Top 12 Credit Monitoring Apps for 2025 | Best Credit Monitoring Apps

Keeping your credit score healthy is crucial for your financial life, but it can be especially challenging for ITIN holders. Traditional financial tools often overlook the unique needs of those without a Social Security Number, creating unnecessary hurdles to accessing loans, housing, and other essential services. That's why choosing from the best credit monitoring apps is not just a convenience, it's a critical step toward financial stability and inclusion. This guide cuts through the noise to deliver a definitive, ranked list of top-tier services available today.

We've done the heavy lifting, analyzing each platform's features, pricing, and real-world usability. Our focus remains on a key question: which apps best serve the 5.8 million ITIN holders in the U.S. who are actively building their financial future? For every app reviewed, you will find direct links, screenshots, and an honest assessment of its strengths and weaknesses, helping you avoid tools that don't meet your specific needs. By the end of this resource, you will have a clear, actionable roadmap to selecting the perfect tool to build, monitor, and protect your credit with confidence.

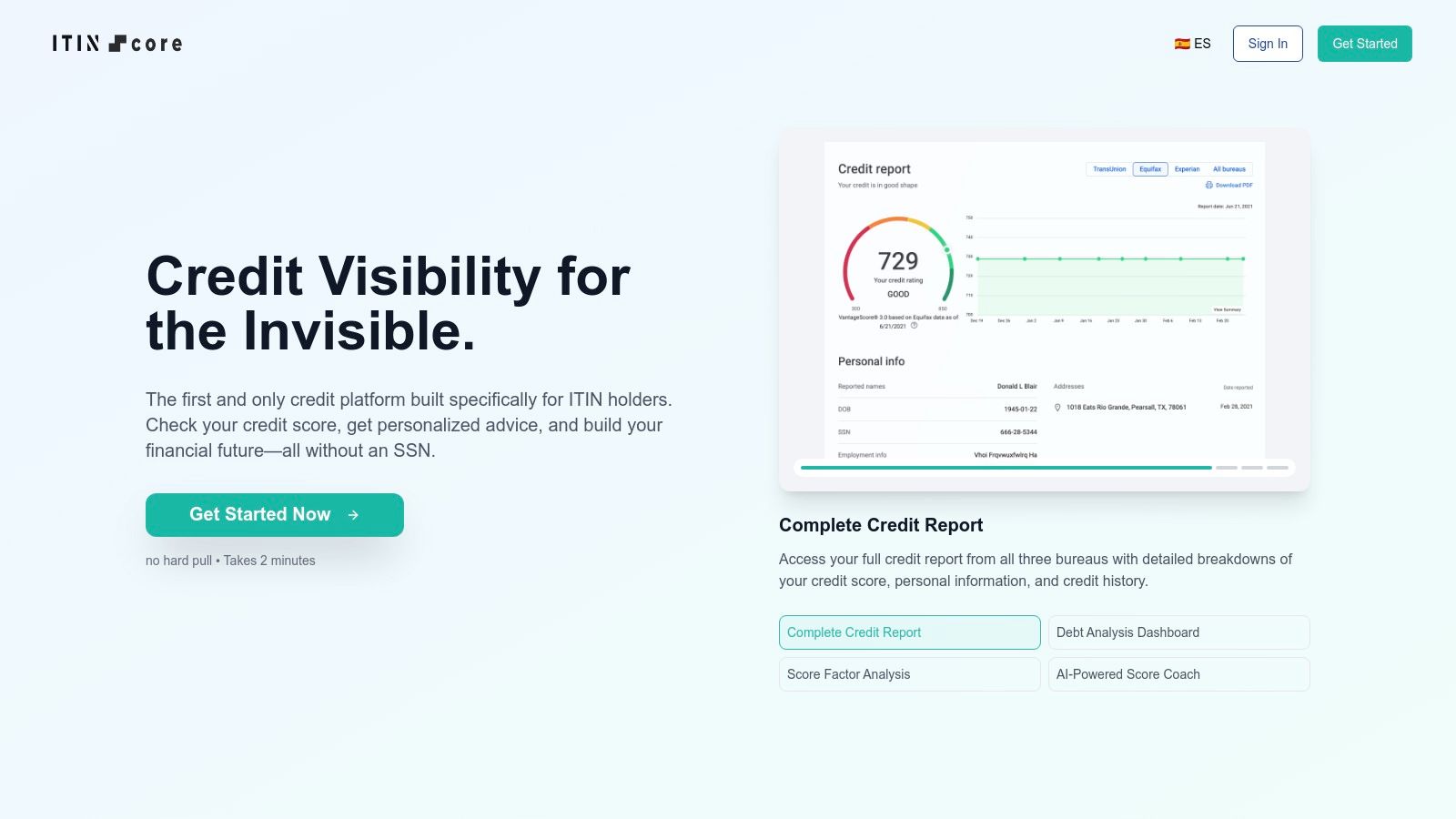

1. itin score

Best For | U.S. ITIN Holders Building Credit from Scratch Pricing | Completely Free

itin score addresses a significant and often overlooked gap in the financial market, establishing itself as a premier credit-building and monitoring platform designed exclusively for individuals with an Individual Taxpayer Identification Number (ITIN). This makes it an indispensable tool for noncitizens, international students, and others without a Social Security Number who are looking to establish a U.S. credit history. The platform’s singular focus on the ITIN user experience sets it apart, providing a tailored pathway to financial inclusion that mainstream services often fail to offer.

