering flexible options to fund the required security deposit.

This card is built for one primary purpose: to help users establish or rebuild their credit profile. It achieves this by reporting payment activity to all three major credit bureaus (Equifax, Experian, and TransUnion). While it lacks a rewards program or a reliable pathway to graduate to an unsecured card, its straightforward application and high approval odds make it a dependable starting point for many.

Key Features and User Experience

Website: https://www.openskycc.com/

7. Merrick Bank Classic Secured

The Merrick Bank Classic Secured card is a straightforward and reliable option for those focused purely on building or rebuilding their credit history. It offers a broad deposit range, giving users flexibility in setting their credit limit from 200 up to 3,000, which is determined by the amount of their refundable security deposit. This makes it an accessible tool for a wide variety of financial situations.

As one of the best secured cards for building credit, its primary function is consistent reporting to all three major credit bureaus (Equifax, Experian, and TransUnion). Merrick Bank also provides a valuable educational tool by offering free monthly access to your FICO Score. This allows you to track your progress and understand how your financial habits impact your credit score over time. While the card doesn't offer rewards, its core purpose is credit establishment, and it fulfills that role effectively.

Key Features and User Experience

Website: https://www.merrickbank.com/products/secured-card

8. First Progress Secured Mastercard (Synovus Bank)

The First Progress family of Secured Mastercards offers a unique approach for those looking to build credit, particularly individuals who may not have their full security deposit available upfront. Instead of one card, First Progress provides a few options with varying annual fees and APRs, allowing applicants to choose the structure that best fits their financial situation. You secure your credit line, from 200 to 2,000, with an equivalent deposit, which can be funded over time.

This flexibility is a key differentiator in the secured card market. Like other top contenders, it reports your payment activity to all three major credit bureaus (Equifax, Experian, and TransUnion), making it an effective tool for establishing or rebuilding your credit history. The choice between cards allows you to prioritize a lower annual fee or a lower interest rate, a trade-off that appeals to budget-conscious consumers seeking one of the best secured cards for building credit.

Key Features and User Experience

Website: https://firstprogress.com/

9. Self Secured Visa Credit Card (Self Financial)

The Self Secured Visa Credit Card offers a unique approach to building credit by eliminating the need for a large, upfront security deposit. Instead, this card is linked to a Self Credit Builder Account, which is essentially a small installment loan. Your payments into the Credit Builder Account build up savings that can then be used to secure your credit line, making it one of the best secured cards for building credit for those without immediate funds for a deposit.

This innovative model allows you to build credit in two ways simultaneously: through the installment loan (the Credit Builder Account) and through revolving credit (the secured card). Self reports your payments to all three major credit bureaus, which is essential for comprehensive credit history development. Once you have made three on-time monthly payments and have at least $100 in savings in your account, you become eligible to open the secured card. For a deeper look into this model, you can learn more about how different credit builder products work.