The platform excels by combining free, unlimited credit monitoring with a proactive, educational approach. Its real-time dashboard provides daily updates, ensuring users can track their progress and spot potential issues immediately. This core feature transforms it from a passive reporting tool into an active financial management partner.

Standout Features and User Experience

What truly elevates itin score among the best credit monitoring apps is its AI-driven credit coach. This feature demystifies the credit-building process by delivering personalized, 24/7 guidance and actionable plans. It analyzes your specific credit profile to offer step-by-step advice on improving key factors like payment history and credit utilization.

The user interface is intuitive and accessible, catering to a diverse, often bilingual audience. Coupled with bank-level 256-bit SSL encryption, the platform provides a secure environment for sensitive financial data.

Visit itin score

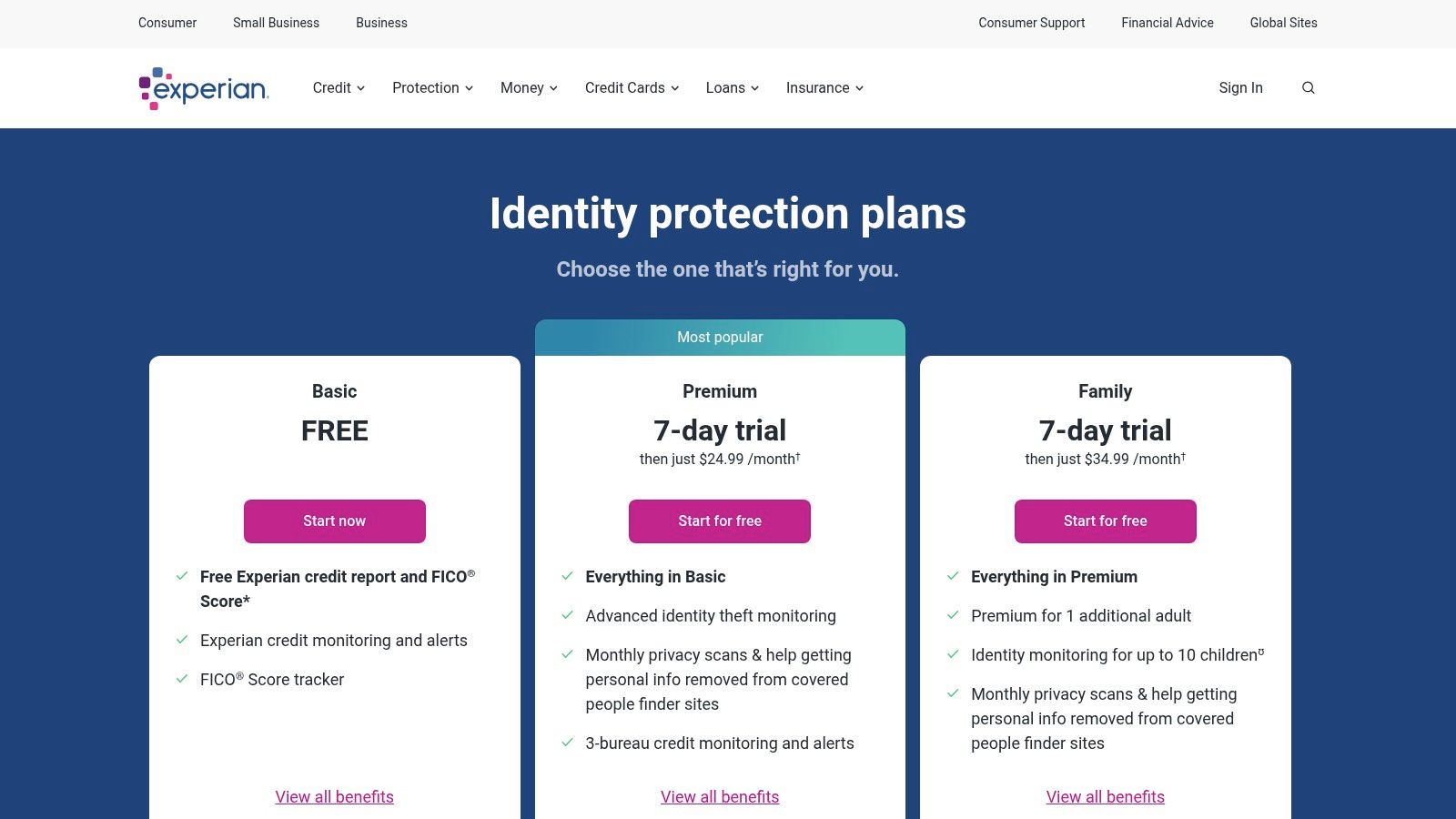

2. Experian IdentityWorks/CreditWorks

Experian, one of the three major credit bureaus, offers its own robust credit monitoring service directly to consumers through its IdentityWorks and CreditWorks platforms. This makes it one of the best credit monitoring apps for users who want data straight from the source, particularly the widely used FICO Score, which most lenders prefer. The platform is designed for direct interaction with your Experian credit file.

For ITIN holders, Experian’s direct service provides a clear path to monitor the credit history they are building. A standout feature is the Experian CreditLock, which allows you to instantly lock and unlock your Experian credit file, offering a powerful layer of security against identity fraud. While the free tier is limited to just Experian data, it’s a valuable starting point. The premium plans expand to include 3-bureau monitoring and reports, though be aware that monitoring for TransUnion and Equifax can take a few days to activate.

Key Features & User Experience

Website: https://www.experian.com/protection/compare-identity-theft-products/

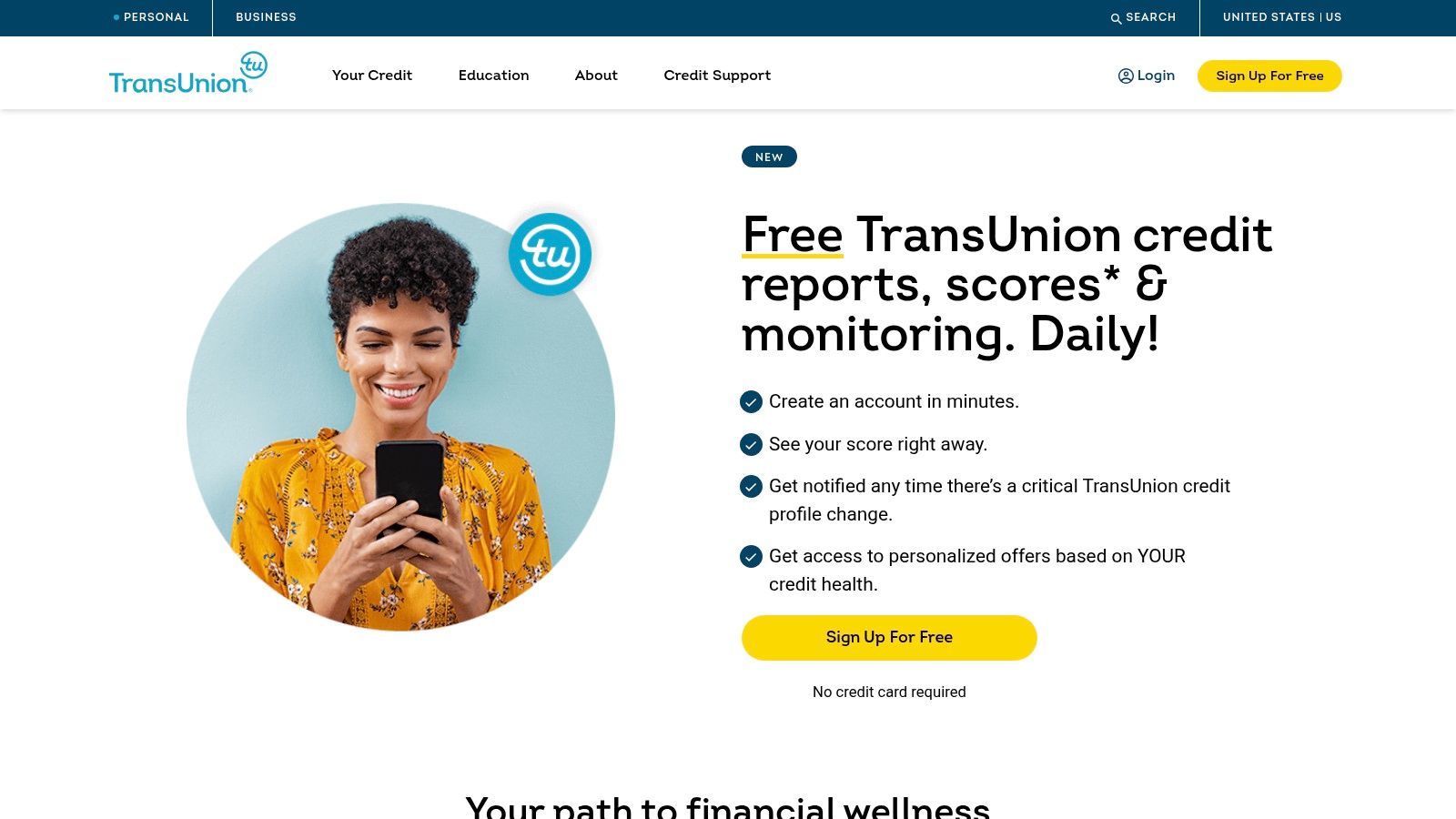

3. TransUnion Credit Monitoring (Credit Essentials)

TransUnion, another of the three major credit bureaus, provides its own credit monitoring service directly to consumers. It stands out as one of the best credit monitoring apps for those who want daily, direct access to their TransUnion credit information without a subscription fee. This service is particularly useful for ITIN holders who are focused on building and tracking their credit with this specific bureau, offering a no-cost way to stay informed about changes.

The platform’s greatest strength is its free daily refresh of your TransUnion report and VantageScore 3.0, a feature rarely found in free services. This allows users to see the impact of their financial actions almost immediately. The service also includes essential tools for placing credit freezes and filing disputes directly with TransUnion. While the free tier is limited to one bureau and lacks identity theft features, it serves as an excellent foundational tool. To get a better understanding of the benefits, you can learn more about what is credit monitoring.

Key Features & User Experience

Website: https://www.transunion.com/credit-monitoring

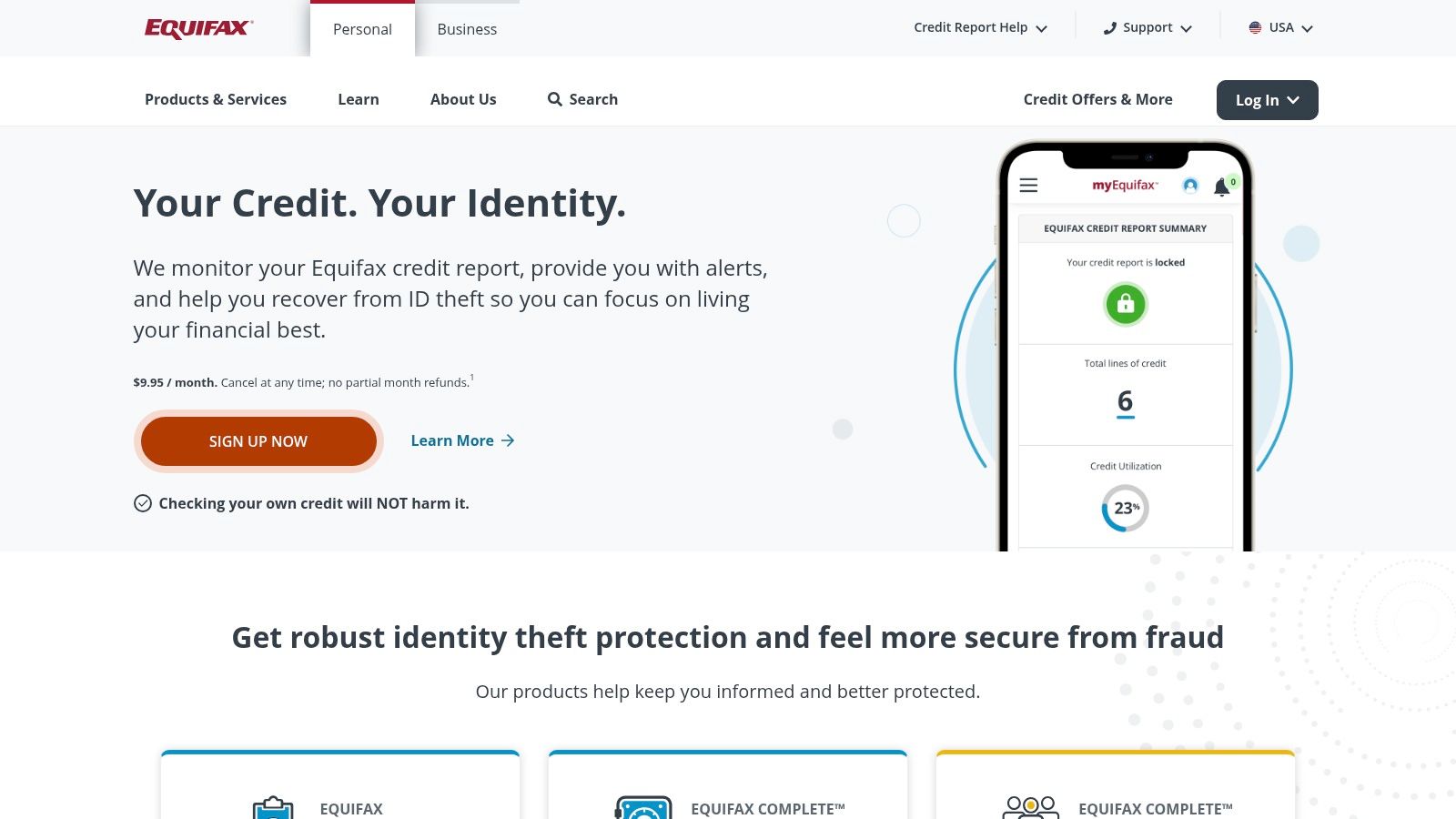

4. Equifax (myEquifax + Core Credit)

As another of the three major credit bureaus, Equifax provides direct-to-consumer monitoring through its myEquifax portal and Core Credit service. This makes it one of the best credit monitoring apps for individuals who want to track their Equifax credit file specifically. The service offers a free and straightforward way to access your Equifax report and VantageScore 3.0, providing essential tools directly from the source.

For ITIN holders building their financial footprint, myEquifax is an invaluable tool for ensuring their information is reported correctly to this specific bureau. A key advantage is the ability to place, temporarily lift, or permanently remove a security freeze on your Equifax credit file directly within the app, giving you powerful control over who can access your credit. While the free plan is limited to Equifax data, its user-friendly interface and direct file management tools make it a strong contender for single-bureau monitoring.

Key Features & User Experience

Website: https://www.equifax.com/personal/

5. Intuit Credit Karma

Intuit Credit Karma has long been a dominant player in the free financial tools space, making it one of the best credit monitoring apps for those seeking robust features without a subscription fee. It provides users, including ITIN holders, with free access to credit scores and reports from both TransUnion and Equifax. This multi-bureau view is a significant advantage over other free services that typically only offer data from one bureau.

The platform's business model relies on offering personalized financial products like credit cards and loans, which is how it remains free. For ITIN holders, this can be a double-edged sword: helpful for finding ITIN-friendly products but also a source of constant advertising. Its credit score simulator is a valuable tool for understanding how different financial actions might impact your credit, which is particularly useful when building credit from scratch. The mobile app is polished and provides frequent updates and alerts.

Key Features & User Experience

Website: https://www.creditkarma.com

6. Credit Sesame

Credit Sesame stands out as one of the best credit monitoring apps by combining free credit score tracking with innovative credit-building tools. The platform offers free access to your TransUnion credit score and report, making it an excellent starting point for anyone looking to monitor their credit without a subscription. Its primary focus is on providing actionable insights and tools to help users improve their financial health.

For ITIN holders, Credit Sesame's most valuable feature is its Sesame Cash account paired with the Credit Builder secured virtual card. This allows users to build credit history by reporting their everyday debit card purchases to the credit bureaus, a powerful feature for those starting from scratch. While the core monitoring service is free, be aware that the Credit Builder tool is linked to the Sesame Cash account, which has specific activity requirements to avoid fees.

Key Features & User Experience

Website: https://www.creditsesame.com

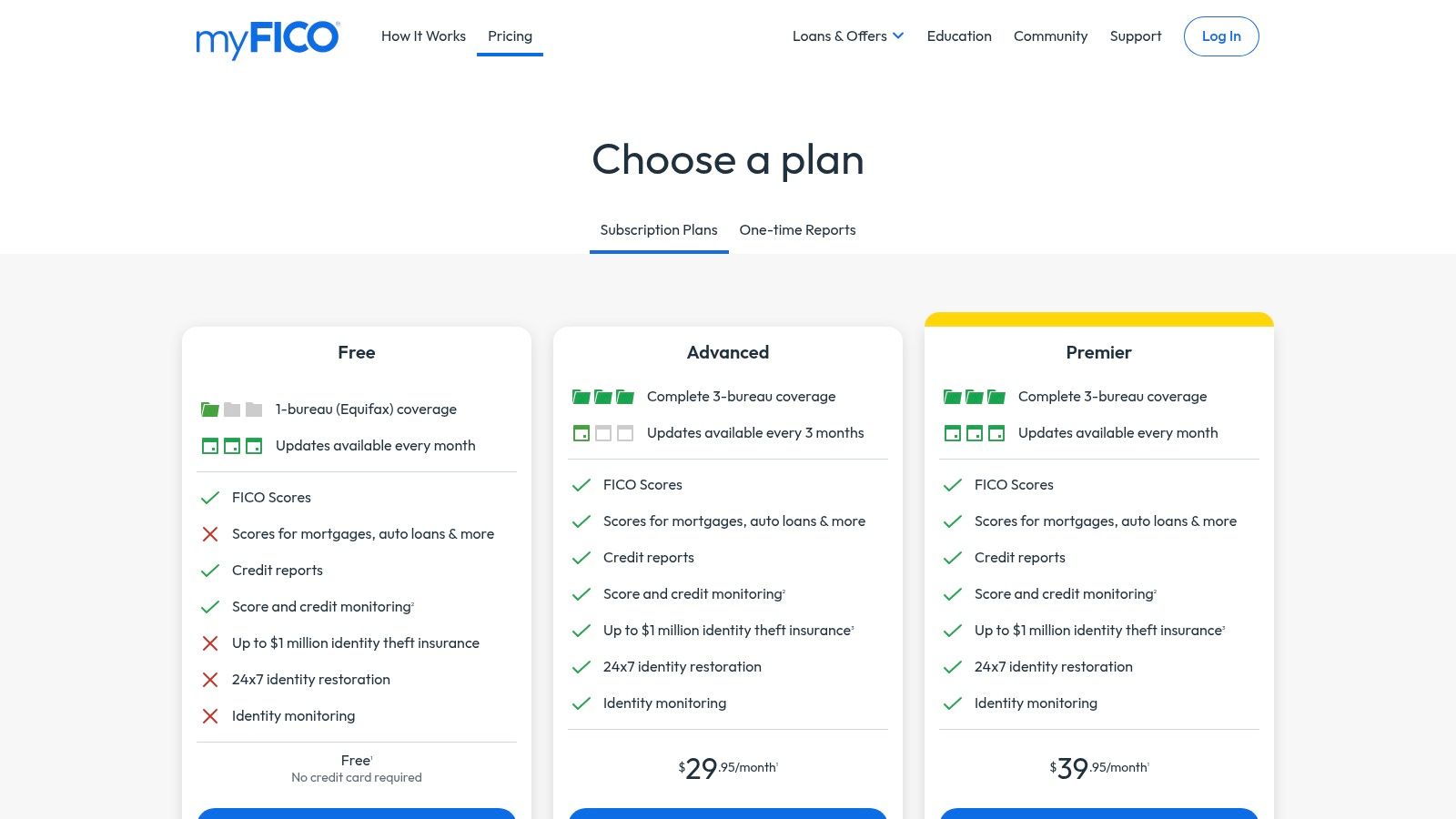

7. myFICO (FICO’s official consumer service)

For those who want to see the exact credit scores lenders see, myFICO is the ultimate source. As the official consumer service from FICO itself, it provides unparalleled access to the various FICO Score versions that are actually used in lending decisions, making it one of the best credit monitoring apps for serious financial planning. This is especially crucial for ITIN holders preparing for a major purchase like a car or home, as they can monitor the specific scores lenders will pull for those applications.

While myFICO comes at a premium price, its value lies in the details. It doesn't just show you one score; it provides up to 28 different FICO Score versions, including auto and mortgage-specific ones. This level of insight allows you to understand precisely how lenders view your creditworthiness. Its deep credit analytics and simulators are powerful tools for anyone, including ITIN users, looking to strategically improve their scores before applying for significant credit. The platform's identity monitoring and insurance add a solid layer of protection.

Key Features & User Experience

Website: https://www.myfico.com/products/fico-score-plans

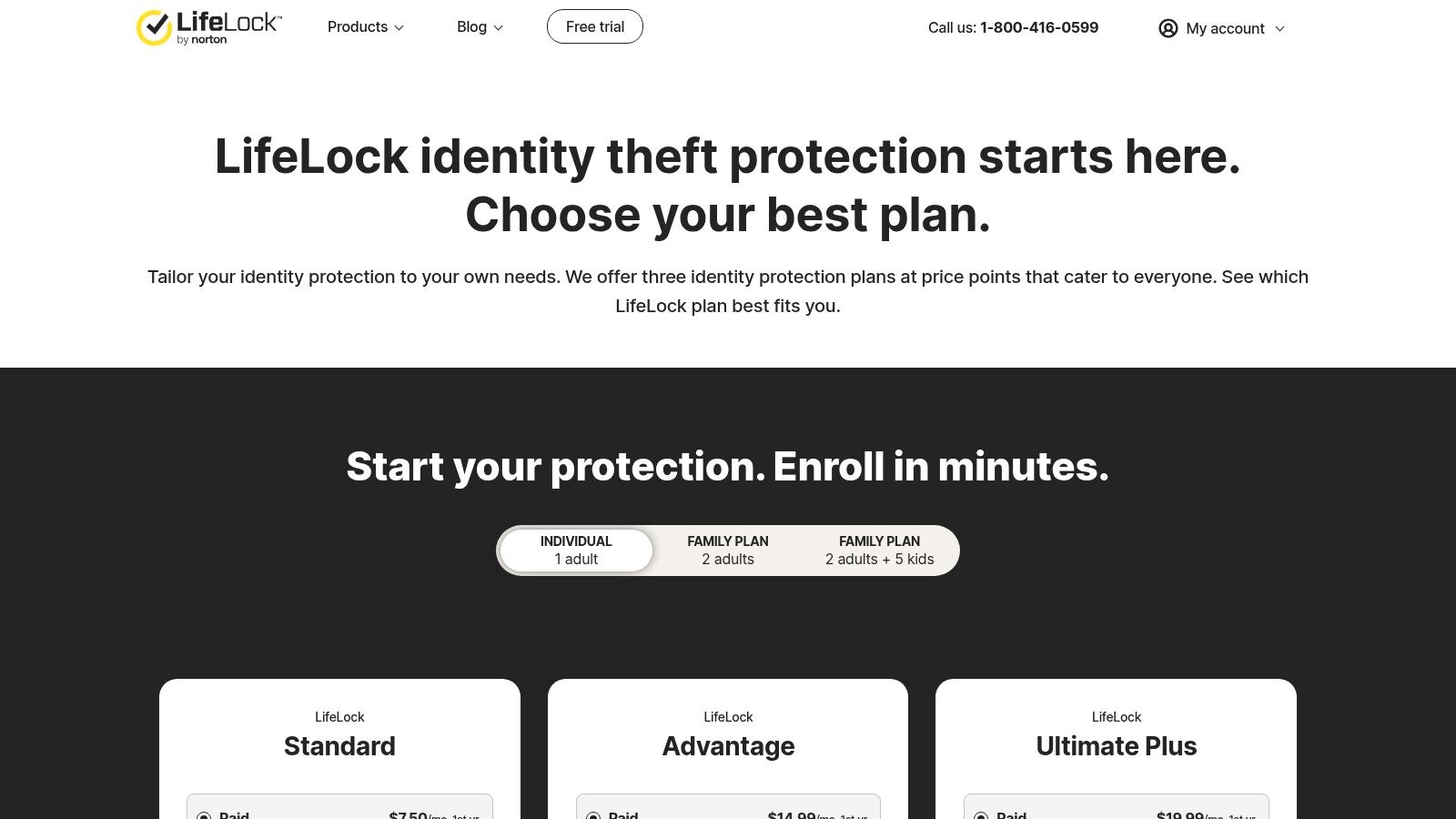

8. LifeLock by Norton

LifeLock, now part of the Norton cybersecurity family, is less of a pure credit monitoring app and more of a comprehensive identity theft protection service. While it includes credit monitoring features, its primary focus is on scanning a vast network of data points to detect fraudulent uses of your personal information. This makes it a strong choice for users, including ITIN holders, who are primarily concerned with the security aspect of their financial identity.

LifeLock's alerts go beyond typical credit report changes, notifying you if your information appears on the dark web or in public records where it shouldn't be. This broader protective net is its key differentiator. For ITIN holders building a financial footprint, understanding how to protect against identity theft is crucial, and LifeLock’s suite provides robust tools for this. However, be aware that its most comprehensive 3-bureau credit monitoring is reserved for its highest-priced tier.

Key Features & User Experience

Website: https://lifelock.norton.com/products

9. Aura

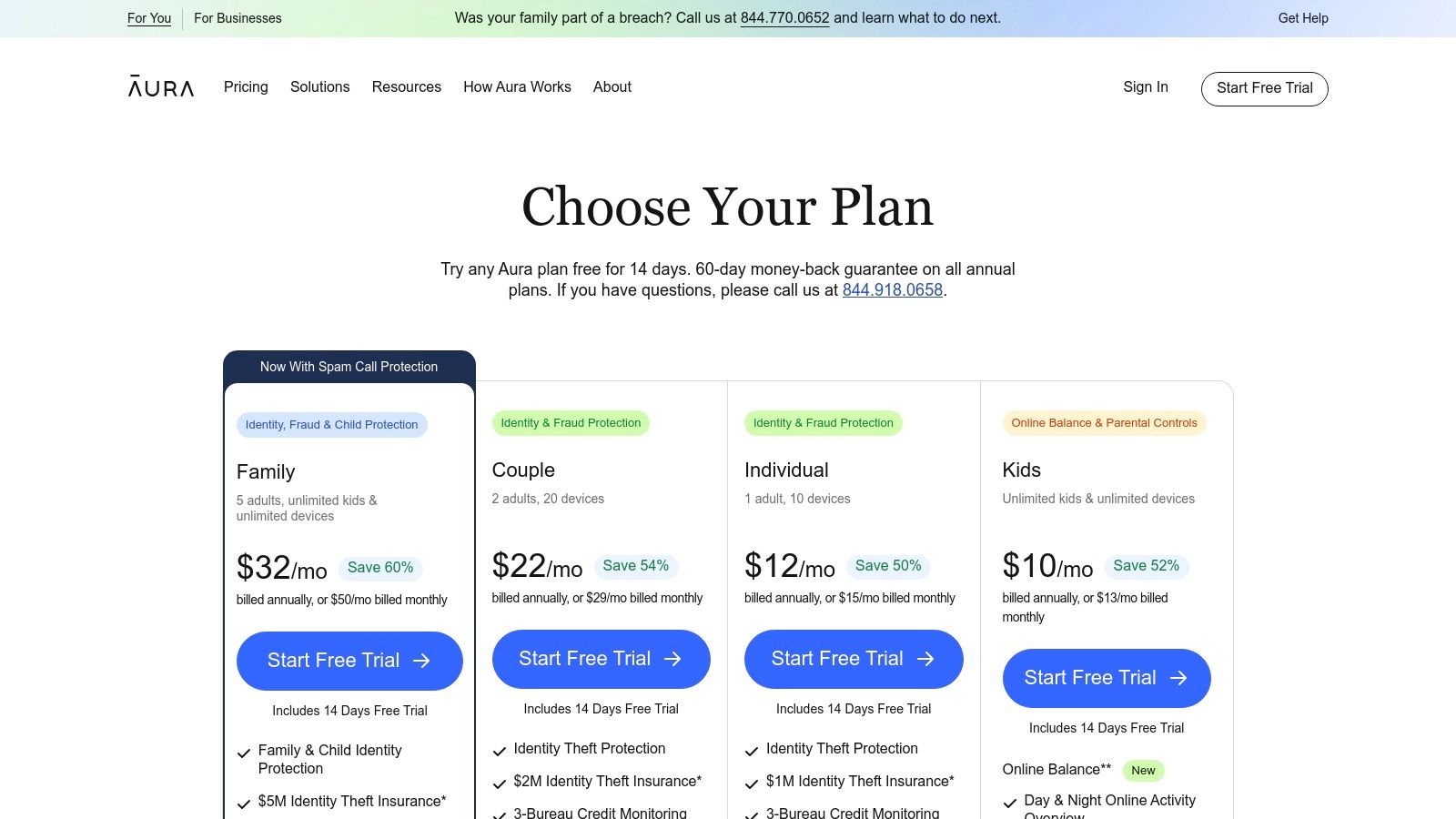

Aura goes beyond typical credit monitoring, positioning itself as an all-in-one digital security suite. This makes it one of the best credit monitoring apps for individuals and families who want comprehensive protection that includes financial, identity, and online threats in a single package. The service bundles 3-bureau credit monitoring with valuable tools like a VPN, antivirus software, and a password manager.

For ITIN holders, Aura provides a robust framework to not only monitor their credit but also secure their entire digital footprint. A key feature is the instant credit lock, which allows users to secure their TransUnion file with a single tap. The value proposition is particularly strong for families, as plans scale to cover multiple adults and children with a generous $5M aggregate identity theft insurance policy, all managed from one dashboard.

Key Features & User Experience

Website: https://www.aura.com/pricing

10. IdentityForce (by TransUnion)

As a TransUnion company, IdentityForce provides one of the most comprehensive identity protection and credit monitoring services available. Its UltraSecure+Credit plans are particularly robust, making it one of the best credit monitoring apps for those who prioritize security alongside credit tracking. The service excels in its extensive alert system, which goes beyond typical credit inquiries to monitor the dark web, social media, and court records for potential identity theft.

For ITIN holders building their financial footprint, the 3-bureau monitoring and daily TransUnion score updates offer a detailed, near real-time view of their progress. IdentityForce also offers strong family plans that include child monitoring, a crucial feature for households. Its higher price point is justified by its extensive identity restoration services and a significant $2 million insurance policy, providing peace of mind. For a deeper analysis, you can see our credit monitoring services comparison.

Key Features & User Experience

Website: https://www.identityforce.com/identity-protection-pricing

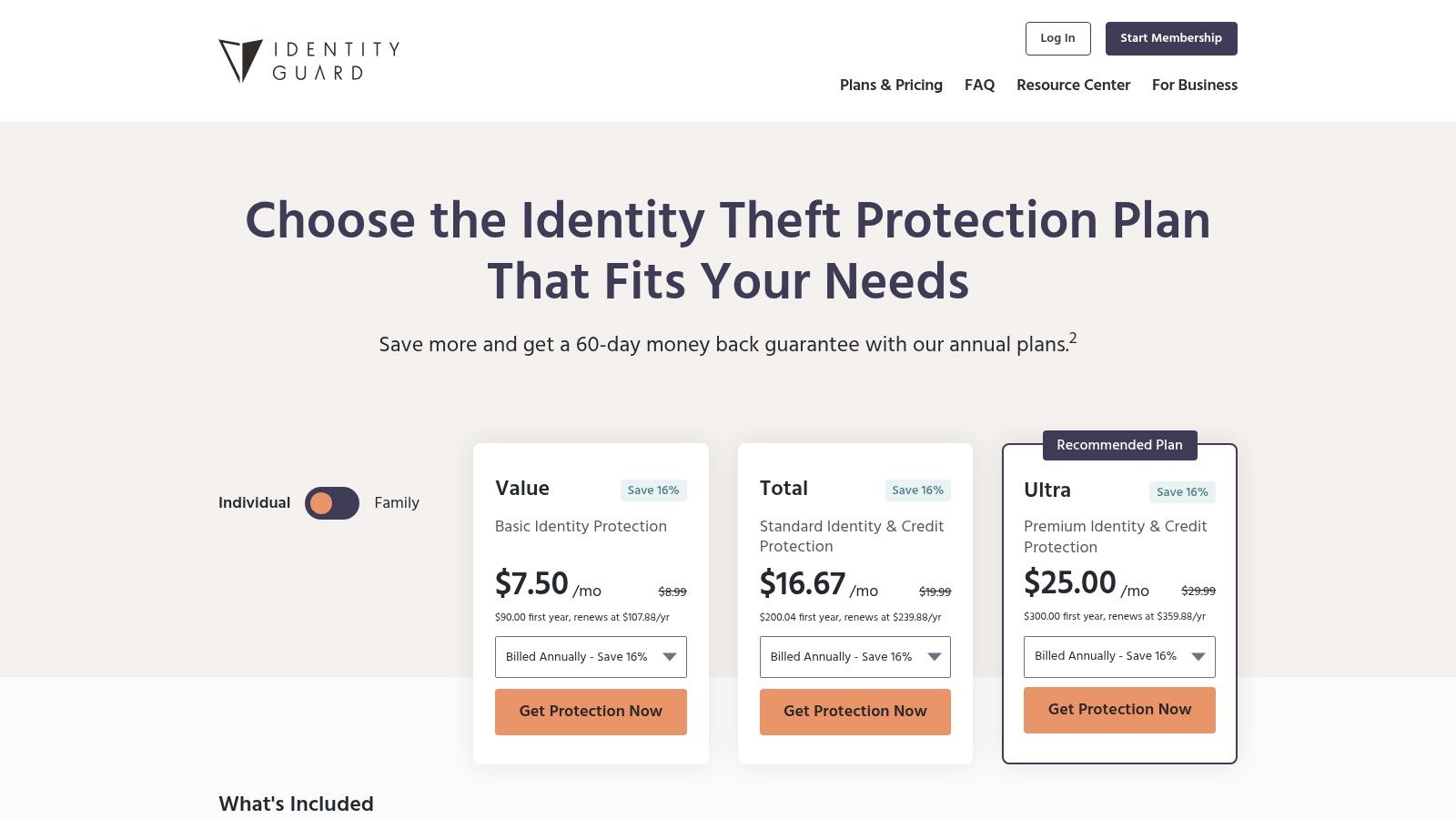

11. Identity Guard

Identity Guard leverages AI technology through IBM Watson to offer a proactive approach to identity theft protection, making it a strong contender among the best credit monitoring apps. While its primary focus is identity security, its higher-tier plans provide comprehensive 3-bureau credit monitoring and reports. This dual focus on both credit and identity makes it an excellent choice for users who want a holistic security solution.

For ITIN holders, the platform’s strength lies in its extensive identity monitoring, which scans everything from the dark web to high-risk transactions. A standout feature is the comprehensive family plan that can cover up to five adults and unlimited children, offering exceptional value for larger households. While the entry-level plans lack robust credit features, the premium tiers deliver a full suite of tools, including a password manager and safe browsing tools to secure your entire digital footprint.